Dry Gas Strategies

Independent Operators See Opportunities In Dry Natural Gas

By Dan Holder

It has been difficult for the nation’s oil and natural gas producers to see beyond the dark clouds that descended on economies around the world this spring, but the glimmer of a silver lining is starting to emerge on the distant horizon.

Thanks to several years of indiscriminate associated gas growth in tight oil plays and abnormally mild weather the past two winters, the rig count in dry gas plays was on a steady decline long before anyone had heard of COVID-19.

That may be about to change dramatically. In late April, Moody’s joined a growing chorus of analysts predicting better times ahead for natural gas pricing, with most forecasters calling for prices to rally later this year as the economic recovery picks up steam and the winter heating season draws near.

That is opening opportunities for operators with dry gas leases, particularly in the gas shale plays that slightly more than a decade ago had producers running twice as many gas as oil rigs. In the last week of April, the 81 active natural gas-directed rigs were concentrated in the Marcellus Shale play in Ohio, Pennsylvania and West Virginia and the Haynesville in Louisiana and East Texas, according to the U.S. Energy Information Administration. Those two plays, the agency reports, accounted for 78% of all active U.S. rigs.

U.S. dry natural gas production set a record in 2019, averaging 92.2 billion cubic feet a day, EIA data indicates. However, the agency says it expects domestic gas output to average only 91.7 Bcf/d in 2020, with production falling from 94.4 Bcf/d in March to 87.5 Bcf/d in December as associated gas output declines. EIA sees dry gas production moving in the opposite direction in 2021, driven by higher prices and incremental demand in key sectors such as power generation and liquefied natural gas exports. Accordingly, the agency forecasts that Henry Hub spot prices will average $2.11/MMBtu in 2020, increasing to an annual average of $2.98 next year.

Appalachian Gas

Production in the Appalachian Basin was predicted to drop by as much as 5%, along with a reduction in capital spending, even before Saudi Arabia and Russia began their oil price war on March 7, recalls Douglas Kris, vice president of investor relations for Montage Resources. Their subsequent agreement to cut production and the reduction in U.S. associated natural gas production, supported by slowly recovering economies in many countries and China’s agreement to purchase more U.S. natural gas, provide some reasons for optimism over gas demand, he assesses.

Employing technologies in different ways is boosting Montage Resources’ Appalachian Basin production. The company says cycle times from well spudding to sale have dropped from 225 days to 140, with completion crews now completing between nine and 12 stages a day on average.

“If you want to put a time frame on something, the second quarter is a throwaway for not only gas and oil but every industry globally, because of what has been going on with the pandemic. As natural gas companies migrate to late in the third quarter and into the fourth quarter, you are going to see robust results from a corporate-level perspective and cash flow generation starting to come out as these gas prices start to get even more teeth in them,” he predicts. “We had abnormally hot winters the past two years, so if you get any normalization of a winter, you can see some pretty interesting things happen to gas prices.”

Montage, formed in a 2019 merger of Eclipse Resources and Blue Ridge Mountain Resources, is developing its 195,000 net acres in the Utica and Marcellus shale play in Ohio, Pennsylvania and West Virginia. Kris describes the company’s holdings as equally split between dry gas and wetter Marcellus. Across that area, he notes Montage has something that is slightly unusual in the basin and unique to the company: it is a stacked play, with the Marcellus Shale sitting right above the Utica.

The company’s initial 2020 operating budget for its acreage in Monroe County, Oh., emphasized wet gas, with 75% of production slated to come from the Marcellus formation, he says.

“In late March, Montage noted this change in the macroeconomic environment, and quickly made a strategic change that flip-flopped the activity level to be 75% dry gas and 25% Marcellus. The company has the ability to do that for a number of reasons–its acreage footprint in that stacked play environment, and its acreage with permits ready and pads ready in terms of attacking the acreage from the drill bit perspective at all times. That allows the company to quickly shift,” he describes.

According to the company’s first-quarter 2020 operational update, Montage’s preliminary net production for the first three months of 2020 averaged approximately 611 million cubic feet of gas equivalent a day, with 65% of its 2020 gas production hedged at an average floor price of $2.62/MMBtu. It also has increased its 2021 gas position.

