Gas Producers, Transporters And Midstream Players Position for Long-Term Success

By Danny Boyd

Since shale plays burst onto the scene, the U.S. natural gas market has generally been characterized by abundant production, low commodity prices, and ultrareliable supply surety. Natural gas producers have time and again demonstrated their innovation, resilience, and, of course, patience. With surging domestic liquefied natural gas exports and higher demand for gas-fired power generation, producers are hoping their patience is about to pay off with higher demand baseloads and generally bullish long-range fundamentals.

The U.S. Energy Information Administration estimates that U.S. marketed gas production averaged 116.8 billion cubic feet a day in the second quarter, more than matching demand. However, ongoing growth in LNG exports and anticipated power needs could change the balance considerably.

The EIA predicts 19% growth in LNG exports this year and an additional 15% increase to 16.4 Bcf/d next year, although some industry insiders suggest that exports are already surpassing the agency’s 2026 forecast. In either case, all parties expect exports to double before the end of the decade as the operating U.S. export terminal count grows from eight to at least 13.

Couple that with a robust outlook for gas demand from data centers, with estimates varying anywhere from 3 Bcf/d to 12 Bcf/d of new baseload consumption by 2030. Regardless of the exact number, the point is that demand is trending sharply upward as the rapid expansion of power-hungry artificial intelligence infrastructure starts pulling ever-more electrons.

With 24/7 uptime requirements, the data center market favors the most consistent, reliable and cost-efficient source of generation at scale, and that gives natural gas a competitive advantage over wind, solar, and other alternatives.

Producers in gas-rich basins, including the likes of PureWest Energy LLC, Comstock Resources Inc., and EQT Corp., have spent years positioning themselves to capitalize on the opportunity set now before them. But even in the “oil basins” of the Permian and Williston, climbing associated gas production is driving midstream and pipeline buildouts for Intensity Infrastructure Partners, Producers Midstream II, and other savvy companies.

Rockies Opportunity

For PureWest, the priority objective of data center hyperscalers to minimize their carbon footprint is already translating into opportunity in the Rockies region for gas produced from vertical wells in Wyoming’s Pinedale Anticline, says company President Ty Harrison.

With emissions from production operations 90% lower than the national average, the Denver-based company has partnered with Prometheus Hyperscale and Frontier Carbon Solutions to supply Pinedale gas as part of a carbon-neutral power strategy at a 1.2-gigawatt hyperscale data center campus in Evanston, Wy.

Harrison insists that other western markets also will need more fuel—and soon—reinforcing the company’s strategy of performing high-volume fracs on vertical wells to boost results.

For PureWest Energy, data center hyperscalers seeking to minimize carbon footprints is translating into opportunities for natural gas produced from S-shaped vertical wells in Wyoming’s Pinedale Anticline. The company has partnered with Prometheus Hyperscale and Frontier Carbon Solutions to supply Pinedale gas to a 1.2-gigawatt hyperscale data center campus in Evanston, Wy.

Chief Executive Officer Chris Valdez and team members honed their skills applying high-intensity slickwater stimulations at other companies in the Piceance, Uinta, Permian, Anadarko and elsewhere, Harrison recalls.

After PureWest emerged from Ultra Petroleum’s bankruptcy and brief rebranding to UP Energy, new owners and the new executive team decided in 2021 to rejuvenate S-shaped vertical development in the Pinedale, pumping 10 times the fluid intensity of legacy completions.

Designs of late have included 1,700 pounds of sand and 3,000 gallons of slickwater per foot, but PureWest plans to boost intensity an additional 30% this year to test upside potential on some of the 32 wells it is drilling across 100,000 acres. On 24 wells drilled last year, 24-hour initial productivities averaged 10 MMcf/d, with the best well approaching 17 MMcf/d.

Total vertical depths in the Pinedale range from 14,000 to 15,000 feet with stacked gas-bearing pays of sedimentary rock, consisting chiefly of the Lance Formation, ranging from 5,000 to 6,000 feet in thickness. Four to eight wells per pad are drilled on 20-30 acre spacing compared with legacy wells drilled only five acres apart, Harrison says.

Well costs last year declined 23% to $6 million/well. The thick vertical column is more affordably exploited vertically and directionally instead of horizontally, he says.

“You increase the spacing, crank up the intensity, and increase the recovery in a system that just has better economics,” Harrison comments.

