Oil Field Formulas

Custom Chemistries Raise Production

By Colter Cookson

From lubricants that optimize long-lateral drilling to wax and scale inhibitors that keep mature wells on line, chemistries play a vital role in oil field economics. Their contributions to a field’s profitability continue to grow as chemical providers and service companies invent new formulas that deliver even better performance and tackle new problems.

The latest innovations include advanced completion fluids that improve well productivity, hydrogen sulfide scavengers that work without generating downtime-causing solids, and fluids for rejuvenating aging stripper wells and improving waterflood sweep efficiency.

According to John Chisholm, president and chief executive officer of Flotek Industries Inc., these technological improvements have been facilitated by a change in how operators buy and deploy chemicals.

“In the past, operators would work with companies that functioned like a Home Depot on location by providing everything the site required,” he says. “Today, many operators are decoupling services. For example, instead of having a pumping company buy diesel to fuel the hydraulic fracturing pumps, they will work with their own diesel distributor.

“Decoupling diesel, acid, proppant and chemistry can lead to tremendous savings. In fact, public companies have reported savings in the tens of millions of dollars,” Chisholm relates. “In addition to its economic benefit, decoupling allows a much tighter relationship between the supplier and the operator.”

That close relationship allows chemical companies to customize chemistry solutions for each project, Chisholm says. “It is no longer enough to take a one-size-fits-all approach,” he stresses. “With current technology and data, we can adjust chemical programs to accommodate changes in geology from pad to pad and maximize the operator’s return on investment.”

James Silas, Flotek’s vice president of research and innovation, concurs. “In many plays, the formation’s rock chemistry, oil composition and produced water characteristics can change from one pad to another,” he says. “All of these factors affect and interact with completion fluids. To increase the chance a well will provide an economic payback, we need to understand those variations and adjust the completion fluid’s chemistry to match and accentuate the chemistry in the reservoir.”

In many cases, Chisholm says a skilled, relationship-oriented chemical company will recommend using fewer chemicals or lower concentrations. “Our goal is to prescribe the right chemistry at the right amount,” he emphasizes. “By working backward from the reservoir and analyzing each well as if it was our own, we often can identify ways to improve performance or maintain performance while reducing costs.”

Cognitive Computing

To ensure it prescribes the right chemistry, Flotek opened a new global research and innovation center in Houston last year, Chisholm notes. With plenty of meeting space and ways for customers to interact with researchers, he says the center is designed to encourage collaboration between clients and employees.

As wells generate more data and researchers discover new ways to use those data, Chisholm warns it will become increasingly difficult to fully optimize chemical programs. “Recognizing that reality, we are making investments in cognitive computing, including an alignment with IBM,” he says. “Like the medical industry, we believe we can employ computers capable of self-learning and adaptive thinking to analyze vast datasets and make recommendations that will improve our clients’ returns on investment.”

One factor that can impact chemical performance is water quality, Silas says. “If the water contains too many dissolved solids and metals, it can keep polymers from dissolving and prevent them from reducing friction as expected,” he illustrates. “Ideally, the completion fluid needs to match the downhole surface chemistry and in situ water so it can allow flow to happen from the source rock to the wellbore.

“In many plays, the water source, and therefore water quality, changes from stage to stage,” Silas observes. “Rather than asking operators to adjust to those changes on the fly, we are creating robust chemistries. For example, we have a new pressure-reducing fluid that is an advancement of polyacrylamide friction reducers. Because it performs excellently in a wide variety of water qualities, it can handle almost any water that shows up on site and put away the frac job as designed.”

Completion Fluids

To reduce costs, some of the best completion fluid providers are partnering with operators to develop fit-for-purpose fluid systems, reports Wayne Cutrer, CEO of Downhole Chemical Solutions LLC. “Instead of using a one-size-fits-all approach, we are getting details on the well and the water, and running tests to make sure every additive provides value to the client,” he details.

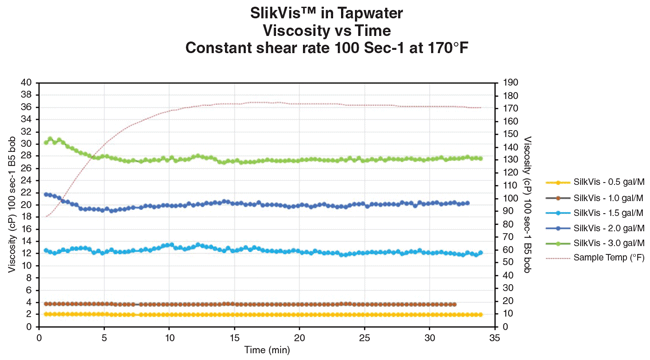

Downhole Chemical Solutions’ Slik-Vis™ completion fluids combine the simplicity and low cost of a slickwater fluid with the proppant-carrying capabilities of a gel system. Because the fluids’ viscosity is easy to adjust, DCS adds, crews can optimize the completion by adapting quickly to downhole conditions.

