Overtime Compensation

Violating Wage And Hour Laws Can Be Costly

By Martin J. Saunders

PITTSBURGH–Most employers know they have an obligation to pay additional wages to certain classes of employees when those employees work more than 40 hours a week. Confusion over to which employees such payments must be made and how to calculate those payments, however, continues to create significant liability for employers in the oil and gas industry.

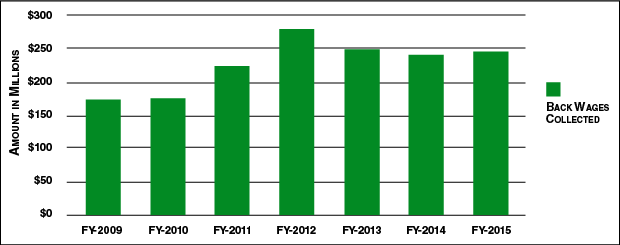

Lawsuits brought under the Fair Labor Standards Act, which governs federal wage and hour law, and related state wage and hour laws continue to rise, and today are the most frequent employment claims filed in federal courts. In fact, 8,954 such lawsuits were brought in 2015, an 11 percent increase from 2014 and a 450 percent increase from 2000. Those settlements resulted in the Department of Labor’s Wage & Hour Division recovering nearly $250 million in back wages for employees (Figure 1), and the combined settlements cost employers $2.5 billion.

Publicity surrounding income disparity and stagnant wages, the proposed increase in the salary applicable to salary exemptions, and a proposed increase in the federal minimum wage–as well as actual increases in various state and city minimum wages–have made employees more aware of their rights and employers’ resulting obligations under the wage and hour laws.

The wage and hour claims of any individual employee may amount only to a few hundreds or thousands of dollars and arise from a payroll department mistake on that particular employee’s compensation (i.e., failing to pay overtime to an hourly employee because of an internal clerical, reporting or computer error). Such claims, however, can amount quickly to a significant liability, since they often arise from a payroll practice that affects a number–or group–of employees, thereby resulting in a collective or class action lawsuit.

In the latter situation, there is, in essence, a multiplier effect on an employer’s liability because liability to one such employee creates liability to all similarly situated/classified employees subject to the payroll practice in question.

Strict Liability

Courts hold employers strictly accountable for compliance with wage and hour laws, since these Depression era laws were passed for the benefit of workers. Employers are in exclusive control of their payroll practices, and courts believe employers must ensure their payroll practices conform to the requirements of wage and hour laws.

Violating these laws can be very expensive for employers. In addition to the costs of their own defense, their own attorney fees, and internal management time spent defending a claim, employers that violate wage and hour laws not only have to pay each employee the wages found to be owed, but in most cases will pay a similar amount as liquidated damages because the employer will be found to have known or should have known of the wage and hour law. In addition, employers will be assessed the employees’ attorney fees.

Wage and hour claims have proven to be an issue not only for small companies; they also have afflicted large, integrated producers. For example, CITGO Petroleum Corp. paid $430 million to settle unpaid overtime claims arising from uncompensated, mandatory preshift meetings of 15-30 minutes in duration. Applied Consultants Inc. paid $9.25 million to settle overtime claims of pipeline inspectors who were paid on a straight day-shift basis without any extra compensation for hours worked in excess of 40 in a payroll week.

Part of this liability is attributable to the common misconception that employees paid on a salary basis can have no claim for overtime compensation if they work more than 40 hours in a pay week. This is incorrect. Being paid on a salaried basis is only the first of three requirements needed to meet the salary/white collar exemption from overtime pay.

Additionally, the employee’s salary (at present) must be at least $455 a week, which will be increased to $913 a week effective Dec. 1, and the employee’s duties must meet the requirements of either the executive, administrative or professional exemptions.

The duties/requirements for each “white collar” exemption are different. To qualify for the executive exemption, the position’s primary duties must be managing the enterprise. This means the responsibilities of the position must include setting the hours of work, evaluating employees, setting pay rates, hiring, discipline, adjusting grievances or assigning work, and directing the work of two or more subordinates.

The administrative exemption is applicable to positions that perform office or nonmanual work directly related to running a department, and that exercise discretion and independent judgment on matters of significance, i.e. evaluating courses of action with the freedom to implement or deviate from policy without approval.

Finally, to qualify for the professional exemption, the primary duties of the position must be work that is primarily intellectual, requires the constant exercise of discretion and judgment, and is derived from advanced knowledge in a field of science or learning customarily acquired by a prolonged course of specialized intellectual instruction.

Day And Shift Rates

One source of frequent wage and hour problems for employers is their attempts to adequately compensate their employees in a manner that does not require the employer to track hours or provide additional pay for work in excess of 40 hours a week. These attempts often have resulted in employers misusing various compensation plans that are intended to include compensation for any and all overtime in a higher base rate.

Such plans are known as day rate, shift rate, or fluctuating work-week plans. Properly utilizing these plans–despite their names–requires that the nonexempt employee be paid additional compensation for hours worked over 40 in the payroll week.

Under day- or shift-rate plans, employees are paid a fixed sum for each day or shift they work, regardless of length. Such an arrangement, however, does not relieve the employer from tracking the employee’s hours and paying the employee for all hours worked in the payroll week. This entails calculating and paying the employee’s regular rate for all overtime hours worked, plus an additional 50 percent of the regular rate for all overtime hours.

Under these plans, the employee’s regular rate, which is the key component for determining the overtime rate, will vary each week, depending on the number of hours worked. The employee’s weekly compensation also will vary each week, and will be the sum of the total weekly day/shift rate plus the additional compensation owed for hours worked over 40 in each payroll week.

