Purple Hayes No. 1H Ushers In Step Changes In Lateral Length, Well Cost

By Tim Beims

STATE COLLEGE, PA.–Eclipse Resources Corp. has sought to continuously improve well economics since entering the Utica Shale three years ago. A powerful lever in lowering the cost per foot of stimulated Utica interval has been a gradual extension of horizontal reach, with the company increasing lateral lengths in evolutionary increments of tens to perhaps hundreds of feet from one well to the next.

Looking to further enhance the cost structure of developing both the dry gas and condensate-rich portions of its Utica leasehold in eastern Ohio, Eclipse Resources is shifting to a new “superlateral” paradigm that measures lateral extension in the revolutionary increments of miles rather than feet.

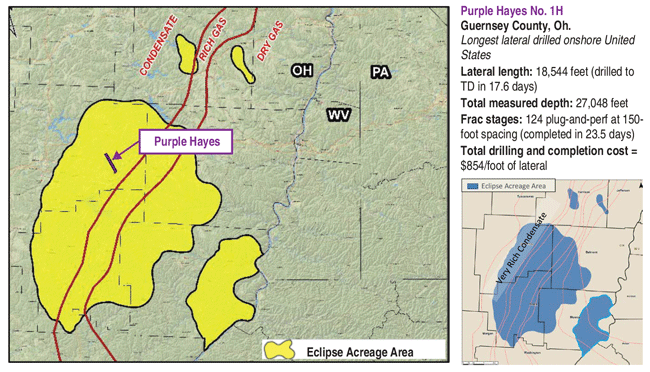

Ben Hulburt, Eclipse Resources’ co-founder, chairman and chief executive officer, says the company’s superlateral program is redefining the standard for Utica horizontal drilling, as demonstrated in early May, when the first such well–the Purple Hayes No. 1H in Guernsey County, Oh.–began flowing natural gas and condensates from the longest lateral ever drilled onshore in the United States.

With a total measured depth of 27,048 feet, the Purple Hayes lateral spans 18,544 feet, yet was drilled in only 17.6 days in a single bottom-hole assembly run, Hulburt reveals. Moreover, he says, Eclipse Resources completed the well in 23.5 days, placing a plug-and-perf hydraulic fracturing stage every 150 feet along the 3.5 mile-long lateral, averaging 5.3 stages each day. When all the work was done, Hulburt says the total drilling and completion cost came in at $854 per foot of lateral, shattering any previous industry benchmark in the Utica Shale.

While the technical achievements associated with constructing the well are impressive, Hulburt emphasizes the fiscal rationale behind Purple Hayes. “It represents a step-change in the cost structure of Utica wells,” he declares. “We are sold on superlaterals.”

The numbers reveal the magnitude of the improvement since Eclipse Resources drilled its first Utica well, the Tippens No. 6HS with a 5,850-foot lateral. Hulburt says the company’s first 10 Utica wells (drilled in 2013-14) had an average lateral length of 6,270 feet and took 49 days apiece to drill to total depth. The aggregate total cost was $2,400 per foot of completed lateral.

In contrast, he reports, Purple Hayes has three times the reservoir interval of those first 10 horizontals at one-third the cost per foot of completed lateral, and Eclipse drilled and completed the 18,500-foot lateral in 15 percent less time than it took just to drill a 6,000- or 7,000-foot lateral two years ago.

“We achieved every objective we laid out for our first superlateral,” Hulburt exults. “The entire Purple Hayes project was executed almost flawlessly. The drilling and completion operations went pretty much exactly as designed from spud to flowback.”

Superlateral Takeoff

While the Purple Hayes 1H is the culmination of Eclipse Resources’ years of experience in the Utica, as well as a concerted internal extended-reach research and development effort, Hulburt suggests it is merely the takeoff point for what the company envisions for the future: field development scenarios in both its dry gas and liquids-rich acreage based on well pads with two-three superlaterals, and perhaps one day, even multiple superlaterals from a single vertical pilot hole.

“This is our first superlateral, but it will not be the last,” he vows. “We plan to spud a superlateral in the dry gas area in the third quarter, and are looking at a couple in early 2017 in the wet gas part of the play that will be even longer than Purple Hayes.”

