Emissions Regulations Require New Balancing Act In U.S. Midstream Sector

By Chris Kipp and Sheila Meehan

Waukesha. WI.–From the Inflation Reduction Act (IRA) to the Lower Energy Costs Act, navigating the midstream sector landscape amidst pending policies, rulings and regulations has rarely—if ever—been more challenging.

In March, the U.S. Energy Information Administration released its Annual Energy Outlook 2023, which provides modeled projections for domestic energy markets through 2050. The report includes cases with different assumptions about macroeconomic growth, world oil prices and technological progress. This year’s edition includes an acknowledgment as part of the executive summary that recognizes much has changed since last year’s annual outlook report to alter the policy landscape underlying the modeled projections—most notably, the passage of HR 5376, the IRA. In addition, after a 23-year hiatus, this year’s outlook report includes an administrator’s foreword “to provide context and outline future direction.”

The foreword opens with reference to technology innovations, specifically related to the record-high levels of U.S. petroleum and natural gas production and includes a narrative around the heightened geopolitical risks that have influenced the energy landscape. Given rapidly changing market dynamics, coupled with uncertainties around policy, the foreword acknowledges that precise forecasts demonstrating how energy prices, technology deployment and emissions will shift over time are, unfortunately, not possible.

As a result, the EIA has added three enhancements to the AEO2023 to provide more detail and context to model results:

- Combination cases combine assumptions from macroeconomic and zero-carbon technology cost cases and reflect a combination of both demand- and supply-side changes.

- Uncertainty visualizations, have incorporated discussion sections designated with shaded areas associated with figures contained in the AEO report that represent a range of results across modeled cases. EIA also indicates that more innovation can be expected as to how it will treat uncertainty.

- Technical notes offer deeper technical details and narratives focused on model-based results to provide insights and better explain results.

However, despite the complexities, challenges and caveats facing the energy industry, one highlight called out in AEO2023 bears particular notice: “The United States remains a net exporter of petroleum products and of natural gas through 2050 in all AEO2023 cases.” This is good news for the industry, but also creates a balancing act since investors, shareholders, governments and communities alike are scrutinizing the carbon intensity associated with the production of fossil fuels driving energy producers to seek new and innovative ways to reduce their methane emissions intensity.

In addition, the IRA includes provisions related to methane emissions impacting the oil and gas industry with specific implications to the gathering and boosting and onshore natural gas production segments.

Methane Waste Fee

The IRA, which was signed in August 2022, includes section 136, “Methane Emissions and Waste Reduction Incentive Program.” The section imposes and collects a charge for excess methane emissions from applicable facilities that report to the U.S. Environmental Protection Agency’s Greenhouse Gas Reporting Program (GHGRP) petroleum and natural gas systems source category (40 CFR part 98, subpart W) and that exceed statutorily specified waste emissions thresholds.

Similar to the passage of the IRA altering EIA’s policy landscape used to develop projections, this first-ever direct “charge” on methane emissions potentially alters a lower-48 landscape that is dotted with natural gas-fired engines providing the mechanical power for compressors located along 3 million miles of pipelines that supply homes, business, schools and more with clean, affordable and reliable natural gas.

To enforce and facilitate methane reduction, a methane waste fee will be imposed on facilities that exceed segment-specific thresholds, and the methane quantification methods will be based on the EPA’s GHGRP. This fee will be $900 per metric ton of methane for 2024, $1,200 for 2025, and $1,500 for 2026 and each year thereafter. The methane intensity calculations are a ratio of the amount of methane emitted to the total natural gas throughput of the station. This means that a producer’s potential fee can be reduced either by decreasing methane emissions or increasing the station’s throughput. The allowable fee thresholds range from 0.05% for gathering and boosting stations to 0.2% for onshore or offshore production segments.

The premise of the regulation is that GAG are contributing to climate change, and that targeting and reducing methane emissions is the fastest, most economical way to reduce impact to the environment.

All of this being stated, it should also be noted that Section 10013, Natural Gas Tax Repeal included H.R. 1, Lower Energy Costs Act, repeals Section 136 of the Clean Air Act (relating to methane emissions and waste reduction incentive program for petroleum and natural gas systems) and also rescinds the unobligated balance of any amounts available under Section 136 of the CAA.

EPA GHGRP

The GHGRP has been the method utilized by EPA since 2011 to collect annual emissions data from nearly 8,000 large U.S. industrial facilities and other sources that emit 25,000 metric tons of carbon dioxide equivalent (mtCO2e) or more per year. The EPA has proposed amendments to specific provisions of the GHGRP to improve the quality of the data collected under the program. According to the EPA, the proposed revisions would further enhance the quality of the data from the Petroleum and Natural Gas Systems source category (Subpart W) so that the GHGRP continues to serve as a tool for both EPA and the public to understand emissions from this sector.

Studies cited in the proposed GHGRP rule indicate that a large portion of emissions can result from unburned methane entrained in the exhaust of natural gas compressor engines, also referred to as “combustion slip” or “methane slip.” The studies further assert that emissions from natural gas compressor engines included in the GHGRP are significantly underestimated because they do not account for combustion slip.

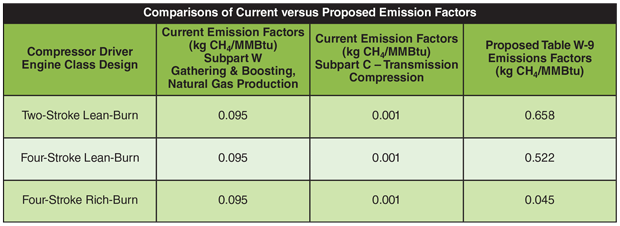

Therefore, the EPA has proposed revised methodologies for determining combustion emissions from compressor engines to account for slip. Reporters would use Subpart W-specific emission factors by engine design class (e.g., two-stroke lean-burn, four-stroke lean-burn, four-stroke rich-burn, or other) in proposed new Table W-9 (Table 1).

