Emissions Data Often Reveals Ways To Improve Other Metrics

By Colter Cookson

With a flurry of executive orders, changes in regulatory policy and ongoing litigation undercutting or delaying methane regulations, oil and gas industry outsiders could be forgiven for assuming that the age of emissions mitigation is over.

Yet, such is not the case. Despite welcome regulatory relief, emissions mitigation is increasingly embedded in daily operations. For some companies, the business case for monitoring and mitigation is reinforced by requirements of European and Asian buyers who demand proof that suppliers are meeting low emissions standards. For others, it reflects a desire to attract investors who are environmentally minded. And for some, methane reduction is driven by state regulations or the knowledge that emissions limits tend to go down over time.

However, according to several emissions experts, one of the biggest drivers of emissions mitigation today is the realization that the data collection and other measures companies take to protect the environment can also yield operational insights that sometimes improve the bottom line.

“Emissions frequently act as an indicator of how well companies are managing their infrastructure,” says Ben Little, chief executive officer of Bridger Photonics. “The more operationally efficient an asset becomes, the fewer emissions we find.”

For example, Little notes that an aerial survey could detect a leak from the third compressor in a compressor station. “If someone recently worked on that compressor, the leak could be a sign that the technician missed a few steps and needs more training. If post-maintenance leaks are common, the maintenance process may need to be revised,” Little says.

More often, he continues, a leak could be a leading indicator that a piece of equipment needs to be serviced.

Such maintenance insights and similar cases have come up repeatedly since Bridger began mapping and quantifying emissions using sensors mounted on planes and helicopters in 2019, Little says. Today, he indicates the company has the largest database of emissions from oil field infrastructure in the world.

By using planes and helicopters equipped with special sensors, Bridger Photonics says it can quickly and efficiently survey well pads, compressor stations and other oil field infrastructure for emissions.

Thanks to advances in machine learning techniques and computing power, past and current surveys have become much easier to analyze, Little shares. He says that trend, as well as a growing effort to connect emissions data with other information sources, is transforming emissions management into an increasingly proactive discipline.

“We’re already partnering with customers to look at data across multiple systems and multiple platforms, add that to our comprehensive energy infrastructure database, and leverage new technologies to analyze the data and predict what may happen,” he reports.

“For example, we can help operators estimate the useful life of a piece equipment. In some cases, it will be six months longer than assumed, and in other cases, it might be a year shorter,” Little relates. “That’s important for operators to know, because it lets them allocate capital with greater certainty and use their resources more efficiently.”

Think of a crew that has driven to a well pad, compressor station or tank battery to perform routine maintenance or address an issue that has cropped up. While in the area, they handle repairs on that site or nearby locations that the historical data suggests will soon need to be performed. Little points out that this forward thinking boosts efficiency and minimizes safety risks.

Getting Data

For the proactive approach to continue evolving, the industry will need to pair operational information with robust emissions data, Little outlines. He says aerial surveys offer the most efficient way to gather that data. “With sensor technology that is accurate and hyper-efficient, we can fly planes to scan hundreds of assets or thousands of mile pipeline a day with each sensor,” he reports.

Depending on the operator’s goals, Little says these surveys can narrow emissions to an area as small as a couple square feet. “Not only do we identify the precise location, but we also attribute the emission to the piece of equipment that is the most likely source,” he adds. “That could be a tank with a worn thief hatch seal, a flare that is unlit, or a wellhead with a leak.”

Bridger’s laser-based methane detection is reliable enough that the EPA has certified it as an alternative test method under Quad Oa and Quad Ob. Little says this allows operators to conduct mandatory leak detection and repair surveys using aerial scans rather than optical gas imaging cameras, which require specially trained crews to drive to sites and check components manually.

“One of the most dangerous tasks an oil and gas company can do is put someone behind the wheel and have them drive to site,” he says. “If we can eliminate the need to send people to site to scan facilities where we know there are no significant emissions, it makes a big difference for both safety and productivity.”

The operational efficiency and emissions reductions from aerial surveys deliver a strong return on investment, Little assures. He says Bridger has more than 100 customers, including nine of the top 10 largest oil and gas companies in the United States.

