Processing Technology Provides Right-fit Economics For Apache’s Alpine High Field Development

By Jim Virginillo, Talal El Awar and David Beck

HOUSTON–The Alpine High play in the southern part of the Delaware Basin is one of the most prolific developments in the rich history of oil and gas in West Texas. Apache Corporation plans to ultimately drill some 5,000 wells at its Alpine High asset, targeting reserves initially estimated at 75 trillion cubic feet of natural gas and 3 billion barrels of oil across its 336,000-net acre lease position.

Producing the wet gas, dry gas and oil at Alpine High requires a multibillion-dollar investment for Apache, including significant gas processing and infrastructure development. Maximizing the return on investment is paramount to capitalizing on Alpine High’s tremendous economic value.

One of the key design issues for any gas processing facility is achieving the operational flexibility to adjust to changing market conditions for improved profitability during periods of diminished or unstable commodity pricing for natural gas liquids products, particularly in regard to ethane recovery versus rejection. Uncertainty in the ethane market is driving midstream companies to evaluate what new processes can be implemented to hedge their investments and guarantee the highest propane recoveries with equal or lower capital and operating costs.

Ethane’s local net back value is obviously the key variable in ethane rejection or recovery determinations. Recent years’ low ethane prices have made it largely uneconomic to recover ethane as a liquid product, forcing processors to operate facilities in ethane rejection mode to maintain profitability. Ethane prices have fluctuated more than 30 percent in either direction during the past 10 years, and with analysts predicting stronger ethane prices in the future, future projections show no indication of diminished volatility.

Gas processors’ ability to manage changing market conditions has been restricted by the limited operational flexibility of their facilities, which for decades predominately have been based on tried-and-true gas subcooled process (GSP™) technology. Although GSP is the worldwide standard in gas processing (particularly for modular plant designs), its fundamental thermodynamic limitations during ethane rejection cause it to lose significant volumes of valuable propane.

GSP facilities are economically limited on the amount of ethane and/or propane they are able to recover in full ethane recovery (>90 percent) and full ethane rejection (<1 percent), resulting in lower revenues not only for gas processors but for producers and resource owners as well. Consequently, producers, midstream facility operators and resource owners alike are recognizing how GSP limitations can reduce long-term profitability, and so they are emphasizing the need for more efficient newer-generation NGL recovery technologies that have the flexibility to adapt quickly to ethane price fluctuations while still recovering all the propane liquid product as NGL sales contracts fluctuate with commodity price shifts.

Although “open art” technologies have been developed to address more efficient operation with better NGL recoveries in one mode of operation or the other, they do not address the issue of full plant flexibility to completely recover or completely reject ethane based on market demand without losing propane recovery. Gas plants operate with tight margins, and any advantage to increase propane recovery without increasing ethane recovery when operating in ethane rejection mode using less compression would be economically advantageous.

Innovative Approach

Apache has long been at the forefront of promoting new methods and technologies in oil and gas drilling, completion and production. Its innovative approach to upstream operations led to a directive to investigate new and improved technologies in the midstream space as well. In planning the development of Alpine High, Apache explored alternative NGL recovery technologies with the goal of optimizing ethane recovery/rejection flexibility while ensuring ultrahigh propane recoveries to enhance profitability by maximizing the value of both natural gas and NGL sales.

Alpine High is an extremely large wet gas play with more than 3,500 highly economic locations and a large dry gas play with more than 1,000 highly economic locations, along with more than 500 oil locations. With well costs averaging $4 million-$6 million, Apache expects typical wet gas wells to have net present values of $5 million to $8 million and high-end wells to have NPVs up to $19 million. Apache is constructing central processing facilities connected to a 70-mile, 30-inch trunk line to flow up to 2.25 Bcf/d of processed gas from Alpine High wells. Three processing plants are operational now, and two more are expected on line by the end of the year.