Cutting Cycle Times

Montage turned five Monroe County Utica dry gas wells to sales in 2019. The company is running one rig on its Appalachian Basin acreage, with the midpoint of its 2020 capital spending set at $155 million, Kris says. Its current guided production forecast is between 81%-83% natural gas production, with 65% of its annual capital expenditure frontloaded to the first half of 2020.

“As natural gas prices improve, Montage’s leaning would be to use that additional cash flow generation to pay down debt, whether it is buying back bonds in the marketplace or paying down its reserve base lending facility,” he reports. “In this environment, you get much more of an evaluation uplift by reducing debt than you do by accelerating activity. What that ultimately means is that even if gas prices improve, you are not going to see the rig count in Appalachia suddenly go up based on pricing. I think companies aren’t going to be rewarded for more activity; they will get rewarded for using the cash flow to pay down the debt.”

Montage is using several existing technologies in different ways to implement cost savings and efficiencies, Kris says. The company’s cycle times from well spudding to sale have dropped from 225 days down to about 140, with completion crews completing between nine and 12 stages a day on average.

“The company tries to have numerous operations going on at the pad. From a production standpoint, you want the production activity ready to go as soon as completions are done. That decrease in downtime allows the company to have those efficiencies on the completion cadence and a reduction in cycle times, which leads to accelerated cash flows,” Kris describes.

In developing the stacked formations, he says Montage drills the deeper Utica first, to hold its rights to the shallower Marcellus. The Utica is the more challenging play because it is a higher-pressure formation, the drilling crew must focus on staying in the pay zone, and costs are slightly higher, Kris notes.

Over the course of the past year, Montage has been able to meaningfully lower its drilling and completion costs by at least 20%, recording a 5% cut in 2020 alone, he says. During that time, company executives renegotiated the gas gathering agreement with one of the Appalachian Basin’s largest providers and revised a Marcellus processing agreement to lower costs and provide additional payout from ethane sales into the gas stream.

Capital And Cash Flows

Range Resources has cut its 2020 all-in capital budget to $430 million from $520 million, but says it expects to maintain production at 2.3 Bcfe/d for 2020. In its late March announcement, the company said, this continues Range’s previous actions and commitment to prioritizing its balance sheet and aligning capital with projected cash flows.

“Having met our firm transportation commitment in the Marcellus, we have flexibility in our development program as evidenced by the 40% reduction in 2020 capital spending compared with last year,” assesses Jeff Ventura, Range’s chief executive officer. “Given near-term challenges in commodity pricing, having a sustainably low maintenance capital is paramount, and I believe this updated capital budget further demonstrates Range’s peer-leading capital efficiency, as our decline rate, well costs and capital spending per unit of operation all remain best-in-class.”

Range Resources says its Marcellus Shale inventory includes 3,300 undrilled Marcellus wells across southwestern Pennsylvania, with the company’s core acreage targeting the Utica and Upper Devonian as well as the Marcellus.

The company says its first quarter 2020 production has averaged 2.3 Bcfe/d, and it expects to maintain that production for the remainder of the year. Range reported peer-leading capital efficiency results, recording the lowest capital development costs on a per unit basis in Appalachia.

According to Range, its Marcellus inventory includes 3,300 undrilled Marcellus wells alone in southwestern Pennsylvania, which it says equates to decades of development. The company’s core acreage also holds significant Utica and Upper Devonian prospects. The company says it has drilled three Utica wells in Washington County, Pa., and its most recent Utica well appears to be one of the best dry gas Utica wells in the basin.

Range is well positioned to survive a period of low commodity prices by maintaining low-maintenance capital paired with improving capital efficiencies. The company says this will help it target free cash flow generation, which is driven by its core Marcellus and Utica assets.

Given the U.S. natural gas base decline rate of 26%, the country needs about 27 Bcf/d of new gas each year to hold production flat. Range predicts that as industry follows a maintenance capital approach, production growth should slow meaningfully for the rest of 2020 and into the next year, if strip prices hold. The company sees total demand growth exceeding 20 Bcf/d through 2025 from LNG and exports to Mexico, backed by industrial and electric power demand growth.