The business case for superlaterals is simple: spread drilling and completion costs over as many lateral feet of stimulated reservoir volume as possible, according to Hulburt. “Our objective is to get total well costs down to where the condensate portion of our acreage becomes very attractive at oil prices in the mid $50s and higher,” he says.

Initial production from Purple Hayes is being restricted to 5 million cubic feet of dry gas and 1,200 barrels of condensate a day to manage pressure drawdown, but Hulburt says all early signs point to promising long-term productivity and reserves recovery.

“We probably could open the well more, but it is exceeding our projections already,” he states, noting that the ability to attain similar recovery rates to shorter-lateral offset wells will be the ultimate gauge of Purple Hayes’ success.

“The final test is recovery per foot,” he says.

Eclipse Resources steadily increased lateral lengths from about 6,000 feet in its first well to an average of 7,000 feet in 2014 and 9,000 feet in 2015, with its longest lateral prior to drilling the Purple Hayes stretching nearly 14,000 feet. “As we moved to longer laterals, we saw no evidence of degradation in the recovery per foot of completed lateral,” Hulburt says. “That may not be true in other reservoirs, but it appears to be true in the Utica. It will take time to get the answer on recovery, but we are excited about the performance to date of our first superlateral.”

Rising To The Challenge

Pushing the boundaries of extended-reach well architectures obviously introduces additional operational risks. According to Hulburt, however, Eclipse Resources’ Utica experience and the expertise of its in-house drilling and completion team gave management the confidence that it could drill a lateral efficiently and safely to a distance roughly equivalent to the maximum altitude for Cessna’s latest-generation turboprop.

Eclipse Resources’ Purple Hayes No. 1H–the longest lateral ever drilled onshore the United States–flowed first production in early May. While the technical achievements associated with the project are impressive, the company says its first superlateral is a step-change in the cost structure of Utica horizontal wells.

“We did not jump right out to 18,500 feet on our first well. We never would have attempted such a project if we did not know it would succeed. We have more than 200 producing Utica wells, and have drilled extensively in both the dry gas and condensate parts of the play,” he relates. “That experience was combined with an R&D project that lasted several months before we decided to drill the well.”

Purple Hayes 1H is the manifested response to a challenge Hulburt issued in 2015 to his Utica team, led by Vice President of Drilling and Completions Oleg Tolmachev, who joined the company in 2014 after supervising the drilling of more than 100 wells as Utica asset manager for Chesapeake Energy Corp.

“Given the very low oil prices at the time, I wanted to know the feasible lateral length limit in the condensate area, where reservoir depth is shallower and pressures are lower than in the dry gas region,” Hulburt recalls. “The team eventually determined that we could effectively drill laterally to 22,000 feet at a vertical reservoir depth of 6,000-7,000 feet. As we started planning Purple Hayes, we felt very comfortable out to 20,000 feet, but because it was our first superlateral, we ultimately decided on a length of 18,500 feet.”

He says contingency planning was integral to the upfront drilling and completion design work to eliminate potential operational “blind spots,” minimize risk, and mitigate nonproductive time. “We conducted a series of engineering exercises, thinking through anything that could possibly go wrong and how to respond if it did go wrong,” he says. “The R&D work ran the gamut from drilling and completion to production, and even the decision to preplan artificial lift into the wellbore.”

Yet for all the technical demands presented by the well’s extraordinary length, the final design included no equipment stamped “Serial No. 001,” Hulburt points out. “Every piece of equipment we used to drill, complete and produce this well was proven. We did not have to design or fabricate any new technology,” he comments. “It was a matter of good engineering and combining several good technologies to accomplish the goals of this application.”

Going forward, Hulburt says Eclipse Resources expects it superlaterals in its dry gas area along the West Virginia border to average around 14,000 feet, which he says is considerably longer than existing wells. “The difficult parts of the play are in the deeper, dry gas window, where pressure gradients are 0.94 and higher. These are the highest pressures of anything we have seen in the Appalachian Basin, and that limits lateral lengths to 15,000-16,000 feet.”

