Efficiency Gains Help Independents Find Success In Marcellus, Utica Shales

Al Pickett, Special Correspondent

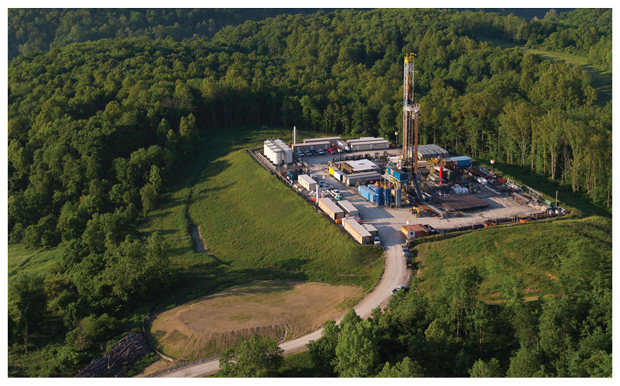

From the panhandle of West Virginia to eastern Ohio, southwestern Pennsylvania and northeastern Pennsylvania, independent operators are finding great success drilling longer laterals and becoming more efficient in the Marcellus and Utica shale plays in the Appalachian Basin.

The numbers speak for themselves. The U.S. Energy Information Administration projected the Appalachian region would produce 28.54 billion cubic feet of natural gas a day in July, an increase of 371 million cubic feet a day from June. That represents more than 40 percent of the country’s natural gas production. And that is on top of the 117,000 barrels of oil a day the region produces.

“I began my career in the industry 33 years ago, and have been working the shale plays exclusively for the last 15,” reflects Keith Yankowsky, executive vice president and chief operating officer of Ascent Resources. “I have had the privilege of seeing most of the shale plays being developed, so nothing we achieve as an industry surprises me anymore. I am proud of what Ascent Resources has accomplished in the Utica. Just a year ago, the initial production on our wells was in the 15 MMcf/d-20 MMcf/d range. Now, in some areas, it exceeds 30 MMcf/d. The Utica had high expectations, but it has exceeded them in both the dry and wet gas areas.”

Ohio Utica

Oklahoma City-based Ascent Resources has 210,000 acres, all in Ohio, in what Yankowsky describes as “one of the best positions in the Utica.” The company announced in June that it had entered into definitive agreements to acquire certain natural gas and oil properties from Hess Corporation, CNX Resources, Utica Minerals Development, and a fourth undisclosed seller for a combined price of $1.5 billion. That deal is to close at the end of August.

The Ohio Department of Natural Resources listed Ascent Resources as the number one natural gas producer in the state for first quarter 2018, as well as first in gas equivalent and third in crude oil production. With 2 billion cubic feet a day of firm transportation capacity, the company can access markets from Chicago and the Midwest to Canada and the Gulf Coast.

“This is a significant acquisition,” Yankowsky observes. “We will have more than 310,000 acres after Sept. 1.”

He says the acquisition will provide Ascent with greater capital efficiency, including the ability to drill longer laterals, as well as complement its existing assets and increase the company’s exposure to liquids.

“We will get a lot more ‘blocky’ on pad development,” he adds. “It provides additional running room as well.”

Among the highlights of the acquisition are 113,400 net leasehold acres and royalty interests on 69,400 fee mineral acres, spanning all three hydrocarbon windows in the overpressured core of the Utica Shale, along with 93 operated wells and net production of 216 million cubic feet equivalent a day (19 percent liquids), more than 380 gross incremental horizontal well locations and a larger working interest in more than 90 gross horizontal well locations, and proved reserves and total resources of 1.1 trillion and 5.6 trillion cubic feet equivalent, respectively.

In making the announcement, Ascent Chairman and Chief Executive Officer Jeff Fisher commented, “These accretive, bolt-on acquisitions are a milestone for the company and have been made possible by our outstanding operational success in the Utica Shale.”

Top Producer

Ascent Resources is running seven rigs and four fracture/stimulation crews in Belmont, Jefferson, Guernsey and northern Monroe counties, Oh.

According to Yankowsky, the Ohio Department of Natural Resources listed Ascent as the number one gas producer in the state for first quarter 2018, as well as first in gas equivalent and third in crude oil production. “We have 30 of the top 40 gas wells in Ohio,” he lauds. “And we have drilled 12 of the top 40 oil wells.”

Yankowsky says Ascent drills a minimum of three wells and usually three-six wells per pad, which provides a number of advantages.

