Better Chemistries Unlock Production

By Colter Cookson

Perfecting completion and production chemistry will only become more important as operators continue to extend lateral lengths and move from top-tier acreage into areas that involve more complex geology, greater depths, and higher pressures and temperatures.

Building completion and stimulation fluids robust enough for increasingly challenging environments will mean conducting tests to identify chemistries that can deliver performance without damaging the formation. Chemical providers say they are doing everything they can to make such testing affordable, hone both proven and emerging chemistries, and streamline the logistics associated with manufacturing and deploying them.

Chemistry has a huge effect on wells’ performance, says Ryan Ezell, chief executive officer of Flotek. That impact can be hard to quantify considering the extent to which geology and completion designs vary between wells, but with enough data, the contrast is stark.

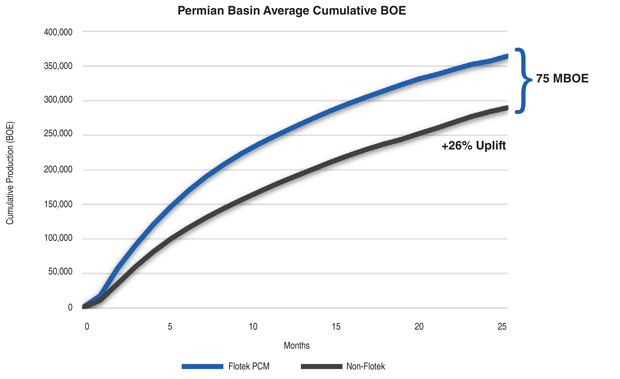

“In the Permian Basin, we analyzed more than 2,000 wells completed from 2019 to 2023 from a publicly available data platform to compare Flotek’s advanced approach to reservoir-specific chemical design. The study found that our prescriptive chemistry approach improved wells’ cumulative production. On average, it increased production 26%,” Ezell reports. “We see even higher uplifts in other areas that require more complex completion fluids.”

While proprietary chemistry is a significant component of the uplift, Ezell stresses that it also comes from tailoring chemistries to the application based on laboratory testing and experience. “We identify the proper combination of drag reduction, clay control, scale inhibitors, biocides, corrosion inhibitors and surfactants by analyzing the unique physicochemical properties of each target reservoir to minimize the impact of formation damaging mechanisms while improving each well’s ability to produce hydrocarbons,” he describes.

To guide its recommendations, Ezell says Flotek has spent the past two years analyzing production and chemistry data from more than 20,000 U.S. wells that it has helped complete. By using machine learning to group wells with similar completion parameters, reservoir conditions and chemistries, the company has identified key indicators that can help zero in on effective chemistries and avoid ones that are likely to cause damage.

According to Flotek Industries Inc., tailoring completion chemistry to the application can deliver substantial production gains. The company cites a Permian Basin study showing that wells completed using its prescriptive chemistry management service had 26% higher estimated ultimate recoveries.

“The AI model starts with four basic factors—the water in the reservoir, the water used for the completion, the reservoir characteristics and the hydrocarbon quality—to set other parameters and help us dial in to specific chemistries,” Ezell relates. “Instead of providing a single recommendation, it offers a series of answers for our experts to evaluate. This approach helps us identify the best chemistries for an application quickly and consistently.”

In addition to providing an initial chemistry package, Flotek can send engineers to the well site to conduct tests during the completion and fine-tune the chemistry. According to Ezell, such real-time analysis frequently leads to a higher return on investment by optimizing chemical spend and improving the well’s long-term production. “If an on-site analytical test reveals that the water’s composition has changed and we no longer need to pump a certain volume of a specific chemistry, the on-site testing can lead to direct savings,” he illustrates. “If a biocide test shows more bacteria than expected, we will ask for permission to increase the biocide concentration to prevent long-term issues.”

Focusing Resources

The research behind the AI model is helping Flotek streamline its product suite. “When I joined the company in 2019, we had more than 5,000 unique products in our portfolio,” Ezell recalls. “Today, we are down to less than 300. The data analytics study helped us identify technologies that we know have efficacy in the field and eliminate ones that rarely saw use and merely diluted our buying power.