“We have an incredibly low attrition rate,” he reports. “It is really gratifying when we talk to customers and they say, ‘do you know that we use Bridger data to quantify our operational efficiency?’ Some companies also use our data as a component in performance bonuses,” Little shares. “That speaks volumes to the visibility that aerial emissions surveys provide into their infrastructure.”

Multifaceted Data

As the industry has become more experienced with emissions data, the focus has broadened, says Scott McCurdy, CEO of Encino Environmental Services. “We used to look primarily at addressing emissions, but there are a lot of other benefits to what we do that we are only beginning to understand,” he says. “Some emissions have to happen for safety reasons, but many of them result from something else being wrong upstream.”

Thanks to strong corrosion resistance, this composite thief hatch from Encino Environmental Services is less likely to leak than traditional designs, the company reports.

Operators are not going to let those problems stand, McCurdy says. “I increasingly see companies look at their high-value or high-risk assets and ask themselves what operational issues are causing the emissions,” he relates. “They know those issues may cause other problems, such as wear and tear on equipment or reduced efficiency, both of which cost time and money.”

Sometimes the link between emissions and revenue is straightforward. “We’ve had situations where we took cameras to a site and immediately saw that a vapor recovery unit was not working, which meant the operator was losing all the gas that VRU was supposed to capture and send to the sales line,” he illustrates.

McCurdy adds that companies increasingly track methane slip from engines, which occurs when fuel that is supposed to be burned inside the engine never gets combusted and escapes. “Checking for methane slip hasn’t traditionally been part of a standard emissions test, but for a variety of reasons, including OGMP 2.0, companies want to do spot checks or install permanent monitors,” he says. “This can help them pass emissions tests, but it also lets them make sure their engines are operating at peak efficiency and generating power with as little fuel as possible.”

Using sensors to watch thief hatches’ performance can yield valuable insights. If a hatch opens frequently, it could indicate a stuck dump valve or other issues with the separator, McCurdy explains. He adds that the sensors can issue alerts if someone gets distracted and leaves the hatch open too long.

“Monitoring thief hatches can help companies keep pressures in the tanks at an optimal level and reduce flash losses,” McCurdy reports. “It can also quickly indicate problems with other equipment that could cost revenue.”

Better Hatches

Worn thief hatches are one of the leading causes of fugitive emissions from upstream facilities, McCurdy says. To extend seal life, Encino has developed a hatch made from a composite material that resists corrosion.

“We have had early prototypes in the field for three and a half years,” McCurdy said in late July. “The operator with the first prototype has looked at it every quarter, and more recently every month, but has never found a leak.”

In addition to reducing flash losses and emissions, McCurdy says the reliability of the composite hatch should simplify operations. “The biggest maintenance cost for thief hatches is replacing the seals and periodic cleaning,” he relates. “Over time, corrosion causes pitting in a traditional metal hatch, which means it needs to be changed out more frequently.”

The composite thief hatches cost slightly more than their metal predecessors, but McCurdy says the return on the incremental investment is quick and well worth it. “We have done side-by-side comparisons where we put a brand-new composite hatch next to a brand-new metal hatch, then check how often each opens for 90 days. Even in that period, when both hatches should be at their best, the difference is dramatic, with the composite opening far less frequently. Over the five-ten years a hatch will be on location, the gap between the two will only get bigger.”

A Maturing Industry

While emissions detection technology and best practices have evolved rapidly over the past five years, McCurdy says many operators have kept pace. “Three or four years ago, some operators would want to try every technology available,” he recalls. “Today, when we get inquiries, the operator often knows each technology’s strengths and weaknesses, and what makes sense for a given site.”

McCurdy attributes that growth partly to the grapevine. “The oil and gas industry is big but small. People talk and share knowledge, especially about the environmental space,” he says. “There have also been public studies comparing emissions detection technologies, including work by the Methane Emissions Technology Evaluation Center out of Colorado State University and similar groups in Canada and France.”

Optimizing emissions monitoring strategies frequently involves deciding where to rely primarily on highly scalable technologies that can cover a broad area for a low cost, and where to use more sophisticated techniques that require more investment but deliver more actionable information or allow continuous monitoring, McCurdy outlines.

