Machine Learning Increases Production By Automating Critical Tasks

By Colter Cookson

Automation and remote monitoring have a long track record of improving wells’ production and longevity. As those technologies constantly perform optimizations and highlight the wells and equipment that need attention, pumpers work faster and smarter.

By leveraging rapid advances in edge computing and machine learning, service companies are expanding automation’s capabilities and reducing its deployment costs to bring even stripper wells under the “manage by exception” model. These companies say their innovations will increase profits and reduce emissions.

Meanwhile, the components of artificial lift systems continue to become more robust and efficient. For example, a new gas lift valve for harsh environments is helping operators in the Eagle Ford and Bakken extend workover intervals.

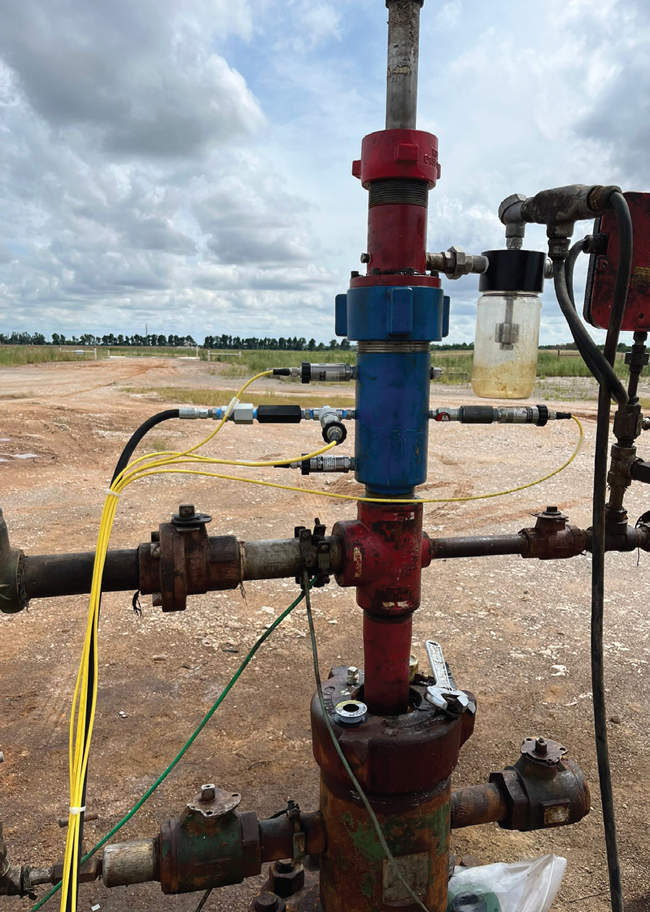

One area ripe for automation entails stuffing box adjustments on rod pump wells, says Jason Pitcher, technical business development manager at Kairos Resources. It’s necessary to periodically tighten the seals around the polished rod to compensate for the wear and tear that friction inflicts on the seals as the rod moves up and down, Pitcher notes. Otherwise, oil and gas can leak through the interface between the seals and the rod.

Ideally, a pumper will notice the leak and stop it by tightening the seals or injecting grease to energize them. If the leak goes unnoticed, commonly-used pollution control devices can prevent environmental contamination. However, they do so partly by shutting down the well, which Pitcher warns can lead to days of lost production.

In partnership with Wellhead Systems Inc., which manufactures wellheads, stuffing boxes, polished rod clamps and other oil field equipment, Kairos is testing ways to tighten seals automatically.

“We want to keep oil from ever reaching the pollution control device,” Pitcher says. “To prevent leaks, the system will adjust the seals as needed. When the seals are almost worn out or the grease reservoir needs to be refilled, it will alert the pumper, who can visit the site and correct the issue before it leads to downtime.

“By allowing pumpers to target wells that need attention, the automated stuffing box will reduce unnecessary windshield time,” he adds. “It will be superb in the northern Permian Basin, where traffic can sometimes prevent pumpers from reaching a site even if it’s only a short distance away.”

The system’s benefits will be magnified in the Rocky Mountains and other areas where snow can make driving particularly risky or impossible, Pitcher predicts. “We are talking with a Canadian operator with wells in the Duvernay that it has to shut in whenever the ice breaks up and pumpers can no longer visit the wells to check for leaks,” he relates. “With our automation, the operator may be able to maintain production through the break up periods.”