“With our sharper focus, we have put research programs in place to advance the technologies we know work and open windows to make those chemistries more effective or sustainable,” he continues. “For example, we are customizing many of these chemistries for each basin and trying to source the base components locally to simplify logistics.”

Ezell says those improvements are paying off. He indicates that revenue from the company’s complex nanofluid segment grew 128% from the second to the third quarter.

“We have made many of our proprietary nanofluid systems into concentrates to reduce the volumes that need to be trucked or shipped,” Ezell mentions. “Instead of shipping a tank of surfactant that is 98% water, we can send a concentrated version to site in a tote and blend it with the water already on site. This makes the operation more efficient and delivers the operator more bang for the buck.”

The concentrates improve safety and minimize environmental impacts by taking trucks off the road, Ezell adds.

Field Gas

Burning field gas rather than diesel or natural gas from remote sites is another way hydraulic fracturing fleets and drilling rigs can operate more economically and ecologically, Ezell notes. “There has always been some fear of running on field gas because the amount of energy it contains can shift during the job,” he says. “If it spikes, it can over-rev the engine and cause a fire or damage.”

To address that risk, Flotek has worked with ProFrac to develop a proprietary skid that uses a sensor to check field gas quality every few seconds. If the Btus increase, the skid diverts gas into a blend-down stack with compressed natural gas to maintain a consistent Btu, Ezell relates.

“We have seen diesel-to-gas conversion rates beyond 90% with these skids,” he reports. “On the first three-pad customer case study where we deployed them, they kept 1.2 million gallons of diesel from being burned. Given the costs, traffic and emissions associated with buying, transporting and burning diesel, that is a huge benefit.”

As of early December, Flotek has 20 field gas monitors in operation. To detect gas quality changes, they rely on sensors from JP3, a data analytics specialist that Flotek acquired in 2020. Using near-infrared spectroscopy and machine learning, JP3’s sensors provide fast and accurate measurements of hydrocarbon quality, Ezell explains.

“What is amazing about these sensors is that accuracy is within the same tolerances as gas chromatography,” he says. “It takes a couple days after installation for the sensors’ chemometric models to adjust to the specifics of a site, but once they set up, the error percentages become extremely low.”

In fact, the readings are sufficiently accurate to be used for custody transfer applications in the upstream and midstream spaces, Ezell says. Instead of evaluating quality every month or two with a gas chromatograph, the sensors take readings every five seconds. Such precision helps sellers receive what they are owed while assuring buyers that the hydrocarbons meet specifications, Ezell says.

“In the long term, this technology should allow us to achieve a revolutionary step in automating production chemistry,” he envisions. “Today, the industry adjusts treatment rates by sending people out to conduct bottle tests and make judgement calls about whether they need to add a pinch of this or drop of that. With near-infrared spectroscopy combined with analytical data, they can base adjustments on quantitative data and potentially automate the entire process from an iPad.”

Automating Dry Chemistry

When operators move from liquid friction reducers to dry friction reducers, the benefits can be tremendous, reports Wayne Cutrer, CEO of Downhole Chemical Solutions. “In general, our clients see cost savings between 15% and 25%,” he details.

Those savings come alongside simpler logistics and lower environmental impacts, Cutrer says. “On average, we can replace four loads of liquid FR with each load of dry FR. This reduces highway logistics by a magnitude of 300%,” he attests.

In the past, applying dry FR meant having the chemical provider’s representative on site to operate the mixing equipment. According to Cutrer, DCS has developed a semiautonomous mixer that eliminates this requirement.

A new skid from Downhole Chemical Solutions automates most of the tasks associated with applying dry friction reducers. The company predicts such automation will enable more pressure pumpers to use dry chemistry, which reduces costs, improves performance and takes trucks off the road.

“With this skid, the pressure pumper’s team can manage the dry chemistry using a laptop or tablet in the data van,” he describes. “All the team members need to do is turn the suction pump on to get water circulating, specify the desired FR concentration, and push a button when they want dry FR. The system automatically handles the technical side of achieving the target concentration.”

