EnerVest’s Long-Held Strategy Reaps New Rewards In Burgeoning Utica Play

By Ken Mariani

HOUSTON–EnerVest Operating Company has spent the past 20 years building on a corporate strategy of selectively acquiring mature onshore assets with proven reserves and enhancing those assets with operational expertise.

That strategy provided the catalyst for EnerVest’s venture into the Utica Shale in Ohio. As early unconventional plays transition into the lower-risk, developmental phase of maturity, EnerVest has applied its strategy to gain entry into areas such as the Austin Chalk of South Texas and the Barnett Shale in the Fort Worth Basin.

In late 2009, as Marcellus Shale euphoria spread across the Appalachian Basin, many operators were divesting their assets in Ohio for prospective Marcellus acreage in Pennsylvania and West Virginia. EnerVest, from its regional offices in Columbus, Oh., and Charleston, W.V., bucked that trend and concentrated on the conventional Clinton and Knox targets of Ohio. EnerVest’s strategy is proving to be a winner again, as the company has emerged as an early leader with a dominant position in the rapidly expanding Utica Shale play.

EnerVest made its initial entry into Ohio through four acquisitions: the purchase of CGAS Corporation and Belden & Blake Corporation in 2003 and 2005, respectively, and the purchase of assets from EXCO Resources in 2009 and Range Resources in 2010.

The Range asset acquisition marked EnerVest’s fourth major acquisition in Ohio and solidified EnerVest’s position as the largest producer and acreage holder in the state. The asset value of the four transactions totaled in excess of $1 billion, securing more than 1.2 million acres held by 8,500 conventional wells with associated pipeline and producing infrastructure. Production on almost all of the 1.2 million acres holds both shallow and deep rights.

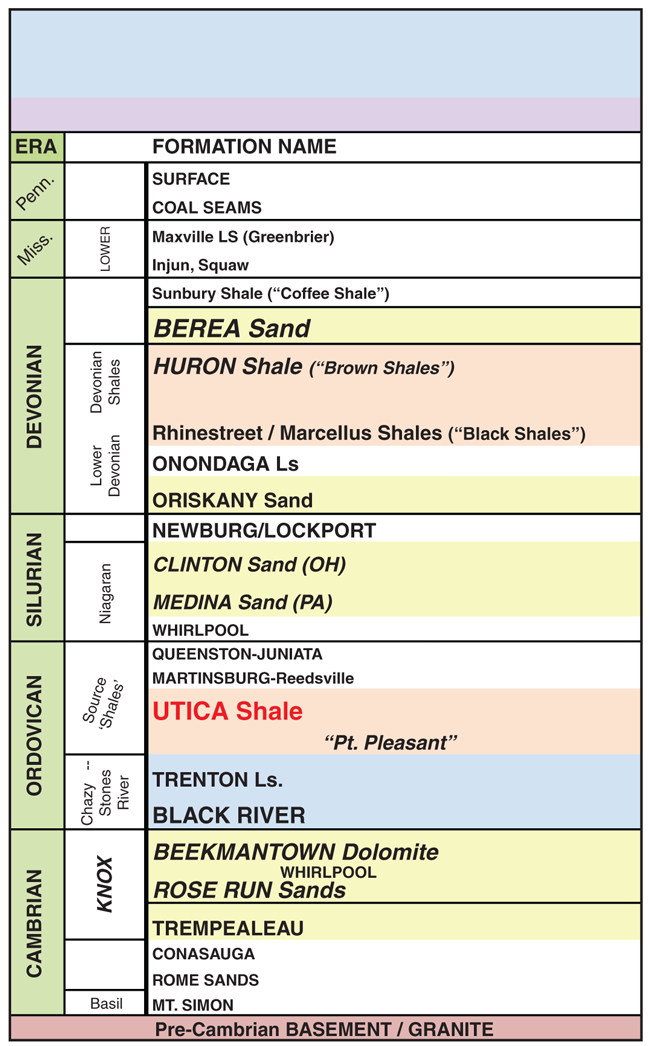

Along with producing wells and acreage, EnerVest also acquired a large amount of scientific data, including the logs, cores and geophysical data that were commissioned in the drilling of the conventional wells obtained through company legacy assets, acquisitions and an active Knox exploration program. The Knox is a seismically driven, Cambro-Ordovician target located below the Utica Shale (Figure 1).