“That allows us to spread the full pad cost over several wells,” he states. “We can skid the rig and walk it over to the next well in a few hours. It also allows us to perform zipper fracs. We average fracturing seven stages a day, and we have done as many as 12. We can perform wireline operations on one well while we are fracturing another. With optimized volumes from multiple wells on the pad, we can right-size our facilities accordingly.”

Ascent averages 12,000-foot laterals, according to Yankowsky, although it has drilled laterals as long as 16,500 feet and plans to drill several laterals longer than 15,000 feet this year.

He says the company has come “leaps and bounds” in its technological advancements, including using fiber optic technology that allows it to evaluate how its fracture stimulation is working in real time.

Yankowsky notes that Ascent is utilizing approximately 150-foot stage length spacing in its dry gas wells and somewhat tighter spacing in wells that offer more liquids. It also is employing cluster spacing in the 30- to 35-foot range, and proppant loadings of 1,500-3,000 pounds per linear foot, depending on what it believes is optimal for the well type.

“We are reprocessing our RG3D dataset that covers much of our dry gas acreage in Belmont and Jefferson counties,” he adds. “We also are doing some inversion work.”

Staying Power

Perhaps the most remarkable thing about Ascent’s Utica wells, Yankowsky proposes, is that their production is staying flat for three-six months after initial production, maintaining rates as high as 40 MMcf/d. Ultimate recoveries for the dry gas area exceed 25 Bcf for a 10,000-foot lateral.

“Belmont County is ground zero for dry gas,” he maintains. “It has double the normal pressure and excellent frac barriers enhance the geometries. It is some of the best rock I have been exposed to in my career.”

As the Utica moves from Belmont west into Guernsey County, it moves from dry gas to condensate yields and then into the volatile oil window. Yankowsky says that provides Ascent with flexibility on where to drill, based on commodity prices.

“If there is an uptick in oil prices, we can move into the oil window,” he observes. “Our position offers us a broad spectrum and great flexibility.”

Coming off the downturn of 2014, Yankowsky says, Ascent Resources has advanced on the technical side, increased its well productivity, reduced costs, developed more running room and transformed its balance sheet.

“We are in a great place and have a very strong position,” he insists. “We will be cash-flow neutral in 2019. The sky is the limit after that. Ascent will continue to focus on optimizing value. Everything has come together to achieve that. We see ourselves as the natural consolidator in the basin, with the lowest cost structure.”

Yankowsky says Ascent will drill 130 wells this year and turn 120 on line. He notes the company has 2 Bcf/d of firm transportation, giving it access to markets from Chicago and the Midwest to Canada and the Gulf Coast.

“Our gas is not trapped in the basin,” he affirms. “Our marketing team has done an excellent job giving us options. We also have a great hedge book with 70-80 percent of our production hedged to protect against downturns. That has turned out to be a great advantage.”

Efficiency Gains

Antero Resources, which has 486,000 net acres in northern West Virginia and southwestern Pennsylvania–all in the southwestern core of the Marcellus Shale–has made a number of notable drilling and completion gains.

“We continued to achieve strong operational execution with fewer drilling days per well and higher completion stages per day during the first quarter than forecast,” states Chairman and CEO Paul Rady in the company’s first-quarter operations report. “Furthermore, the ongoing liquids focus in the Marcellus and strong production performance in the Utica Shale during the quarter boosted results.”

Denver-based Antero Resources is operating five rigs and four completion crews in West Virginia. It placed 16 horizontal Marcellus wells on line during the first quarter with an average lateral length of 9,100 feet and a 30-day rate of 19.8 million cubic feet equivalent a day. Average well costs are $850,000 per 1,000 feet of lateral, assuming average lateral lengths of 10,000 feet and 2,000 pounds of proppant per foot.

Operating five rigs and four completion crews in West Virginia, Denver-based Antero placed 16 horizontal Marcellus wells on line during the first quarter with an average lateral length of 9,100 feet and a 30-day rate of 19.8 MMcfe/d (with 25 percent ethane recovery). Average well costs, according to the operations report, are $850,000 per 1,000 feet of lateral in the Marcellus, assuming a 2018 average lateral length of 10,000 feet and 2,000 pounds of proppant per foot of completion.

Antero reports drilling an average of more than 4,700 feet a day during the first quarter when drilling the lateral sections, which represents a 4 percent increase compared with full-year 2017. In fact, the company says, it drilled a company-record 8,206 lateral feet in one well in 24 hours. It also completed its longest lateral at nearly 14,400 feet during the period. Average drilling days from spud to final rig release were 11.5 in the first quarter, a 6 percent reduction from 2017.

