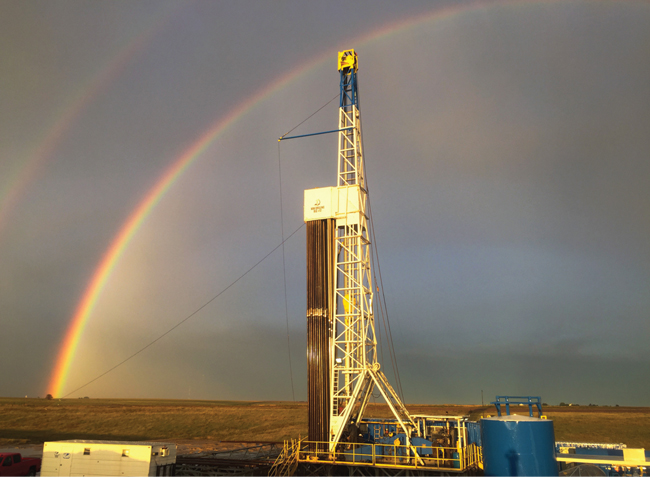

STACK, SCOOP Plays Teeming With Life In Mid-Continent

By Al Pickett, Special Correspondent

Stacked-pay geology, top-flight industry technology, and well economics among the best in the nation are combining to create golden opportunities for independent oil and gas companies in the oil-prone South Central Oklahoma Oil Province and Sooner Trend Anadarko Canadian Kingfisher plays.

As illustrated by several prolific wells in the vast geography and target-rich geology of the appropriately named plays, STACK and SCOOP are providing high-potential drilling targets across more than 15 Oklahoma counties through a super thick pay section that extends from the shallower Mississippian Springer Shale to the deeper Silurian/Ordovician Woodford and Hunton formations.

It was only five years ago that Continental Resources Inc. announced the discovery of the SCOOP and four years since Newfield Exploration Co. announced the STACK discovery, which were then followed by additional finds such as the SCOOP Springer Shale, Northwest Cana, Meramec STACK, Osage and Oswego sub plays. And while all of these geologic concepts still may be relatively new in the industry’s lexicon, the central and southern parts of the Sooner State quickly have developed into a world-class horizontal resource playground.

For a growing list of independent companies, SCOOP and STACK leaseholds have become prized assets with the upside to ensure economic oil production and reserve growth over the long term. In fact, Continental Resources President and Chief Operating Officer Jack Stark points out that the company increased its acreage position in STACK by more than 50 percent (to 200,000 net acres) during the past 18 months, a fitting accomplishment that just happens to coincide with Continental celebrating its 50th anniversary in 2017.

“We have increased our legacy leasehold position with good land work,” he credits. “We got there early and paid well below market rates.”

According to Continental, the company’s fourth-quarter STACK production topped the preceding quarter’s output by 38 percent. Production of approximately 17,000 barrels of oil equivalent a day for full-year 2016 totaled three times the company’s 2015 STACK production.

“Continental completed its first STACK well in August 2015,” Stark recounts. “In the past year-and-half, we have pioneered the play into the overpressured window of Blaine County, Ok. STACK clearly has become a key catalyst for Continental’s growth. We have never had a play this prolific evolve so quickly. The results have exceeded our early expectations, and the impact on Continental’s production growth both near term and long term will be significant.”

Continental reported seven new completions in the STACK Meramec over-pressured oil window for the fourth quarter. Initial 24-hour production rates on the seven wells ranged from 2,463 boe/d (73 percent oil) from a 9,800-foot lateral on the Roth 1-26-35XH well to the Wintersole 1-4-33-28XH that had an IP rate of 1,604 boe/d (70 percent oil) from a 10,500-foot lateral.

“I have been with the company 25 years,” Stark observes. “The depth and quality of our inventory, as well as our capital efficiencies, are at all-time highs.”

Geology And Technology

According to Stark, the 19 rigs Continental has been operating for the last year-and-half are divided between the Bakken formation in North Dakota and the SCOOP and STACK. He says the company holds 1.8 million net reservoir acres in those three plays.

Of the 11 rigs Continental Resources Inc. is running in the STACK play, six are drilling Meramec wells and five are targeting the Woodford zone. The company has completed 35 STACK wells, all of which are flowing with an operating cost of less than $2 a barrel.

Stark credits good geology and advanced technology for the company’s burgeoning STACK success. “We are dealing with excellent reservoir quality rock by resource play standards,” he assesses. “It is also over-pressured, which is great help. And then, the stimulation technology has improved so much. All that makes STACK one of the country’s top plays. The wells do not produce much water either, so every barrel pays.”

Continental is running 11 rigs in the STACK, six of which are drilling Meramec wells and five that are targeting the Woodford zone. “We are developing both reservoirs,” Stark explains. “We have a joint development agreement with SK E&S Company for the Woodford.”