“Looking beyond short-term demand headwinds, we see the potential for meaningful improvements in natural gas and NGL pricing as significant reductions in energy investment across U.S. shale are occurring while global demand for cleaner, efficient fuels like natural gas and NGLs is increasing,” Ventura says.

Cutting Costs

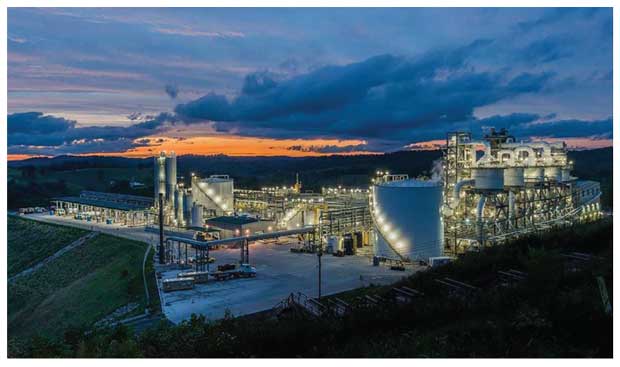

A drilling and completion efficiencies program, supported by midstream cost savings, gives Antero Resources Corp. $600 million in savings in 2020 compared with the previous year’s initial budget. Its 542,000 net acres in the southwestern core of the Marcellus and Utica shales–451,000 acres in the Marcellus play in northern West Virginia and 91,000 acres in eastern Ohio’s Utica Shale–holds 19.0 trillion cubic feet of new proved reserves, the company says.

In addition to its production holdings, Antero owns a 29% interest in Antero Midstream, which owns and operates gathering lines, compression, processing and water handling/treatment assets.

“Our reduced 2020 drilling and completion capital budget highlights the continued momentum in our capital cost savings initiative that was launched in early 2019,” described Paul Rady, the company’s chairman and CEO. “The new $750 million budget is 41% lower than our 2019 capital spend, with no change to our growth target of 9% for 2020.”

Although freshwater is an abundant resource in the Appalachian Basin, Antero is committed to reducing the use of freshwater throughout its operations with an active wastewater recycling program. Antero’s freshwater infrastructure consists of more than 350 miles of pipelines and 37 impoundments. The system reduces water truck traffic by 4,500-4,750 truckloads per well and lowers associated greenhouse gas emissions by 30,000 tons of carbon dioxide equivalent annually.

The 2019 initiative lays out a $350 million reduction in gathering, processing and transportation costs through 2023, the company says. The program includes agreements with Antero Midstream Corp. and other third-party midstream providers, as well as an asset sale program targeting $750 million-$1 billion in proceeds in 2020.

The company’s first quarter earnings call points out Antero has cut its drilling and completion costs by 26%, from $970 a lateral foot at the beginning of 2019 to $715. Its D&C capital budget for 2020 is $750 million, a $400 million drop from 2019 projections. At the same time, Antero forecasts its net production will stay unchanged, at 3.5 Bcf, with natural gas production at 2.375 Bcf.

Other savings will result from reducing operated rigs from four in early 2020 to one for the remainder of the year, decreasing the number of completion crews from three to one for the rest of 2020, and garnering produced water savings through the Antero Midstream system. For 2020, the company expects to drill 95-100 wells and complete 105.

On the financial side, Antero says it has multiple assets that can be monetized in 2020 to reduce debt. It reports targeting as much as $900 million in asset monetization, including possible sales of undeveloped leaseholds and producing properties. The company adds it has 1.8 Tcfe of natural gas hedges, with a current hedge value of $825 million, as well as an additional 688 billion Btus of gas hedges to calendar 2022 at an average price of $2.48/MMBtu.

Rady points out because of the near-term liquids pricing environment, Antero has deferred 20 well completions into 2021, which he says will lead to a positive cash flow of $175 million for 2020, based on current commodity strip prices.

“We anticipate a maintenance capital spend level in 2021 of $600 million to hold 3.5 Bcfe flat,” Rady offers. “This low-maintenance capital level, combined with the substantial natural gas and liquids production base, enables Antero to have success under various pricing environments.”

