U.S. Emissions Fall Dramatically

WASHINGTON–Thanks to plentiful supplies of clean-burning domestic natural gas, carbon dioxide emissions related to energy usage in the United States fell to their lowest level in two decades during the first quarter of 2012, according the U.S. Energy Information Administration.

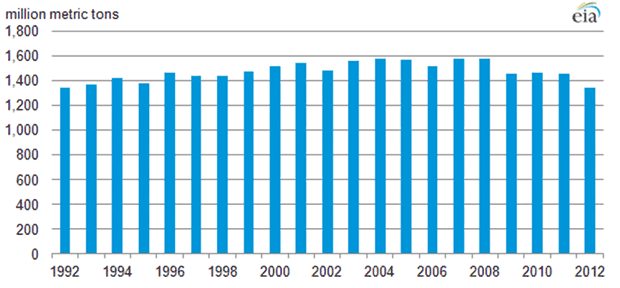

Total U.S. CO2 emissions from energy consumption totaled 1.340 billion metric tons during the first quarter of 2012, falling nearly 8 percent from first quarter 2011 to their lowest level for any January-to-March quarter since 1992, the EIA summarized in a technical report issued on Aug. 1.

Noting that seasonal CO2 emissions typically are highest in the first quarter because of winter heating demand, EIA said the 20-year low in emissions in the first quarter this year was partly attributable to the mild winter weather that diminished heating loads, as well as reduced gasoline demand in the transportation sector, as the nation’s economy continued to struggle. However, the agency reported that the most notable factor was a decline in coal-fired electricity generation, with natural gas increasingly displacing coal in the power sector.

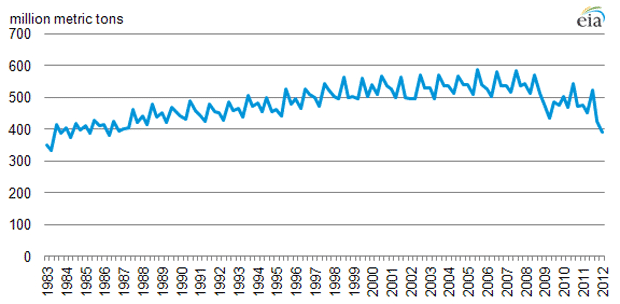

In 2005, coal was used to produce about half of all the electricity generated in the United States, but EIA data show that percentage has dipped to 35-40 percent, marking coal’s smallest market share in decades. As a result, EIA reported that U.S. CO2 emissions from coal fell 18 percent, to 387 million metric tons, during the first quarter of this year, ranking as the lowest first-quarter CO2 emissions from coal since 1983 and the lowest for any quarter since the second quarter of 1986.

“The decline in coal-related emissions is mainly attributable to utilities using less coal for electricity generation as they burn more low-priced natural gas,” EIA states in the report.

Noting that coal has the highest carbon intensity among major fossil fuels, and that coal-fired plants have the highest output rate of CO2 per kilowatt-hour, EIA projects that 90 percent of the energy-related carbon dioxide emissions from coal came from generating electricity.

Leading The World

The EIA’s findings for the United States stand in stark contrast to global trends identified by the International Energy Agency in its World Energy Outlook 2011. IEA projected that worldwide carbon dioxide emissions from fossil fuel combustion would increase by 1 gigaton last year to a new high, with coal accounting for 45 percent of global energy-related CO2 emissions.

IEA’s global database shows the U.S. energy sector leading the world in reducing carbon emissions, including among the nations that committed to curb annual CO2 and other greenhouse gas emissions to 1990 base-line levels under the 1997 Kyoto Protocol. According to IEA, China was the largest contributor to increased global emissions in 2011, with emissions rising 9.3 percent to 720 million tons, chiefly because of higher coal consumption. India’s emissions rose 8.7 percent, to 140 million tons, moving it ahead of Russia to become the fourth largest emitter behind China, the United States and the European Union.

However, IEA says, U.S. CO2 emissions trended in the opposite direction in 2011, falling by 1.7 percent (or 92 million tons), primarily as a result of switching from coal to natural gas for power generation, as well as the mild winter. Since 2006, U.S. emissions have declined by 430 million tons, or 7.7 percent, representing “the largest reduction of all countries or regions,” according to IEA.