Operating the skid is easy enough that Cutrer says pressure pumpers’ employees will be able to learn everything from setup to troubleshooting in six-eight hours.

As of early December, DCS had two automated skids in the field. “The reception has been overwhelmingly positive,” Cutrer remarks. “The producers love that the skids remove a man off location without sacrificing safety or performance. They also appreciate the footprint, which is only five feet by seven, much smaller than the 32-foot trailers we would normally use to manage dry FR.”

Cutrer attributes the skid’s success to a robust design. “We took out any unnecessary equipment,” he says. “The skid has a suction pump that pulls water into the unit from the working frac tanks on location. As the water travels through the system, we introduce dry powder using the vacuum created by the water moving through our proprietary nozzle system, then discharge the water straight into the tub on the blender. The discharge takes place through gravity, so we do not need a discharge pump.”

The only moving parts are the suction pump and automated valves that regulate water flow, Cutrer says. To increase reliability even more, he indicates that potential failure points have redundant equipment. “The only key component without a backup is the suction pump, which we know from pumping more than 100 million pounds of dry FR has a very low failure rate.”

Noting that the simple design translates into low capital costs and short lead times, Cutrer predicts that DCS will have eight units in the field by the second quarter of 2024. He says the skids will enable more companies to benefit from dry chemistry.

“Today, we provide dry FR in the Haynesville, Eagle Ford and Permian. We still have enough runway for growth in these areas that we do not have any immediate plans to expand into other regions,” he reflects. “But with the automated skid, we should be able to partner with pumping companies in other places, including the Rocky Mountains and Canada.”

Leveraging Scale

According to Cutrer, DCS has grown enough to partner with its manufacturers on new products. “We are not forced to buy off-the-shelf products,” he clarifies. “We can sit down with our manufacturers and give them specifics on what the FR needs to accomplish in various basins.

“The chemistry we have structured for the Haynesville and the Eagle Ford is not the same as the one we are pumping in the Permian Basin, where operators use more produced water in their completion fluids,” he illustrates. “We tweak particle size, molecular weight and other variables to optimize the powder for particular basins and water conditions.”

As of early December, DCS only has a few months of experience with these area-specific chemistries. “We will have to get a few more months of data from the field to verify the impact, but from the testing we have done in the lab and the experience we have built up over the past four and a half years, we should see a 5% improvement in performance at no additional cost,” Cutrer estimates. “In the field, that will translate to lower product concentrations, lower treating pressures and quicker rate achievement, which may help operators cut a few minutes off each stage. A few minutes may not seem like much, but it adds up to significant savings.”

In addition to providing dry FR, Cutrer says that DCS has begun offering dry guar in the Haynesville at the request of several clients. “We are supplying guar to three spreads as of late November and expect to enter 2024 on four or five spreads,” he reports. “Companies prefer our equipment over traditional dry guar delivery systems because it is more efficient.”

Cutrer points out that completion crews often call for guar when treating pressures increase and they want extra viscosity to help put the proppant away. With a conventional delivery system, the dry guar needs to sit in a hydration tank for several minutes before it can be pumped. To accommodate this delay, Cutrer says completion crews may reduce the pump rate until the guar is ready.

“Because our system uses a patented powder dispersion technology that accelerates hydration, we can deliver guar within 10 or 15 seconds,” Cutrer contrasts. “That lets pumpers get guar when they need it while maintaining a consistent rate, so they finish the job faster.”

Bio-Based Chemistry

Turning feedstocks made during soy and corn production into oil field chemistries has both economic and environmental advantages, says Darin Oswald, vice president of technology for LFS Chemistry. The benefits include streamlining supply chains. “Since most of the material we use comes from agricultural waste streams, all of which are generated by American farmers, the supply is plentiful,” he says. “We do not have to worry about the ebbs and flows of supply chains from Europe, Asia and the Middle East.”

“Abundant supplies and local logistics translate into affordable costs,” says Neil Hayes, LFS’ chief commercial officer. “Bio-based chemistries also generally have much lower environmental hazard ratings than synthetic alternatives, which makes them much simpler to handle. In fact, most of them do not qualify as hazardous substances and can be transported by drivers without hazmat training, which reduces costs.”