Assuming the Purple Hayes 1H’s initial performance stands up to the test of time, Hulburt says the company’s future wells in the condensate area likely will average 20,000 feet. “Purple Hayes went extremely well, but we did learn some lessons we think will bring well costs even a little lower on subsequent superlaterals,” he offers.

Beating Expectations

All the upfront planning resulted in Eclipse Resources bringing in its first superlateral under budget, with actual drilling and completion times beating predrill expectations. Hulburt reports a major enabler to eliminating rig time was the ability to TD the entire lateral section with a single bit on a rotary steerable assembly.

“We expected to achieve rates of penetration comparable to our shorter laterals since the Utica is very drillable in the southern part of the play, once you turn horizontal and get past shallow zones that tend to have sloughing issues,” he details. “We think rotary steerables are the only way to drill superlaterals, but given the length of the well, a bit trip would have meant considerable time and expense.”

After drilling the vertical pilot hole with air, a Helmerich & Payne FlexRig™ moved on location to drill the curve and lateral sections. Eighteen days later, with the toe of Purple Hayes 1H more than five miles in measured depth from the rig floor, the Smith Bits’ MDi516 matrix bit fitted with 16-millimeter PDC cutters was pulled from the well in an excellent dull condition, according to Hulburt. “The bit is sitting in our conference room. We probably could drill another well with it,” he quips.

According to Schlumberger, the five-blade, 81⁄2-inch bit was designed specifically for drilling extended lateral sections using its PowerDrive Orbit™ rotary steerable system to minimize erosion while meeting requirements for both steerability and penetration rates. The bit was designed for optimal performance and improved cleaning using modeling solutions within the Schlumberger IDEAS™ integrated dynamic design and analysis platform, as well as computational fluid dynamics, the company adds.

Hulburt says the drilling and completion fluid was the only component in the system that required customizing for superlateral drilling. “We did a lot of work with downhole friction reducers because of the lateral length and the amount of water we were using,” he remarks. “Once we tweaked the chemistry, the fluid worked very well.”

While the well’s record lateral length made the headlines, the completion operation was no less newsworthy. Hulburt reports that only one of the 125 total stages failed to effectively put away the 1,400 pounds pumped per foot of lateral. The efficiencies achieved during treatment allowed Eclipse to improve its daily completion rate by 20 percent over the original plan.

Based on prior Utica wells, Hulburt says Eclipse Resources used an optimal frac design on Purple Hayes that consisted of 100 percent slickwater and white sand. “The single biggest variable we have seen in frac effectiveness is switching from hybrid and cross-linked gel systems to all slickwater,” he offers. “We think proppant concentration is important, but using 100 percent slickwater appears to be the determining factor in well performance. Slickwater appears to create a more complex fracture system closer to the wellbore. The added advantage is that it also is cheaper than hybrid and cross-linked gels.”

The stages were spaced evenly to create optimal stimulation density throughout the lateral section. “We have experimented with stage spacing, and see benefits with tighter spacing in heavier condensate areas,” Hulburt says. “We expect to maintain spacing on the order of 100-150 feet in condensate wells and 220 feet in dry gas wells.”

Halliburton performed the frac treatment using dual-fuel and SandCastle® proppant loading units equipped with dust control systems. The well also achieved a North American land plug setting depth record of 26,641 feet using Halliburton’s Obsidian® composite plugs.

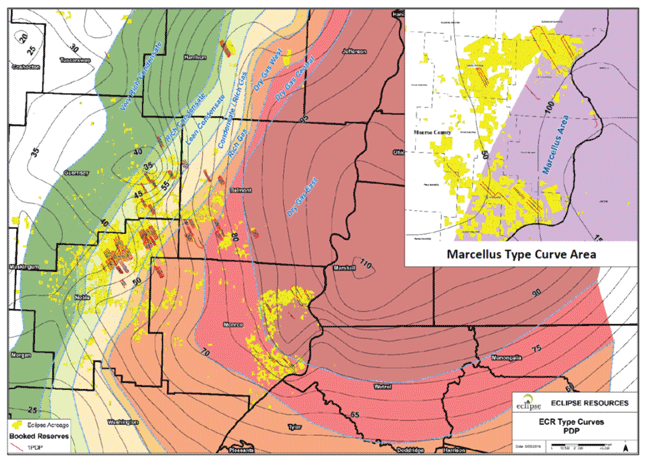

One of the challenges in forecasting production from the Purple Hayes is that the lateral is so long it extends across two Utica Shale type curve areas, with the toe of the well in a heavier liquids model. These type curve maps show original gas-in-place estimates for Eclipse Resources’ Utica acreage position, as well as its Marcellus leasehold. The Utica map delineates the dry gas, rich gas and condensate regions, including the very rich condensate area in Guernsey County, Oh., in which the Purple Hayes superlateral is located.