This well is testing an automated stuffing box that tightens the seal packs around the polished rod as needed to prevent leaks. Kairos Resources, which developed the automated stuffing box through a partnership with Wellhead Systems Inc., says such automation can reduce the frequency of pumpers’ site visits.

The system detects leaks by comparing pressures in the seal pack with the flowing wellhead pressure. “If those values match, the lower seal pack is leaking,” Pitcher explains. “When our algorithm detects a leak, it will start by pumping grease into the space between the upper and lower seals to push the lower seal against the polished rod. This accelerates wear, but it’s often enough to keep hydrocarbons from bypassing the seal.”

The grease gradually will bleed off as the polished rod travels through the seals, so injecting grease between the seals is a temporary fix, Pitcher notes. However, the required volume is so small that it’s usually practical to inject grease every few hours.

If the leak continues, the system will tighten the lower seal even more by injecting grease into a piston to compress the seal. This causes more wear than the first step, but eventually proves necessary as the seals erode, Pitcher says.

By tracking how much grease it has sent to the piston, the controller can estimate how worn the seals are so they can be replaced before they fail, Pitcher reports.

As of early January, the system still was being refined. “Before we commercialize it, we need to be confident we have nailed down all the edge cases we can,” he says. “We have one unit that has been on a test site in Oklahoma for several months, and we have four more going into manufacturing for testing purposes. If all goes as planned, I am hoping we can start taking orders by the end of the first quarter.”

Additional Potential

The system’s components include a stuffing box made by Wellhead Systems Inc., three pressure sensors, two temperature sensors and a control panel that processes the data at the edge, Pitcher describes. While it will be impractical for stripper wells, he predicts the automated stuffing box will have a broad application window.

“The test units only control one well with each panel, but we are planning to expand that to four to increase the automated system’s capital efficiency,” he says. “That should help the system move from prolific wells to more marginal ones.”

To improve the system’s economics, WSI and Kairos are repurposing the necessary components and adding new ones. As an example, Pitcher cites the temperature sensors the controller uses to distinguish between pressure changes associated with seal failures versus ones that result from day/night cycles and other ambient temperature changes. “If a well begins to gas lock, the temperature inside the wellhead will climb quickly,” he says. “By watching for that, we can warn the operator when gas lock occurs or even shut the pumpjack in to protect the seals.”

The grease injection system can help keep rod rotators running, Pitcher continues. “Rod rotators fail frequently, with some estimates suggesting that a third of the rotators in the field no longer work,” he comments. “Maintaining rotators generally only involves squirting grease into the rotator, but it is on top of the bridle, so to reach it, the pump needs to be off. That means the rotator rarely gets grease unless the pump shuts off for other reasons.

“By adding a simple manifold diversion to our system, we can hook into a grease line that is attached to the rod rotator and inject grease periodically to keep it lubricated,” Pitcher says. “Since the automated stuffing box already includes a grease pump, the extra cost for this option is low.”

The control panel also can link to a methane sensor above the seals. “Methane is a much smaller molecule than oil, so it will leak through the seal packs before oil does,” Pitcher explains. “By watching for methane, we can spot seal degradation quicker.”

Emissions Detection

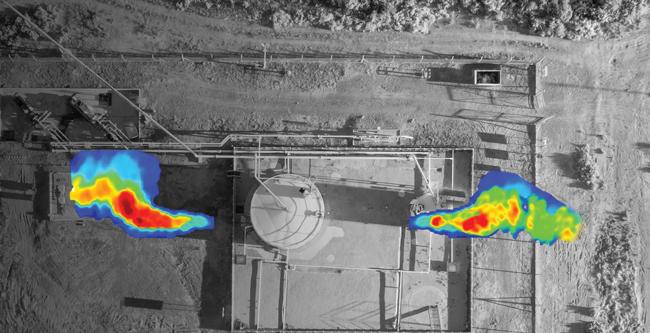

As interest in mitigating emissions grows and regulations tighten, operators will need reliable ways to detect, quantify and address emissions, suggests Burt Stringer, vice president of Sytelink360™, the emissions remote monitoring and management business segment for Cimarron. On many sites, he recommends deploying permanent optical gas imaging cameras that constantly monitor for emissions.