Despite severe winter weather disruptions at times, Antero says it averaged completing 4.3 stages a day in the first quarter, improving to 5.1 stages a day in March as weather factors abated. That exceeded the 4.1 stage-a-day average from fourth quarter 2017 and the 4.4 stages a day budgeted for 2018, the report indicates.

Antero says it commenced production on its two largest Marcellus pads to date in the second quarter. One 12-well pad has a combined total of 120,000 lateral feet, while the other 12-well pad has 106,000 lateral feet. The company projects production from the 24 wells at a combined 90-day gross rate of 350 MMcfe/d-400 MMcfe/d, including more than 20,000 bbl/d of liquids.

The company claims its acreage in the southwestern core of the Marcellus includes 214,000 net acres in the slightly shallower Upper Devonian Shale and 253,000 net acres in the deeper Utica Shale.

Antero says it is constructing its own gathering facilities in Doddridge, Tyler and Ritchie counties, W.V., to connect its wells to compression facilities and processing. At present it is processing more than 1.8 Bcf/d of rich gas from the Marcellus Shale through MarkWest’s Sherwood complex. MarkWest is expected to place Sherwood 10, its 10th 200 MMcf/d plant, into service in the third quarter.

Long Utica Laterals

Meanwhile, Antero says it also has 137,000 net acres in the Ohio Utica Shale. It placed five horizontal Utica wells there to sales during the first quarter with an average lateral length of 11,000 feet. The company drilled four wells during the period with an average lateral length of 9,200 feet in 15.5 days from spud to final rig release, which it says represents a 7 percent decrease in drilling days compared with 2017 for wells drilled to a similar lateral length.

Antero says it expects to operate one drilling rig and one completion crew in the Ohio Utica during 2018. Average well costs are $910,000 per 1,000 feet of lateral, assuming a 2018 average lateral length of 12,000 feet and 2,000 pounds of proppant per foot.

Antero also began completion operations on five Ohio wells during the first quarter, including four with 17,400-foot laterals. They represent Antero’s longest wells drilled and completed to date.

Antero also turned 10 wells to sales in December with average lateral lengths of 10,200 feet, the company says, which were Antero’s first wells completed in the Ohio Utica dry gas regime. According to the first-quarter operations report, those wells produced 24 Bcf of dry gas (20 MMcf/d average per well) and had not yet begun to decline after 130 days on line.

Antero adds that it has completed 634 horizontal Marcellus Shale wells, as well as 161 horizontal Utica Shale wells in its core Ohio area, all of which are on line.

Marcellus Growth

Southwestern Energy (SWN), which is headquartered in Spring, Tx., divides its Appalachian assets into northeast and southwest divisions. At the close of 2017, the company reported 191,226 net acres in its Northeast Appalachia Division with reserves of 4.1 trillion cubic feet, and 290,291 net acres in its Southwest Appalachia Division with 2017 reserves of 7.0 Tcf equivalent (48 percent liquids).

Southwestern Energy’s Southwest Appalachia Division placed 16 wells to sales in first quarter 2018, producing more than 130 million cubic feet equivalent a day, including more than 5,000 bbl/d of condensate. Its Northeast Appalachia Division placed 17 wells to sales. The average 30-day rate for the eight wells on line for at least 30 days as of the company’s May investor report was 15.2 MMcf/d.

The company’s Southwest Appalachia acreage is located predominately in the West Virginia Panhandle, with some acreage in southwestern Pennsylvania. SWN’s Southwest Appalachia division’s first quarter production was 51 Bcfe (567 MMcfe/d), a 42 percent increase over first quarter 2017, according to its May investor report.

The report notes the company’s continued efforts to extend lateral lengths–achieving its longest lateral in Southwest Appalachia to a measured depth of more than 20,000 feet and a horizontal lateral of more than 13,400 feet.

In the first quarter, SWN says, it placed 16 wells to sales, producing more than 130 MMcfe/d, including more than 5,000 bbl/d of condensate–a 27 percent quarter-over-quarter increase in condensate exit rate.

As of the May report, SWN’s 2018 plan was focused on the wet gas window of the West Virginia Panhandle to capitalize on improving liquids pricing. It lists 875 Marcellus rich- and lean-gas locations it says are economic below $3.00 New York Mercantile Exchange gas and $50 West Texas Intermediate oil prices.

Fourteen of its 16 Southwest Appalachia wells placed on production in the first quarter were in the rich gas window and had 30-day IP rates of 8.4 MMcfe/d (32 percent gas, 24 percent condensate and 44 percent natural gas liquids), the company reveals.

While its focus is on the Marcellus in Southwest Appalachia, Southwestern Energy reports it also is testing the 20 Tcfe-plus resource potential in the Utica and Upper Devonian formations. This effort includes permitting a 200-square-mile 3-D seismic acquisition in an effort to enhance the drilling economics of its Utica resources.