An example, Cutrer offers, is clay control additives in the Permian Basin. “We see many clients in the Permian, particularly the Midland Basin, pumping clay control additives,” he says. “By studying clay swelling and fines migration using water, oil and cuttings from the reservoir, we often discover those additives are unnecessary.”

In most wells, Cutrer says it is unnecessary to use guar. “We have a guar-free viscosifying slickwater fluid system that offers better performance and cleans up more easily than guar,” he explains. “This system has completed more than 16,000 stages, so we know it provides value to our clients.”

The viscosified slickwater fluid system has been used in almost every U.S. unconventional play, Cutrer says, including the Bakken, Denver-Julesburg, SCOOP/STACK, Permian, Eagle Ford, Barnett, Haynesville, and Tuscaloosa Marine Shale. According to Cutrer, it has proven to cost less than guar-based systems while offering lower treating pressures and better regain conductivity.

“It also is easier to use,” he adds. “To increase viscosity, we only need to adjust one polymer. To get more out of a linear gel, we would need to adjust the hydration unit and wait a few minutes for the change to take effect. A cross-linked gel would introduce pH buffering and cross-linking agents. The one-component system is much easier because it does the job of three or four traditional chemicals.”

The ease of use translates into better completions, Cutrer assures. “The completion crews can adjust much faster to changing well conditions, such as rising pressures, that might keep them from putting enough proppant away,” he explains.

“With fewer chemicals on location, there is less risk of leaks or spills and fewer trucks on the road to the well site,” Cutrer reports. “Those logistical efficiencies translate to better safety and lower costs.”

Recycling produced water can greatly reduce completion costs, but it can compromise well performance if the water is not properly treated, Cutrer notes. “One of the biggest technical challenges to produced water reuse and management is iron sulfide,” he comments. “In response, we are working with exploration, drilling and production companies on a technology to control iron sulfide and hydrogen sulfide.”

DCS’s sister company, Micro Chem Solutions, has a test unit in the field and provisional patents on the technology, Cutrer says. “If it performs as we expect, it will be the lowest-cost, best-performing chemical solution for iron sulfide, hydrogen sulfide and bacteria in produced water,” he says.

Deepwater Displacement

A new displacement fluid has the potential to greatly reduce costs in offshore wells, says Joey Detiveaux, TETRA Technologies Inc.’s area manager for U.S. offshore completion services and fluids.

“In the interface between the displacement fluid and drilling mud, the chemicals within them commingle and make it impossible to recycle either fluid,” he says. “Over time, the interface has grown from a few hundred barrels to more than a thousand barrels. By changing the process and the chemistry involved, we have gotten the number of barrels going to waste back into the low hundreds.”

It took only 12 months for TETRA Technologies Inc.’s research and development team to create TETRA CS Neptune™, a zinc-free, high-density completion fluid for deepwater wells that reduces costs and environmental impacts. The company reports it is expanding the fluid’s capabilities to make it suitable for particularly deep, high-pressure wells.

Detiveaux estimates that the small-interface displacement fluid saves $250,000 for each displacement.

In many deepwater wells, TETRA recommends a high-density, zinc-free completion fluid. Samy Helmy, the company’s vice president of completion fluids and water management, describes the fluid as economic and environmentally friendly.

“We developed the fluid in response to a request from a Gulf of Mexico operator that needed to complete a challenging ultradeepwater well with a zinc-free fluid,” Helmy says. “The only other zinc-free fluid available at that time, cesium formate, would not have been available at the required volumes and would have been cost-prohibitive.”

In only 12 months, Helmy says TETRA developed an alternative that costs a quarter or a third as much as cesium formate. “In most applications in the Gulf of Mexico, using the fluid can save tens of millions of dollars,” he calculates. “In the North Sea, where zinc has been banned since the late 1990s, the savings in comparison to cesium formate, the only other zinc-free fluid, could amount to 60-70 percent of the fluids bill.”

Much of those savings come from TETRA’s ability to recycle the fluid, Helmy says. Because TETRA manufactures its fluids, it has the expertise and infrastructure to clean and reuse or remanufacture all but the dirtiest fluids, a process Helmy says minimizes both costs and waste.

“Our filtration units help make reuse possible by cleaning the fluid at the high flow rates needed in ultradeepwater fields,” Helmy comments. “To make these filtration units even more effective, we have developed flocculants that cause large, easy-filtered clumps to form. This clumping speeds filtration, saving the operator money.