Permanent emissions cameras from Cimarron enable operators to detect and address leaks quickly, then verify and show that the leaks have stopped. The cameras notice leaks 98% of the time and quantify them with 78% accuracy, Cimarron reports.

“By using software to monitor data from cameras, we can quickly pinpoint where leaks come from and quantify the amount,” he assures. “Over time, we can look at when leaks occur and optimize the facility to prevent them from happening again.”

At well sites and production facilities, Stringer says most emissions come from oil or water tanks. “We can configure the cameras to tour automatically so they get a good view of each tank or other piece of equipment. Depending on how long the operator wants the camera to stay on tank, those tours can happen as quickly as every seven minutes,” Stringer describes. “If the camera picks up a leak, it will quantify it, identify the source, and notify the operator.”

Source identification is partly a matter of labeling. “When we set up the system, we label each piece of equipment the cameras look at with whatever name the operator prefers,” Stringer says. “When the system detects a leak, it shows the equipment the leak is coming from and provides a picture for visual verification. If a notification recipient needs more information, he can take control of the camera remotely and swing it back to the point of interest.”

Automating source identification rather than requiring someone to visit the site to find the leak speeds repairs, Stringer says. Because the cameras quantify emissions, he adds, they help companies prioritize repairs.

The machine learning algorithms that analyze the cameras’ images have become extremely accurate, Stringer says. He indicates the cameras notice leaks 98% of the time and quantify those leaks with 78% accuracy.

“Because of their accuracy and reliability, the cameras have been accepted by several state regulatory agencies and some of the Environmental Protection Agency’s regions as autonomous solutions for leak detection and identification,” he mentions. “We have also had several operators test us against leaks they can already quantify to confirm we get the amount right.”

Next Steps

Once a leak has been fixed, the cameras verify it has stopped, Stringer reports. In addition to quantifying leak duration and amounts for regulatory reporting, this capability can help companies improve repair procedures.

“In one instance, technicians would replace the seals and springs on thief hatches only for them to continue leaking because of a gap in the repair process,” Stringer recalls. “By identifying that gap and improving the way the technicians were trained, we prevented the problem from occurring across the field, which had a huge impact on emissions.”

Effective as they are, Stringer says cameras are only one tool among many for reducing emissions. He encourages companies to put sensors on equipment, so they have enough information to determine why leaks occur and prevent them from recurring.

“One simple way to reduce leaks on tank batteries is to adjust vapor recovery units’ set points when production is about to spike,” he illustrates. “For example, instead of kicking the vapor recovery unit on when pressures reach four ounces, we can temporarily lower the threshold to two ounces. That way, the VRU will turn on early enough to handle the entire production spike rather than getting overwhelmed and sending part of it to the flare for combustion.”

Thief hatches that are left open or that stay open after popping can be a major source of emissions, Stringer warns. To ensure they’re shut as soon as possible, he suggests installing wireless, battery-operated inclinometers that can detect partially open hatches and communicate with a central module to make alerts available in the cloud.

Aside from tank batteries, flares are one of the most common sources of avoidable emissions on production sites, Stringer says. Sometimes those emissions can be traced to a flare pilot that has gone out. “The pilots are 30-60 feet above ground, so pumpers cannot check them every time they visit a site,” he notes. “Sometimes the operator may not realize the pilot is out until the site is surveyed for emissions.”

Even a flare that appears to be running well can cause unnecessary emissions, Stringer cautions. He says this is particularly common if the amount of air sent to the flare to assist combustion rarely changes.

“When crews set up the blower and the variable frequency drive that controls how much air it provides, they often look at the flame and think it’s good. That may be the case initially, but if no one tweaks the VFD as production falls, smoke and emissions will begin escaping because the flame no longer receives enough air to complete combustion,” Stringer relates.

“On the flipside, the operator may say, ‘Last time, we set the VFD at 30 hertz only to have problems once production fell off. Let’s start at 55 this time.’ In this case, the flame will look great to the naked eye, but a camera will detect emissions because the extra air is pushing many of the hydrocarbons past the combustion zone before they can be destroyed,” he reports.

To prevent under- or over-aeration, Cimarron has developed a controller for air-assisted flares that enables the blower’s VFD to accelerate or slow as production increases or decreases. “By keeping the amount of air close to the ideal, we can achieve destruction efficiency beyond 99%,” he reports. “Pair those sensors with a camera that is trained not only to capture fugitive emissions, but also to detect when a pilot has gone out, and an operator can make sure the flare is ready when it’s needed.”