Using additives made with materials from American corn and soy farms can significantly reduce completion fluids’ carbon footprint, LFS Chemistry reports. The company says its bio-based additives perform as well or better than synthetic solutions.

Because they are made from waste streams, the chemistries have a low carbon footprint, Hayes continues. “The delta between a bio-based chemistry and a synthetic varies, but it can be substantial,” he says. “For example, one of our clients is using our bio-based surfactants and clay control additives. This company is extremely environmentally conscious, so we compared the total carbon associated with our products to the carbon from the synthetics it would otherwise pump. We are removing tons of carbon from each well.”

One of the most common synthetic clay control additives is choline chloride. “If each well normally uses about 10,000 gallons of choline chloride, switching to one of our bio-based alternatives will remove 10 tons of carbon for every well,” Oswald calculates.

The bio-based clay control additives deliver such dramatic benefits because they are made almost entirely from biorenewable materials, Hayes notes. “Renewable carbon makes up about 90% of the carbon associated with the additives,” he details. “For some of our products, the ratio of renewable carbon to nonrenewable is closer to 50%, and for others, it’s around 5% or 10%.”

Even 5% is better than zero, Hayes argues. “Given the volumes the industry pumps, a slight improvement in a completion fluid’s carbon footprint can be significant,” he considers.

Effective Options

The bio-based additives provide environmental benefits without compromising performance, Hayes assures. “For us to bring a bio-based alternative to market, it has to perform as well or better than the synthetic incumbents, and it has to be available at a competitive or more affordable price,” he stresses.

Corn and soy feedstocks can be converted into a wide variety of end products, Oswald says, with imagination constituting the greatest limitation on their potential. However, he acknowledges the testing, experimentation and validation that goes into developing new chemistries requires a substantial investment.

Today, LFS’ bio-based products include surfactants, additives for controlling clay swelling and migration, iron control, and a conductivity preserver. The latter mitigates water damage in shale reservoirs by bonding with the fracture face where proppant embedment is likely to occur, Hayes describes. He says it has demonstrated sustained production increases.

Most of the company’s clients are in the Permian Basin, South Texas and the Mid-Continent, along with some in South America, Canada and Saudi Arabia, Hayes reports.

“The majority of our revenue comes from our bio-based products,” Hayes says. “Our clients range from large cap supermajors to privately held oil and gas companies. These companies are willing to try our products because lab tests and field trials show that they offer excellent performance at an affordable cost.”

Hayes indicates that LFS is developing a bio-based scale inhibitor platform. “In our initial testing, the inhibitors are proving to be very effective,” he says. “We think they will be commercial in 2024.”

Remediation

As drilling inventories diminish, production optimization through stimulation is moving to the forefront in many plays, observes Eric Scheerschmidt, vice president of sales for North America at STIMWRX, the stimulation engineering division of Jacam Catalyst under the umbrella of CES Energy Solutions. He says that using proprietary stimulation chemistries to repair residual damage from completions, waterfloods, hot oiling treatments and other common activities is one of the more economic ways to improve production.

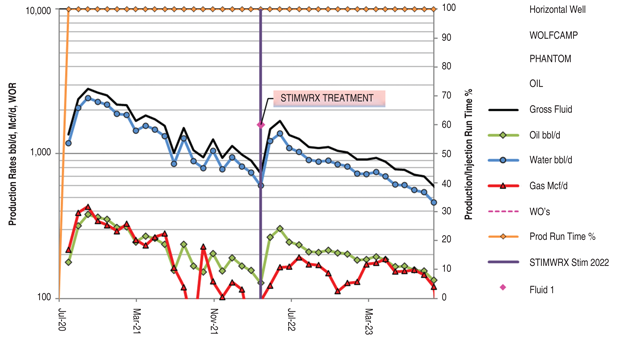

This Wolfcamp well is one of many to benefit from a remediation treatment developed by STIMWRX, the stimulation engineering division of Jacam Catalyst. To deliver sustained production increases at a low cost, the company says it optimizes its chemical blends to target each well’s damage mechanisms and delivers those blends down hole using in-house pumps.

