Crude Oil Rail Transport

Rail Gives Oil Shippers New Capacity, Flexibility

Special from The American Railroad Association

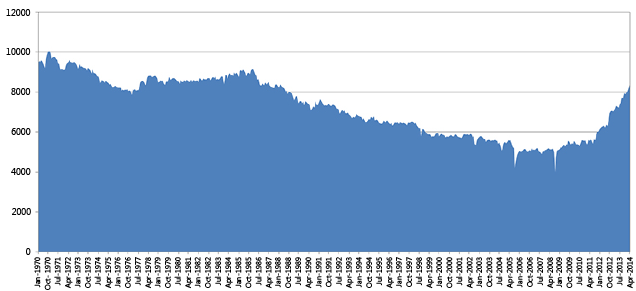

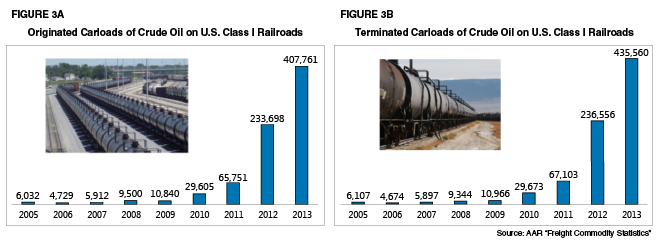

WASHINGTON–U.S. crude oil production has risen sharply in recent years, with much of the increased output moving to market by rail. In 2008, U.S. Class I railroads originated 9,500 carloads of crude oil. In 2013, they originated 407,761 carloads in step with a sharp incline in domestic crude oil production.

In light of these increased volumes, railroads have taken numerous steps to enhance crude oil safety. They have undertaken top-to-bottom reviews of their operations and voluntarily updated their operating practices, from the selection of routes, to train speeds, to track and equipment inspections. Railroads already provide training to more than 20,000 emergency responders each year, but they are increasing their efforts to train first responders and are creating inventories of emergency response resources along their lines.

And in addition to reviewing their own operations to make them safer, railroads are urging federal regulators to toughen existing standards for new tank cars and require that existing tank cars used to transport crude oil either be retrofitted with safety-enhancing technologies or aggressively phased out.

As shown in Figure 1, U.S. crude oil production grew by nearly 2.5 million barrels a day between 2008 and 2013, and averaged 8.37 million bbl/d in April of this year (the highest daily output since the late 1980s), according to the U.S. Energy Information Administration. Beyond providing safe and efficient transportation capacity, railroads offer oil producers the ability to shift deliveries quickly to different markets, enabling them to sell their product to whichever market offers the best price.

While oil has historically moved from production areas to refineries by pipeline, and additional oil pipelines will be built in the years ahead, the competitive advantages railroads offer producers will keep them in the crude oil transportation market long into the future.

It is hard to overstate the economic and security benefits associated with continued growth in domestic crude oil production. Over time, it will mean reductions in the nation’s trade deficit of tens of billions of dollars every year, new and better employment opportunities for hundreds of thousands of Americans, and better economic development opportunities for regions all over the country. It also means billions of dollars in new tax revenues, and less reliance on sources of imported oil from places around the world that are not secure and whose interests do not necessarily correspond well to those of the United States.

The Peterson Institute, a nonprofit and nonpartisan research institution devoted to studying international economic policy, found that, along with lower energy costs, the growth in domestic energy production should increase annual U.S. gross domestic product growth between 0.09 and 0.19 percentage points through 2020. That adds up to hundreds of billions of dollars in higher GDP. Domestic crude oil production growth represents a tremendous opportunity for the nation to move closer to energy independence and to benefit in many other ways. However, the United States cannot take full advantage of new crude oil resources without railroads.