For Apache, Alpine High is an extremely large wet gas play with more than 3,500 highly economic locations, a large dry gas play with more than 1,000 highly economic locations, and an oil play that offers more than 500 highly economic locations. With well costs of $4 million-$6 million, the typical wet gas well is expected to attain net present values ranging from $5 million to $8 million, and up to $19 million for a high-end well (with estimated ultimate recoveries of 9 billion-21 billion cubic feet equivalent). The economics of the play are driven by the low cost and the tremendous volumes of oil and NGLs. Each dry gas well is forecast to generate an NPV of $3 million-$7 million (EURs of 17 Bcfe-23 Bcfe). These will cost $5 million-$6 million.

Alpine High is a good candidate for analyzing how new technologies can be applied to a wet/rich gas field while providing economic advantages over standard NGL recovery technologies. The specific goal for processing natural gas in the Alpine High play was to implement a solution that could maximize:

- Ethane recovery flexibility without sacrificing propane and heavier (C3+) recoveries;

- The return on capital in conjunction with minimizing operating expenses; and

- Alpine High’s revenue potential for all stakeholders.

To achieve Apache’s processing and profitability goals for both the short and long terms, a study of processing technologies was performed to provide a technical and commercial evaluation of market drivers and processing solutions. The analysis included both standard and relatively new technologies–from mechanical refrigeration and cryogenic gas plants to the selection of a new technology: Ortloff’s supplemental rectification with reflux (SRX™) process.

The study’s results demonstrate how the effects of variable ethane commodity pricing can be mitigated with a technological solution that delivers operational flexibility to address continual market changes without sacrificing profits.

High-Btu Content Gas

Apache has identified 4,000- to 5,000-foot wet/rich gas and oil columns spanning five unique hydrocarbon-bearing formations at Alpine High. Initial test wells in the play show an array of wet/rich gas analysis ranging from 1,350 to 1,478 Btu gas, depending on the unit and well depth. The large volumes of high-Btu content gas are what prompted Apache to search for a processing solution capable of providing maximum flexibility during the life cycle of the play without diminishing NGL recoveries.

Alpine High’s processing facilities incorporate Ortloff’s supplemental rectification with reflux (SRX™) technology to efficiently recover C3+ in full ethane rejection operation. SRX is considered a very flexible processing technology capable of recovering almost all of the ethane in ethane recovery mode or operating in full ethane rejection without losing propane recovery.

Apache recognized that any recovery enhancements would translate into significant revenues because of the large volume of gas that will be processed at Alpine High facilities. Moreover, the flexibility to react to future ethane market fluctuations also was a key factor in the evaluation. The processing plant analysis methodology included reviewing five readily available technologies and comparing the NGL recoveries for each in both ethane recovery and ethane rejection modes, followed by a respective economic analysis.

In addition to GSP, the study evaluated:

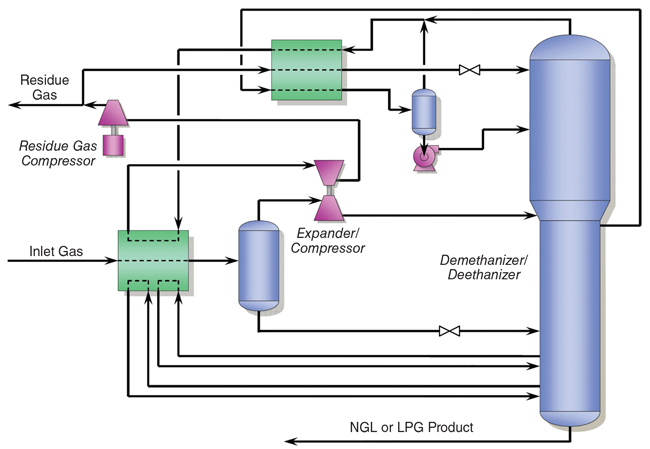

- Recycle split vapor (RSV™) technology, which was developed to exceed GSP ethane recoveries by an additional reflux stream from the residue gas line that is used to supplement the usual reflux stream in a GSP plant. The liquefied residue stream is fed into an additional section installed above the typical reflux feed in a GSP. The design provides high ethane recoveries with no propane recovery losses, but typically increases compression horsepower requirements.