The controller can eliminate cold venting or improper aeration, which are major contributors to super-emitter events, Stringer says. He mentions that the patented technology is featured as part of the Department of Energy’s ARPA-E project and has been tested with several operators, including ones in the Permian Basin and North Dakota.

Economic Considerations

Whether they focus on storage tanks, flares or other equipment, Stringer says permanent monitoring systems can deliver rapid returns. “On many sites, a single leak detection and repair (LDAR) survey with handheld optical gas imaging cameras costs as much as monitoring a site 24 hours a day, seven days a week for a month,” he calculates.

Over time, regulations tend to call for more frequent emissions surveys, such as LDAR surveys, audio, visual and olfactory inspections, or Method 22 visual observations. As that occurs and the industry gets better at using emissions data to optimize equipment, Stringer says the economic case for continuous monitoring will grow even stronger. Citing deployments across the United States, including the Permian, Eagle Ford, Haynesville, Bakken and Marcellus/Utica, he says payback frequently only takes months and sometimes occurs in weeks.

In some cases, a single event can pay for the technology, Stringer relates. “Imagine that an operator has a leak large enough to qualify as a super-emitter under EPA’s new methane rule. Without continuous monitoring, the leak will take longer to detect, and the operator may have to assume that it began shortly after the last LDAR survey, which could be months ago,” he relates.

“With our system, they can spot that leak within minutes, dispatch someone to the site to fix it, prove that it has been fixed, and show exactly how long it lasted,” he contrasts. “The speed and precision can cut the fine from $54,600 to $75.”

Stripper Well Monitor

Because stripper wells’ production tends to fall short of justifying investments in sophisticated SCADA systems, pumpers generally need to check them manually rather than using remote monitoring, reflects Randy Krall, the founder of Telemetry Insight. To trim the cost of remote monitoring, he says the company has developed sensors that, at costs below $2 a day, can tell whether a pumpjack is running.

“With our sensors, pumpers or field supervisors get daily reports every morning that sort the wells they oversee by how long they have been down, with the ones that have been down the longest at the top of the list,” Krall describes. “The goal is to let pumpers know where they need to go first so they can optimize their time instead of driving around to look for issues.”

In addition to producing daily reports, Krall says the cloud-based software that interprets the sensors’ data can graph each pumpjack’s strokes per minute, as well as when it stopped and started.Krall estimates that traditional remote monitoring systems, which can require thousands of dollars in hardware and software, increase production 2%-5%. “If they can achieve even a fraction of that production gain at $2 a day, our customers will see a strong return on investment,” he says. “From anecdotes, we know some customers are saving thousands of dollars by catching events they otherwise would not know about.”

According to Krall, the monitoring system is affordable because it combines low-cost components in a novel way. “For example, we use accelerometers, the devices that allow phones and tablets to tell whether they are being held vertically or horizontally. They once cost thousands of dollars, but are now almost disposable,” he says. “By sampling readings from them at high speeds, sending that information to the cloud, and analyzing it with a neural network, we can determine how the pump is moving.”

Installation is so simple that customers do it themselves, Krall adds. “The monitor attaches to the top of the bridle with a magnet, so all the customer needs to do is shut the pump off, climb the pumpjack to stick it on, and turn the pump back on,” he says. “Once that is done, we activate the monitor remotely.”

Noting that they are made in Albuquerque, N.M., Krall says the monitors have been built for the oil field. In demonstrations, they keep working even after being run over by a backhoe or dropped 20 feet to simulate a fall from a pumpjack.

With a solar-powered device that costs less than $2 a day, stripper well operators can count each pumpjack’s strokes and determine which ones are no longer running. According to Telemetry Insight, this information helps pumpers prioritize sites that need attention.

The solar-powered devices can shut down if panels get covered in dust or if the area experiences a particularly lengthy stretch of cloudy days, Krall notes. “In one of the few cases where we have had a monitor stop reporting, it was on an unusually short pumpjack where two dirt roads intersected. As trucks drove by, they would kick dust onto the solar panel. Eventually, it built up enough to keep the solar panel from working. All we had to fix that was wipe off the dust.”