Drilling efficiencies include an 18% increase in footage per day on a footprint with a decade of drilling at sub-$3 breakevens. The position includes 3,500 existing wells, including 1,700 operated for Stone Ridge Energy, which acquired the assets from PureWest in 2023. Daily production of 600 MMcfe/d includes just under 300 MMcfe/d net to PureWest.

With an eye on potential merger and acquisition opportunities and bolt-on expansions in the Rockies and elsewhere, the company is feeding gas markets in the Pacific Northwest, California and the desert Southwest. In addition to data center demand growth, more regional production will be needed to backfill supplies of Permian Basin gas expected to be diverted from other western markets to Sempra Energy’s Energia Costa Azul LNG export terminal on Mexico’s Baja California peninsula, which opens next year, Harrison states.

Dry Gas Motherlode

Comstock Chairman and Chief Executive Officer M. Jay Allison predicts that U.S. LNG output could more than double to 32 Bcf/d in five years or less, with gas demand for behind-the-meter, low-carbon power plants could add up to 12 Bcf/d.

As Comstock’s gas production approaches 1.3 Bcf/d, the Frisco, Tx-based company is counting on a 525,000 net-acre Western Haynesville natural gas motherlode located 100 miles from both Dallas and Houston to help meet the looming demand hike.

Combining the advantage of company-owned midstream player, Pinnacle Gas Services, and access to nearby storage makes it easy to ship gas down the road to LNG plants on the Gulf Coast or to support a potential new power plant currently being explored by NextEra Energy in the Western Haynesville.

Comstock Resources is going full steam ahead on a 525,000 net-acre position in the Western Haynesville play 100 miles west of Dallas. The company doubled the size of its acreage position in the new play last year at an average cost of only $401 an acre and is now running four rigs, with plans to drill 19 wells this year and turn 13 to sales.

“Most of our Western Haynesville acreage is contiguous, and its location about 100 miles from Houston and 100 miles from Dallas also offers the water resources and electrical grid infrastructure to support a gas-fired power plant,” Allison comments. “If you are a data center operator and you need electricity, we also have a storage facility allowing us to provide the reliable source of natural gas they need.”

This year, Comstock unveiled for the first time its map of its Western Haynesville position amassed over five years through acquisitions, bolt-ons, and good old-fashioned leasing by an army of landmen. The company added half of the acreage last year at a rate of $401 an acre. The large acreage position is 80% held by production, which allows Comstock to provide consistent gas supply over decades without having to rush development to meet lease terms points out Comstock President Roland Burns.

This summer, 35 wells were producing, being drilled, or being completed in the new play, and 80% of acreage was held by production. Four rigs are drilling 19 wells there this year with 13 being turned to sales.

Recent results include a 41 MMcf/d IP from a 10,306-foot lateral on the Olajuwon-Pickens No. 1H, Comstock’s first well in Freestone County. This completion was 24 miles from the nearest Western Haynesville well. A second well in the area is planned for the fourth quarter.

Backing the growth is an investment of $1.3 billion from Dallas Cowboys owner Jerry Jones, who owns 71% of the company and supports building long-term drilling inventory, Allison says.

Also supporting westward expansion are strong returns from its legacy Haynesville acreage in northern Louisiana and northeast Texas, where four rigs are spudding 32 wells this year on 302,000 net acres with almost 1,000 producing wells and 1,100 in future drilling locations. Average IPs this year were in the 25 MMcf/d range on laterals extending beyond 12,000 feet.

Given higher pay thickness and higher pressures supported by an expansive library of 2-D and 3-D seismic data and logs from early vertical wells, the company expects the Western Haynesville to yield substantially more resource potential per section than the legacy acreage, Burns says. Drilling inventory in the new play could be two to three times larger than its drilling inventory in its legacy Haynesville acreage e after assessments are finalized.

An added advantage includes 100% midstream expansion financing from Quantum Capital Solutions for up to $300 million, in exchange for a preferred return. Comstock also recently signed an agreement with BKV Corp. to study potential carbon capture at Pinnacle treating facilities in keeping with a focus on reducing emissions to meet standards required by European and Asian LNG importers and U.S. data centers, Allison concludes.

Appalachia Acquisition

Already one of the largest U.S natural gas producers, EQT Corporation is securing gas supply agreements with large Appalachia power generators supplying data centers and working to expand regional pipeline takeaway and markets.