Filling The Gaps

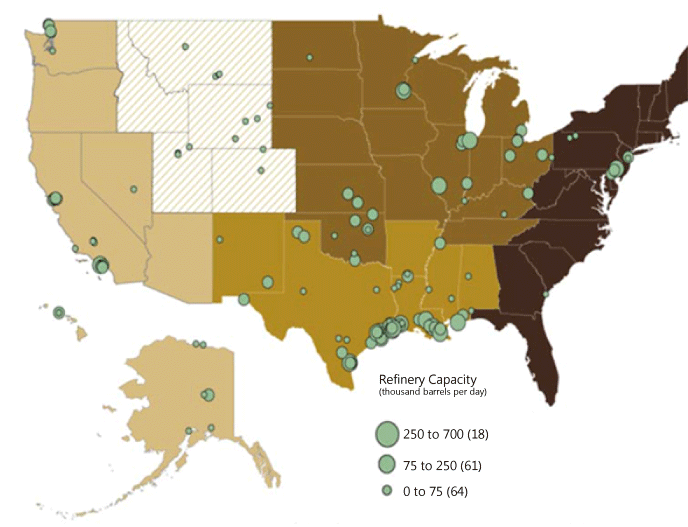

As oil producers know very well, crude oil has little value unless it can be transported to refineries. However, most U.S. refineries are located in traditional onshore and offshore crude oil production areas such as Texas, Oklahoma and the Gulf Coast, or along coastal regions where crude oil imports transported by tanker are readily accessible (California, Washington and New England), rather than near booming crude oil production areas such as the Bakken Shale in North Dakota or the Niobrara in Colorado and Wyoming (Figure 2).

In part because of the long, rigorous process required to obtain the necessary permits to build new refineries, it is basically impossible for refineries to come on line quickly (or cost effectively) near new production areas. Moreover, existing pipeline networks in many tight oil regions lack the capacities to handle higher production volumes, as well as the flexibility and geographic reach to serve multiple potential markets. Fortunately, railroads have both the capacity and flexibility to fill the gaps.

Relatively small amounts of crude oil have long been transported by rail, but the increase in rail oil movement has been enormous in recent years. Originated carloads of crude oil on U.S. Class I railroads (including the U.S. Class I subsidiaries of Canadian railroads) rose from 9,500 in 2008 to 233,698 in 2012 to 407,761 in 2013 (Figure 3A). In the first quarter of 2014, they totaled 110,164 higher than in any previous quarter. Terminated rail carloads of crude oil on Class I railroads (including carloads that may have originated on non-Class I railroads in the United States or on a railroad in Canada that then headed south, totaled 435,560 in 2013 (Figure 3B).

North Dakota, and the Bakken play more generally, have accounted for the vast majority of new rail crude oil originations. According to estimates from the North Dakota Pipeline Authority, nearly 700,000 bbl/d of crude oil was moving out of the state by rail in early 2014, the equivalent of more than 60 percent of North Dakota’s crude oil production.

While there has clearly been significant growth in U.S. crude oil rail traffic, it is not plausible to claim that oil has “crowded out” other rail traffic to a significant degree. One must be careful not to overstate crude oil’s importance given that crude oil accounted for 1.4 percent of total Class I originated carloads in 2013 (up from 0.03 percent in 2008).

Assuming, for the sake of simplicity, that each rail tank car holds 30,000 gallons (714 barrels) of crude oil, the 407,761 carloads of crude oil originated by U.S. Class I railroads in 2013 were the equivalent of about 800,000 bbl/d (or 11 percent of total U.S. crude oil production, according to EIA data) moving by rail.

Rail Shipping Advantages

In addition to the critical fact that railroads provide transportation capacity in many areas where pipeline capacity is insufficient, railroads offer a number of other advantages for transporting crude oil, including:

- Geographical flexibility;

- Responsiveness;

- Efficiency;

- Improved infrastructure; and

- Product purity.

By serving almost every refinery in the United States and Canada (Figure 4), railroads offer market participants enormous flexibility to shift product quickly to different places in response to market needs and price opportunities. Railroads deliver crude oil to terminals not only in Louisiana and other places in the Gulf Coast region, but also to locations on the East Coast, the West Coast, and elsewhere.