He reports growing adoption of satellites, which pick up major leaks and can revisit the same site frequently, as well as planes and drones, both of which can achieve much lower detection thresholds with the right sensors and flight paths. In most cases, companies use these aerial techniques alongside ground-based continuous monitors and field surveys that check specific components.

For continuously monitoring specific sites, blind ground sensors offer an affordable option that can alert operators about a leak but may not be able to pinpoint its location. Cameras that combine emissions detection with visual information can increase repair teams’ efficiency by offering more precise source determination, he says.

According to McCurdy, these technologies are improving. He points to OGI cameras as an example.

“We invested in and partnered with Sensia Solutions, an optical gas imaging camera company based out of Madrid,” he notes. “We have been utilizing Sensia’s technology for four years now. Even in that time frame, we have seen meaningful improvements in the probability of detection and quantification, significantly fewer false positives, and better range. A new offering can observe up to a mile away, and another offering can calculate flare combustion efficiency.

“At the same time, the cameras are adding capabilities beyond emissions that help companies justify the investment,” he continues. “We have cameras that not only spot and quantify gas leaks, but also track tank levels, use thermography to track temperatures and detect flames, and issue alerts when someone walks into a zone they are not supposed to be in. As the cameras continue to add functions and their safety and operational benefits grow, they should get easier for companies to deploy.”

Compressor Emissions

The more the industry learns about methane leaks from compressors, the more those leaks become worthy of attention. From compressor rod packing to engine crankcase blow-by to leaks from pneumatic valves on separators, these emissions were once dismissed as negligible, recalls Will Nelle, vice president of technology and innovation at Flowco Inc. However, their aggregate effect can be significant.

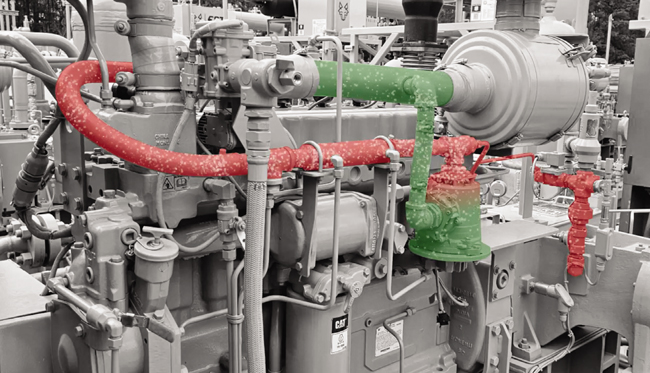

In response, Flowco has developed and patented a methane abatement system that captures fugitive emissions from common leak points on compressors, including rod packing, crankcase vents and separator pneumatic valves, then redirects the captured methane into the engine’s air intake for combustion. This approach eliminates methane emissions by turning them into usable energy, Nelle says.

This compressor is equipped with a methane abatement system from Flowco that captures fugitive emissions from common leak points, then redirects the captured methane into the engine’s air intake for combustion. The company says the red-to-green coloring shows the methane being converted from harmful emissions (red) to useful fuel (green).

The system, called Sentry, has garnered positive feedback in the field. “Our thermography team performed a leak survey on a compressor with the new Sentry system. We could not find any emissions points on the unit during operations,” attests Jonathon Poe, staff facilities engineer at Pioneer Resources.

Kenny Robles, a compression specialist at Devon, had a similar experience. “We usually detect leaks within packing vent and crankcase breather systems, but when we conducted an LDAR survey on Estis GTA38 compressor unit 2255, we found no active leaks,” he says. “Field teams have reported that the system operates as designed and have experienced great results.”

A third-party review by Step2Compliance backs up the system’s effectiveness at reducing emissions, Nelle mentions. He says the review confirmed that the system meets or exceeds Quad O requirements for compressors.

While some federal emission regulations have been delayed, Nelle says the industry continues to shift toward sustainability and operational efficiency. By going beyond compliance, operators can reduce their environmental footprint and potentially gain a competitive edge in a market increasingly attentive to corporate responsibility factors that may impact their reputation with investors and the public, he explains. With regulations in a constant state of flux every two to four years, a proactive approach can also mitigate risks and give operators less to worry about.

