Gulf of Mexico Update

Moratorium, Permitting Delays On Gulf Projects Taking Toll On Independents

By Tim Beims

For the better part of the past decade, independent oil and gas companies were the driving force in Gulf of Mexico exploration, drilling and production activity, bringing new levels of economic efficiency, technical proficiency and safety to operations in all water depths. At independent companies top-level decision makers are much more involved in day-to-day operations because there are fewer layers of people within their organizations. Decisions are made more frequently at the point of question by seasoned veterans as a result.

Turn the clock back four or five years and independents were drilling 80 percent of deep- and ultradeepwater discoveries, and the countdown was on to milestone achievements such as first production at the 10-field Independence Hub project. There were hard times to be sure–commodity price crashes, the worst hurricane seasons in Gulf oil and gas development history, and a severe financial contraction–but independents persevered through it all to safely bring new energy supplies to U.S. consumers and generate untold billions in economic benefits.

Throughout the 2000s, majors and independents alike recorded dazzling “technical firsts” on project after project, and deepwater production and reserves ramped up year after year. Looking in from the outside, it must have appeared to the casual observer that drilling and producing reserves in thousands of feet of water had become, incredibly, almost a matter of routine. Then on the evening of April 20, everything went terribly wrong. The BP-operated Macondo well blew out, sending a jarring and tragic reminder of the monumental challenges inherent in deepwater development.

Ten months later, Macondo’s long shadow has left independents in the dark about how pending rule changes could impact their deepwater businesses, or whether there even will be any business left to affect. The drilling moratorium that followed and the regulatory sea change that is sweeping into the region in the wake of the disaster is unlike anything independents have had to navigate before, says T. Paul Bulmahn, chairman, chief executive officer and founder of ATP Oil & Gas Corp. in Houston.

Referencing permitting delays and potential liability requirements intended to safeguard against future spills, Bulmahn cautions that smaller companies could effectively be squeezed out of deep water altogether. “Given the stellar record of independents, it would be a shame if the end result of the Macondo tragedy was to punish independents,” he remarks. “I hope government leaders are wise enough not to practice overkill by mandating onerous regulations. They would be prudent and level headed to make sure there is a place for independents.”

With the one-year anniversary of the disaster approaching, the silence in the deepwater Gulf has grown deafening for independents. Bulmahn says, “We are an independent company with expertise in deep water and a long history of safety, environmental responsibility and innovative technology utilization. But four months after the deepwater moratorium was lifted, we still are waiting on drilling permits, as is the rest of the industry. We simply cannot wait forever.”

Letter To The President

Motivated by equal parts frustration and the reality that nothing was moving, Bulmahn says he penned a letter to President Barack Obama on Dec. 20 (copied to Secretary of the Interior Ken Salazar and Michael Bromwich, director of the newly formed Bureau of Ocean Energy Management, Regulation and Enforcement) in which he urged approval of a permit basically to continue to drill a sidetrack in 4,000 feet of water at ATP’s Telemark Hub development in the Mississippi Canyon area.

“The moratorium that shut ATP Oil & Gas Corporation down–although ATP always has drilled safely and environmentally soundly–was lifted Oct. 12,” Bulmahn wrote. “As Christmas approaches, the industry still is awaiting the first deepwater drilling permit to be approved. Because the moratorium was lifted, we had hoped that we would be able to resume work. ATP continues to keep a large team of skilled drillers standing by idle. ATP will be forced to lay off these talented people during the Christmas season without a permit from you.”

Noting that the well already was drilled and cased to 12,000 feet and that the target reservoir had known temperature and pressure properties from penetrations by five other wells, Bulmahn stated: “ATP’s permit application was filed in July 2009. It has been supplemented, revised and amended with every additional addendum required, requested or suggested by your regulatory agency, BOEMRE, including resubmission of a revised oil spill response plan with new compliance calculation methods for worst case discharge.”

The letter concluded with a final plea for action: “Please, Mr. President, give ATP a permit to return to work rather than forcing more American jobs to be lost. Approving this one permit of the six ATP is pursuing will help support your cause of keeping jobs and stimulating the economy.”

The reply to Bulmahn’s appeal?

“Not a word, neither publicly nor privately from the president, Secretary Salazar or Director Bromwich of the BOEMRE,” says Bulmahn.

