Exporting U.S. Oil

Nation And States To Benefit From Shipping Crude Overseas

WASHINGTON–Two studies document the economic and employment benefits of lifting U.S. restrictions on crude oil exports, projecting as many as 940,000 additional jobs could be created across the United States.

In addition to job creation, a study by IHS projects removing the 1970s-era restrictions on U.S. crude exports would lead to increased domestic oil production, which is likely to lower gasoline prices. Meanwhile, a state-by-state analysis conducted for the American Petroleum Institute by ICF International and EnSys Energy concludes that 18 states each will gain more than 5,000 jobs in 2020 from crude oil exports.

The IHS study, U.S. Crude Oil Export Decision: Assessing the Impact of the Export Ban and Free Trade on the U.S. Economy, says that making domestic oil available to global markets would unlock the supply and refining gridlock in the United States and lead to $746 billion in additional investments during the study period (2016-2030). It also would result in an average of 1.2 million barrels a day of additional oil production, IHS projects.

That additional crude would lower gasoline prices by an annual average of 8 cents a gallon, the study says. The combined savings for motorists during the study period total $265 billion, compared with the situation where the restrictive trade policy remains in place.

Aside from employment increases, IHS asserts that doing away with export restrictions also would benefit U.S. household incomes, gross domestic product, and government revenues. It says the resulting jump in domestic oil production would be so great that it would cut the U.S. import bill by an average of $67 billion a year.

The study says the additional economic activity resulting from increased crude production would support an average of 394,000 additional jobs, with highs of 811,000 new jobs in 2017 and a peak of 964,000 new jobs the following year.

Front-Loaded Benefits

According to IHS, the growth in economic benefits would be rapid, with many of the economic impacts reaching peak levels in the next few years before maintaining elevated levels through 2030. The study says this is because of an immediate surge in investment that would be unleashed from pent-up potential if crude exports were permitted. However, as a result of the increase in overall oil supply, it projects annual reductions in gasoline prices would remain largely consistent.

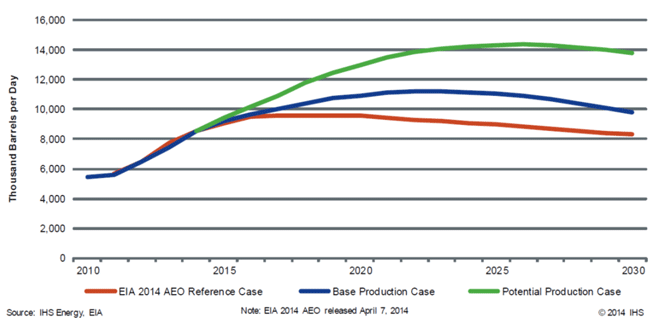

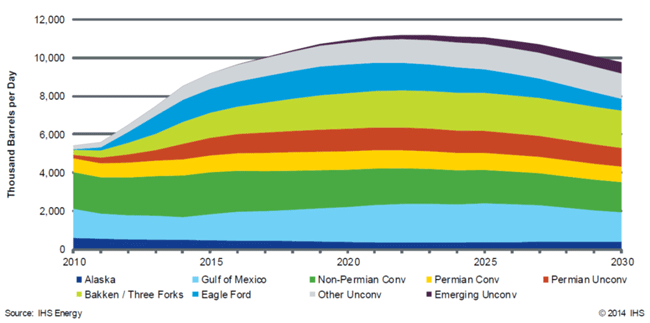

IHS looks at domestic oil production under two scenarios: a base production case, where U.S. output peaks at 11.2 MMbbl/d in 2022, and a potential production case, which projects an output peak of 14.3 MMbbl/d in 2026. The study then compares them with production projections from the U.S. Energy Information Administration (Figure 1). According to IHS, nine hotspots–representing conventional onshore and offshore as well as unconventional plays–will contribute to the increase in U.S. oil production (Figure 2).