Other key contractors included Nine Energy Service, which provided the wireline work during the completion phase, and Deep Well Services, which performed snubbing services during frac plug mill-out and tubular installation. Nine Energy Service says it worked directly with Eclipse to design the plug-and-perf system using NOV’s Cerberus™ modeling software, and completed all 124 stages with no nonproductive time or misruns. According to Deep Well Services, it enhanced the hydraulic rotary capabilities of its 285,000-pound stand-alone snubbing unit to accommodate the demands of Purple Hayes, achieving plug-back total depth at 26,868 feet.

“As with the drilling operations, there was very little downtime during the frac treatment,” Hulburt attests. “It was a very well-run operation.”

Despite the scale and complexity of the project and all the logistics involved, Purple Hayes was drilled and completed under the budgeted $15.8 million. “We are proud of that. It is the result of an extensive amount of planning and preparation, as well as a collaborative team effort with our service contractors,” Hulburt relates.

“But while we could not be happier with our contractors, the success of this project is because we have the best technical team in the business,” he continues. “We made the decision a few years ago to develop world-class technical expertise rather than consulting out functions such as directional drilling and mud or cement engineering. Even before Purple Hayes, we were the lowest-cost operator in the Utica. A big reason for that is the in-house specialists we have in every facet of drilling, completion and production. They are outstanding.”

Very Encouraging Results

Purple Hayes began producing on May 3 after 24 hours of flowback. Through early June, Hulburt reports production from the choked-back well had remained unchanged from its initial rate of 5 MMcf/d of gas and 1,200 bbl/d of condensate. Just as importantly, downhole pressures had not budged either.

“We are holding back production because we believe very strongly that tightly managing pressure drawdown achieves better recoveries in Utica wells. We set the initial production rate at a level we believed would cause pressure to fall by 150 psi a week. We are extremely happy to see basically no pressure decline and very constant production levels over the first month,” Hulburt reported in early June. “Pressure and production have stayed almost perfectly flat, but water production has fallen more rapidly than in other area wells. Even the best wells show some pressure decline after a few weeks.”

Chemical tracers indicate that all parts of the lateral are contributing production. “In the first two weeks, the toe was not contributing, but it kicked in by the third week,” Hulburt observes. “It is early and we will continue monitoring the tracer surveys, but that is very encouraging.”

One of the difficulties in forecasting Purple Hayes’ production is that the lateral is so long it covers two type curves, with the toe of the well in a heavier liquids model. Consequently, Hulburt says Eclipse’s internal projections are based on a weighted average of both type curves.

“Condensate yields typically drop by 50 percent over the first 12 months in our shorter-lateral offsets, but because this well is so heavily choked, we expect less of a drop in the gas-to-condensate ratio in the first year,” he reasons. “You eventually see reduced condensate yields no matter what you do, but the controlled pressure management should delay the decline onset.”

In addition to the ultralong lateral, Purple Hayes is the first well to incorporate all three variables in Eclipse’s optimized Utica completion design: 100-percent slickwater, tighter stage spacing, and managed pressure drawdown. “Our hope is that Purple Hayes’ EUR will be the same as shorter-lateral offset wells at significantly lower cost per foot,” Hulburt expresses. “Should the recovery factor end better than our normal type curve assumptions, it would be a result of the optimized frac design.”

Given the heavy condensate yields, offsets usually require artificial lift within 18-24 months of production startup, depending on the degree of choking. Accordingly, Hulburt says valves were built into the Purple Hayes completion to allow gas lift to commence without having to re-enter the lateral to conduct a workover.