- Single column overhead recycle (SCORE™), which was developed as an ethane rejection (C3+ recovery) technology only. Incorporating column reflux techniques that differ from both GSP and RSV, the technology allows gas plants to recover C3+ more efficiently than either of those approaches. SCORE typically is limited to less than 40 percent ethane recovery, and therefore implemented in plants that operate in ethane rejection only.

- Supplemental rectification with compression (SRC™), which is an enhancement over both SCORE and GSP. The technology includes a small reflux compressor to assist with condensing and subcooling a side draw vapor stream that is then used as reflux in the distillation column. SRC is considered a flexible gas processing technology capable of recovering almost all ethane in ethane recovery mode or operating in full ethane rejection without hurting propane recovery.

- SRX, which is an enhancement over RSV that also incorporates SCORE gas processing techniques to efficiently recover C3+ in full ethane rejection operation. SRX is considered a very flexible processing technology capable of recovering almost all of the ethane in ethane recovery mode or operating in full ethane rejection without losing propane recovery.

Comparing Options

A base line plant with a nameplate capacity of 200 million cubic feet a day was used to compare each option. The design basis set by Apache required a minimum of 95 percent recovery in ethane recovery mode and a minimum of 95 percent propane recovery in full ethane rejection (< 1 percent recovery) while utilizing three Caterpillar 3616™/Ariel reciprocating compressor packages to compress the residue gas stream to a maximum sales pipeline pressure of 1,340 psig. All options considered as part of this analysis remained within the compression limitations set by Apache.

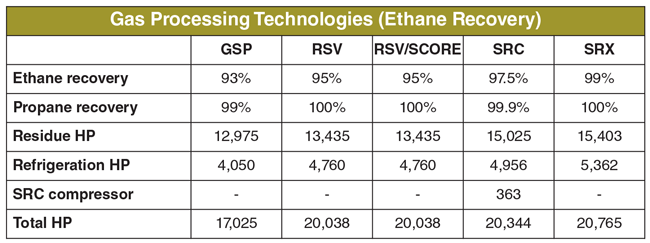

Tables 1 and 2 compare ethane and propane recoveries for each technology, as well as the horsepower requirements for each process. The results in Table 1 show that RSV, RSV/SCORE, SRC and SRX all are able to achieve higher ethane recoveries than GSP, satisfying Apache’s targeted 95 percent ethane recovery requirement. All options also satisfied the compression horsepower requirements. Even though GSP, RSV and RSV/SCORE utilize less compression than SRC or SRX, the fuel savings are considered insignificant when evaluating the technology options according to overall plant operating costs.

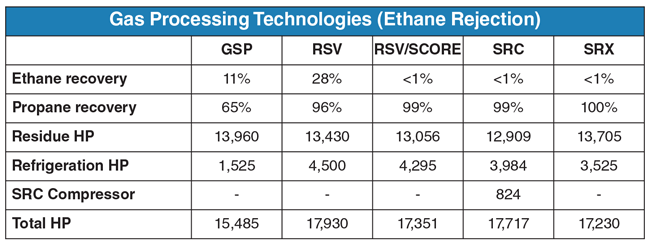

The results in Table 2 show that RSV/SCORE, SRC and SRX are the only technologies that are able to maintain the ultrahigh propane recoveries while operating in maximum ethane rejection mode. The GSP and RSV technologies are limited in propane recovery at essentially the same compression level as RSV/SCORE, SRC or SRX. Had the GSP and RSV cases been designed for maximum ethane rejection, propane recovery would have decreased even further, highlighting the lack of operational flexibility.