“In addition, we are looking at the next advancement in the zinc-free fluid system itself,” he reports. “We have filed patents on a next-generation version that will bring the system’s economic and environmental benefits to wells with pressures exceeding 20,000 psi.”

Wellbore Conditioner

With 10,000-15,000 foot laterals becoming routine in onshore resource plays and some horizontal well designs pushing 20,000 feet, friction is a major concern in drilling, suggests Elan Watson, Western Hemisphere manager for Drilling Specialties Co., a division of Chevron Phillips Chemical Company LP. To minimize wellbore instability, Drilling Specialties has developed a latex-based miscible mud conditioner designed to significantly increase mud inhibition. Watson says it is particularly effective when used in conjunction with the company’s Soltex® additive.

“In an East Texas field trial, we used that combination in a water-based mud to drill a problem formation where the two offsets had shale stability issues,” Watson relates. “In the first offset, which had reactive clays, the operator had trouble pulling the drill string out of hole. He also could not get the casing to bottom, so he had to cement the casing in place. After drilling through the cement to begin the next section, the bit got stuck, and the well had to be abandoned.”

Changes to the drilling fluid enabled the second well to be drilled and cased successfully, but tripping in and out of the hole and running casing took excessive rig time, Watson continues. “In the third well, which used the new wellbore conditioner additive as well as our proven shale stabilizer, we got in and out of hole and ran casing without any issues,” he says. “That saved a lot of rig time.”

In some applications, Watson predicts the new additive will enable operators to switch from oil-based to water-based muds. “WBMs have higher fluid costs, but they reduce overall drilling costs,” he says. “They can be mixed on site, so they eliminate the need to truck mud from a mixer to the well. They also reduce the costs associated with removing oil from the cuttings and trucking the cuttings off site for disposal.”

The multipurpose mud conditioner is easy to mix using standard equipment and is compatible with a wide range of fluid systems, Watson assures.

H2S Scavenger

Because of its affordability and effectiveness, triazine has long been the hydrogen sulfide scavenger of choice for most operators, says Jon Rogers, global head of oil services for Clariant. “Triazine works well, but the reaction it uses to remove H2S creates byproducts that can form solid material. To remove that material, the operator eventually needs to shut the plant down and clean it out, which leads to production downtime,” he warns.

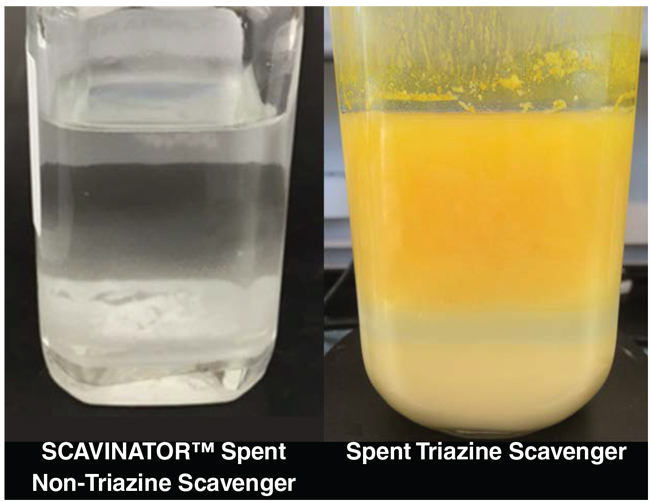

Because Clariant’s SCAVINATOR™ hydrogen sulfide scavenger (left) works without creating solid byproducts, it can reduce the downtime and maintenance costs associated with the traditional alternative (right). The company says its new solution is reliable and cost competitive.

To eliminate the challenges associated with the use of triazine, Rogers says Clariant has developed a cost-competitive alternative with equal or better performance. “The newly launched scavenger practically eliminates solids from the reaction byproducts, which can greatly reduce downtime and maintenance costs,” he reports.

“This patent pending technology is mostly applied in contact towers, but also can be applied to pipelines,” Rogers says. “Because removing solid buildup in pipelines would require the costly procedure of stopping production and cleaning out deposits, triazine never has been a fully satisfactory choice for pipelines, where no practical alternative has been available. By developing this affordable alternative, we have created a new opportunity in the market.”

Rogers adds that the scavenger has a lower pH than triazine, “A high pH can reduce produced water’s ability to hold mineral scale,” he notes. “Water treated with the new scavenger is about 100 times less alkaline than water treated with triazine. As a result, it is less likely to cause scale deposition that could plug flow/production lines or filters in saltwater disposal wells. In the long run, this can reduce water disposal costs.”