The deepwater drilling moratorium was lifted only three days after ATP wrapped up completion operations, which were allowed under the moratorium, on its No. 3 Mirage well in 4,000 feet of water. “We were eager to move to the next well because we think it’s equal to the Mirage No. 3 completed on Oct. 9, and would have grown our production and reserves in a very meaningful way,” he explains. “So ATP elected to keep the Nabors rig on standby status so we could immediately begin drilling the next Telemark Hub well as soon as the permit was approved.”

It still is waiting on the approval to come through. After keeping the rig stationed on the Mississippi Canyon location for more than two months at an overall standby spread cost of $330,000 a day, and no permit in sight or response to his letter forthcoming, Bulmahn reports that ATP was forced to address the circumstance.

Agonizing Decision

The next decision was even more agonizing, Bulmahn relates. “I waited until after Christmas, when I was forced to terminate a number of talented drilling personnel on the 200-person team,” he says. “It was extremely difficult, but there was no other option left.”

The quality and proficiency of ATP’s staff has been a source of personal pride as the company has expanded over the years, according to Bulmahn. “Once you have put together a talented team, you do whatever you can to keep it together. It takes tremendous skill, communication, collaboration and effort among team members to keep operations running smoothly,” he insists. “The last thing I wanted to do was dismantle a good team.”

That is especially true given the technical demands in offshore oil and gas, and the value experienced and well trained personnel bring to daily operations. “We believe ATP has the highest safety and performance standards in the Gulf,” Bulmahn offers. “We assembled an experienced team capable of functioning at the highest level, but they were not even given an opportunity to work.”

Last spring, ATP had 10 drilling and pipe-lay permits outstanding, had just installed the $650 million ATP Titan (the Gulf’s first minimum deepwater operating concept, or MinDOC), and was on track to double its Gulf production by year’s end. Then the unthinkable happened at the Macondo site, and Bulmahn says ATP has been on hold ever since.

“When the world financial markets collapsed in late 2008, ATP had committed to two $1 billion projects: The Telemark Hub with the ATP Titan and the Cheviot Field in the North Sea with the newly built Octabuoy dry tree semisubmersible. It was very difficult to weather the financial turmoil and keep our projects on schedule, but we did it; we reached the point where we were ready to drill and bring production on at Telemark Hub,” Bulmahn recalls. “Then the moratorium was put in place. That was understandable and we complied with it. But we now face a permitting situation that makes it impossible to effectively utilize our $650 million infrastructure investment. That is not understandable.”

In a January news release, ATP was among 13 companies that the BOEMRE said might be able to resume previously approved activities without needing to submit revised National Environmental Policy Act reviews. “We do not know exactly what to make of that,” Bulmahn confesses. “We feel like we have complied with everything asked of us, but every time we submit requested supplements or amendments to a permit, we almost immediately get another request for additional supplements or amendments. Nowhere is there any kind of written list of what is required to secure a permit; there is only a never-ending string of requests for more supplements and amendments.”

The arbitrary nature of first the moratorium and now permitting delays is particularly frustrating–and costly–for small independents, according to Bulmahn. “The administration is painting the entire industry with the same brush, but I do not believe bad management practices and flawed executive decision making is systemic,” he says. “Smaller independents must take steps all the time to make sure we make sound decisions, because we cannot afford mistakes and unnecessary risk. Our driller knows that if a red flag pops up on his watch, he immediately shuts in the well without hesitation. He does not have to call me or anyone else before taking action.”

Even the design of ATP’s production platform at Telemark Hub is representative of a safety-first mentality. For example, Bulmahn notes, the ATP Titan has built-in safety redundancies and seafloor flow containment using a surface blowout preventer stack on the deck and a subsea shut-in isolation device at the mud line with controls independent of the surface BOP. “We believe it is the most advanced safety-engineered drilling system in the world, and we built it for our relatively low-risk developmental drilling in reservoirs with known properties,” he remarks.

The Gulf of Mexico accounts for 26 percent of total U.S. crude oil production and 11 percent of domestic natural gas production. When the moratorium on deepwater drilling was in effect last year, the number of approved shallow-water drilling permits also slowed dramatically. Although the number of shallow-water permit approvals has increased since the deepwater moratorium was officially lifted on Oct. 12, permitting delays continue to prevent operators from drilling in deep water.