Moreover, rail facilities can almost always be built or expanded much more quickly than pipelines and refineries in response to demand growth. Essentially, railroads are the only transportation mode that can invest in facilities quickly enough to keep up with production growth in the emerging oil fields.

As new rail facilities are developed, railroads are involved every step of the way. For example, at origin and destination sites, railroad economic development and operations teams help facility owners decide where to locate assets and how to lay out rail infrastructure on the site to maximize efficiency. Railroads also help crude oil customers find ways to load and unload tank cars more quickly and reduce en-route delays.

Promoting unit train shipments is often a key part of the process to optimize efficiency. Unit trains are long trains (usually at least 50 and sometimes more than 100 cars hauling a single commodity). Unit trains use dedicated equipment and generally follow direct shipping routes to and from facilities designed to load and unload them efficiently (i.e., from a gathering location near oil production areas to an unloading terminal at or near a refinery) and generally have much lower costs per unit shipped than nonunit trains. A single large unit train might carry 85,000 barrels of oil and be loaded or unloaded in 24 hours.

In regard to underlying infrastructure, railroads have invested hundreds of millions of dollars over the past few years on tracks, locomotives, terminals and more to enhance their ability to transport crude oil.

Finally, with the composition of crude oil varying from region to region, and even from well to well within a region, crude oil consumers often desire a specific type of crude oil. Shipping crude by rail allows “pure barrels” to be delivered to destination in ways that are not always possible with pipelines.

Enhancing Safety

Railroads devote enormous resources to enhancing the safety of moving crude oil by rail. Rail actions in this regard fall into three broad categories: accident prevention, accident mitigation, and emergency response.

Railroads’ overall safety record, as measured by Federal Railroad Administration (FRA) data, has been trending in the right direction for decades. In fact, based on the three most common rail safety measures, recent years have been the safest in rail history. The train accident rate in 2013 was down 79 percent from 1980 and down 42 percent from 2000, the employee injury rate was down 84 percent from 1980 and 47 percent from 2000, and the grade crossing collision rate was down 81 percent from 1980 and 42 percent from 2000.

Railroads are proud of these achievements, but they know the pursuit of safety never ends. The rail industry’s goal is zero accidents, which is why railroads are always looking for ways to prevent accidents, including capital reinvestments, technological advancements, defect detectors, routing modeling, inspections, speed restrictions and train braking.

One of the most important ways railroads have reduced accidents is through significant and consistent investments back into their networks. Despite a weak economy, railroads have invested far more back into their networks over the past five years (nearly $115 billion) than in any five-year period in history. One of the major aims of these investments is to make the rail network more robust, so that the industry’s decades-long record of declining accident rates continues. In fact, for many of these investments, improving safety is the primary reason the investments are made.

Railroads are constantly incorporating new technologies to improve rail safety, including sophisticated detectors along tracks that identify defects on passing rail cars, specialized inspection cars that identify defects in tracks and the ground beneath tracks, and sophisticated systems that combine data from a variety of sources to produce “vehicle condition reports” on individual rail cars so that poorly performing cars can be identified before accidents occur. Many railroad-related technological advancements are developed at the Transportation Technology Center Inc. (TTCI) in Pueblo, Co., a subsidiary of the Association of American Railroads.

By July 2014, railroads will ensure that specialized track side “hot box” detectors are installed at least every 40 miles along routes with trains carrying 20 or more cars containing crude oil. These detectors help prevent accidents by measuring if wheel bearings are generating excessive heat, and are therefore, in the process of failing.

Several years ago, the rail industry and several federal agencies jointly developed the Rail Corridor Risk Management System (RCRMS), a sophisticated statistical routing model designed to help railroads analyze and identify the overall safest and most secure routes for transporting highly hazardous materials. The model uses a minimum of 27 risk factors (including HAZMAT volume, trip length, population density along the route, availability of alternate routes, and emergency response capability) to assess the overall safety and security of rail routes. On July 1, major U.S. railroads will begin using the RCRMS for trains carrying at least 20 carloads of crude oil.