The Next Phase

While still in the preliminary planning stages, Hulburt reveals that Eclipse Resources’ 2017 drilling program includes a four-well pad with two laterals in excess of 19,000 feet and two about 10,000 feet long.

“That will give us a direct comparison of recovery per foot using shorter versus longer laterals,” he explains. “We definitely anticipate drilling more superlaterals in the condensate-rich area because the economics are so much better than shorter-lateral wells. There is no reason not to. It is a greater amount of land work and planning, but we essentially get three wells for the cost of two.”

That implies the ability to replace five-eight shorter laterals on each pad with two-three superlaterals, but Hulburt acknowledges that constructing ultralong laterals introduces constraints in pad drilling. “The length means we cannot have much step-out. For example, we need to keep the vertical section as straight as possible in superlaterals, and cannot drill out 2,000 feet from a pad before making the horizontal turn, which often is done with shorter laterals,” he says. “In addition, we think it is important to drill updip in the condensate area so liquids drain back toward the vertical hole, which means all the wells must go in the same direction.”

While superlaterals may be applicable to other shale plays, Hulburt says the economics are most compelling in areas such as the Utica and Marcellus, where topography and population densities increase pad costs. “Pads cost $1.5 million-$2.0 million in the liquids portion of the Utica, and $2.5 million and up in the dry gas portion,” he remarks. “The vertical section also is relatively expensive. The ability to spread those costs over a longer reservoir interval makes superlaterals worthwhile. You could replicate this design in, say, the Permian Basin, but it would not generate the same cost benefits because you can build a pad there for $100,000.”

Longer term, Eclipse Resources is investigating the potential of creating “super-multilaterals” from the same vertical pilot hole. “Multilateral drilling is the second phase of our Utica engineering project, and we have teams working on it. In fact, we have engineering designs to drill Utica multilaterals and think it is technically feasible,” Hulburt concludes. “However, there are several aspects of a multilateral operation where you have a single point of failure. That makes it much more challenging. We do not yet have enough redundancy in the design to move forward with it, but it is the next step.”

Operations Update: Eclipse Resources’ Drilling Activity Increases

STATE COLLEGE, PA.–On June 28, Eclipse Resources issued an operations update, which included announcing increased 2016 capital expenditures and releasing information on the initial performance of the Purple Hayes superlateral.

During the first 45 days of production, Purple Hayes produced a cumulative 583 million cubic feet of natural gas equivalent and exhibited very shallow pressure declines of 50 psi a week, according to the company. The well continued to produce at its managed choke target rates with flat production and no change in the condensate yield to date, which Eclipse Resources said it believed was “indicative of better-than-anticipated performance.”

Eclipse also reported a $28 million increase to its $168 million capital budget for 2016, and revealed that it expected to cease its voluntary production curtailment program at the end of the third quarter.

“The company has made the decision to accelerate our operated drilling and completion activity,” comments Ben Hulburt, chairman, president and chief executive officer. “Looking at forward strip prices, we anticipate lifting our self-imposed production curtailment program and bringing our production back on line at the end of the third quarter. We expect to continue to complete our drilled but uncompleted wells through the remainder of the year and into the first quarter of 2017, and to continue to run our operated rig continuously going forward.”

For full-year 2016, Eclipse Resources planned to spud 10-12 net wells and complete 21-24 net wells, including 16-19 net DUCs (drilled, uncompleted) in inventory, according to the release. As it drills and completes new wells, and re-establishes flowing producing wells at normal type-curve rates, Eclipse said it anticipated production increasing to an average of 240 MMcfe/d for the fourth quarter and continuing to grow next year.

“We forecast production growth in 2017 between 40 and 60 percent compared with our 2016 forecast production,” Hulburt notes.

The company also reported expanding its 2017 hedged oil and gas production to include 170,000 MMBtu/d of gas (75 percent of its expected production) at an average floor price of $2.84 an MMBtu and 3,500 bbl/d of oil (75 percent of its expected production) at an average floor price of $46 a barrel.

“While we can never completely eliminate commodity risk, we believe we have significantly reduced that risk next year by substantially increasing our hedge position, while at the same time structuring our hedge portfolio to not eliminate our exposure to further commodity price increases,” Hulburt concludes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.