Strategic Agreements

In March 2008, prior to the EXCO and Range asset acquisitions, EnerVest entered into an agreement with Anschutz Exploration Company on 409,000 acres in Ohio and Northwest Pennsylvania designed to expand the areas of the deeper (>7,000 feet) Trenton-Black River and Knox production. This agreement left EnerVest with an overriding royalty interest (ORRI) and the capital commitment by Anschutz to partially fund drilling a series of deep exploratory wells in Carroll County, Oh., where the first whole core of the Point Pleasant member of the Utica Shale was taken. EnerVest and Anschutz geologists analyzed the core for its potential as an unconventional resource play.

In June 2010, EnerVest sold 75 percent of its Utica rights on 363,000 acres in Central Ohio to Chesapeake Energy Corp. Again, EnerVest retained an ORRI working interest and the Chesapeake-carried capital partially funded drilling a series of Knox wells that were cored in the Utica/Point Pleasant interval. In total, more than 2,600 feet of Utica/Point Pleasant core was retrieved and served as the foundation for defining the Utica’s potential as an economic resource play. The actual core data were calibrated to NuTech Energy Alliance’s petrophysical model, which was then applied to 80 deep wells in Ohio and Pennsylvania for EnerVest’s first total-gas-in-place mapping of the Utica Shale.

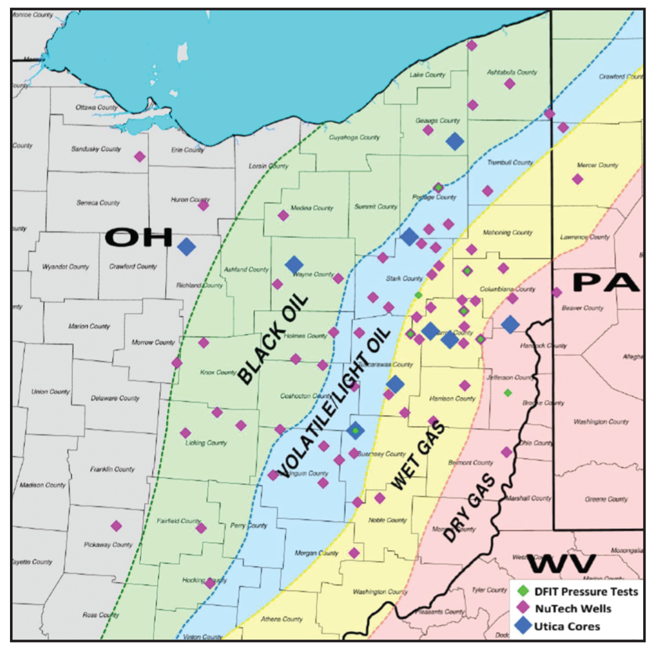

EnerVest’s dataset now consists of more than 500 digital LAS (log ASCII standard) logs, nine whole cores of the Utica/Point Pleasant, sidewall cores from seven additional wells, eight diagnostic fracture injection test (DFIT) pressure readings, and more than 10,500 miles of 2-D and 450 square miles of 3-D seismic data (Figure 2). In addition, EnerVest is participating in two large, speculative seismic programs targeting the Utica Shale: a 400 square-mile 3-D shoot and a survey acquiring 1,000 miles of 2-D data. This wealth of technical data has yielded a superior understanding of the Utica Shale and has proven indispensable in early geologic and reservoir assessment, drilling and completion design, and production techniques for the Utica Shale.

In November 2011, EnerVest entered into a joint venture agreement in east-central Ohio with Chesapeake and Total E&P, structured for development drilling in the Utica Shale. As of year-end 2012, EnerVest participated in drilling 93 Utica wells with Chesapeake and Total. Eighty-four of these 93 wells had reached total depth at the end of the year, and 34 wells had production data. Combined with local operational and drilling expertise, EnerVest strategically pursued opportunities to drive this play forward efficiently and economically in order to move from a regional resource assessment phase to a drilling development stage, long before competitor activity “heated up.”