Northeastern Appalachia Gains

SWN reported 108 Bcf (1.2 Bcf/d) of net first quarter production for its dry-gas acreage located in northeastern Pennsylvania, which was a 24 percent increase over first quarter 2017.

The company placed 17 wells to sales in the first quarter, it says, all in Susquehanna County, Pa., including the Watts 1H well, which boasted a lateral length of more than 11,200 feet and initial production of 34.1 MMcf/d. The average 30-day rate for the eight wells on line for at least 30 days was 15.2 MMcf/d, the company says.

SWN’s initial Susquehanna County EURs have increased by more than 25 percent compared with its previous operations design, according to its May report. The company attributes these results to changes in completion and flowback methods, and says it is applying what it has learned across its Northeast Appalachia acreage position.

SWN is driving further improvements in its Tioga area economics by installing infrastructure and increasing lateral lengths, its report shows. It commissioned a dedicated third-party water facility in Tioga County, which is expected to reduce its completion costs by $400,000 a well.

Additionally, the company reports, its latest three-well pad drilled in Tioga County had an average lateral length of more than 10,800 feet, a 45 percent improvement over wells historically drilled in the area.

Continuous Improvement

JKLM Energy is a privately held company with technical staff located in Franklin Park and Coudersport, Pa. It has 120,000 acres, all in Potter County in north-central Pennsylvania.

Privately-held JKLM Energy, which has operated one drilling rig in Potter County, Pa., for the past two years and plans to do so for the foreseeable future, expects to drill 14 wells this year. The company focuses its efforts on the Utica Shale, although it also is testing the Marcellus and Burkett formations.

“We have 18 producing wells,” Vice President of Business Development Ben Wingard stated in mid-July. “We have operated one drilling rig for the past two years, and we plan to do so for the foreseeable future. We expect to drill 14 wells this year.”

He says JKLM is concentrating its efforts on the Utica formation, although it also is testing wells in the Marcellus and Burkett formations. All three are yielding dry gas, according to Wingard.

“We monitor industry developments closely, and we seek continuously to improve efficiencies in response to and consistent with market conditions,” he adds.

Wingard points out that JKLM’s current practice is to constrain initial production to prevent damaging the reservoir. “Our EURs have been in the range of 2.0 Bcf-2.5 Bcf per 1,000 feet,” he states.

He says the Appalachian price differential remains a challenge. “We are optimistic this will improve over the next several years as more pipelines are built out of the basin, more natural gas power generation comes on line, and liquefied natural gas exports increase,” Wingard offers.

An often overlooked element of shale resource development, according to Wingard, is what it has meant to local economies, especially in rural areas.

“We are proud that our work in responsibly developing shale resources in Potter County is advancing both our energy and national security,” he emphasizes. “Our mission is to achieve these goals while adding to the economic vitality and quality of life in the region.

“We see positive impacts in the communities that host shale development,” Wingard continues. “Activities directly and indirectly associated with natural gas production, including royalty payments to mineral owners, are aiding local economies. These positive impacts extend to agriculture, tourism, the development of small businesses and more. Local governments and their capacity to deliver services are benefitting as well.

“Individual landowners are a big part of the shale gas economic engine as well,” Wingard points out. “Their local and regional purchases and investments add to economic development. We are proud that these economic and national security advancements are teamed with strong environmental protection and improvement in various environmental indicators, especially cleaner air.”

Conventional Activity

While horizontal Marcellus and Utica drilling dominates news about Appalachian Basin activity, there still are smaller companies making a living by drilling shallow, vertical conventional wells in Pennsylvania, which produced the nation’s first oil well.

One example is family-owned Bald Hill Oil in Sheffield, Pa., which has four wells drilled in the 1930s that still are making 100 barrels a month, according to partner Thomas Holden.

“That is pretty good for wells that old,” remarks Holden, whose family started the company in 1970. “There is a lot of oil industry history in this part of the state. It costs more to plug these old wells, and we keep sweeping more oil out of them.”

Bald Hill Oil operates 16 wells in Forest, McKean and Warren counties in Northwest Pennsylvania. It plans to drill four more wells this year.

“They are shallow wells: 2,500 feet in the Cooper Sand,” he reveals. “They are all conventional and produce 95 percent oil.”

Holden says there are a lot of companies like Bald Hill, employing two-15 people, that still are making a living and creating jobs in the region. He notes the edge of the Marcellus play in northeastern Pennsylvania is 15-20 miles east of where his company operates.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.