SOURCES: BOEMRE and EIA

Economic Impacts

Like many other independents, ATP has grown in size and scope in the Gulf over the past decade, starting with one-off Shelf prospects that were too small for majors to develop and gradually transitioning to multiwell deepwater developments such as Telemark Hub. Since the company undertook its first deepwater project in 2000, its portfolio gradually shifted to the point where 90 percent of its 2009 and 2010 Gulf activity was in deep water.

ATP’s economic fingerprint has increased as it has moved into deeper water, Bulmahn points out. “For example, ATP Titan was constructed entirely in the United States,” he says. “It is the first and only deepwater platform built 100 percent by U.S. labor, and the total economic impact of that $650 million investment in the domestic labor force has been substantial.”

There are many measures by which to evaluate the financial contribution of the Gulf’s independent sector, but Bulmahn says one of the most telling relates to the economic significance of only one of its deepwater projects. “When we have a project going, we send checks to vendors and service providers in 44 of the 50 states,” he comments. “That has an impact on the national economy, not just the Gulf of Mexico. That is what has been lost.”

And the damage already done could be miniscule compared with future financial losses. An independent study conducted last year by IHS Global Insight and commissioned by Cobalt International Energy Inc. found that independents accounted for some 200,000 jobs related to Gulf oil and gas development in 2009; $70 billion in economic value; and $20 billion in federal, state and local revenues. The study forecasts that by 2020, excluding independents from the Gulf will eliminate 300,000 jobs and result in a loss of $147 billion in federal, state and local taxes over 10 years. If independents are excluded from deep water only, the study reports that the losses will be 265,000 jobs by 2020 and $106 billion in tax revenues over the next decade.

Last spring, ATP Oil & Gas had 10 drilling and pipe-lay permits outstanding, and had installed the $650 million ATP Titan platform with state-of-the-art redundant safety systems at its $1 billion Telemark Hub development. With its planned drilling program, ATP was on track to double its Gulf production by year’s end. But after the four-month moratorium and months of delays in obtaining permits to drill low-risk developmental wells, ATP has been forced to terminate a number of talented drilling personnel, reassess its long-term investment plans in the Gulf, and seek business opportunities in international waters.

While noting the need for new systems and procedures in the wake of the Macondo incident, a study released in January by the Greater New Orleans Inc. Regional Economic Alliance warns, “Unless there are significant changes, the future may prove disastrous to businesses, livelihoods, and coastal communities.

“If the rate of issuing drilling permits remains unchanged, this study suggests that unemployment likely will increase dramatically as businesses continue to diminish their savings. This would be a huge blow to the state and coastal parishes,” the group concludes. “Additionally, rigs and entire drilling operations may move to other areas or even overseas, taking with them valuable jobs and tax revenue. Many small, family-owned businesses that support the oil and gas industry are vulnerable. Without increased business–in the form of drilling activity–these companies may not survive.”

Permitting Delays

Another study released in December by Wood Mackenzie for the American Petroleum Institute conducted full-cycle investment analyses of the economics of 25 probable deepwater field developments and found “substantial” potential impact from permitting delays. Under a one-year permitting delay, 13 of the 25 fields would become uneconomic, risking daily lost production of 540,000 barrels of oil equivalent by 2019. That number jumps to 17 under a two-year delay, equating to 680,000 boe/d in potential lost production by 2019.

Of the $105 billion in estimated investment spending on the 25 probable developments between 2011 and 2020, Wood Mackenzie found that $43 billion already could be at risk. A one-year development delay increases that amount to $59.6 billion, while a delay of two years increases it to $70.5 billion. Government revenues also would take a significant hit from lost royalties and corporate tax payments. Potential lost government revenues would total $13.7 billion and $17.1 billion, respectively, if project development timelines were delayed by one or two years.

“Much of the deepwater Gulf is marginal under one- and two-year field startup delays, without considering higher costs . . . the future of the Gulf is currently very uncertain,” the report reads. “Deeper, more challenging plays, which are more costly and provide much of the expected future growth, are disproportionately affected because of already marginal returns.”

The economic consequences of permitting delays already have exacted a toll at ATP. Exhibit A is the Mississippi Canyon 305 sidetrack, which, Bulmahn says, was halted by the moratorium. It was a low-risk developmental well in a dry gas reservoir previously penetrated by multiple wells. “We knew exactly what we were drilling into and there was zero chance of an oil spill, but we still have been unable to get a permit,” he details. “Even if a permit was granted tomorrow, the rig is long gone. In addition, the price of gas has declined since the well was originally scheduled to drill, and it would not be economically viable to drill today.”