Third-Quarter Production

In the second quarter of 2020, Cabot Oil & Gas Corp. says, it will produce as much as 2.25 Bcfe a day, a production decline from the first quarter’s 2.36 Bcfe/d primarily driven by a decision to place only 13 wells on line from the beginning of the year to mid-May. According to the company, about two-thirds of Cabot’s wells are scheduled to be placed on production between May and late August, resulting in a significant sequential production increase in the third quarter.

Since Cabot launched its horizontal drilling program in 2008, its Marcellus Shale position in Northeast Pennsylvania has developed into a cornerstone of its portfolio, with the company drilling 790 net horizontal wells on its 173,000 net acres in the play’s dry gas window. Cabot adds it plans 60-70 net horizontal wells in 2020.

“While natural gas prices are expected to remain challenged in the near term as we manage through an oversupplied market exiting the winter heating season and the unexpected loss in demand resulting from COVID-19, we expect a much healthier supply and demand balance for natural gas later this year and in 2021,” predicts Dan O. Dinges, Cabot’s chairman, president and CEO. He notes the company’s improved outlook for the natural gas markets primarily is driven by expectations of significant declines in natural gas supply in 2020 and 2021 because of continued reductions in natural gas-directed drilling and completion activity and less associated gas production from reduced operating activity in oil basins.

In its production guidance for 2020, Cabot says it is reaffirming its capital program of $575 million.

“The midpoint of our updated production guidance range implies flat production levels year-over-year, with fourth quarter 2020 exit volumes expected to be flat to the fourth quarter of 2019,” Dinges describes.

Cabot’s capital expenditures in the first three months of 2020 totaled $160.3 million, including $158.0 million for drilling and facilities, $900,000 for leasehold acquisition and $1.4 million for other capital expenses.

“As it relates to our outlook for 2021, we are extremely encouraged by the increase in the NYMEX natural gas futures for 2021 from a low of $2.28 per MMBtu in early March to approximately $2.75 per MMBtu,” Dinges said on April 30. “We will continue to assess the natural gas market dynamics, including the impact of COVID-19 and lower crude oil prices on the natural gas supply and demand outlook, before formalizing our plans for 2021.”

Wyoming Production

Depending on market conditions, Jonah Energy will resume drilling in the Jonah Field in Sublette County, Wy., this summer, says Paul Ulrich, the company’s vice president of government and regulatory affairs. About 15% of Jonah’s production is associated condensate, which he notes accounts for 30% of company revenues, but its principal targets remain dry gas.

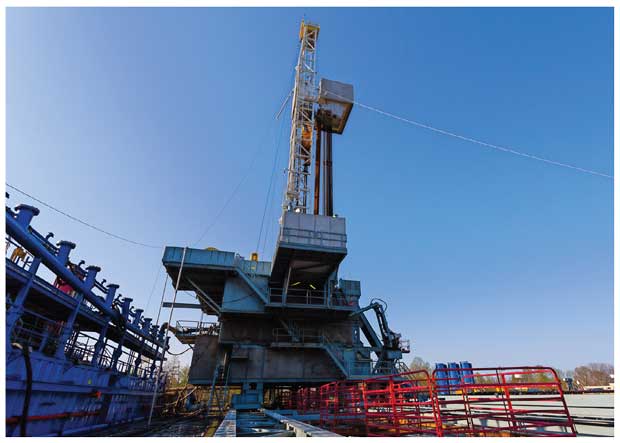

Jonah Energy operates more than 2,400 wells across the Jonah Field’s 24,000 acres. When it was discovered in the 1990s, the leasehold had an estimated original resource of 19.2 trillion cubic feet, the company reports. Immediately south and west of this play, the Normally Pressured Lance or Jonah Extension Project, encompasses 140,000 acres, with company estimates of as many as 3,500 directionally drilled wells possible.

When gas prices recover, Jonah Energy plans to resume development of the Jonah Extension (Normally Pressured Lance) play, which lies south and west of the Jonah Field. The company says the 140,000 acres in that new play may support as many as 3,500 directionally drilled wells.