Figure 1 shows first-quarter U.S. CO2 emissions from energy production between 1992 and 2012, as reported by the EIA. On an annual basis, U.S. energy-related carbon dioxide emissions peaked in 2007-08, and have declined since to the point where full-year 2012 emissions are expected to approach the 5 billion metric tons of 1990.

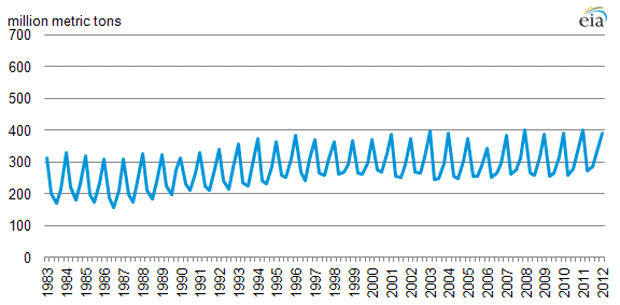

While factors such as mild weather last winter, improvements in vehicle efficiency and the weak economy certainly have contributed to shrinking U.S. emission levels, experts say the increased usage of natural gas–particularly the shift from coal to gas in the power sector–is the primary catalyst (Figures 2A and 2B).

Coal-To-Gas Switching

With an influx of supplies from shale gas plays, the U.S. electricity market’s ongoing transition to natural gas as a fuel source has been driven by market forces associated with the economic as well as the operational and environmental benefits of natural gas, as opposed to government mandates. In the August edition of BENTEK Energy’s The Market Call™ issued in late July, the company reported that year-to-date natural gas demand from power generation was 4.9 billion cubic feet a day higher than the first seven months of 2011, representing a 24 percent year-to-year increase.

“The majority of this increase can be attributed to sustained coal-to-gas switching, the onset of the peak power season in July, and record high summer temperatures,” BENTEK states in the monthly publication. “To reflect these market changes, BENTEK has revised the U.S. power burn forecast upward by an average of 1.0 Bcf/d through the end of summer, with an average power burn of 24.4 Bcf/d forecast for October.”

In a market alert issued in early August titled Gas Burn Key as Emissions Fall in U.S., BENTEK reports that about as much electricity was generated from natural gas as coal in April, for the first time in U.S. history. BENTEK says that trend that continued in May, when natural gas had a 32 percent share of the total fuel market and coal accounted for 34 percent. Based on EIA data, BENTEK projects the amount of U.S. electricity generated from coal-fired plants will decline to its lowest level since World War II by the end of this year, with natural gas continuing to displace coal in power generation.

Moreover, BENTEK says owners and operators of coal-fired power plants expect to retire 27 gigawatts of capacity from 175 coal-fired plants by 2016, amounting to 8.5 percent of 2011’s total U.S. generating capacity. The switch to natural gas not only makes sense from an economic perspective, but also enables compliance with stricter standards for CO2 and other emissions, the company emphasizes.

“Because of lower emissions from natural gas power generation compared with coal, the increasing use of gas in the power sector is a key factor in helping states comply with the Environmental Protection Agency’s Cross-State Air Pollution Rule (CSAPR), which seeks to limit sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions from power plants,” the market alert reads.

On Aug. 21, the U.S. Court of Appeals for the D.C. Circuit struck down CSAPR and sent the rule back to the EPA for revision, instructing the agency to administer the Clean Air Interstate Rule in the interim. If ultimately enacted, BENTEK says CSAPR would impact more than 3,600 electric generating units at more than 1,000 power plants in 28 states. NOx and SO2 emissions from power generation have already fallen by 16 and 34 percent, respectively, during the past two years in those 28 states, BENTEK reveals, with low natural gas prices enabling utilities to burn more gas to rapidly approach compliance with CSAPR’s proposed emissions targets.

BENTEK says many plants under potential CSAPR mandates already have made changes to comply with the new emissions rules, including switching from coal to gas-fired generation. “As a result, for January through June 2012, the fuel market share for natural gas at the plants in the 28 states had grown 34 percent, compared with the same period in 2011, which is the largest increase in seven years,” BENTEK notes, adding that 18 of the 28 states are compliant already with the proposed CSAPR targets on SO2.

Long-Term Decisions

Dan Whitten, vice president of strategic communications at America’s Natural Gas Alliance, says lower emissions from firing a larger share of U.S. electricity with natural gas affirms the merits of using natural gas as a primary fuel source across all major energy sectors–from transportation to electric generation.