As of early January, Krall says Telemetry Insight has deployed several hundred monitors across seven states: California, Utah, New Mexico, Texas, Oklahoma, Nebraska and Kansas. “We are growing partly because the sensors are so affordable and easy to deploy that we can send companies several to try for 30 days without taking much risk,” he comments.

Krall says Telemetry Insight plans to offer versions of the monitor that mirror pump-off controllers’ capabilities. “Many of our customers will be happy with merely watching the pump, but others will want pump-off detection and other control capabilities,” he says. “The constant optimizations such control allows can save thousands of dollars a year in lost revenue and unnecessary costs.”

Robust Gas Lift Valve

In the Eagle Ford and Bakken, gas lift valves must endure high temperatures, elastomer-degrading gases, and the pressures and debris from offset hydraulic fracturing operations, observes Daniel Murski, regional operations manager for the Eagle Ford within Liberty Lift Solutions LLC’s gas lift division.

“Heat, gases such as carbon dioxide and hydrogen sulfide, and frac activity work numbers on valves,” he says. “Some valves will last months or years, but we have seen cases where operators pull a well and replace valves only to have a new one fail in days or weeks.”

Murski warns that valve anomalies can be costly. “When the valve’s elastomer seal gets damaged and pressure intrusion or pressure loss occurs, it can affect the internal set pressure of that valve, which in turn affects the gas lift system,” he says. “Understanding what is happening can require troubleshooting, a lot of field time, and potentially a workover, which increases lease operating expenses as well as overall capital expenditure.”

To minimize such costs, operators and service companies have begun analyzing damaged valves more thoroughly. According to Murski, valve teardown reports frequently suggest that failure is primarily attributable to inadequate protection in the valve’s tail and insufficient tolerance for seal failure.

“In a traditional valve, the tail plug arrangement has gaps or voids that expose the primary sealing elastomer to the environment and that may fail to contain the pressure loss resulting from a seal failure,” he says. “As soon as the valve enters the wellbore fluid, the seal is in constant contact with heat, chlorides and gases that may cause seal issues eventually.”

To prevent or at least delay those issues, Liberty has introduced a new valve for challenging environments that adds redundant protection and is designed to limit pressure drops resulting from seal failure.

To address major causes of gas lift valve failure in the Eagle Ford and Bakken, Liberty Lift Solutions LLC has developed a valve (right) that includes a more robust tail plug assembly than a traditional injection pressure operated valve (left). Liberty says the new tail plug includes redundant barriers to protect the seal, and is engineered to minimize the consequences of any seal failures that still occur.

“A traditional tail plug relies on two components to prevent pressure loss or intrusion—a copper crush gasket and a single elastomer—and is not engineered to be tolerant of seal failures to the fullest extent,” Murski says. “With our new valve, we have a copper crush gasket, another O-ring on a primary plug and two more elastomers that are incorporated to the exterior with encapsulation. We also include a metal-to-metal backup seal for the encapsulation cap. Essentially, we are going from two barriers to six. More fundamentally, we have engineered the valve to limit the pressure loss or gain resulting from a barrier failure.”

In lab tests, the extra barriers and pressure barrier interfaces have made a huge difference, Murski reports. “Through a third-party lab, we ran a test comparing conventional injection-pressure operated (IPO) valves to our more robust design. The test involved placing the valves in large chambers filled with hydraulic oil and subjecting the valves to 5,000 psi of pressure and 325 degrees F for 13 hours,” he details. “The IPO valves had several issues with pressure loss, pressure gain and extreme damage to some of the elastomers. The new valve had no intrusion or extrusion of pressure, and the elastomers were in great shape.”

These results make Liberty confident its new valve will last longer, Murski says. As of early January, the company has more than 1,200 units in the field. “The largest operators who are using the valves have not reported any issues with the valves coming back prematurely,” he relates.

Adoption of the patent-pending valve seems to be accelerating, says Logan Evans, Liberty Lift’s vice president of operations. “In almost 10 years at Liberty, I have never seen a technology take off so fast,” he remarks. “The robust valve is gaining popularity so quickly because it is fully compatible with traditional gas lift systems and provides markedly better performance. Outside the re-engineered tail plug assembly, it’s like a traditional valve, so operators see little risk in trying it.”

Murski predicts the valve will pay for itself quickly. “For the benefits we expect to see, the cost to the customer is negligible,” he reports.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.