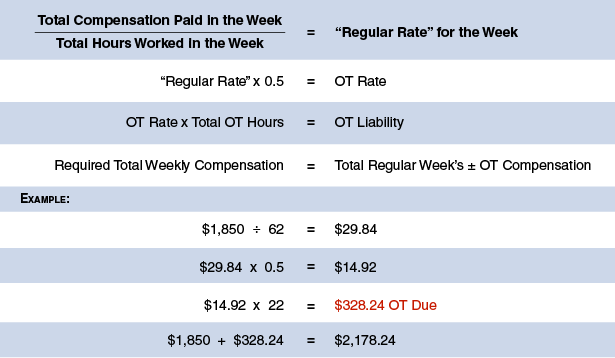

Overtime payments under day/shift rate plans are computed each week by totaling the day/shift rate for the week and dividing that number by the total number of hours worked. This will determine the employee’s regular rate for that week.

The employee’s regular rate for that week then is multiplied by 0.5 to determine the overtime rate, which in turn is multiplied by the hours worked in excess of 40 during the payroll week to yield the overtime payment requirement for that week. Table 1 provides an example of this calculation for a nonexempt employee who earns $1,850 in one week in regular compensation on a day- or shift-rate plan and works a total of 62 hours in that payroll week.

Fluctuating Work Week

A similar overtime computation must be made with regard to fluctuating work week compensation plans. Under such compensation arrangements, a nonexempt salaried employee is paid a fixed salary for all hours worked during the work week.

For a fluctuating work week plan to be valid, however, the employee’s hours of work must vary from week to week, and in some weeks, must be less than 40 hours. Nevertheless, the employee still must be paid the set salary for those weeks in which he works fewer than 40 hours.

However, this compensation system also requires the employer to continue to track the nonexempt salaried employee’s hours, since the employer still must pay overtime for hours worked in excess of 40 in the payroll week. The set salary divided by the number of hours worked in each work week produces the employee’s regular rate for that particular week.

The regular rate, thus, will differ each week, based on the total number of hours worked. The regular rate then is multiplied by 0.5 to determine the overtime rate, which in turn is multiplied by the number of hours worked over 40 to obtain that week’s overtime pay.

As with day/shift-rate plans, the employee’s total compensation for the week in question is equal to the week’s overtime pay plus the guaranteed salary.

Bonuses And Benefits

Attempts to incentivize performance with various types of bonuses for attendance, productivity, safety, etc., also regularly come back to demonize employers.

The first question that must be answered regarding such incentives is: Are they, as designed, nondiscretionary in that the employer is obligated to pay the bonus if the employee meets the designated target?

If the answer to that question is in the affirmative, such bonuses increase the employee’s regular rate and, therefore, increase the overtime payment owed for any pay week in which the employee works more than 40 hours. Failure to include nondiscretionary bonuses in its employees’ regular rate cost Urban Outfitters $5 million to settle claims.

The increase in the regular rate attributable to nondiscretionary bonuses is calculated by dividing the bonus by the total number of weeks in the covered bonus period, thereby arriving at the bonus per week. The bonus per week is divided by the total hours worked each week. That result is multiplied by 0.5. This sum is multiplied by all overtime hours in a particular week, and that product is added retroactively to each respective week’s pay.

Calculating bonuses must be done on a week-by-week basis and allocated retroactively to each week.

If the bonus is discretionary, however, it does not need to be included in the regular rate. A bonus is discretionary if the employer has the unilateral power to decide whether to pay the bonus, or to decide how to calculate or determine the bonus, and there is no custom or practice of paying such bonus; it is akin to a gift.

Bonuses are not the only item that can increase an employee’s regular rate. In some cases, nonmonetary benefits provided by the employer also must be allocated over the pay period and added to the employee’s weekly regular rate. These circumstances arise when an employer provides an employee with lodging, meals, clothing, fuel, etc., for the employee’s benefit.

In such circumstances, the fair value of the noncash payment must be included in computing the employee’s regular rate for the pay period, since these payments are accounted as wages. Such payments also should be reflected on the employee’s IRS Form W-2.

The value of noncash payments provided to an employee for the employer’s benefit, however, is not included in his regular rate or added to the employee’s W-2, and cannot be credited toward the payment of wages. This is the manner in which payments made for employee fringe benefits or into benefits plans are treated.

Employer Safeguards

There are several actions employers can take to avoid becoming part of the wage/hour statistics. First, audit all payroll practices to ensure all hours worked are being captured and overtime is being calculated properly, based on the compensation method used.

Second, have a written agreement with each employee who is compensated on the basis of a day/shift rate or fluctuating work-week compensation plan, specifying the employee knows and agrees to such a compensation arrangement.

Third, include an agreement requiring arbitration of all employment claims in all employment documents, including job applications, and raise and promotion forms. Also include a provision in all such documents by which the employee agrees not to bring any claim as a class or collective action, requiring instead that any claim be brought only as an individual claim.

Fourth, do not try to get too cute–remember that employees cannot waive their rights under wage and hour laws.

Fifth, and finally, when in doubt, have any questionable compensation arrangements reviewed by competent employment counsel.

Currently of counsel at Steptoe & Johnson PLLC in Pittsburgh, Martin J. Saunders has focused his practice on labor and employment law on behalf of management for more than 40 years. He is an experienced litigator and adviser to organizations in a wide range of matters, including human resource practices, discrimination, and collective bargaining. Saunders holds an L.L.M. in labor law from New York University and a J.D. from William & Mary. A frequent speaker and author, he was recognized in 2015 and 2016 in “Best Lawyers in America.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.