Israel-Iran War Highlights Middle East’s Diminished Oil Influence

A swift spike in oil prices following Israel’s surprise attack on Iran in June was followed by an equally swift return to pre-conflict prices, according to reports by Reuters, NPR, and other news outlets. According to one Reuters columnist, the price fluctuations suggest that the Middle East is losing its grip on the global oil market.

“The jump in oil prices following Israel’s surprise attack was meaningful but relatively modest considering the high stakes involved in the conflict between the Middle East rivals,” writes Reuters Energy Columnist Ron Bousso. NPR’s Camila Domonoske made a similar observation, saying that the spike “wasn’t the kind of meteoric rise that would signal that the world could be headed for an oil crisis.”

On June 12, the day before Israel’s attack, benchmark Brent crude prices began to rise from below $70 per barrel. They peaked at $81.40 on June 23 following the U.S. attack on Iran’s nuclear facilities, Bousso recounts.

“Prices, however, dropped sharply that same day after it became clear Iran’s retaliation against Washington—a well-telegraphed attack on a U.S. military base in Qatar that caused limited damage—was essentially an act of de-escalation,” he says.

Prices then dropped below pre-war levels to $67 after President Donald Trump announced a ceasefire agreement between Israel and Iran.

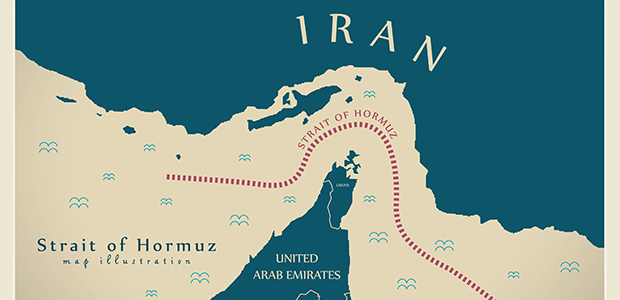

All in all, there was little disruption to the flow of Middle East oil throughout the nearly two-week conflict, Bousso states. “The doomsday scenario for energy markets—Iran blocking the Strait of Hormuz, through which nearly 20% of the world’s oil and gas supplies pass—did not occur,” he says.

NPR’s Domonoske suggests Iran may have considered its own economy when planning its response. “So far, Iran has declined to block the Strait of Hormuz, and analysts think the prospect is unlikely at this point—in part because of the intense economic pain it would cause Iran,” she wrote on June 25.

The relative stability—with prices seeing a 15% low-to-high swing—suggests that oil traders and investors have slashed the risk premium surrounding Middle Eastern politics, Bousso argues.

“Consider the impact on prices of previous tensions in the region. The 1973 Arab oil embargo led to a near quadrupling of oil prices. Disruption to Iranian oil output following the 1979 revolution led to a doubling of spot prices. Iraq’s invasion of neighboring Kuwait in August 1990 caused the price of Brent crude to double to $40 a barrel by mid-October. And the start of the second Gulf war in 2003 led to a 46% surge in prices.”

While Busso acknowledges that all but the first of these price surges were brief, and notes that comparing conflicts requires consideration of their unique factors, he still sees a trend. “The oil market’s response to major disruptions in the Middle East has—in percentage terms, at least—progressively diminished in recent decades."

Bousso isn’t the only one to notice a shift. “The market has shown that it’s been very resilient to some of the geopolitical shocks that historically would have sent prices skyrocketing,” NPR quotes Angie Gildea, U.S. energy lead for KPMG. “We didn’t see that much with Russia-Ukraine, and we haven’t seen that with Israel-Hamas. And we’re certainly not seeing that in this case.”

What Changed?

Several changes could explain the more modest reaction to geopolitical tensions, Bousso and Domonoske say. Investors may have simply become more rational in volatile situations thanks to easily accessible news and more robust data, Bousso says, with investors now keeping tabs on near-live market conditions.

“Using satellite ship tracking and aerial images of oilfields, ports and refineries, traders can monitor oil and gas production and transportation, enabling them to better understand supply and demand balances,” he illustrates.

Citing Rebecca Babin, a senior energy trader at CIBC Private Wealth, NPR suggests that many traders have learned from the markets’ reaction to other Middle East conflicts, including Hamas’ attack on Israel in 2023 and Iran’s attacks on Israel in 2024.

“It’s like the story of the boy who cried wolf: Markets keep signaling there’s a reason to panic, but as the threat fails to materialize again and again, the response is diminishing,” Domonoske summarizes.

The explanation could also be that producers in the region have grown savvier, learning from previous conflicts and building alternative export routes and other infrastructure in case of disruption in the Gulf, Reuters’ Bousso says.

As an example, he points to the East-West Pipeline, a crude oil pipeline that runs from the Persian Gulf coast to the Red Sea port city of Yanbu, enabling Saudi Arabia to bypass the Strait of Hormuz if necessary. According to the Associated Press, the pipeline was built in the 1980s amid fears that the Iran-Iraq war would cut off shipments through the Strait.

Bousso adds that many of the top oil-exporting countries in the region, including Saudi Arabia, the United Arab Emirates and Kuwait, have significant storage facilities throughout Asia and Europe, allowing them to continue supplying customers through brief disruptions.

Supply-and-demand fundamentals may also contribute to oil prices’ relative stability. “Lately, demand has been growing slowly, thanks in large part to an underwhelming Chinese economy,” NPR says. “Supply, though, has been booming, in part because OPEC and its allies keep putting more barrels on the market.

“The market is oversupplied. That pushes prices down—and it means there’s less panicking about something that could potentially cut into supplies.”

U.S. Production

The United States’ growing production dampens the effect of Middle East tensions, Bousso argues. “OPEC’s share of global oil supply declined from over 50% in the 1970s to 37% in 2010 and further to 33% in 2023, according to the International Energy Agency, largely because of surge in shale oil production in the United States, the world’s largest energy consumer,” he observes.

That production can have a local impact. As an example, consider Wyoming, which the Wyoming Tribune Eagle argued was well-positioned to weather the storm in the Middle East.

“Pump prices in Wyoming in recent days have tracked slightly lower than the national average of about $3.22 per gallon,” the newspaper reported on June 25. “That’s owed, in part, to regional production and refining capacity.””

Global market supply was strong heading into the conflict, Reuters’ Bousso reiterates, helping further curb market concerns.

Taking all these factors into consideration, the war between Israel and Iran and the reaction from markets is strong evidence that the link between energy prices and Middle East politics has weakened, Bousso says.

“The Israel-Iran war is further evidence that the link between Middle East politics and energy prices has loosened, perhaps permanently,” he concludes. “So geopolitical risk may keep rising, but don’t expect energy prices to follow suit.”

For more details on Bousso’s argument, see Israel-Iran War Highlights Middle East’s Declining Influence on Oil Prices. For NPR’s list of factors behind the muted price response, see Why a War in the Middle East Hasn’t Sparked an Oil Crisis.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.