Clariant has completed more than 15 field trials using the scavenger in the Eagle Ford, Permian and Haynesville plays. “These trials confirm that the product offers a solids-minimizing, cost-competitive alternative to triazine while providing field data to further improve the product’s performance,” Rogers reports.

In the lab, he says, Clariant is working on developing a second-generation version of the product. “It is our goal to enhance this scavenger to be more attractive from an economic and performance standpoint, when compared with triazine or its predecessor,” Rogers says. “Early results indicate it will make H2S scavenging even more appealing to the pipeline industry.”

Wax Inhibitors

Clariant also is developing more efficient wax inhibitors, Rogers announces. “Traditional paraffin inhibitors in use in the Eagle Ford and similar waxy crude basins typically prevent only 30-50 percent of the wax from depositing,” he estimates. “We are increasing the efficiency of wax inhibition to reduce the amount of paraffin that must be removed mechanically or chemically with the use of hot oil/water.”

This improved performance has been proven in multiple field trials in the Eagle Ford and other areas, Rogers assures. “We also are modifying wax inhibitors to work in low-temperature areas, such as the northern Mid-Continent, northern Canada, and Alaska,” he says. “In those environments, to keep a traditional wax inhibitor from freezing, the industry has had to use products that heavily dilute the active ingredient in solvents. This significantly raises the volume of inhibitors that have to be injected, and therefore, increases transportation costs.

“Clariant is developing high activity/low viscosity wax inhibitors that can remain liquid well below the freezing point, even at activities three-six times higher than traditional cold weather inhibitors,” Rogers says. “With higher concentrations of the active ingredient in the same volume, the amount of chemical that needs to be transported and injected can be much lower. These more concentrated versions will help reduce operators’ total chemical costs while improving wax inhibition effectiveness.”

Engineered IOR Fluid

For Kemira, improved oil recovery has become a major research focus, according to Paula Henderson, the company’s global marketing manager for oil and gas. “IOR and EOR have become a key part of our growth strategy, so we are investing heavily to develop new products and methods of applying them,” she says.

As an example, Senior Technical Manager Randy Prater offers an engineered fluid for improved oil recovery. “This fluid has a long-term effect on oil recovery,” he reports. “We initially thought many of its components would be short-lived, but we are finding they stay on the rocks long after the initial treatment, where they improve wettability and help release additional oil from the rock.”

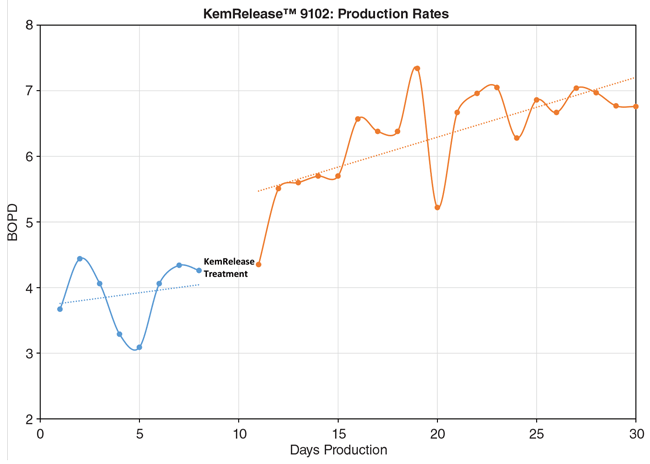

Field studies show that Kemira’s KemRelease™ multifunctional engineered fluid improves oil recovery in mature wells. To illustrate, the company offers this chart showing results from a well producing from a tight sandstone reservoir in Kansas. The treatment increased average daily oil production from 3.9 barrels to 6.5 barrels, providing a return on investment in fewer than 10 days.

The fluid offers an economic way to enhance reservoir penetration and recovery across a wide range of conditions, Prater says. “We began applying the technology last fall, so we are still learning where and when it works best,” he comments. “Some interesting outcomes have been in stripper wells, where we have seen sustained production rates three times higher than before the treatment.”

The fluid also has been applied to waterflood injection wells. “It reduces injection pressures significantly and enables much higher injection rates. It also dislodges paraffins, asphaltenes and other downhole debris that would otherwise keep injected fluid from sweeping oil out of the reservoir,” Prater reports.

The lower injectivity pressures translate into less wear and tear on surface facilities, Prater says, as well as cleaner produced fluids that require less treatment before the oil can go to the sales tank.

In most applications, Prater says the engineered fluid is cost competitive with alternatives. “We can almost assure the fluid will not harm production,” he adds. “Since it is economic to try, has almost no risk of causing problems, and has a strong upside, it has a lot of operators excited.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.