Shale Plays Present Global Opportunity

By Gregory DL Morris, Special Correspondent

A small independent exploration company with a gargantuan acreage position in central Australia is making final preparations to spud its third test well in an unconventional formation that looks very similar to the Bakken and Eagle Ford shale plays half a world away. Elsewhere around the globe, from Argentina to Quebec and Poland, North American independents are testing other shale gas and tight oil formations. Some are in the early stages of development, with limited production possible by the end of this year or early next year.

Several analysts see the oil-rich Neuquén Basin in Argentina as the most likely to be the first of the international shale plays to deliver commercial output. Not only does the basin have highly prospective shale reservoirs, namely the Vaca Muerta and Los Molles formations, but it also has a long history of conventional oil and gas production, an established service sector, and ready market access–attributes that can be notably lacking in some global regions prospective for shale and tight oil plays. While the infrastructure may not be adequate for extensive shale development, it does provide a solid foundation, the experts note.

Another reason handicappers put Argentina in the near-term commercial category is the presence of large U.S. independents and a few majors, including Apache Corp., EOG Resources and ExxonMobil. These larger organizations have both the unconventional expertise from North American operations and the corporate size and financial wherewithal to support aggressive exploration and production programs in the Neuquén Basin’s oil shale and tight gas sand reservoirs, namely the Vaca Muerta and Los Molles formations.

In 2011, Apache reports that it completed the first horizontal multistage hydraulically fractured shale gas well in South America, and the company says it will continue to evaluate using horizontal drilling techniques on tight and unconventional resources in the pre-Cuyo, Los Molles and Vaca Muerta formations of the Neuquén Basin, including testing the oil potential of its shale acreage. The company has earmarked $250 million in capital expenditures in Argentina in 2012.

EOG Resources reports that it has initiated a drilling program, as has ExxonMobil, which spudded its first two wells in December, according to company releases.

Last fall, Mark Papa, chief executive officer of EOG Resources, reported that preliminary testing on the company’s 100,000 acres in the Vaca Muerta oil shale play had been “very promising,” and revealed, “We think it could be bigger than the Eagle Ford.”

The home team in the play is Repsol YPF, which says it began exploring the oil-prone portion of the Vaca Muerta Shale in 2009 and has invested more than $300 million to drill 28 wells across its acreage through January. Almost all of these wells are vertical, and have been reported with initial oil production rates of 200-600 barrels a day. The company reports that the few horizontal wells it has drilled to date are still being evaluated.

Ever since the Bakken formation in the Williston Basin was heralded as the largest oil development in the world in the past 40 years, the bar has been set high for any new unconventional plays. True to form, Repsol YPF has released Ryder Scott estimates for the Vaca Muerta Shale that indicate a potential resource in place of at least 21 billion barrels of oil equivalent, with at least 150 million boe recoverable. The Vaca Muerta is estimated to be present over 7.5 million acres in the Neuquén province.

Arthur Creek ‘Hot Shale’

Not far behind development in Argentina is Australia. PetroFrontier, a Calgary-based company, holds 14.1 million gross acres in the Georgina Basin in the east-central part of the Northern Territory. “We hold an 87 percent working interest in the acreage, which is a huge impact for a small company like ours,” says Paul Bennett, president and chief executive officer.

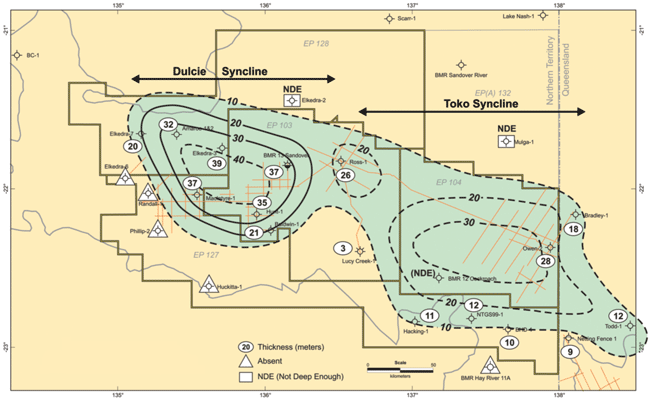

He explains that the target formation is the Lower Arthur Creek “Hot Shale” (Figure 1), which is a middle Cambrian source rock. It is analogous to the Bakken in most places, Bennett says, but more like the Eagle Ford with carbonates and high organic content in others. A November 2010 Ryder Scott evaluation estimates the shale contains 26 billion barrels of oil in place in the shale, plus another 1 billion barrels in conventional carbonates (P50 recoverable).