Lifting export restrictions would lower net petroleum exports to the United States by nearly 1 million barrels a day, for an annual savings of more than $43 billion, IHS says. The savings would continue to grow until peaking at more than $86 billion in 2025. The study predicts import savings remain significant for the rest of the study period, averaging more than $74 billion a year through 2030.

“The 1970s-era policy restricting crude oil exports–a vestige from a price controls system that ended in 1981–is a remnant from another time,” asserts Daniel Yergin, IHS vice chairman. “It does not reflect the dramatic turnaround in domestic oil production led by tight oil, which has reversed the United States’ oil position so significantly.

“The United States has cut its dependence on foreign oil in half since 2005, and its production gains have exceeded that of the rest of the world,” Yergin points out. “The economic contributions of this turnaround have been substantial. Allowing the free trade of oil would expand those gains for consumers and the wider economy.”

If the nation lifted export restrictions, IHS says the economic benefits would come by way of relieving the gridlock in light-oil supply that exists in the United States. The rapid growth in tight oil production, which already has increased domestic oil output from 5.0 MMbbl/d in 2008 to 8.2 MMbbl/d in March 2014, has outpaced U.S. refining capacity for the light oil found in unconventional formations, thus restricting investment in production.

“Export restrictions mean that light crude has to be sold at a sharp discount to compensate for the extra cost of refining it in facilities that were not designed for it,” says James Fallon, IHS director and study co-author. “That gridlock is preventing additional investment and production, and the additional economic benefits that could otherwise take place.”

IHS says the assumption that allowing crude oil exports would lead to higher gasoline prices is not accurate. Rather, import restrictions discourage additional crude oil supplies from being brought to market, which actually makes gasoline prices higher than they otherwise would be, it counters.

State Benefits

The Impacts of U.S. Crude Oil Exports on Domestic Crude Production, GDP, Employment, Trade and Consumer Costs, the state-by-state analysis conducted by ICF International and EnSys Energy, concludes that in addition to job growth, most states could see economic activity climb by hundreds of millions of dollars because of increasing energy production and downward pressure on gasoline prices.

“The United States is poised to become the world’s largest oil producer, and access to foreign customers will create economic opportunities across the country,” poses API Vice President for Regulatory and Economic Policy Kyle Isakower. “When it comes to crude oil, the rewards of free trade are not limited to energy-producing states. New jobs, higher investment, and greater energy security from exports could benefit workers and consumers from Illinois to New York, especially in areas where consumer spending and manufacturing drive growth.”

The API study found that if exports were allowed, the United States could sustain growing levels of tight oil drilling through 2035, after which the most productive portions of some plays would be developed fully and drilling levels would decline. The analysis says the economic and employment impacts result from drilling activity, and thus are higher in 2020, when drilling levels are nearing their peaks, than in 2035.

According to the study, nine states–Florida, Michigan, Indiana, California, New York, Pennsylvania, Ohio, Texas and North Dakota–could see more than $1 billion in state economic gains in 2020, depending on global price trends. It projects slower growth through 2035, after new drilling plateaus.

In other predictions, the study says that by 2020:

- Eight states–Illinois, Florida, New York, Pennsylvania, Ohio, California, North Dakota and Texas–could gain more than 10,000 jobs each.

- Texas alone could gain as much as $5.21 billion in added economic activity and 40,921 jobs.

- North Dakota could gain 22,215 jobs and $4.81 billion in state economic growth.

- States with significant manufacturing and consumer spending, such as California, could add 23,787 jobs and $2.06 billion in economic activity.

- New York could add 15,350 jobs and $1.95 billion in economic activity.

“Restrictions on exports only limit our potential as a global energy superpower,” says Isakower. “Additional exports could prompt higher production, generate savings for consumers, and bring more jobs to America. The economic benefits are well established, and policymakers are right to re-examine 1970s-era trade restrictions that no longer make sense.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.