Geophysics & Seismic

Trends Spark Collaboration, Drive Technology Innovation In Geophysics And Seismic

By Robert P. Peebler

HOUSTON–The timing, intensity and duration of economic contractions are difficult to predict, but like it or not, they are an inevitable part of the business cycle. After all, there can be no peak without a trough.

The financial crisis of 2009 touched off a global downturn that proved more difficult to navigate than anyone could have imagined. In the grand scheme of things, however, the impact of the “great recession” amounted to little more than a blip on the energy demand radar screen.

I do not believe anything has changed fundamentally in global energy supply and demand. No one knows what the next couple years will hold, but the long-term picture remains essentially the same as before the recession: The industry will be challenged going forward to offset decline curves while adding sufficient reserves to accommodate demand growth. As was a common refrain at industry gatherings during the 2007-08 peak, we truly do “need everything we have.”

What is needed most is continued innovation in exploration, drilling and production technologies, and in developing a network of highly skilled individuals to develop and deploy them. As complex as it may seem at times, the ability to maximize value creation fundamentally boils down to putting the right tools in the hands of the right people focused on the right assets.

Geophysics arguably represents the single most transformative technological link in the value creation chain for oil and gas companies, if for no other reason than the fact that it is typically where the value creation process begins. The point of inception of almost every discovery or infill well can invariably be found somewhere in a seismic data set.

Technology has become ubiquitous in geophysics. For all intents and purposes, any company engaged in providing geophysical services and equipment to the oil and gas industry is in the business of technology. But technology innovation in today’s interconnected world is a much different proposition than in the past. Traditional “inside the firewall” research and development models are no longer sufficient, as the process of developing acquisition, processing and interpretation technologies has become increasingly networked and collaborative, involving third-party partnerships, strategic joint ventures, and long-term alliances with both private and public sector participants.

R&D Megatrends

The entire R&D system necessarily has been driven to change during the past decade, not only in upstream oil and gas, but across all technology sectors–from computing to aerospace. Two megatrends are driving that change: the need for a more rapid diffusion of technology, and a movement toward full “ecosystem” integration.

Compared with other industries, technology diffusion moves at a snail’s pace in oil and gas. This is the result of numerous factors, including the way oil and gas companies have organized themselves, the often unclear payoffs related to new technology deployments, and the fact that the ultimate end product is a commodity that really cannot be differentiated. Obviously, the value of any new technology is reduced if innovations cannot be diffused commercially within an appropriate time frame. To slow the decline of the global production base and develop the resources needed to meet future demand, the diffusion curve must be shortened, necessitating new R&D paradigms for implementing technological advances and new commercial models to bring these technologies to the marketplace.

Technology innovation in today’s interconnected world requires extending R&D far beyond the corporate firewall through strategic partnerships, joint ventures, alliances, consortia, etc., involving both private and public sector participants. Operator partnerships and joint ventures have proven crucial in developing, testing and deploying full-wave cableless acquisition technology, substantially shortening the system’s diffusion curve.

The second megatrend impacting all technology R&D is integration. Increasingly, technology seeks to create value by building complete and fully integrated ecosystems. In consumer electronics, an example of this approach is Apple’s iPod™ personal music system, which was introduced in late 2001 and has since evolved into the iPhone™ and iPad™. Although small in size, these devices are based on an elaborate integrated system involving not only Apple, but an extended network of applications providers and the music industry itself.

What Apple has done, in effect, is integrate technologies into a business model that spans multiple technical boundaries. That has required not only innovating across internal R&D divisions, but also working with outside partners and devising new business models to support the technology.

Ten years ago, geophysical R&D was mainly an internal endeavor inside individual companies. At ION Geophysical, we were working on a micro-electromechanical device that was to form the basis of a new digital sensor. I do not think the company had yet comprehended that transitioning 3-D seismic surveying to digital technology was going to require much more than designing a new type of sensor.

In reality, the sensor was only the initial step. An entire system had to be built around it. We had to think about how digital data should be processed and interpreted, and how oil and gas companies could use the information to maximum benefit. That underscores the dual challenges of innovating around comprehensive integrated systems while also shortening the diffusion rate.