Voluntary Emissions Reductions

Technological advances have made emissions detection and mitigation easier to scale and more versatile, says Kyle Jantzen, vice president of business development at Archrock. “At this point, emissions detection and mitigation should not be driven solely by regulatory compliance and managed by the health, safety and environment department,” he says. “There is a strong business case for that to be done by operations teams that want to improve safety and efficiency.”

To demonstrate the link between reducing emissions and improving operational efficiency, Jantzen points to methane slip from engines (i.e., the methane that passes through an engine without being combusted). According to the U.S. Department of Energy, slip accounts for almost half the methane emissions from compressor stations. If it goes unnoticed, the slip from a high-horsepower engine could waste thousands of dollars of gas every month, Jantzen warns.

When it’s noticed, excess slip can usually be addressed by tuning the engine or performing maintenance, Jantzen notes. “Our partners at Ecotec have developed a handheld tool and a kit that lets technicians pull a sample from the exhaust and estimate the slip with quick spot checks,” he says. “That has been a game changer for technicians’ ability to reduce slip.”

Aside from methane slip, two of the biggest sources of compressor methane emissions come from rod packing and blowdowns. Together, Archrock’s research suggests that these sources account for as much as 98% of a compressor package’s methane emissions.

“We got a team of in-house engineers together and asked ourselves how we might be able to capture these emissions,” Jantzen relates. “Ultimately, we developed and patented a closed vent system that returns the gas coming out of the packing to the inlet header system, meaning it goes back down the pipe.

“It does not require site power,” Jantzen mentions. “We’re able to use solar panels to power the control panel. The system itself works by taking advantage of the pressure differentials that occur during typical operations on most sites.”

In addition to capturing fugitive gas that leaks through packing, the system can collect the gas that would naturally vent to the atmosphere during blowdowns, Jantzen reports. To reduce costs, each system comes in a six-foot-by-eight-foot skid that can connect to several compressors. “Hooking the skid up to one unit takes less than a day,” he says. “For multiple units, installation may take a couple days, but it’s relatively easy.”

Jantzen says that simplicity extends to operations. “One of the best compliments we get is when operators tell us they forget the device is even there,” he comments. “There are no moving parts, so it is designed to collect emissions continuously and without intervention.”

During operation, the system collects captured gas in a tank until that tank’s internal pressure exceeds a threshold, at which point the gas is sent to the inlet header of a connected compressor package. By tracking how often the tank cycles, Archrock can estimate how much packing is leaking and how much gas would have otherwise been released to the environment during blowdowns.

In many installations the tank cycles more frequently than expected, Jantzen reports. “Sometimes unusually fast cycles alert the operator to blown packing and the associated leaking of a lot of product that that they were previously unaware of,” he says. “Capturing and selling that gas makes it easy to show a strong return on investment.”

Routine Leak Detection

As leak detection tools become easier to use and more readily available, Jantzen says issues that would have once gone unnoticed until the next flyover or quarterly LDAR survey can be picked up by mechanics as part of routine site visits.

One tool driving that shift is a miniature methane scanner from Ecotec that takes proven tunable diode laser-based technology and puts it into a more affordable package. “With this product, the price point has gotten low enough that it no longer needs to be treated as a tool for a LDAR specialist or an HSE person. It’s something every mechanic can carry,” Jantzen enthuses.

For mechanics, the handheld detector offers huge efficiency gains, Jantzen reports. “In the past, mechanics would have to look for leaks by waving a wand-like sniffer over every single leak point or spraying soap and watching how it moves,” he recalls. “With the new tool, they just point a laser at the component they want to check. If there is a leak, the scanner will beep and estimate the amount. This allows mechanics to find leaks in 15 minutes instead of 45.”

Those time savings add up. “If each mechanic is doing two maintenance events a day, for every 12 mechanics with the device, we have essentially added an extra person to our team,” Jantzen calculates.

Because the scanner makes it easy to check for leaks, including ones in less accessible places, Jantzen says mechanics often find issues they would have missed with traditional techniques. The device also gives them a simpler way to verify that repairs have fixed the issue.