“The impact of natural gas on lower greenhouse gas emissions is very clear when you look at the numbers. As the amount of gas used to fire electric plants increases, it leads to a corresponding reduction in the emissions of GHGs, mercury, SO2, NOx and more. The main number for consumers, however, is price,” he insists. “It is not just the power sector, but people in the transportation, manufacturing and industrial sectors also are making long-term decisions to invest in natural gas and gas infrastructure because the data show there is going to be a lot of clean-burning natural gas available at reasonable prices for decades.”

With vast reserves waiting in shale plays from the Marcellus to the Haynesville, Whitten underscores that natural gas provides an unprecedented opportunity to redefine the nation’s energy future to the benefit of all Americans.

“Shale formations have completely changed the way the United States looks at energy,” he observes. “Seven years ago, we were creating policies that would lead to opening dozens of liquefied natural gas import terminals all over the country. Thanks to the abundance of shale plays, we now have ample domestic resources to expand U.S. markets to capitalize on the economic and environmental attributes of natural gas and supply the nation’s energy needs for generations to come.”

Falling Emissions

In a blog posted on ANGA’s website, Whitten references a study by Ceres, an environmental investment network. The study found a range of pollutants emitted by the top 100 U.S. power producers dropped by nearly one-third between 2008 and 2010. SO2 emissions fell 32 percent while NOx emissions dropped 31 percent as the power generation sector shifted from coal to natural gas, leaving both SO2 and NOx power plant emissions 68 percent lower in 2010 than they had been in 1990, the study’s base-line year.

The Ceres study, titled 2012 Benchmarking Air Emissions, found that CO2 emissions from U.S. power plants fell 4 percent between 2008 and 2010. While still 24 percent higher than the 1990 level, Ceres says preliminary data suggest that CO2 emissions declined an additional 5 percent in 2011, with further reductions expected as utilities retired older coal-burning facilities. In addition to the downward trend on CO2 emissions, the preliminary data indicate that power plant SO2 and NOx emissions continued to fall significantly in 2011.

“This is an historic transition for the electric power industry,” Ceres President Mindy Lubber comments in the report. “More and more power producers are shifting away from coal-fired generation in favor of lower-emitting natural gas-fired plants, renewable power and energy efficiency. The economic case for cleaner energy is better than it ever has been, and this report shows that the industry is adapting to stronger Clean Air Act emission standards, state-driven efficiency and renewable energy incentives, and the dynamics of the natural gas market.”

Widespread Transition

The Ceres study details how the “widespread transition away from coal” is affecting some of the nation’s largest power producers. For example, Ceres notes that American Electric Power–the country’s largest electricity producer–used 62 percent more gas in the first three months of this year than in the first quarter of 2011. Meanwhile, Southern Company projects its fuel mix will include more natural gas than coal in 2012 for the first time in its 100-year history.

Since January 2010, Ceres reports that power plant owners have announced 40 gigawatts of coal plant retirements, representing 12 percent of the nation’s coal-fired capacity. Most of the plant closures are scheduled to occur between 2012 and 2020. As these older, higher-emitting plants go off line, they are expected to be replaced largely by high-efficiency gas-fired capacity, continuing the trend toward expanding demand in the power sector, where gas consumption has increased at an average rate of 4 percent annually over the past decade, according to the report.

Benchmarking Air Emissions also shows zero-emitting technologies gaining ground. Excluding large hydroelectric projects, Ceres found that renewable energy accounted for 5 percent of U.S. electricity generated in 2011, primarily from wind generators.

However, in its Annual Energy Outlook 2012, issued in June, EIA reports that natural gas accounted for 81 percent of all generation capacity added between 2000 and 2010, with the 237 gigawatts in additions representing more than a 70 percent increase in U.S. gas-fired capacity. At year-end 2010, natural gas accounted for 39 percent of the 1,042 gigawatts of total U.S. generation capacity.

According to EIA, the relatively low cost of natural gas and the low capital costs of gas-fired facilities make natural gas the “primary choice” to fuel new generation capacity. Consequently, EIA says it expects gas-fired plants to dominate capacity additions through 2035, accounting for 60 percent of new capacity on average, compared with 29 percent for renewables, 7 percent for coal, and 4 percent for nuclear.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.