Given the vast expanses of the Australian bush, there are not any other developments nearby (for comparison’s sake, if laid over Texas, the Georgina Basin would stretch from Brownsville to the top of the panhandle) but Hess and Shell both report having farmed into shale plays elsewhere in Australia. Another independent, Australian-Canadian Oil Royalties, based in Cisco, Tx., is active in the Georgina Basin, where it reports drilling an oily shale formation it labels a “Bakken look-alike.”

PetroFrontier has three developmental wells under way, according to Bennett. “First, we drilled the Baldwin-2Hst1 well in the central part of our acreage to total measured depth of 1,948 meters while remaining in the target zone for 900 meters horizontally, installed the Packers Plus liner, and then temporarily suspended it,” he details. “Then we drilled the Macintyre-2 well 37 miles to the west and got as far as the high-angle pilot hole before we had to move the crew off because of the onset of the Northern Territory wet season.”

When the rains abate in April or May, Bennett says PetroFrontier plans to return to complete the horizontal leg at the Macintyre-2 well, and also drill the Owen well 125 miles to the east on the edge of its acreage. “Our leases cover a huge area, about 250 by 190 miles,” he says. “Once all three wells are completed, we are going to bring in a Schlumberger frac crew for at least the first two, if not all three wells, if the money holds out. Once we establish producibility, we could have a real winner here.”

PetroFrontier has three developmental wells under way. The Baldwin No. 2Hst1 well location, shown here, is in the central part of the company’s expansive acreage position in the Georgina Basin in the Northern Territory. The horizontal well was drilled with a 2,950-foot horizontal lateral.

PetroFrontier is also working with Macquarie, a major Australian investment bank through its office in Calgary, to secure a joint venture partner for the project. Bennett says the company hopes to be able to announce an investment by the time drilling resumes, if not before. “With such a large acreage position and high working interest, we are hopeful that we can attract the right kind of joint venture partner,” he notes.

PetroFrontier could have marketable oil from extended tests, but Bennett says such testing could continue for a year or two. “Even a major would have to stop and think about how and where to develop this play. We have the entire basin! This is potentially a mega-project. We need people, and 3-D seismic, and a realistic development plan.”

Once the resource does start to emerge, getting to market is going to present challenges, but nothing that is not manageable, according to Bennett. There is a railhead at Alice Springs, 124 miles to the west, which runs to the territorial capital of Darwin on the north coast and south to Adelaide. “At first, oil will be moved by truck and loaded at Alice. There is a gas pipeline running from Alice to Darwin, where it supplies a liquefied natural gas plant. When the line was built, provisions were made for a parallel oil pipe,” he observes.

Utica Shale

In April 2008, Forrest Oil drilled a well in the St. Lawrence Lowlands in the Province of Quebec. The formation Forest tested is today known as the Utica Shale, and it has become one of the hottest plays in the business. Forrest Oil took its Canadian operations public last year as Lone Pine Resources, and it remains active in the play. But the largest position is held by Junex, based in the provincial capital of Quebec City. Junex holds a total of 5 million acres in the province, of which 1 million gross and 800,000 net acres are prospective for the Utica Shale.

There is no current Utica production in Quebec, but a Netherland, Sewell analysis commissioned by Junex estimated probable (P50) gas in place at 49 trillion cubic feet, of which 10 percent is considered recoverable, for a net unrisked target of 3.5 Tcf. Peter Dorrins, president and chief operating officer of Junex, reports that the company is moving as quickly as it can to delineate and develop its holding, but is facing temporary restrictions on hydraulic fracturing in the province.