The miniature TDLAS scanner evaluates methane concentrations by reflecting a laser off a surface, so it cannot detect every leak that a formal LDAR survey would, Jantzen acknowledges. However, he says it picks up the vast majority of leaks. Since mechanics can fix many of those leaks right away, the cost for repairs goes down significantly, he reports.

In both their original and miniature versions, the laser-based scanners have a huge advantage over the OGI cameras traditionally used for LDAR surveys, Jantzen continues. Because their effectiveness depends partly on ambient temperatures, OGI cameras struggle to pick up leaks from engines, which tend to be hot. Sometimes a missed leak from a fuel line, starter motor, valve cover or other component sprays methane onto those hot surfaces, where it can ignite and start a fire.

According to Jantzen, a single engine fire can cost as much as $1 million. “There is not only the cost of rebuilding the compressor itself, but the hours that go into replacing it, the downtime and the lost production,” he says. “This adds up enough that some operators put together teams with scanners specifically to check for the types of leaks that can cause fires.”

From a safety standpoint, Jantzen says mechanics welcome the scanner. He points out that the original scanner has a range extending beyond 300 feet, while the miniature version reaches up to 50 feet. “When they show up to location, mechanics can scan methane leaks from a safe distance in as little as 30 seconds to a minute,” he says.

Design Process

For safety checks and thorough leak inspections to become second nature, the scanner must be easy to use, says Alan Vidal, the chief technology officer for Ecotec.

“We have always designed field equipment, not laboratory equipment,” he assures. “When we are creating sensors, we know they need to endure shocks without losing their accuracy or sensitivity. The scanner will hang from someone’s belt or stick out of their pocket. As they move around, it will inevitably bump against pipes and occasionally fall out of their pocket.”

Weather also matters. “The adhesive labels on the casing have to stay on whether the temperature is above 110 degrees Fahrenheit or below zero,” Vidal comments.

By sweeping this handheld methane scanner from Ecotec across points of interest, compressor mechanics can find leaks much faster than they could using traditional techniques, the company reports. It adds that the scanner picks up methane from 50 feet away, meaning users can detect unsafe concentrations before they are in danger.

The casing is made of aluminum. Vidal says plastic would be lighter, but also more likely to crack after repeated falls. “Aluminum will take an impact,” he contrasts. “It is soft enough that it will dent and absorb some of the impact, keeping it out of the electronics and sensor units the casing needs to protect.”

Field testing has had a significant influence on the miniature scanner’s design, Vidal mentions. “We initially tried to see how small we could make it, but we realized that something too small would be uncomfortable to hold, especially for long periods of time,” he says. “To find the right size, we lengthened the handle, then had people with large hands put gloves on and use the device to create three versions. Then we sent those models out into the field to end up where we are today.”

Vidal says Ecotec also drew on more than a decade of feedback from the larger scanner’s users, who range from compression and pipeline companies to fire departments, police departments, utilities and manufacturers. The manufacturers include European crystal makers, who have used the same gas systems for centuries and want to preserve their processes.

Vidal points out that both scanners produce a green dot that shows where they are pointed. They also have a V-shaped notch that extends across the top and allows users to aim in areas too bright for the dot to show. “We could have used traditional sights, but those could get stuck in a pocket or caught on something,” he remarks.

Usually, it takes less than a minute to teach someone how to use the miniature scanner. “All we really have to do is show them where the power button is,” Vidal says. “It’s pretty intuitive.”

Because the laser needs to hit a surface and come back for the scanner to pick up methane, there is some art in checking elevated assets, such as thief hatches or flares. “Most sites have catwalks or other equipment above tanks that mechanics can point at,” Vidal says. “Understanding how air moves gas can also help. It may not be possible to scan a tank directly, but if the user goes to the downwind side and points at the lip, the scanner should pick up emissions as wind carries them across the tank.”

The scanner can let field teams pinpoint leaks discovered by aerial surveys or satellites, Vidal mentions. “Sometimes the leak comes from an underground line but looks like it’s coming from another piece of equipment because the plume happens to pass over that equipment,” he says.