The loss of already scarce deepwater-rated rigs to overseas markets is an ominous signal to smaller operators. “Most small independents tend to take excess rigs when the deepwater fleet is not being fully utilized. Those rigs are now gone,” Bulmahn asserts. “Rig costs increase as availability decreases, which means these expensive, long-lead time projects will become even more economically challenging in the future.”

Eventually, Gulf independents could follow those rigs into international waters, and Bulmahn says ATP Oil & Gas can be counted among that number. “I am working to diversify ATP’s portfolio. Our deepwater expertise is highly sought after in other parts of the world, and we are being courted by a handful of governments that want to develop their offshore reserves,” he reveals. “Whether we wind up developing projects offshore West Africa, Australia or in the Mediterranean, you can count on the inevitability of ATP moving at least some of its activity to other parts of the world.”

Still, Bulmahn adds that ATP has not given up on its long-term business plans in the Gulf. “Right now our stock is being treated as if we are a byproduct of the BP spill. I don’t think that is a fair way to treat ATP, and one permit is all it would take to overcome that perception,” he holds. “I believe there is always reason for hope, but I also think that it is important for the industry to make sure that the actions of government follow its language. Government must do what it says it’s going to do.”

In the end, Bulmahn contends that the U.S. energy consumer will pay the price, noting that the administration estimates that 10.5 million boe of Gulf production was lost each month during the moratorium. “Regardless of the original intent of the moratorium, the result is forcing economic hardship on the taxpayer and putting the nation’s long-term energy production capabilities and security at risk,” he concludes.

Ultradeep Shelf

Although the number of approved shallow-water permits declined sharply from June to October while the deepwater moratorium was in effect, one well that commenced drilling in early October was Lafitte, an ultradeep Shelf exploratory test with a planned total depth of 29,950 feet in 140 feet of water at Eugene Island 223. It is the latest in a series of ultradeep Shelf wildcats operated by New Orleans-based McMoRan Exploration Co. that target deepwater-like reserves, only without the deep water.

The shallow-water Shelf and deep water are distinct operating environments in terms of drilling, completion and production engineering, but James R. Moffett, McMoRan’s co-chairman of the board, says the geology is all the same–from onshore the Gulf Coast, through the Shelf, and into the farthest reaches of ultradeep water.

“The discovery of Thunder Horse in 1999 and then Cascade a couple years later in deep water redefined the whole game. We realized that the Miocene and Wilcox/Lower Tertiary sands that had been drilled for years onshore the Gulf Coast had made it all the way out into 4,000-10,000 feet of water,” Moffett explains. “To get into deep water that far from shore, those sands had to cross the Shelf during deposition.”

Finding them on the Shelf has led McMoRan to drill to uncharted depths below salt, and the initial results are challenging conventional views of the basin’s depositional history and shallow-water stratigraphy. McMoRan’s 2008 Blackbeard West well confirmed Miocene sands below 30,000 feet, and last year’s Davy Jones confirmed Wilcox sands below 27,000 feet. Lafitte is targeting the same age of structures, while the 34,000-foot Blackbeard East in 80 feet of water at South Timbalier 144 has encountered potentially productive sands in both the Miocene as well as the Oligocene (Frio), according to Moffett.

“These wells show that the sands being drilled in the deep water have identical Miocene and Wilcox stratigraphic equivalents in the ultradeep Shelf, and possibly the Tuscaloosa below the Miocene and Wilcox as well,” he reports. “And we just added a new objective by finding a Frio sand at Blackbeard East–the first hydrocarbon-bearing Frio sand encountered either on the Shelf or in deep water offshore Louisiana.

“This possibly could open another east-to-west corridor parallel to the Flex trend and deep Miocene and Wilcox trends in deep water, and of course, parallel to the Frio and Miocene plays onshore,” Moffett goes on. “They all follow the Texas and Louisiana coastline in terms of stratigraphy and structure.”