Continental has completed around 35 STACK wells, all of which are flowing, Stark says, with an operating cost of less than $2 a barrel. “The Ludwig well, our first in the play, is still flowing,” he marvels. “It has produced 368,000 boe (71 percent oil) in 445 days and continues to flow 520 boe/d.”

Moreover, another 35 wells are progressing toward completion, Stark says, and Continental expects to drill around 100 gross wells in the STACK in 2017. It has expanded the play west of the original core into Blaine County, where the rock initially was thought to be gassier. But, he says, Continental has proven the expanded acreage is capable of producing oil. The company’s leasehold includes about 40 percent in the over-pressured oil window, 30 percent in the condensate window and 30 percent in the dry natural gas window.

Outstanding Economics

The company indicates that approximately 47,000 net acres–or 60 percent of Continental’s leasehold in the STACK’s over-pressured oil window–has been de-risked and is in development. This includes an estimated 55 operated units that the company projects will be typically developed in two Meramec zones, as well as in the Woodford, with a pattern of as many as six wells in each zone.

Continental reports that it is drilling or completing five of those units, including the Bernhardt, Blurton, Gillilan, Verona and Compton units, and expresses plans to commence a sixth test in the Angus Trust unit in the over-pressured condensate window. These density tests will include as many as six wells a zone in combinations of the Upper, Middle and Lower Meramec and the Woodford.

Stark explains that the company considers a unit to be 1,280 acres, or a two-mile section. He says a majority of Continental’s 2017 STACK drilling will be in unit development, adding that the company is drilling two-mile laterals in every well possible. “We recently completed our first dual-zone density test of eight wells in the Ludwig unit–four Upper Meramec and four Middle Meramec,” he relates. “They came on flowing at a combined maximum 24-hour initial flow rate of 21,350 boe/d (70 percent oil).”

Moreover, Stark reports, the dual-zone density test demonstrates how the company continues to hone its technique, slashing drilling costs by 35 percent and slicing 30 percent off its overall well costs. “There is a lot of efficiency in unit development,” he emphasizes. “The original Ludwig well cost $11 million. By comparison, the average cost of the Ludwig density wells was $7.8 million. At $7.8 million, the density wells deliver 100 percent rate of return at $35. At our current stand-alone well cost of $9 million, we will make a 100 percent rate of return at $45 oil. The economics are outstanding.”

According to the company, another key success in the second half of 2016 was Continental’s completion of three Meramec wells in the STACK’s over-pressured gas window. The three wells are located in the southwestern part of the company’s leasehold in an area it calls Deep STACK, where the Meramec is encountered at depths of at least 13,000 feet.

According to Continental, all three wells completed flowing more than 20 MMcf/d and 49-84 bbl/d at flowing casing pressures of 5,900-7,500 psi.

The company projects that its Deep STACK wells have an average estimated ultimate recovery of 20 Bcf per well from a 9,800-foot lateral, generating an approximate 50 percent rate of return at a completed well cost of $11 million, based on natural gas prices of $3.50 an Mcf.

SCOOP

As prolific STACK wells generate headlines, the SCOOP play, which Continental originally pioneered, continues to be a success, the company indicates. Stark says Continental is operating five rigs in the SCOOP.

“We continue to expand and de-risk the play,” he describes. “We are focusing on the Woodford oil and condensate windows. After a two-year hiatus, we also are going back in and drilling in the Springer.”

Stark explains that the company first announced the discovery of the SCOOP Woodford in 2012 and then the SCOOP Springer in 2014. He describes the SCOOP Springer as an over-pressured oil reservoir that yields 80-85 percent oil. “We drilled the Woodford, and our team recognized the zone above the Woodford (the Springer) was a potential resource candidate,” he notes. “We evaluated the potential reservoir with core work, which was followed by vertical and horizontal tests.”

Thanks to the company’s Woodford activity, essentially all of Continental’s Springer acreage was held by production, Stark points out, so it postponed development and waited for market conditions to improve. After pausing a couple years from Springer drilling, Stark says, Continental is ready to start testing the zone again. “We are excited to see what the new stimulation techniques and longer laterals will do,” he relates.

Continental has completed around 40 Springer wells in the SCOOP, mostly with one-mile laterals. Stark says the company has scheduled a five-well Springer test this year that will utilize one-mile, 7,500-foot and two-mile laterals.

As for the key elements that comprise the company’s enhanced completions, Stark lists higher proppant loads and tighter stage spacing. He reports those stimulations have increased production rates and estimated ultimate recovery.

Ultimately, he details, Continental’s 2017 drilling plans include 34 gross (20 net) wells in the SCOOP and 100 gross wells (50 net) in the STACK.

