Easily Carried Proppant Enables Slickwater Fracs To Deliver More Production

By Harold Brannon

For more than two decades, unconventional operators have steadily refined horizontal drilling and multistage hydraulic fracturing. Longer laterals, tighter cluster spacing and high-rate slickwater treatments have unlocked vast resource volumes that once seemed unreachable. Yet as these practices have matured, a familiar reality has emerged: simply pumping more fluid and more sand does not guarantee proportionally better results. In many wells, large portions of the created fracture network remain poorly propped, limiting conductivity and leaving hydrocarbons behind.

Against this backdrop, neutrally buoyant proppant technology has quietly moved from niche innovation to established practice. Once viewed as an experimental add-on, neutrally buoyant proppants (NBPs) are now supported by years of laboratory work, extensive field deployment and repeatable production results across multiple basins. Their value proposition is straightforward and increasingly relevant: improve proppant placement efficiency, increase effective fracture connectivity, and do so in a way that improves overall well performance and reduces lifting costs over the life of the asset.

The Transport Challenge

The core challenge addressed by NBPs is not new. Conventional slickwater fracturing relies on low-viscosity fluids to maximize fracture complexity and reduce pumping costs. However, these fluids provide limited capacity to transport dense proppants. Traditional sand, with a specific gravity more than twice that of water, settles rapidly once slurry velocity decreases. Laboratory flow cells and fracture models consistently show that sand tends to form settled banks near the bottom of fractures, leaving much of the created height and width effectively unpropped.

Field experience has reinforced these findings. In many unconventional completions, only a fraction of the stimulated fracture area contributes meaningfully to production. The remainder may initially flow due to fracture complexity and pressure drawdown, but without durable conductivity, those pathways close or degrade quickly. The result is early-time production that looks promising, followed by a steeper decline and lower ultimate recovery than models may predict.

Neutrally buoyant proppants were developed to directly address this transport limitation. By closely matching the density of the carrier fluid, these materials remain suspended far longer than conventional proppants. Instead of rapidly settling, they move with the fluid phase throughout the fracture network, accessing regions that sand alone cannot effectively reach.

How NBPs Work

At a fundamental level, NBPs are engineered materials with apparent specific gravity near that of water-based fracturing fluids. This near-neutral buoyancy dramatically reduces settling velocity, allowing the particles to be carried upward and outward within fractures even under low-viscosity conditions.

Beyond buoyancy, modern generations of these proppants incorporate mechanical properties that further enhance performance. Unlike brittle materials that crush under closure stress, NBPs are designed to deform plastically. Under load, individual particles flatten slightly, increasing contact area and distributing stress without generating fines. This behavior helps preserve conductivity while minimizing embedment into the fracture faces.

Because they occupy more volume per unit weight than sand, NBPs can deliver meaningful fracture coverage at very low mass loadings. Rather than replacing sand entirely, they are typically deployed as a small fraction of the total proppant volume, strategically placed to supplement conventional designs. This hybrid approach allows operators to enhance fracture connectivity without fundamentally changing their pumping schedules or logistics.

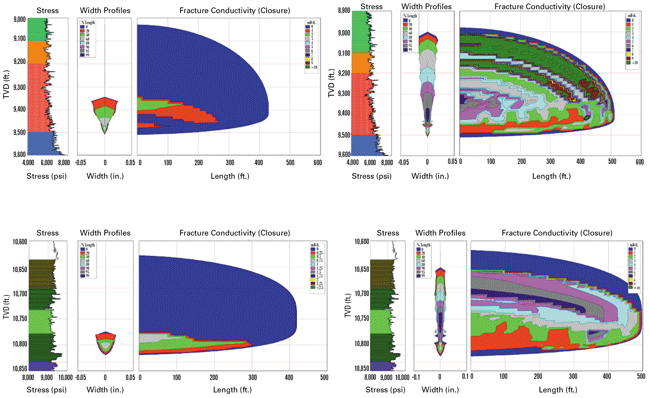

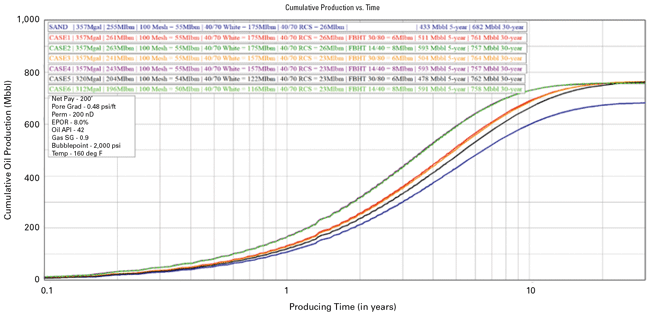

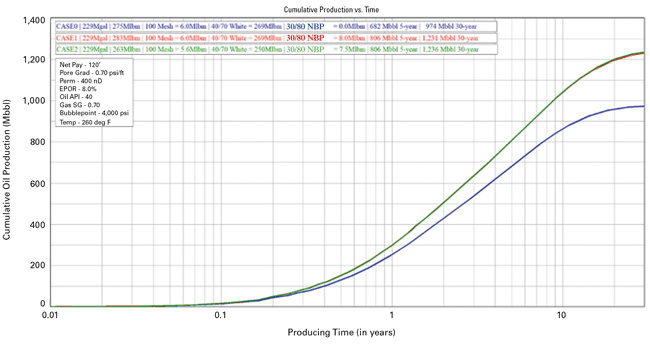

These fracture models compare conventional slickwater/sand completions (left) with designs that incorporate neutrally buoyant proppant (right). The top models represent the Permian, while the ones on the bottom are for the Middle Bakken. In both cases, fracture conductivity and width profiles show substantially greater propped fracture area when neutrally buoyant proppant is added, translating into higher cumulative oil production over time and a lower cost per barrel that is driven by improved recovery efficiency and reduced lifting costs.