FRA regulations dictate the types and frequencies of inspections that railroads must perform. The FRA-mandated inspection regime is comprehensive and thorough. New FRA regulations regarding inspections for internal rail defects became effective on March 25. Railroads have agreed to perform at least one more internal rail inspection each calendar year than the new FRA regulations require for main line tracks on which trains carrying at least 20 carloads of crude oil travel. In addition, railroads will conduct at least two automated comprehensive track geometry inspections each year on main line routes over which trains with 20 or more loaded cars of crude oil travel, something FRA regulations do not currently require.

In August 2013, railroads self-imposed a 50-mph speed limit for trains carrying 20 or more carloads of oil. Beginning July 1, if a train is carrying at least 20 cars of crude oil and at least one of the cars is an older “DOT-111” car, it will travel no faster than 40 mph when travelling within one of the 46 nationwide “high threat urban areas” designated by the Department of Homeland Security.

As of April 1, trains operating on main line tracks carrying at least 20 carloads of crude oil have been equipped either with distributed power locomotives (i.e., locomotives placed in locations other than the front of the train) or with two-way telemetry end-of-train devices. These technologies allow train crews to apply emergency brakes simultaneously from both the head end and locations further back in the train to stop the train faster.

Accident Mitigation

In addition to efforts to prevent accidents, railroads have taken numerous steps to mitigate the consequences should an accident occur. Many of these mitigation efforts focus on increased federal tank car safety and design standards. The total North American tank car fleet consists of about 335,000 cars. Railroads themselves own less than 1 percent of these cars, with the vast majority owned by rail customers and leasing companies. The dozens of distinct types of tank cars are differentiated by characteristics (pressure or general service, insulated or noninsulated, how much they can carry, etc.) that make them suitable or not suitable for carrying specific commodities.

U.S. federal regulations pertaining to tank cars are set by the Pipeline and Hazardous Materials Safety Administration (PHMSA). Transport Canada performs a similar role in Canada. In addition, the AAR Tank Car Committee sets rail industry standards regarding how tank cars used in North America are designed and constructed. These standards are often above and beyond federal standards.

The rail industry has long supported increased tank car safety standards. For example, in 2011 the AAR petitioned PHMSA to adopt more stringent requirements for new tank cars used to transport certain types of materials, including crude oil. These tougher standards called for more puncture resistance through the use of a thicker tank car shell or jacket, extra protective half-height (at a minimum) “head shields” at both ends of tank cars, and additional protection for the fittings on the top of a car that enable access to the inside of the car.

A few months later, after it had become clear that PHMSA’s adoption of the proposed requirements was not imminent, the Tank Car Committee adopted AAR’s proposal as the basis for new industry standards for tank cars used to carry ethanol or crude oil. The new standards, referred to as CPC-1232, apply to new tank cars ordered after Oct. 1, 2011. To date, some 20,000 tanks cars have been built to the CPC-1232 standard.

Late last year, the rail industry called on PHMSA to adopt standards even more stringent than CPC-1232 for new tank cars used to transport crude oil and ethanol. Railroads expressed support for requiring that tank cars be equipped with jackets and thermal protection, full-height head shields, top fittings protections, and bottom outlet handles that will not open in a derailment. The proposal also called for aggressively retrofitting or phasing out older tank cars. The proposal recognizes that input is needed from shippers and tank car manufacturers to determine the precise parameters of a phase-out program and to identify the required retrofits.

The rail industry continues to evaluate what other standards might be appropriate to enhance the safety of tank cars used to transport crude oil. For example, railroads now support strengthening tank cars used to transport crude oil with thicker (9/16-inch) shells.

Approximately 228,000 tank cars are DOT-111 general service cars, and about 100,000 of them are used to transport crude oil or flammable liquids. To the extent that DOT-111 cars are used to transport crude oil, the rail industry believes they should be retrofitted or replaced.

Under federal regulations, the entity “offering” crude oil to the railroad for transport (e.g., the oil producer) is responsible for properly classifying the oil based on its level of hazard. On February 25, FRA issued an executive order requiring that crude oil from the Bakken region be tested to ensure that it is properly classified before it is transported by rail. Railroads support the pursuit of proper classification and labeling of petroleum crude oil in tank cars by shippers prior to transport. This is essential to ensuring that first responders are able to safely and appropriately respond in the event of an accident.