Enhanced Completions

After pioneering the STACK play in 2013, Newfield Exploration Company has invested significantly in both the STACK and SCOOP to build its Oklahoma asset base into a 400,000-net acre powerhouse of resource play prospects.

The results speak for themselves. One of its newest STACK wells in Kingfisher County achieved a 24-hour flow rate of 2,931 boe/d (69 percent oil) and a 20-day average rate of 2,492 boe/d (70 percent oil), according to Steve Campbell, Newfield’s vice president of investor relations.

One of Newfield Exploration Company’s STACK wells in Kingfisher County, Ok., has produced 417 barrels of oil per 1,000-foot gross perforated interval, and a 20-day average of 361 barrels per 1,000-foot gross perforated interval. Both are the most prolific publicly reported rates for a well in the STACK and SCOOP, the company says.

The Burgess well, drilled with a 4,859-foot lateral, posted a record 24-hour oil production of 417 barrels of oil per 1,000-foot gross perforated interval (GPI) and a 20-day average oil production of 361 barrels per 1,000-foot GPI, the company indicates. “Both are the highest oil production rates per 1,000-foot GPI publicly reported in the SCOOP and STACK,” says Campbell.

Campbell says Newfield is the most active SCOOP and STACK operator, and points out the company has 400,000 net acres in the Anadarko Basin–300,000 in the STACK and 100,000 in the SCOOP.

“We have drilled 140 wells and participated in 250,” he states. “The industry as a whole has drilled only 550-600 (SCOOP and STACK) wells, so by far we are more active than any other company.”

Newfield indicates it first discovered the STACK in 2010 and 2011 while drilling gas wells in southeastern Oklahoma’s Arkoma Basin. “In the early days, companies avoided the oil side of the shale plays,” Campbell recalls. “As the industry accumulated more data, it gave us the idea that there could be an oil play updip from a gas play. The Cana-Woodford was a well-known dry gas play. Our idea was to go 15-20 miles updip and find mobile and commercial oil. We kept it quiet for nearly two years and were able to lease our acreage for less than $3,000 an acre.”

He says Newfield has drilled 140 wells; completing the first 100 with similar techniques, using 1,000 pounds of proppant and 1,000 gallons of liquid per foot. Today, however, the company is utilizing 2,000 pounds of proppant and 2,000 gallons of liquid per foot and is experimenting with even larger completions. It also is drilling mostly two-mile laterals.

With the enhanced completions, Campbell reports that Newfield’s wells are outperforming the company’s type curve. “We are trying to solve what is the optimal number of wells drilled per section,” he adds.

According to Campbell, Newfield was testing eight-12 wells a section and expected to have results by late May on two wells drilled in tighter spacing. “We have planned nine development pilots,” he details.

Newfield is running four SCOOP rigs and five in the STACK, he indicates. Campbell goes on to note that SCOOP is a little more mature than STACK, and so the company plans to come back in and drill two or three additional SCOOP wells on tighter spacing.

Campbell indicates Newfield never uses the term “over-pressured,” but according to other companies’ classification, he says the company’s record-setting Burgess well lies outside the over-pressured window.

“It has more to do with depth,” he claims. “The key understanding is getting the science right. One of these developments is an $80 million-$100 million investment, so we have to make sure we understand the science. Otherwise, you can outrun the science.”

Recycled Water

Water and take-away capacity are key SCOOP and STACK considerations. Newfield announced in March that it had broken ground on a water recycling facility in its STACK acreage in Kingfisher County, Ok. The complex, named the Barton Water Recycle Facility, is expected to process 30,000 bbl/d of water upon completion in the third quarter.

The company says the facility will utilize aerated biologic treatment technology to convert produced fluids into water that can be used for hydraulic fracturing. The treatment process relies on natural and enhanced bioremediation–or useful bacteria and nutrients–to separate and break down any of the produced water’s existing impurities. The result, Campbell describes, is a high-quality water nearly free of impurities–very similar to that initially found in the reservoir rock.

Newfield reports it has invested more than $40 million in STACK play water management. Campbell says the new recycling facility is a multi-million dollar investment on a 30-acre site that will connect to seven pits with nearly 6.5 million barrels of storage capacity and utilize more than 70 miles of underground pipeline by the end of 2017.

According to Newfield, the company also has secured a 10-year contract with a subsidiary of Enable Midstream Partners LP for 205,000 dekatherms a day of firm natural gas transportation from the SCOOP and STACK. The 10-year contract is associated with Enable Gas Transmission’s Cana and STACK Expansion (CaSE) project that was announced last fall. Together with existing and third-party system capacity, CaSE will provide residue take-away from across the active, multi-stacked region. The proposed project provides transport options for volumes of 190,000-490,000 dekatherms a day.