Highly Networked Undertaking

Today, seismic R&D has become a highly networked undertaking. The relatively straightforward objective of commercializing a full-wave (multicomponent) approach to seismic imaging has evolved well beyond a digital sensor and into a complex assortment of R&D-related initiatives within ION. Technology development is still internally led, but it includes strategic partnerships with oil and gas operating companies, academic partnerships, joint product development efforts, transborder joint ventures with seismic contractors, and corporate venturing with third parties where we put seed capital into projects.

Managing all of these efforts is creating a very different R&D landscape in the company and among the clients we serve, bringing along its own sets of challenges.

To solve many of the unsolved problems in geophysics, we need to build large-scale systems that integrate advanced seismic sensors and recording instruments, command and control software, and processing and interpretation methods. Since we are focused on technology development, forging partnerships with service providers in the field is vital to the technology commercialization process. To test a next-generation steerable streamer system for marine acquisition, for example, required forming close working relationships with oil and gas companies that needed the data as well as seismic contractors with the vessels and crews to deploy the technology. This kind of integrated and sophisticated system simply cannot be effectively developed and tested in isolation by “going it alone.”

Co-development and co-deployment also impacts technology diffusion. In the case of the full-wave seismic acquisition system, we were faced with the challenge of building a cableless array on a large enough scale to allow a lifelike field test of the technology. One of the problems in testing geophysical systems is that experimental prototypes often are field tested on such small scales that issues can go undetected until full-scale commercial deployment. So how does a geophysical technology provider test an experimental prototype on the scale of an actual deployment of 10,000 or more stations when building such a test system would be cost prohibitive?

That is where working relationships with operators come in. A couple of operating companies not only helped to underwrite the development of the cableless technology, but also cooperated in field testing very large-scale deployments of the system. Thanks to those partnerships, the diffusion curve for the cableless system has been shortened substantially.

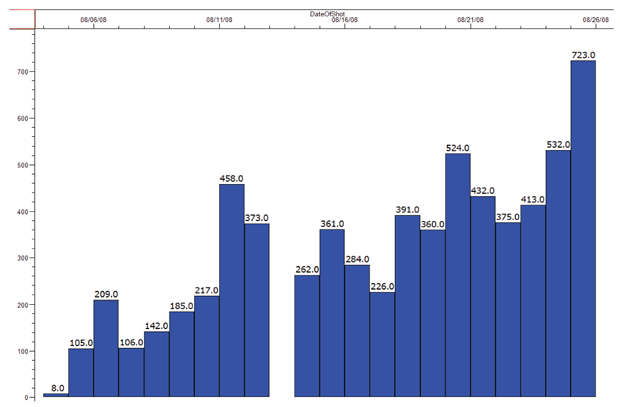

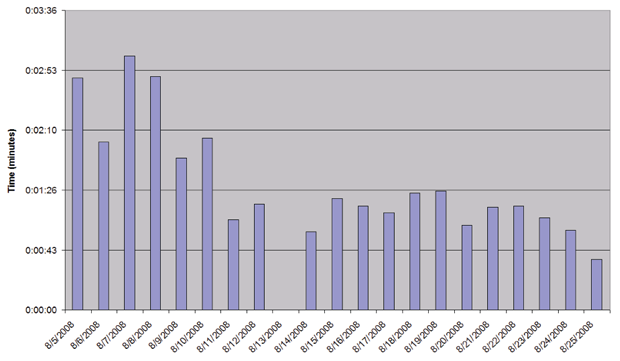

In 2009, only four years after initial field testing, the technology was deployed in seven cableless acquisition projects spanning from the Haynesville Shale in East Texas to Mexico and China. Figures 1 and 2 show sample learning curves using the cableless system in a 3-D acquisition project in August 2008. The number of shots recorded each day followed a marked upward trend as the project proceeded, while the time between shots trended in the opposite direction–underscoring the technology’s improved efficiencies as the crew’s experience and comfort levels increased.