On July 1, the company closed on a $1.8 billion cash-and-stock acquisition of Olympus Energy and a 90,000 net-acre position in Southwest Appalachia already yielding 500 MMcf/d. Included is a 10-year Marcellus and seven-year Utica drilling inventory complementing EQT’s existing 4,000-well drilling portfolio across what is now more than 1 million acres in Pennsylvania, West Virginia and Ohio.

In July, EQT Corp. closed on its $1.8 billion cash-and-stock acquisition of Olympus Energy and a 90,000 net-acre position in Southwest Appalachia producing 500 MMcf/d. Included is a 10-year Marcellus and seven-year Utica drilling inventory complementing EQT’s existing 4,000-well drilling portfolio across what is now more than 1 million acres in Pennsylvania, West Virginia and Ohio.

“We also see the opportunity to organically bolt on low-cost acreage around the Olympus assets, which could materially expand inventory duration in this area,” says EQT President and Chief Executive Officer Toby Rice. The Olympus acreage next to EQT’s is accessible for nearby power projects, including the largest gas-fired power plant development in North America, he points out.

Formerly the site of a decommissioned coal-fired plant, the Homer City Redevelopment 50 miles east of Pittsburgh will soon consist of seven gas turbines on a 3,200-acre campus powered by 665 MMcf/d of EQT-produced gas. The beneficiaries include a growing number of data centers.

In late July, EQT announced its intention with the Frontier Group of Companies to provide long-term gas supply to the Shippingport Industrial Park northwest of Pittsburgh. EQT will supply 800 MMcf/d to the conversion of a retired coal-powered plant into a 3.6-gigawatt gas-fired generation facility.

Other projects include building midstream infrastructure for a new 610-megawatt combined cycle gas power plant in West Virginia.

EQT’s acquisition of Equitrans Midstream last year included majority ownership and operatorship of Mountain Valley Pipeline, built to provide additional takeaway from Appalachia into Virginia, where the line connects to Transco’s system. Following the anticipated 2027 startup of Transco’s expanded southeast supply pipeline, two MVP projects will increase Appalachia takeaway for EQT and others, Rice says.

The MVP Boost project, expected to be operational by 2029, adds 180,000 horsepower of compression to the MVP main line to increase capacity by 500 MMcf/d to 2.5 Bcf/d. The MVP South Gate project, expected to receive its FERC environmental assessment in October, includes a 31-mile pipeline from the MVP mainline in Virginia to North Carolina to supply 550 MMcf/d to anchor customers Duke Energy and the Public Service Company of North Carolina.

EQT also has secured a new gathering contract with a large private producer to expand capacity on its Saturn pipeline system in West Virginia.

“Collectively, these projects represent a pipeline of nearly $1 billion of organic investment opportunities with premium low-risk supply agreements, which we estimate will generate an aggregate free cash flow yield of approximately 25 percent once fully online,” Rice remarks.

All told, reports of sizable gas-fired power generation and data center projects are reinforcing expectations for additional regional gas demand of 6 Bcf/d to 7 Bcf/d by 2030, he says.

Nearly 2 Bcf/d of EQT gross production sold locally in Appalachia provides supply flexibility for volumes that can be redirected into firm supply arrangements, Rice adds. Growing production capacity also provides longer-term growth options to partially or fully backfill diverted output.

Bakken Gas Pipeline

One of the primary byproducts of oil production in tight plays such as those in the Permian and Bakken is natural gas, and a lot of it. According to EIA statistics, the Permian and Bakken combined in 2023 to produce about 14 Bcf/d. And as wells in tight oil plays mature, gas-to-liquid ratios tend to become higher, making associated gas a growing component of the total production stream and creating opportunities for gas midstream and pipeline development in “oily” basins.