Multiple Targets

Gastar Exploration Inc. announced in March that it had closed its capital and refinancing transactions with funds managed by affiliates of Ares Management L.P. The deal with Ares includes new financing to Gastar in the form of a $250 million secured term loan, the issuance of $125 million secured convertible notes and a $50 million purchase of Gastar common stock.

Gastar Exploration Inc.’s 2017 drilling plans include 30 STACK wells, all with one-mile laterals. The company is drilling one well on each unit to hold the acreage by production and plans to test tighter spacing.

“It allows us to restructure our balance sheet,” explains Gastar Chief Executive Officer Russ Porter, “and it gives the company a five-year timeline to prove up, delineate and de-risk our acreage.”

In addition to targeting the Meramec formation, Gastar also is drilling in the Osage and Oswego formations. “We have at least five targets on our acreage,” he explains. “The Osage is right below the Meramec. There are multiple horizons–the Meramec, the Hunton, the Osage and the Oswego. Everything except the Oswego is sourced by the Woodford. It is all the same system, sourced by the same formation.”

Porter says Gastar has drilled 60 Hunton wells, two Osage wells and eight Meramec wells. It is completing 14 more Osage wells this year and is drilling and completing another 10 in the Meramec. The company’s 2017 drilling plans also include 30 STACK wells in the varied horizons. “Everything is one-mile laterals,” he mentions. “These are in the normally pressured window, and we have found one-mile laterals are the most efficient.”

Gastar’s production is roughly 45 percent crude oil, Porter indicates, with the remainder split evenly between natural gas liquids and dry gas. He says Gastar is drilling one well on each unit to hold the acreage by production and plans to increase density tests in the future.

He predicts the company’s leasehold will support six Meramec wells on each section, and four-eight Osage wells, four Hunton wells, four Woodford wells and two-four Oswego wells a section. Some of its acreage includes all of those horizons, Porter says, and about half its acreage is prospective for the Meramec.

Gastar is operating three rigs in the STACK, he indicates. Two are drilling Osage wells, which Porter suggests will attract more attention as the play continues to develop. The other rig is targeting the Meramec.

Mississippian Lime

Many Mid-Continent companies will recall how, several years ago, the Mississippian Lime–which stretches from northern Oklahoma into Kansas–had a reputation as the next big play. However, acknowledges Klee Robert Watchous, president of Palomino Petroleum in Newton, Ks., that prediction did not come true.

“When out-of-state operators came in and called it the Mississippian Lime, it taught us that the formation could be drilled horizontally,” he recounts. “But they paid too much for the acreage and thought they could drill anywhere.”

Palomino Petroleum has shot 3-D seismic over almost all its 200,000 acres in west-central Kansas and relies heavily on that data to ascertain where to drill next. Although Palomino is targeting the dolomite within the Mississippian formations at about 4,500 feet mostly through vertical drilling, it also has begun a horizontal drilling program.

By contrast, Watchous says, his company focuses on seismic data to pinpoint the best areas. Palomino is targeting the dolomite within the Mississippian formations at about 4,500 feet with a mostly vertical drilling program in west-central Kansas, specifically Ness, Gove, Trego, Scott and Logan counties. He points out the company has 200,000 acres “scattered all over the place.”

According to Watchous, Palomino, which will celebrate its 50th year of business in 2019, was very active in Kansas from 2012 to 2015 before lackluster commodity prices curtailed its drilling program, along with those of many small Kansas operators. “Those still in the business have survived the last two-and-a-half years,” Watchous says. “We believe better days are ahead.”

Although it is not abandoning its vertical drilling program, Palomino recently has drilled its first horizontal Mississippian well, he reports. “It is very early, but we are cautiously optimistic,” Watchous expresses. “We have not tried this before, but the results are encouraging.”

Alongside that horizontal well, he states, Palomino has drilled four vertical wells in 2017, all of which have been completed naturally or have used acid stimulation. Although the foray into horizontal drilling is new for the company, Palomino is considering more such projects, Watchous reveals. “You have to change how you do things,” he advises. “We want to extract reserves more quickly. Necessity is the mother of invention, and horizontal drilling is more efficient in certain situations. If you can drill one horizontal well versus multiple vertical wells and drain the same area, then it is more economical. You have to be selective, however, knowing which area to drill. We are still very early in this process.”

Moreover, Watchous offers, Palomino will make the most of being associated with WW Drilling, a drilling company owned by Watchous and his business partner, Nicholas P. Gerstner. Although it serves Palomino, Watchous says, WW Drilling also actively drills for many other companies.

Watchous says Palomino has shot 3-D seismic over the vast majority of its acreage. The 3-D data, along with the geologic information, are the major factors that determine where to drill, he describes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.