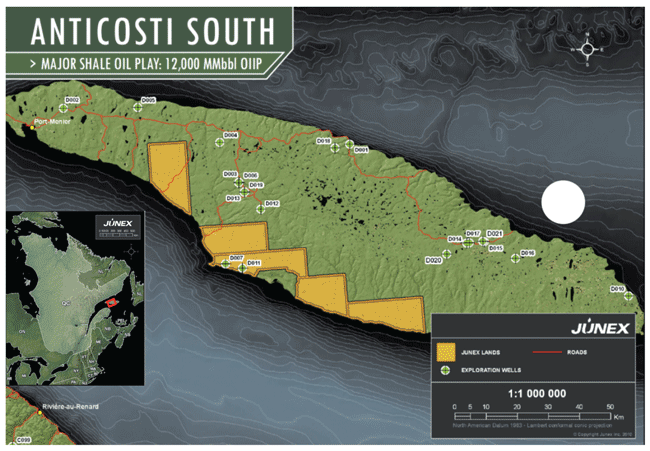

Junex holds 233,275 gross acres in the Macasty Shale play on Anticosti Island in the Gulf of St. Lawrence off the Gaspe Peninsula in Quebec. The Ordovician Macasty Shale is a corollary to the Utica Shale, and is estimated to contain 12.2 billion barrels of oil in place across Junex’s lease position.

The company also is evaluating an oil lime carbonate resource play at the Galt Dome in the Gaspe Peninsula in Quebec, where it holds 53,461 acres in 83.5 sections. “The Lower Devonian Limestone in the Forillon and Indian Point formations is oil saturated, with sweet spots composed of silty dolomite,” Dorrins states. “An independent evaluation of the original oil in place is 14.3 million barrels per section. Horizontal drilling with multistage hydraulic fracturing will be used to further appraise the hydrocarbon potential of the Galt Field.”

As a source of revenue, Dorrins reports that Junex entered an agreement in January with an unnamed private, Texas-based oil and gas company to take a nonoperator position in the Permian Basin. The multiwell program targets lower-risk, multizone oil and gas reservoirs in Schleicher County. Junex will earn a 25 percent working interest in approximately 2,300 acres through paying a 25 percent share of the acquisition costs of the acreage and participating in drilling two initial wells at a level of 33 percent of the drilling costs to the casing points. Any subsequent completion expenditures in the first two wells or drilling and completion expenditures in new wells will be at a 25 percent interest net to Junex.

Anticosti Island Oil Play

Beyond the St. Lawrence lowlands in Quebec, the Utica also is accessible on Anticosti Island, a stretch of land in the Gulf of St. Lawrence off the Gaspe Peninsula. There it is called the Macasty Shale, and is an oil play.

Junex holds 233,275 gross acres in the Macasty Shale play on Anticosti Island. “Netherland, Sewell estimated in 2011 that our acreage on the island held 12.2 billion barrels of oil in place,” says Dorrins “Together with our neighbors’ 30-plus billion barrels, we are closing in on 50 billion barrels in place on Anticosti.”

Another independent developing in eastern Quebec and Anticosti Island is Petrolia, also based in Quebec City. The company claims the first oil discovery in the province in 2006. It has several conventional plays on the mainland, as well as its shale acreage on the island, according to Alexandre Gagnon, vice president of finance. Petrolia is in a partnership with Halifax-based Corridor Resources in its Anticosti Macasty Shale development project.

“Two years ago, we drilled three wells on the island and a core taken in the Macasty Formation proved oil in place,” says Gagnon. He adds that the company commissioned a study from Sproule Associates of Calgary, which estimated 31 billion barrels of oil in place.

“Even with only 5 percent extraction, this could be a very big project,” Gagnon relates. “It is the same formation as the Utica in Ohio; it just goes by a different name. The porosity and permeability are the same as for the Point Pleasant (Ohio). But we need a partner. Until we get one, we will continue with a project of drilling core holes to confirm the formation parameters. We are seeking $36 million-$50 million, preferably from an operator with experience in the Bakken, Eagle Ford or Utica.”

Polish Shale Gas

Talisman Energy also is active in Quebec, but it has gotten even more attention for its gas shale gas development in Poland in conjunction with Dublin-headquartered San Leon Energy. The two companies have spudded their third well in Poland, with Talisman holding a 60 percent interest on three of San Leon’s six blocks.

San Leon has four other Baltic Basin concessions in Poland, in two of which it holds 100 percent, and five concessions in the southern Permian Basin targeting both conventional and unconventional oil and gas. It has completed its first well into Carboniferous strata in the Permian Basin to prove a new potential unconventional play, says John Buggenhagen, director of exploration.

With 1.7 million acres across two basins, San Leon is the largest net land holder in Poland after PGNiG, the national oil company, Buggenhagen notes.

“What is going on in Europe is something that North America has never seen,” he says. “This is true unconventional exploration. All around the United States and Canada, the industry is developing unconventional reservoirs, but they are basins where there already has been significant exploration and production. Some conventional basins had thousands of wells drilled. But in Poland and elsewhere around Europe, we literally are redefining the stratigraphy with each well.”