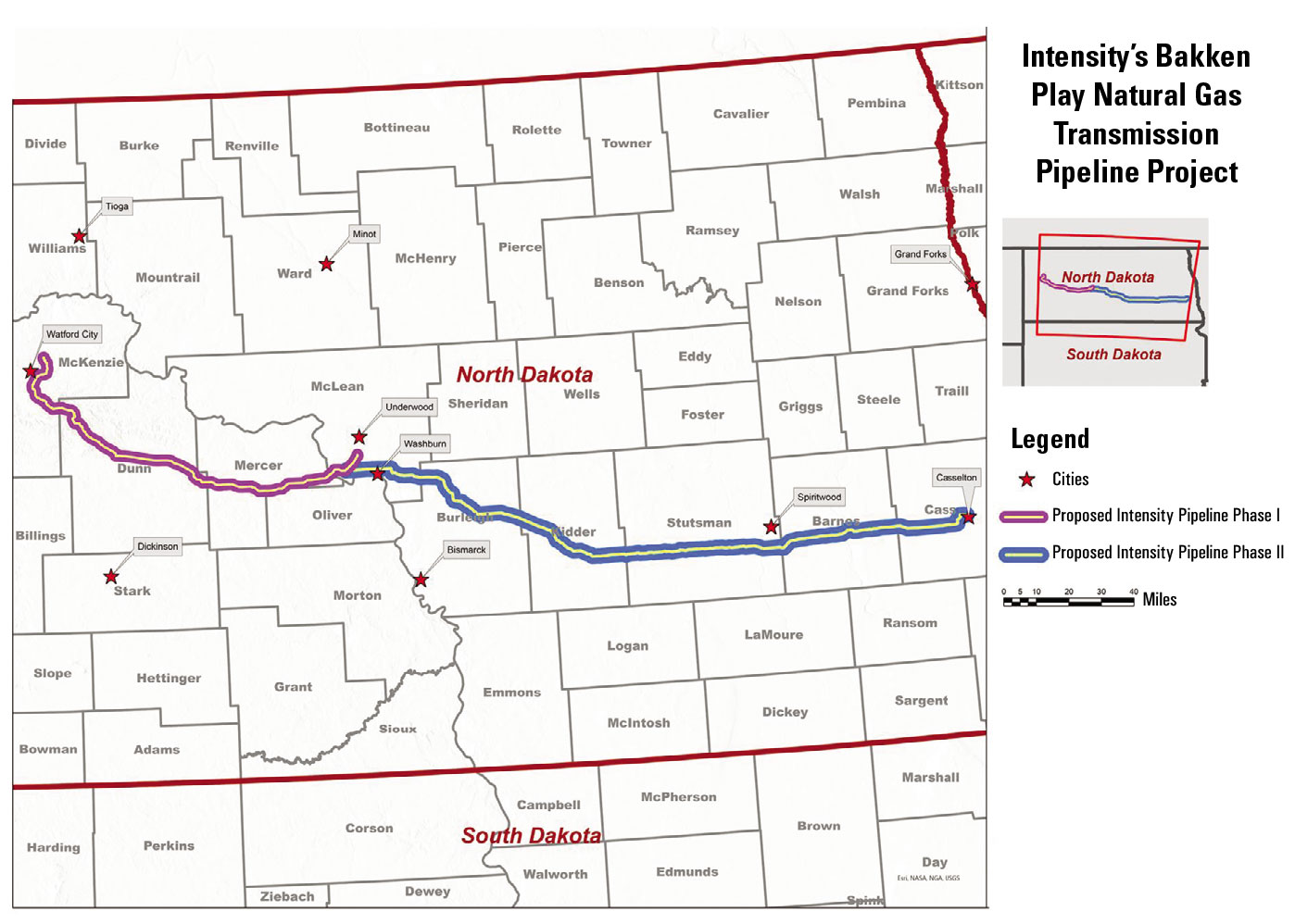

In the Williston Basin, Tulsa-based Intensity Infrastructure Partners is preparing to build a 344-mile Bakken Natural Gas Transmission Pipeline in two phases from the Williston Basin to eastern North Dakota, says President Derek Gipson.

Independent power producer Rainbow Energy Center of Bismarck has committed to be the foundation shipper. In addition to Rainbow, other beneficiaries are expected to include local distribution companies needing redundancy to serve growing communities across the state and data centers being built or planned as North Dakota touts available gas and a pro-business climate to attract hyperscalers.

Intensity Infrastructure Partners is preparing to build in two phases a 344-mile Bakken Natural Gas Transmission Pipeline from the Williston Basin to eastern North Dakota. Phase 1 includes a 1 Bcf/d, 36-inch line extending 136 miles from McKenzie County to McLean County, with a targeted in-service date of July 2029. Phase 2 consists of a 400 MMcf/d, 30-inch pipeline extending another 208 miles to the Fargo area. The tentative in-service date is January 2030.

“The state is very forward thinking and is pushing midstream companies to think about projects like this so it can utilize this great asset of abundant natural gas reserves for the benefit of all North Dakotans,” Gipson says.