World-Class Resource Play

The Late Ordovician Utica Shale is a laterally extensive, world-class, liquids-rich resource play that covers a large geographic area of the Appalachian Basin. Extending from Ohio into Pennsylvania, New York and West Virginia, the U.S. Geological Survey estimates the play contains 38 trillion cubic feet of natural gas, 940 million barrels of oil and 9 million barrels of natural gas liquids. The thermal windows of the Utica Shale are characterized by a western oil phase, a central wet gas phase and an eastern dry gas phase.

The primary producing facies consist of calcareous to clay-rich mud rock and argillaceous limestone (Point Pleasant member) with total organic carbon values ranging from 1.0 to 4.0 weight percentage. Hydrocarbons have been generated from the organic-rich shale and mudstone, and occupy matrix porosity (2.0-6.0 percent effective porosity) as well as organic porosity within the source rock itself.

The Utica is characterized by Type II kerogen, which is prone to oil generation. Clay content ranges from 20 to 40 percent and water saturations are extremely low at 1-25 percent. Permeability ranges from 300 to 1,200 nanoDarcies. Locally, natural fracturing can play an important part in reservoir enhancement. Favorable drilling depths of 5,000-9,000 feet TVD pervade most of the play. The Utica Shale is most likely analogous to the Eagle Ford Shale in South Texas.

As of year-end 2012, the Ohio Department of Natural Resources had issued 485 horizontal Utica Shale permits, of which 199 were drilled or were being drilled and 45 were producing (EnerVest has working interests in 25 of the 45 producing wells reported to the ODNR). Because of commodity pricing, most of the drilling activity has been in the wet gas window, with the counties of Carroll, Columbiana and Harrison leading the way. The low percentage of producing wells can be attributed to a lack of infrastructure, with these three counties having little to no historical production.

As in any burgeoning shale play, one of the more challenging tasks is creating a type curve for play economics when production data are limited. Using data from the producing Utica wells, EnerVest created a “wet gas window” type curve that had an initial gas production rate of 5 MMcf/d, a b-factor of 1.80, initial decline of 66.5 percent per year and a final exponential decline of 6 percent per year. EnerVest also used an initial and final condensate ratio of 120 and 15 barrels per MMcf, respectively. For NGL volumes, EnerVest assumed a total of 140 bbl/MMcf, consisting of 80 bbl/MMcf of ethane and 60 bbl/MMcf of propane plus. In addition, a well life of 40 years was assumed, based on well production histories in analogous shale plays.

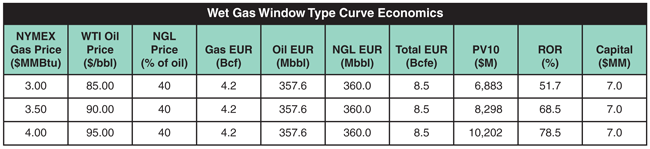

Table 1 shows how the return on revenue (ROR) and PV10 of EnerVest’s wet gas window type curve are affected by varying commodity prices. Profitability is evident in the Utica wet gas window, even at current prices, where operators have 20 rigs running.

Well Construction Costs

Drilling operations in the play continue to improve significantly as operators gain regional knowledge and adapt to employ best practices while drilling various sections of Utica horizontal wells. Some of the improvements made from 2011 to 2012 include cutting the average well cost from more than $9 million to slightly less than $8 million by increasing the footage drilled per day from 250 to more than 750 feet, which in turn, decreased average drilling days per well from more than 50 to fewer than 20.

Operators continue to realize cost savings and efficiencies resulting from a reduced number of drilling days in the vertical and the horizontal sections of the hole. A single lateral well drilled on a pad will add an incremental $1 million-$2 million to costs associated with full pad development. Well cost should continue to decline from slightly less than $8.0 million to approximately $6.5 million as more pad development occurs.

Another important development affecting the play involved updates by the Ohio Department of Natural Resources to its well construction regulations, which placed additional obligations and requirements on operators for any horizontal shale wells drilled. Operators have complied proactively with the new regulations. For example, operators now capture “flash gas” generated by the high-Btu gas produced from the Utica, and vapor recovery systems are being used throughout the testing and production periods to eliminate volatile emissions from production equipment and stock tanks.

Initial Utica/Point Pleasant completions had the primary goals of creating a significant amount of stimulated rock volume and generating as much conductivity as possible. Both of these factors are crucial to producing low-permeability shale reservoirs, especially when considering the volumes of natural gas condensate and liquids produced throughout the life of a Utica well.