Emergency Response

Railroads have extensive emergency response functions, which work in cooperation with federal, state and local governments to assist communities in the event of an incident involving crude oil or hazardous materials.

Railroads’ emergency response efforts begin internally. All major railroads have teams of full-time personnel whose primary focus is HAZMAT safety and emergency response, as well as teams of environmental, industrial hygiene, and medical professionals available at all times to provide assistance during HAZMAT incidents.

Railroads also maintain networks of HAZMAT response contractors and environmental consultants, strategically located throughout their service areas, who can handle virtually any air, water, waste or public health issue. They also have comprehensive “standard of care” protocols that ensure that impacts to the community, such as evacuations, are addressed promptly and professionally.

Each year, railroads actively train more than 20,000 emergency responders throughout the country. This training ranges from general awareness to much more in-depth offerings. The precise parameters of these emergency response training programs vary from railroad to railroad, but they generally consist of some combination of:

- Safety trains and other training equipment that travel from community to community to allow for hands-on training for local first responders;

- Centralized centers to train employees, first responders, customers and other railroad industry personnel in all aspects of dealing with HAZMAT incidents;

- Local firehouse visits to provide classroom and face-to-face HAZMAT training;

- Partnering with local emergency responders to conduct simulations of emergency situations and discuss general problems and procedures in the context of an emergency scenario, with the focus on training and familiarization with roles, procedures and responsibilities; and

- Making self-study training courses (including Web-based training on HAZMAT and general rail safety issues) available to emergency responders to allow them to learn proper procedures at an individualized pace of study.

Railroads also support national emergency response capability through the TTCI-operated Security & Emergency Response Training Center (SERTC). Since its inception in 1985, SERTC has provided in-depth, realistic, hands-on HAZMAT emergency response training to more than 50,000 local, state and tribal emergency responders and railroad, chemical and petroleum industry employees. Most of the training at SERTC is advanced training that builds on the basic training responders receive elsewhere. Instructors at SERTC average more than 30 years of emergency response experience.

Many railroads regularly provide funding to emergency responders in their service areas to attend SERTC. In addition, the AAR recently announced that railroads will provide approximately $5 million to develop a specialized crude-by-rail training and tuition assistance program for local first responders. The funds will be used to design a TTCI curriculum specifically devoted to crude oil emergency response, provide tuition assistance for an estimated 1,500 first responders to attend training at TTCI, and provide additional training to local emergency responders closer to home.

In May, the U.S. Department of Transportation issued an emergency order requiring railroads operating trains containing large amounts of Bakken crude oil to notify state emergency response commissions (SERCs) about these shipments. As noted, railroads have for years worked with emergency responders and personnel to educate and inform them about the hazardous materials moving through their communities. These open and transparent communications will continue as railroads do all they can to comply with the emergency order.

Effective July 1, railroads also must develop an inventory of resources for emergency responders along routes over which trains with 20 or more cars of crude oil operate. This inventory will include locations for staging emergency response equipment and contacts for notifying communities. When the completed inventory, railroads will provide the DOT with information on the deployment of the resources and will make the information available upon request to appropriate emergency responders.

Emergency responders have control of railroad accidents in which hazardous materials are spilled, but railroads provide the resources for mitigating the accident. Railroads also reimburse local emergency agencies for the costs of materials the agencies expend in their response efforts.

North America is experiencing an unprecedented boom in crude oil production. Among many other benefits, this means North America is likely to move closer to energy self-sufficiency. Railroads are playing a critical role in this energy renaissance, with rail shipments of crude oil growing in recent years Because of the flexibility and other advantages that moving crude oil by rail offers.

Editor’s Note: The Association of American Railroads is the standards setting organization for North America’s railroads, working with elected officials and leaders on critical issues in the rail industry. Its members transport freight, including crude oil, over a 140,000-mile network of tracks.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.