As made apparent by the proposed emission factors, four-stroke, rich-burn engines simply and inherently emit less methane. Rich-burn engines operate near the stoichiometric air-to-fuel ratio (16-to-1) where theoretically 100% of the fuel and oxygen is consumed during combustion. In reality, this is about a 99.7% combustion efficiency, and results in a more than 90% methane emission reduction compared with four-stroke lean-burn engines.

In the EPA’s Revisions and Confidentiality Determinations for Data Elements Under the Greenhouse Gas Mandatory Reporting Rule (MRR) published in the Federal Register in June 2022, the proposed revisions were slated to become effective on Jan. 1, 2023, with reporters implementing the changes beginning with reports prepared for the 2023 reporting year, submitted April 1, 2024. The IRA’s Section 136(h), however, requires revisions to the requirements of 40 CFR part 98, Subpart W to ensure that reporting and calculation of charges are based on empirical data and accurately reflect total emissions from applicable facilities.

EPA is still evaluating the scope and risks associated with the prospective rule published in June 2022 and is currently evaluating several options related to calculation of reported emissions and charges. As of early May, the EPA was expected to solicit comments on those options soon.

Compression Site Modeling

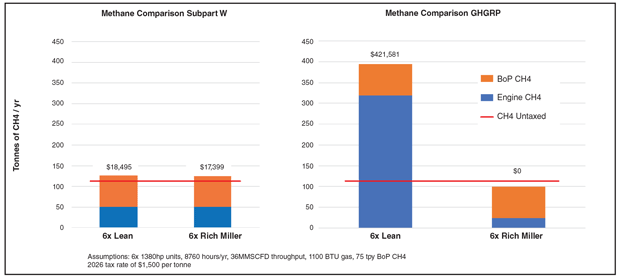

To demonstrate the impact of the proposed emission factors, a sample compression site was independently modeled as both a 100% compressor driver rich-burn site and a 100% compressor driver lean-burn site, as shown in Figure 1. The site includes six compressor skids, each running at 1,380 brake horsepower and compressing 6 million cubic feet a day. With the compressor vents, tank vents and blowdowns, the site is estimated to emit 75 metric tons of CH4 per year outside of the engine’s exhaust.

In 2026, with a fee of $1,500 per metric ton of CH4, using the EPA’s old Subpart W factors, both the modeled rich-burn and modeled lean-burn site will have to pay just under $20,000 to satisfy the methane fee. By applying EPA’s proposed GHGRP factors, the lean-burn site would pay more than $400,000 annually while the rich burn site would pay $0 in methane fees.

The producing companies most severely impacted by IRA’s Methane Emissions and Waste Reduction Incentive Program are midstream oil and gas companies with large fleets of lean-burn engines. These fleets will have the lowest fee threshold factor and the highest engine CH4 emission factors. As such, the incentive to reduce methane emissions (and their associated taxes) are high, but so can be the cost.

Major maintenance events can also be expensive, but a lean-burn to rich-burn conversion at the time of major overhaul can be a way to leverage existing operating budgets to help achieve emissions (and tax) reductions. For example, OEM remanufactured engine exchange programs can help facilitate engine swap outs or exchanges, seamlessly transitioning from lean-burn combustion into the latest Miller cycle rich-burn technology. The Miller cycle rich-burn technology engines are on par with lean-burn fuel consumption but with a much lower CH4, and therefore CO2e, footprint. Other emissions such as nitrogen oxides and volatile organic compounds can also be reduced by transitioning from lean-burn to rich-burn.

In addition, the methane fee is averaged over entire fleets as opposed to at individual sites. There is still time to act before the methane fee goes into effect. To target package emissions, a quick remediation is to reduce the CH4 emitted from the package, especially pneumatic items that are powered by gas or vents. Targeting and mitigating engine CH4 emissions requires additional planning. Since an engine is typically overhauled once every six-plus years, this interval becomes the most economical time to target an upgrade and start reducing or eliminating applicable methane fees.

Furthermore, combining engine overhauls with emissions reductions generates multiple synergies: increased profitability, reduced emissions, cleaner communities, attraction of a new skilled workforce, and the continued investment in the technologies required to grow economies and improve the quality of life around the globe.

The world needs access to hydrocarbons now more than ever. The United States has the reserves, the infrastructure and technology to grow the production and export capacity to bring clean-burning natural gas to places where it is needed most. The oil and gas industry is well-positioned to continue innovating, supported by collaboration between industry and policymakers, to implement the technologies available to achieve the lowest methane and carbon footprint. The world needs more energy and lower emissions; and fortunately, the technologies are available today to simultaneously accomplish both of these goals.

CHRIS KIPP is a senior business development manager at INNIO’s Waukesha Engine. Over his 12-year tenure with the company, he has held technical positions in application engineering, product management and sales. In his current role, Kipp helps end customers achieve ESG goals with Waukesha’s upgrade and remanufacturing programs. He holds a B.S. in mechanical engineering from the Milwaukee School of Engineering and an M.B.A. from the University of Wisconsin-Madison.

SHEILA MEEHAN is a strategic marketing manager at INNIO’s Waukesha Engine. She has spent more than 25 years in various marketing roles driving product visibility and strategic growth plans for a range of industrial products and services, including reciprocating engines and power systems across the oil and gas and power generation markets. Meehan holds a B.A. in communications from the University of Wisconsin-Whitewater.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.