The scanners pick up tiny leaks from unsealed flanges, leaking valve stems, and fuel lines, as well as larger leaks, Vidal reports. Often, he says users will turn it on to verify a successful repair, then sweep it along the line to look for other issues. “They’ll often find one or two minor leaks that they can fix by tightening a few bolts or sealing up a flange,” he says. “These issues rarely get documented or talked about, but they add up over time.”

Addressing Pneumatics

Gas-operated pneumatic valves can be a significant source of emissions because of how many there are, says Jacqueline Peterson, chief external affairs strategist at Kathairos Solutions. “Estimates vary, but the best accounts say pneumatic venting and associated leaks contribute about a third of all the methane emissions from the upstream oil and gas sector,” she says. “Fortunately, there are readily available solutions to eliminate the need for venting.”

On many sites, Peterson recommends replacing pneumatic gas with liquid nitrogen stored in specialized tanks. Because nitrogen accounts for 78% of air and already has many uses inside the oil and gas industry, it is readily available. However, she says the biggest appeal of the inert gas is its reliability.

“We have more than 25 million recorded operating hours from our nitrogen tanks, and our uptime is 99.985%,” she reports. “In many cases, the nitrogen is even more reliable than the fuel gas that was previously used, which may contain impurities or water that might freeze or cause other issues.”

Instead of operating pneumatic valves with gas, many sites now use liquid nitrogen that is stored in specialized containers. Noting that nitrogen is readily available, Kathairos Solutions says this approach is affordable enough to be economic for any well site.

Peterson attributes that reliability largely to the nitrogen-based system’s simplicity. She says it only has two major components: the nitrogen and the tanks that keep it cold enough to stay in liquid form until it’s needed. At that point, a small amount is released from the tank. As it encounters ambient temperatures, it turns into a gas that Peterson describes as ideal for operating the valves. In fact, many manufacturers test their valves using nitrogen.

With no moving parts, the tanks excel in the 100-plus degree temperatures of West Texas summers and the -40 temperatures encountered in northern Canada, Peterson says. They do not need electricity, so they will keep working even if clouds or dust block the sun, she adds.

“We do not have any electrical components, and the steel tanks are heavy, so we have never experienced theft,” Peterson continues. “The tanks are hard to damage and end up being a simple solution for all sorts of situations.”

Low Costs

Peterson says installing the tanks is straightforward. “The entire process only takes a few hours and involves stainless steel tubing that operators and instrumentation technicians are familiar with,” she explains.

The steel tubing connects the tank to the pneumatic control loops and the appropriate headers. Once that connection is made, the fuel gas line is shut off but left in place. Finally, Kathairos commissions the tanks, which means cooling them and then filling them with liquid nitrogen, Peterson describes.

On most sites, the tanks are sized so that they only need to be refilled about once a month, Peterson says. “We have a significant team devoted to dispatching and automating the routes to make sure we can deliver nitrogen to the oil patch at minimal cost,” she says. “Our cost efficiencies will only improve as we grow.”

The monthly cost for the tank and nitrogen is already low enough that small tanks are being used on remote pads with a single stripper well, Peterson says. In late July, she said the company was in the final stages of releasing a compressed nitrogen system for wells with particularly low production and vent profiles.

“This system would effectively use bottles that could be stored on site and swapped out as needed,” she outlines. “We think the cost will be around $80 a month, which should make nitrogen affordable for any well site.”

To schedule refills of its traditional tanks, Kathairos uses telemetry to monitor the level of each tank. According to Peterson, that data lets the company give operators accurate information on how much switching to nitrogen reduces emissions. “Because we operate in a closed-loop system, we know that for every kilogram of nitrogen used, 1.276 kilograms of methane otherwise would have been vented,” she explains.

The emissions from pneumatic valves tend to be lower than the U.S. Environmental Protection Agency’s emissions factors would suggest, Peterson reports. However, she says the emissions that occur following leaks often end up being much larger than operators expect.

Those leaks could come from a valve that gets stuck open or a connection that is loose, Peterson relates. “With our system, those issues cause a spike in nitrogen consumption. When we notice that spike, we alert the operator so they can fix the problem before it has a big impact.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.