If the reserves potential of McMoRan’s ultradeep discoveries are confirmed, it would open an entirely new geologic realm in shallow water. “Only a handful of wells have been drilled below 20,000 feet on the Shelf and even fewer below 25,000 feet. The ‘subsalt play’ on the Shelf between 19,000 and 34,000 feet is in its infancy,” Moffett holds. “If the discoveries are confirmed and the play breaks open the way we think, it will be like starting all over again on the Shelf.”

One Obvious Distinction

If drilling results continue to prove McMoRan’s geologic model correct, Moffett suggests that that the difference between the ultradeep Shelf and the deep- and ultradeep water plays will boil down to one obvious distinction: water depth. “You are talking about tens of feet of water instead of thousands of feet,” he says. “Although the bottom-hole pressures and temperatures in deep water are not as high as they are in the ultradeep Shelf, the water depths are much greater and the salt is thicker, so you have to drill 10,000-14,000 feet of salt before you ever hit subsalt sediment.”

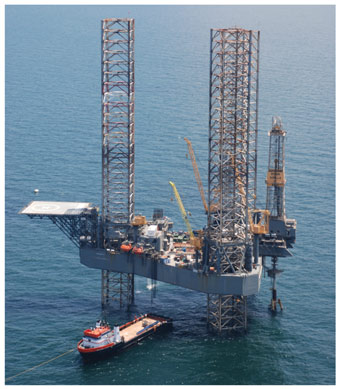

The shallow water means ultradeep Shelf wells can be drilled with jackups and completed with dry trees instead of floating semisubmersibles and subsea wellheads. “Floating drilling and completion technology has been redefining itself almost every day in deep water. Then, of course, with the Macondo well, floating technology has come under scrutiny, and it has yet to be seen exactly how things will go forward from here,” Moffett says.

Consequently, whatever new drilling regulations ultimately are put in place, Moffett says they should have minimal impact on ultradeep Shelf operations. “Shallow-water drilling using jackups is completely different from floaters in deep water. Jackups put the blowout preventer on the rig floor and wells are completed with dry trees on the platform instead of subsea,” he points out. “We have enough experience at McMoRan to show that we can drill these wells without incident, even with the high bottom-hole pressures and temperatures.”

Early results from McMoRan’s ultradeep Shelf exploration program support its structural and depositional models, which show identical geology from onshore the Gulf Coast, across the Shelf and into deep water. McMoRan’s ultradeep wells–drilled to depths of 27,000 to 34,000 feet–have logged the same Miocene and Wilcox/Lower Tertiary sands discovered both onshore and in deep water. It also has encountered the first hydrocarbon-bearing Oligocene/Frio sand found offshore Louisiana.

Looking to the future, Moffett says the changes coming to deepwater regulations could very well limit independents’ ability to participate in that environment. “Increased operating costs and especially soft costs–the biggest unknown in terms of independents’ future role in deep water–could mean that independents become few and far between in deep water,” he comments. “They will have to be part of an emergency relief effort, such as the $2 billion project the majors have started to make sure the equipment will be ready to move quickly to cap any leaking subsea tree or well that is out of control.”

Insurance is also a problem. “Until the regulations get sorted out, no one knows what it will take to insure independents working in deep water with floating rigs and subsea trees, but it will be expensive and independents are not large enough to self-insure,” Moffett continues.

While the ultradeep Shelf offers an alternative, Moffett is quick to note that it has its own set of unique challenges. “For 20 years, independents made a living on the Shelf using 3-D seismic bright spot detection to sharp shoot reserves. There was no need to rely on structural geology; if it didn’t glow, it didn’t go,” he remarks. “But bright spot detection does not work for ultradeep objectives because pressure changes and rock parameters make a lot of things light up on seismic. To be in the ultradeep Shelf play, independents have to be prepared to drill structures below the salt weld, which means they have to understand deep structural geology and deposition.”

As with water depth, the cost structure also increases exponentially with subsurface depth. “Below the salt weld on the Shelf, drilling prospects start at 19,000-20,000 feet and go down to 34,000 feet. There are very high pressures and temperatures. The depths require multiple casing strings, and the HP/HT bottom-hole conditions require special completions equipment,” Moffett says.

“In my opinion, majors will come back to the Shelf as we get more data and discoveries are confirmed because they hold a lot of Shelf acreage, some of which will be farmed in by independents such as McMoRan,” he goes on. “Several independents will also take a crack at ultradeep Shelf prospects, but they have to be prepared to spend $125 million-$150 million to test each ultradeep prospect.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.