That said, Buggenhagen adds that it is important to keep potential partners and investors focused without overstating the case. “There is a balance. We have to keep them actively involved, but I cannot let them drive our operational decisions. First, we have to prove there is gas in place, and we have done that. Then we have to prove there is an extractable quantity. We have done that also,” he remarks. “The hardest part is proving commercial viability over the long term. That is what we will be doing over the next few years.”

Once that happens, Buggenhagen anticipates a consolidation, similar to what has taken place in North American shale plays. Beyond Poland, San Leon is developing significant acreage positions in Spain, Morocco and France. “I believe they will sort out their fracturing issue,” Buggenhagen says of France, where there is a temporary national prohibition on hydraulic fracturing. “The key to our portfolio is diversity across many basins as well as in each basin. We do not believe every shale basin will work, and in those that do, not every block will be commercial. But we do believe that multiple plays will work. That is the key to long-term success.”

Indeed, there is no perfect combination, agrees Florence Geny, research fellow with the Oxford Institute for Energy Studies and author of a 2010 study titled, Can Unconventional Gas Be a Game Changer in European Markets?

“The discussion in Europe is focused on Poland, with the rest of the countries much further behind. But Poland still has a coal-dominated economy. Domestic gas would make it more independent from Russia, but we estimate it would take 1 trillion cubic feet a year of gas produced across Europe to meet 5 percent of demand, and that is not realistic in the near term,” Geny states.

Underscoring a point that Buggenhagen made, Geny notes, “In Europe, the subsurface is not as easy as what was initially believed. The developers are working out the best combination of technology, and going through the realism phase. Exxon announced that initial results from its first two wells were unsuccessful.”

In contrast, Geny says Argentina is mostly likely to be the first big shale play beyond North America to see commercial production, followed possibly by Australia. “Argentina has world-class tight oil in the Neuquén Basin, and two target formations. (Companies) are working in mature basins, so there is infrastructure and services. The question in that country is price. Oil and gas prices are kept quite low by government subsidies. There is a heavy level of government involvement, inefficiency and even corruption.”

New Paradigm

By pioneering gas shales and then tight oil plays, there is no doubt that North American independents have set in motion a new paradigm for international exploration and development strategies. “People all over the world have been watching what has been going on in the United States and Canada,” says Steve DeVito, senior director of regional teams for IHS. “They have been thinking about analogue formations in their own countries, and now that the unconventional technology is becoming less unconventional, several of these plays are moving forward.”

He agrees there will be steep geological hurdles in many parts of the world because of a lack of data from previous conventional exploration. “The aboveground problems will be just as challenging,” he says. “Rigs are not always hard to find, but it is usually hard to come by a lot of rigs in one place. Look at some of the big plays in the United States, where there may be a dozen operators running up to 20 rigs each in the same basin or play. That just does not exist in many other places.”

A lack of rigs and crews is a particular impediment in resource plays, where large-scale, multiwell development programs are essential to profitability, DeVito says. “You have to remember project economics,” he reminds. “Even if you get 500,000 barrels out of a well, as in the Eagle Ford, you might lose money on that one well. You need lots of wells for the manufacturing economics of shale plays to work.”

On a larger scale, DeVito says host government policies can add to the infrastructure challenges in many areas. “You can find great rocks in lots of places, and you probably can get rigs on top of them. But even if you have all kinds of oil and gas potential, there are still environmental, labor, tax and permit issues,” he states. “You never can lose sight of the geology, but even if you retain that, there are all kinds of other complications. Unconventional plays require critical mass, and while the geology is worldwide, there are very few countries that have favorable policies and where critical mass exists, or could be assembled quickly enough, for a realistic payout.”

As the saying goes, all politics are local, which is why it is critical to have the right people on the ground in any exploration or development, DeVito adds. “There is certainly a place for the domestic independent companies to be active in international shale plays,” he says. “But it is very important for them to get people on board early who have experience in the country. There have been many companies with good technology that got burned in contracts. You cannot just export your expertise.”

DeVito concurs that Argentina’s Neuquén Basin is likely to be the next big commercial shale play, but says China also has shale potential. “The basins in China are not as good as in other areas, but there is a lot of room to run, and the Chinese are also very eager for technology,” he comments. “On the downside, the Chinese government is notoriously difficult to work with. There are some companies that simply will not do business there.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.