Long Track Record

NBPs are not a recent experiment. Early versions were introduced in vertical and short-lateral wells more than a decade ago, providing valuable insight into transport behavior and long-term conductivity. Over time, material science advances improved strength, temperature tolerance and consistency, enabling application in today’s high-rate, long-lateral horizontal wells.

As horizontal development accelerated, operators began integrating NBPs into slickwater designs at low concentrations, often on the order of a few percent by weight relative to sand. Fracture modeling consistently showed a dramatic increase in the percentage of created fracture area that remained propped when these materials were included. In many designs, effective propped area expanded from roughly 25% of the fracture network to the majority of the created geometry.

Production data from multiple basins has since validated these models. Wells incorporating NBPs have demonstrated higher cumulative production, flatter decline trends and improved estimated ultimate recovery when compared with nearby offsets completed with similar fluid and sand volumes alone. For example, some recent comparisons reported that NBP increased normalized first-year cumulative production by about 27%. That is typical, with most comparisons finding an uplift between 25% and 35%.

Importantly, these uplifts have been observed across a range of reservoir types, including oil- and gas-weighted systems. Today, many compelling case studies come from unconventional wells in the Marcellus, Mancos, Middle Bakken, and Wolfcamp shales. However, NBPs have a long and impressive track record.

For instance, from 2009 to 2015, NBPs saw use in numerous Texas plays, including the Austin Chalk, Barnett, Bone Spring, Cherry Canyon, Cotton Valley, Delaware, Devonian, Eagle Ford, Granite Wash, Huron, San Andres, Spraberry, Travis Peak and Woodford. During the same period, they also boosted production from wells in the Denver-Julesburg Basin and Appalachia. In the decade since then, their popularity has grown significantly.

Operational Simplicity

One reason NBPs have gained traction is their compatibility with existing completion workflows. They do not require wholesale redesign of stimulation programs. Instead, operators typically evaluate several integration options, ranging from simple addition to cost-normalized designs.

In a straightforward approach, the NBP is metered at a constant rate throughout sand stages, targeting uniform distribution across the fracture network. Alternative designs reduce total sand volume to offset the added material cost, relying on improved placement efficiency to maintain or improve performance. In some cases, total fluid and proppant volumes are adjusted to keep overall treatment cost near baseline levels.

Because loadings are relatively low, surface handling requirements are modest. Many operations have successfully incorporated NBPs using standard blending equipment with minor procedural adjustments. Tolerances on delivery rate are forgiving, further reducing operational risk.

Long-Term Impact

While production uplift is often the most visible benefit, the economic impact of NBPs extends well beyond early-time rates. Improved fracture connectivity enhances reservoir drainage efficiency, which in turn influences long-term operating costs.

By sustaining higher conductivity deeper into the fracture network, these proppants help maintain reservoir pressure support and reduce near-wellbore drawdown stress. The result can be lower water cut acceleration, improved gas-liquid ratios and more stable artificial lift requirements. Over time, these factors contribute to lower lifting costs on a per-barrel basis.

From a capital efficiency standpoint, faster payout and higher net present value have been documented in wells where NBPs are used effectively. Even when incremental material costs are considered, the combination of increased recovery and lower operating costs often yields attractive returns, particularly in capital-constrained environments.

Field trials show remarkable returns. In the Permian Basin, NBPs reduced the cost per barrel by 20%, delivering a 5x ROI (Figure 1). In the Middle Bakken, costs fell 30% for an 18x ROI (Figure 2).

Reducing Risk

As unconventional development shifts from rapid delineation to disciplined manufacturing, risk management has become a central concern. Operators are increasingly focused on repeatability, capital efficiency and predictable outcomes. In this context, technologies that improve the effectiveness of existing designs without introducing operational complexity are especially valuable.

NBPs fit this profile. Their performance mechanisms are well understood, supported by laboratory testing and validated through extensive field application. They address a known limitation of slickwater fracturing instead of relying on unproven concepts or marginal gains.

Equally important, they offer a pathway to optimization without escalation. Instead of pushing pump rates higher or adding more sand, operators can improve the quality of fracture connectivity with modest adjustments to existing programs. This approach aligns well with the industry’s broader emphasis on doing more with less.

Looking Ahead

The evolution of neutrally buoyant proppants mirrors a broader trend in unconventional development: a shift from brute-force stimulation toward engineered efficiency. As reservoirs become more competitive and margins get tighter, the ability to extract more value from each stage and each pound of proppant will only grow in importance.

Future work will undoubtedly refine material properties, integration strategies and modeling tools. However, the core value proposition is already clear. NBPs are no longer experimental or theoretical. They represent a proven, field-tested technology that improves fracture effectiveness, lowers application costs on a normalized basis, enhances overall production and contributes to reduced lifting costs over the life of the well.

For operators seeking practical ways to improve returns without increasing complexity, NBPs offer a compelling example of how thoughtful engineering can unlock meaningful gains in a mature unconventional landscape.

HAROLD BRANNON is the vice president of production enhancement for Sun Specialty Products. He has 42 years of petroleum industry experience focused on well completion, stimulation, and remediation technologies, including six years as vice president of technology for Baker Hughes’ pressure pumping division. Brannon is an inventor named on approximately 140 U.S. patents issued and pending. He is an active member of the Society of Petroleum Engineers, serving as a Distinguished Lecturer in 2010 and as a technical program committee member for several SPE conferences. He has authored well over 100 technical publications, and he received the SPE Peer Apart Award for his service as an editor for SPE Journal publications.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.