Backed by EIV Capital of Houston, Intensity conducted two open seasons earlier in the year to assess market interest. Based on a strong show of support, the company adopted a two-phase approach that optimizes the proposed pipeline’s size and extends its reach to eastern North Dakota, says Chief Commercial Officer Matthew Griffin. No cost estimate has been released but financing is readily available, Gipson adds.

Phase 1 would include a 36-inch line with capacity of 1,100,000 dekatherms/day. It would extend 136 miles from Watford City in McKenzie County to Washburn in McLean County. Although no firm construction date has been revealed, a preliminary Phase 1 in-service date is projected for July 2029.

Phase 1 includes tie-ins to major midstream operators ONEOK, Energy Transfer, Targa, Hess, and Kinder Morgan. The line also connects to Northern Border Pipeline and WBI Energy Transmission. All gas carried on the line would be used in the state, Gipson notes.

With a tentative in-service date of January 2030, Phase 2 would consist of a 30-inch pipeline extending 208 miles from Washburn to Casselton just west of Fargo. Designed capacity is 430,000 dekatherms/day.

Gipson, along with Intensity Chief Executive Officer Joe Griffin and other team members, previously spent a decade building Williston midstream company Hiland Partners, which had been founded by Harold Hamm, also the founder of Continental Resources, and was sold to Kinder Morgan in 2015.

The storied Hiland buildout included 2,000 miles of crude and gas gathering lines, gas processing, compressor stations, crude oil storage and a long-haul oil pipeline connecting North Dakota to Gurnsey, Wy., where the line links to the Pony Express Pipeline moving oil to Cushing, Ok.

The team also later oversaw Woodford Express in the Oklahoma SCOOP play for Quantum Energy Partners until its sale to Energy Transfer and managed Sendero Midstream for Energy Capital Partners before its sale to Energy Transfer predecessor Crestwood Midstream.

“When considering Bakken production along with emerging demand in Central and eastern North Dakota, now is the right time for a project like this,” Gipson insists. “Key stakeholders are saying the same thing.”

Repurposing Midstream Assets

Drilling in the oil-rich Delaware Basin is yielding a flood of associated gas, and Tailwater Capital-backed Producers Midstream II continues to meet rising demand. The company is expanding its processing footprint and repurposing an existing gas pipeline to serve growing West Texas markets, including a wave of new data centers.

Founded in 2016, the Dallas-headquartered midstream company announced in late July definitive agreements with Permian operators for the second phase of a project expanding gathering, treating, and processing infrastructure in Lea County, N.M., from relocated assets originally installed in the Anadarko Basin.

In late July, Producers Midstream II announced definitive agreements with Permian operators for the second phase of a project expanding gathering, treating, and processing infrastructure in Lea County, N.M., using relocated assets originally installed in the Anadarko Basin. Operations are scheduled to commence in the fourth quarter. The project’s first phase of operations started in the second quarter, just eight months after the final investment decision.

Processing capacity will increase by 50% (from 60 MMcf/d to 90 MMcf/d) and includes a new acid gas injection well, says Chief Executive Officer Matt Flory. The company plans to start operations of phase two in the fourth quarter of this year.

The first phase became operational in the second quarter, just eight months after the final investment decision in November 2024, made possible by the quick relocation of processing assets.

Formed by long-time midstream developer and leader Jim Bryant, Producers Midstream has evolved through two iterations. The first focused on gathering assets in the Permian. In 2019-20, Producers Midstream II built greenfield projects in Scurry and Fisher counties on the Permian Eastern Shelf, and then in the following year acquired all Anadarko midstream assets, including the Palo Duro Pipeline from Midcoast Energy. Midcoast had earlier acquired the Anadarko assets from Enbridge.

With a strategic focus on Permian growth, the company found the Lea County greenfield location after conducting an extensive search and quickly began making plans to relocate the idle assets, Flory explains.

“We think this area in Lea County is possibly the largest undeveloped block of Tier 1 Permian acreage left,” he comments.

To further support regional development, Producers Midstream II announced a binding open season in late June to solicit interest in firm transportation on a repurposed Palo Duro Pipeline. The 16-inch line carrying wet gas 275 miles across Texas from Nolan County to Wheeler County for processing and access to additional markets will be converted to a residue gas line.

By processing wet gas closer to the Permian, it can deliver residue volumes along the length of the line for a growing number of data centers and other users, according to Flory.

Centers are already under construction in Amarillo in the north and Abilene in the south, with the area in between including wide open spaces for facilities with ample access to broadband, he concludes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.