Hence, operators focused on several parameters to target the optimal completion, including stage and cluster spacing, sand concentrations and loading, fracturing fluid types and volumes, and finally, a combination of proppants. No single completion design will accommodate the entire Utica Shale resource area, but rather a variety of techniques have been developed, based on rock properties, product window and thermal maturity.

Gathering And Midstream

To complement its investment in upstream production assets and diversify its oil and gas portfolio, EnerVest Energy Partners (EVEP) took a nonoperated position in gathering and midstream facilities to further participate in developing the Utica Shale. EVEP participated with its joint venture partners, Chesapeake Energy, through its affiliate Chesapeake Midstream Development (now Access Midstream Partners LP), and Total E&P USA Inc. to form Cardinal Gas Services. The charge of this newly formed company is to construct gas gathering facilities from the well pad to the first point of midstream infrastructure.

Cardinal is projected to build nearly $1.2 billion in regional gas gathering facilities over the next 10 years to support Utica Shale development. Cardinal consists of 60 miles of gathering pipeline and throughput is approximately 59 MMcf/d. EVEP owns a 9 percent interest in the project.

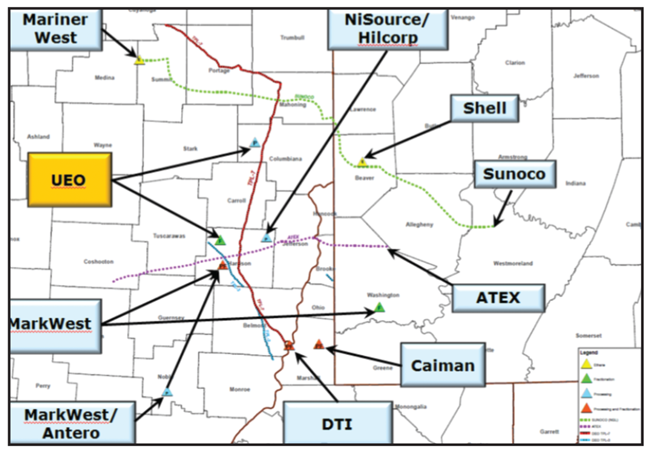

EVEP also holds a 21 percent nonoperated interest in Utica East Ohio Buckeye (UEO), a midstream joint venture with Momentum Energy and Access Midstream Partners to build gas processing and fractionation facilities in Columbiana, Carroll and Harrison counties in the heart of the Utica Shale in Ohio. UEO’s project, with a targeted in-service date of June 2013 and a cost of nearly $1 billion, consists of 800 MMcf/d of cryogenic processing, 90,000 bbl/d of fractionation, and 870,000 bbl/d of NGL storage and rail-loading facilities.

Many infrastructure constraints in east-central Ohio’s Utica play will be alleviated by the late first quarter to early second quarter of 2013 as expected build-outs of wet stream gathering and expansions of processing/fractionation come on line (Figure 3). The wet gas window of the Utica undoubtedly has moved beyond the early appraisal stage as operators continue to prove up the productivity and deliverability of the Utica Shale reservoir.

Going forward, operators will focus on play refinement, technical optimization and cost reductions as the Utica moves into full development mode. EnerVest continues to focus on these factors to optimize its Utica position by relying on the strategy the company began implementing 20 years ago, and is evaluating every option to continue maximizing the value of its Ohio assets for its investors.

KEN MARIANI is president and chief executive officer of EnerVest Operating Company LLC. He has served in that capacity since January 2012. Mariani joined the EnerVest family in 2000 and was senior vice president and general manager of the eastern division for 11 years. From 1991 to 2000, he served as vice president of operations for Energy Corporation of America, and was responsible for ECA’s engineering, land, geology and production operations. Prior to that assignment, Mariani had held various engineering positions in Conoco Inc.’s Midland, Tx., and Rocky Mountain divisions. He holds a degree in chemical engineering from the University of Pittsburgh, and an M.B.A. from the University of Texas (Permian Basin). Active in various regional/state independent oil and gas associations as well as the Independent Petroleum Association of America, Mariani is a past chairman of the Society of Petroleum Engineers.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.