Economic Analysis

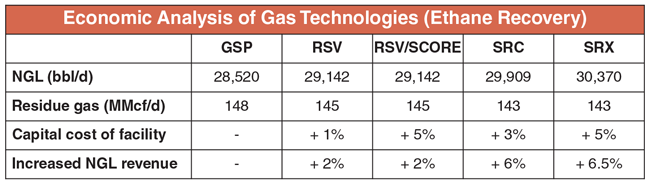

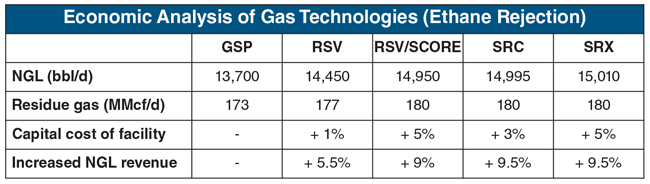

Tables 3 and 4 present the expected NGL production, residue gas production and capital costs for the 200 MMcf/d base line processing facility when operating in both ethane recovery and ethane rejection modes.

The primary selection criterion was based on whether the technology was capable of achieving the desired liquid product recoveries in each mode of operation within the specified compression limitations. The plant economics then were evaluated with each technology to determine if any could justify incremental capital cost thanks to increased NGL production.

Results show the incremental NGL production increase for each technology compared with a GSP. The GSP and RSV designs in this study, while providing the lowest capital investment, were not considered viable because of their inability to maintain the desired propane recoveries in ethane rejection mode. The RSV/SCORE provides recoveries similar to an SRC or SRX design, but lacks those technologies’ operating flexibility. Unlike SRC or SRX, which offer on line switching, the RSV/SCORE requires shutting in the inlet gas to switch between recovery and rejection modes.

In addition to operational flexibility, both SRC and SRX allow the operator to adjust ethane recovery to match demand and operate across the entire ethane recovery range without losing propane recovery.

Evaluating SRC and SRX required assessing the reliability of the designs, considering the additional equipment required. An SRC design requires a cold compressor to compress the side vapor draw, while SRX collects the side vapor draw in a reflux drum after it is partially condensed before it is pumped back to the column. Pumps generally tend to have a much wider operating range than compressors, giving SRX more flexibility to adjust the reflux rate over a wider operating range than SRC. It also is less expensive to spare a pump than a compressor.

The incremental increase in production provided by an SRX design was evaluated against the additional capital investment requirements. The analysis shows that the incremental ethane recovered during ethane recovery and/or the incremental propane recovered during rejection mode provides an incremental capital payout in less than one year. Furthermore, the “dialing of ethane” capability offered by SRX technology provides Apache the marketing flexibility to quickly and efficiently respond to commodity price fluctuations.

The combination of SRX’s ultrahigh propane recovery, the flexibility to adjust ethane recovery across the entire design range, an attractive return on capital investment, and a reliable design solidified Apache’s decision to utilize this technology as the preferred method to process its Alpine High wet/rich gas. The implementation of SRX will help to shield Apache from ethane price volatility and serve as one of the field’s key strategic contributors as Apache works to develop Alpine High into a highly profitable field.

Editor’s Note: The preceding article was adapted from a technical paper presented at the 2018 GPA Midstream Convention, held April 15-18 in Austin, Tx.

Jim Virginillo is process engineering manager at Apache Corporation, where he manages a team of facility and project engineers responsible for the compression and processing facilities in the Delaware Basin/Alpine High area. Before joining the company as a project manager in 2014, he served in gas processing and facilities engineering roles at Enerflex Ltd. and Imperial Oil Ltd., and worked as an engineering consultant. Virginillo holds a B.S. in chemical engineering from the University of Alberta.

Talal El Awar is director of operations at Audubon Companies, which is providing engineering, procurement support and construction management for processing and compression facilities at Alpine High. El Awar joined Audubon in 2011 and has managed the installation of gas processing facilities, compression and hydrocarbon storage projects. He supports Apache Corporation in the systematic midstream infrastructure development at Alpine High. El Awar holds a B.S. and an M.S. in electrical engineering from Texas A&M University.

David Beck is a managing partner at Audubon Companies, where he leads the company’s midstream initiatives. With more than 20 years of executive management and business development experience in the oil and gas industry, his expertise is in international and domestic operations, midstream gas processing, midstream services, and NGL recovery. Beck holds dual B.S. degrees in chemical engineering and biochemistry from Texas Tech University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.