To extend the functionality of full-wave technology, we have now begun another phase of R&D in the interpretation realm to optimize the value of the multicomponent 3-D data acquired. To that end, a corporate venturing initiative has been established with a third-party software provider to develop new platforms to interpret full-wave data in 3-D volume and to analyze variations in reservoir properties (such as fracture patterns) so that new well locations can be drilled to their most optimal locations.

Key Take-Aways

These kinds of collaborative business arrangements take a long time to deliver results and require significant upfront relationship building and technology vetting. But no matter how long it may take to get an acquisition system to a completely rock solid commercial status where 10,000, 20,000 or 30,000 nodes can be deployed over many square miles, I can assure that it will be considerably less time than would be required without operator partnerships and the ability to conduct early experimental field tests on an appropriate scale.

A number of other lessons were learned from the technology provider/operator partnership model used to develop the cableless digital recording system. Key take-aways for introducing new technologies to the geophysical sector include:

- Since the technology is new, there will be learning curve effects (with significant potential for upside as all parties learn and improve).

- All parties need to strive for success, but acknowledge the real likelihood of setbacks, especially at the earliest stages of technology development and testing.

- A committed and steady champion within the operating company is vital to success.

- It is important to manage expectations of managers and technical leaders, while fighting off and helping to navigate around naysayers (which will always exist).

- Operating company partners must have realistic expectations.

- Partners must be willing to commit real money and field assets to the R&D program, and they cannot aspire to lock up the intellectual property of the technology developer.

- Traditional procurement metrics and processes likely will not apply.

- A true model and spirit of collaboration can add value all around.

Beyond The Firewall

The idea that a company can have its own R&D budget, and conduct all research and technology development internally, simply does not make sense in today’s business environment. There are a lot of moving parts to geophysical R&D, and whether a large or small company, the world we now live in demands pushing R&D far beyond the corporate firewall.

Other examples of corporate venturing that ION has been involved in include partnerships with third party acquisition service providers to develop a new generation of redeployable ocean bottom seismic recording technology and a permanently embedded seabed recording system. Onshore, we recently formed a trans-border joint venture with the Bureau of Geophysical Prospecting (BGP), a subsidiary of China National Petroleum Corporation, to align ION’s land equipment business with BGP’s land seismic operations on a global basis. New joint venture products are expected to be designed and field tested for reliability, quality and productivity to the benefit of all land contractors.

Academic partnerships are important as well. For example, we are working with the University of Texas to develop a next-generation seismic source, and are collaborating with Lawrence Berkeley National Laboratory on carbon management and sequestration solutions.

To manage technology innovation in an interconnected world, technology providers have to improve their ability to access the best ideas. Because those ideas certainly do not all come from internal resources, companies have to screen and triage ideas outside the boundaries of their own organizations. One of the latest developments is to access “virtual” user groups in association with online product development laboratories to take R&D collaboration across the Internet.

The Internet is a natural fit with the increasingly distributed organizational structure of R&D. Personnel engaged in R&D are rarely co-located anymore, because by definition, a system typically is built across groups and even companies, adding additional infrastructure, security and management challenges. Obviously, engineering styles vary across cultures, and time horizons vary from one region of the world to another, between academic and corporate organizations, between publicly traded companies versus private ownership models, etc.

While it is crucial to establish the foundations to foster outside collaboration with third parties, I have learned that the best ideas often are found in the “white space” that exists between disciplines across the value chain. Individual companies must find ways to tap into this white space and foster collaboration between disciplines such as geophysics and engineering.

The bottom line is that managing technology innovation requires collaboration now more than ever, both internally and externally with operating companies, technology developers, service companies and academia.

ROBERT P. PEEBLER is chief executive officer of ION Geophysical Corporation. Before joining ION in 2003, he was founder, president and CEO of Energy Virtual Partners, an asset development and management company for oil and gas properties. Prior to founding Energy Virtual Partners, Peebler was vice president of e-business strategy and ventures at Halliburton, which he joined after Halliburton acquired Landmark Graphics Corporation, where Peebler had served as CEO. He began his career with Schlumberger, where he spent 17 years in various positions, including head of U.S. wireline operations and executive in charge of strategic marketing for the corporate energy services group. Peebler holds a B.S. in electrical engineering from the University of Kansas.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.