“To meet growing demand for our remediation services, we have tripled the size of our engineering teams between the Rockies and West Texas area in the past year,” Scheerschmidt relates.

Strong technical engineering teams are vital to effective stimulation techniques, says Kelly Knudtsen, STIMWRX’s team lead for engineering and sales in the southern United States. “Understanding the damage mechanisms in a particular reservoir is key,” he says. “We can develop customized, effective treatments through lab testing and engineering.”

“Depending on the field and the operator’s goal, we build new stimulation systems all the time,” Scheerschmidt remarks. “Our team in Gardendale, Tx., has introduced three or four novel chemistries, including nanosurfactant, capillary pressure reduction and silica dissolving technologies, in the past six months to deal with specific issues.”

To maximize treatment effectiveness, Scheerschmidt says the company blends several components together rather than deploying them in stages. “It’s common for companies to pump a solvent to deal with paraffin and asphaltenes, then follow up with an acid to handle scales or iron, but that is inefficient,” he argues. “Because the separate fluid systems have different densities, they tend to commingle down hole, which dilutes their effectiveness. This is especially noticeable in long or deep wells.

“Our blends are leading-edge, all-in-one products designed to treat multiple damage mechanisms at the same time,” he contrasts. “That makes the reactions more efficient, allowing us to address downhole issues while running decreased volumes.”

To deploy its stimulation fluids, Knudtsen says the company has invested in a fleet of customized pressure pumping equipment. “This helps us provide an affordable alternative for wells that would otherwise require expensive workovers,” he explains. “We typically only need bulk transport drivers, a pump operator and a supervisor, which makes deployment more efficient and provides cost savings that we pass to the customer.”

Diversion

To ensure even distribution across the targeted interval, Scheerschmidt says STIMWRX is refining its proprietary visco-elastic gel diverters. “Most diverters are solids that have to be mixed on site, which requires specialized blenders and hoppers,” he notes. “Instead, our gel diverter is built and quality checked at our blend facilities and brought on site on the same truck as the fluid system, but in a separate compartment. There is no need for extra equipment or personnel.”

Knudtsen says building diverter blends in the factory rather than the field ensures consistent quality control. “The gel is extremely versatile,” he adds. “Depending on the application, we can pump down the annulus or the work string regardless of the artificial lift mechanism. This chemistry is nondamaging to the downhole equipment and reservoir, providing a clean break post-treatment.”

According to Scheerschmidt, the gel diverter tends to be more affordable and effective than solids. “In a lateral, benzoic flakes, bioballs, rock salts and other traditional diverters require high frac rates to create turbulent flow and keep gravity from causing them to settle out on the bottom of the liner,” he says. “With our diversion system, we do not need turbulence and can pump at much lower rates. As the gel travels down hole, it conforms to the rock rather than settling, allowing it to temporarily block zones so the treatment can reach its target.”

Because it pairs application-specific chemistries with simple deployment and effective diversion, the remediation service is seeing rapid adoption in U.S. plays such as the Eagle Ford, Permian Basin, Mid-Continent, Powder River and Bakken, Scheerschmidt reports. While that growth includes individual jobs, he says the treatments frequently become part of ongoing programs that are worked into yearly budget routines.

As an example, Scheerschmidt cites a conventional waterflood in New Mexico that is operated by a large major. “Before, the operator would stimulate these wells by using a service rig to run tubing and mechanical isolation packers, then pump a traditional blend containing hydrochloric acid,” he recalls. “We are able to treat them by pumping our diverters and chemistries down the annulus from the surface, which is more cost-effective and accelerates the return on investment.

“The rigless treatments can save up to $250,000 in many instances,” Knudtsen calculates. “They also are more effective and show significantly better longevity because they contact more of the producing reservoir. By using our diverters to get the chemistries into the problematic zones and letting them soak overnight, we can remediate the well using a fraction of the treatment volumes normally required. The operator is seeing superior payout metrics compared with previous practices, and has therefore treated more than a hundred wells in the past couple years.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.