The company has seen some slight increases in gas prices and that is positive news for those in Southwest Wyoming who make a living off dry gas, Ulrich says, adding “Forecasts show a steady climb in prices. They certainly are not where we want, but prices are better than they have been. We are hoping that holds as we move forward through the summer and into 2021.”

Future Jonah Field and NPL development will use new vertical and horizontal well technologies, Ulrich says, pointing out the company also is relying on improvements to reduce supply and overall well costs.

“There is growing concern in the industry as a whole about securing capital, particularly for new projects and obviously for ongoing operations,” he says. “This is an area we all need to look at seriously as we chart a path forward. Oil and gas are the bedrocks of Wyoming’s economy and the bedrock of a number of states’ economies. We need to gear up first and foremost to a quick recovery, and then pivot to growth.”

Forecasts for gas prices to bounce to $4/Mcf would allow consideration of developing the NPL play, which he says already has been authorized by the Bureau of Land Management.

“When we stood up Jonah Energy a number of years ago, natural gas prices were hovering in that high $3-low $4 range. That gave the company optimism that it could not only continue developing the Jonah Field, but look at prospects such as the company’s Jonah Extension (NPL),” Ulrich indicates. “Current prices don’t support that play as being economic, but if those prices change over the next year or two or beyond, that gives a lot of promise that Jonah Energy might be able to begin in earnest development of that aspect. To me, that is very exciting.”

In March, Jonah Energy became the first gas producer to be certified for low methane emissions under Independent Energy Standards Corp.’s TrustWellTM Responsible Gas program. The company says the certification process tracks the leak rate as a percentage of overall production and the reduction in methane footprint versus the industry benchmark.

“This low emissions certification is really important for the market,” Ulrich applauds. “Jonah Energy takes pride in differentiating itself as an operator from an environmental and sustainability standpoint. The company works with a number of environmental groups, and without any specific endorsement yet, it has received feedback that this is a very positive step for the natural gas industry.”

Adjusting To Demand

While gas demand is staying strong, structural changes in the nation’s supply system, including the drop in rig count, eventually will push production down, predicts Tom Ward, chairman and CEO of Mach Resources. He points to EIA projections of gas prices above $4.00/Mcf this winter as cause for optimism.

“I look at the market and see we aren’t having the demand destruction in natural gas that we see in crude oil or gasoline because people aren’t traveling,” he poses. “Industrial demand might be down somewhat but that still is buffeted by usage of natural gas around the world, and we are seeing production declining.”

Domestic gas production has been dropping since hitting a peak last October, Ward says, adding that the impacts are increasing as companies shut in production and drill fewer wells. “I don’t think there is any doubt prices will go higher in the near term, and then probably much higher out to 2021,” he predicts. “There have been projections we will lose 10 Bcf/d of supply by year-end 2021, dropping down to 82 Bcf/d.”

Many gas producers still will be standing at years’ end, but Ward predicts they will see significant changes in their makeup. Publicly held companies already are saying they are in a restructuring mode, with even a number of healthy firms seeing the need to sell assets to beef up their balance sheets. He says Mach Resources has made seven acquisitions in the past two years, including three deals in the Mississippian Lime and two in the western Anadarko Basin.

“Companies such as Mach Resources, which are seen as distressed buyers and that have a very large operating team and are focused on one particular area, will be the survivors that end up rolling up a lot of production,” he projects. “So, whenever we look at a project, we look at it only on the basis of proved, developed, producing reserves at some discount to PV-10. Instead of drilling for excess cash flow, we buy it. To me, it doesn’t matter if that is natural gas or oil. I like both.”

Mach Resources’ April 9 acquisition of the upstream assets of Alta Mesa Holdings and the midstream assets of Kingfisher Midstream moves the company into both Oklahoma’s STACK and Eastern STACK plays, Ward says. The deal includes 30,000 barrels of oil equivalent a day from more than 900 operated wells, and 350 million cubic feet a day of processing capacity connected to 450 miles of gas gathering pipelines. “There will be more acquisitions that we make in and around us, as other companies need to consolidate,” he notes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.