EIA Nudges Crude Price Predictions Upward

WASHINGTON—Scarce wiggle room in the global crude market will push oil prices higher than previously anticipated this year, predicts the U.S. Energy Information Administration’s March Short Term Energy Outlook. If global tensions remain high, the market’s tautness could persist in 2025.

EIA observes that February’s average Brent crude oil spot price of $83 a barrel was $3/bbl higher than the average January price. The agency attributes some of that increase to geopolitical dynamics, including Middle Eastern tumult and expectations that OPEC-plus would maintain its existing production levels.

“Prices rose in February in part due to continuing uncertainty and increased risk around the attacks targeting commercial ships transiting the Red Sea shipping channel, as well as an anticipated extension to voluntary OPEC-plus production cuts, which were officially announced on March 4,” EIA relates. “The OPEC-plus voluntary production cuts are an extension of the existing production cuts that were announced on Nov. 30, and are now extended through the second quarter of 2024. The announcement also included an additional voluntary production cut from Russia.”

Those output limitations—which include both officially stated production targets and additional voluntary cuts pledged by some participants—are likely to translate into tight near-term global oil supplies, the agency suggests, especially in 2Q24. That probable tightness, it acknowledges, calls for revising the predictions in its February STEO.

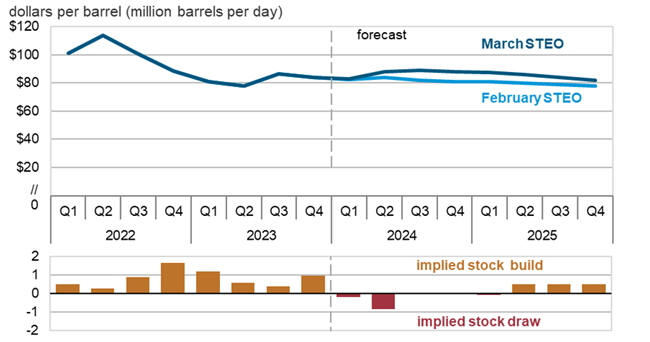

“Although our previous forecast had assumed that some of the OPEC-plus members would maintain some voluntary cuts through 2Q24 in an effort to balance markets, this new announcement pledges the continuation of cuts for all of the members through the first half of 2024,” EIA says. “Because some OPEC-plus members are extending these voluntary production cuts and because Russia added new voluntary production cuts, we now expect oil markets to be much tighter in 2Q24 than we previously expected. We forecast global oil inventories will fall by 900,000 bbl/d in 2Q24; last month, we had expected inventories to remain relatively unchanged in 2Q24.” (Figure 1)

FIGURE 1

Brent Crude Oil Spot Price and Global Inventory Changes

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook, March 2024

In light of the lower inventory levels, EIA indicates it has revised its price expectations upward for the coming months. Instead of the $84/bbl estimate for 2Q24 that February’s STEO foresaw, EIA now estimates the quarter’s Brent prices will average $88/bbl. After that, it suggests, prices will remain relatively flat for the duration of 2024 before OPEC-plus supply cuts expire at year’s end and begin to nudge crude prices lower. Ultimately, the agency forecasts, the average price will slip to $85/bbl in 2025.

World events may cloud these contingencies, EIA notes. “Our forecast of global oil balances and their impact on our crude oil price forecast remain significantly uncertain,” EIA reflects. “Although no oil production has been lost because of the attacks on commercial shipping traveling through the Red Sea, production could still be disrupted or some oil production in the Middle East could be shut in, which would likely cause oil prices to increase.

“It also remains to be seen how strictly the latest round of voluntary OPEC-plus production cuts are adhered to, which has the potential to add additional oil supplies back on the market and lessen the expected tightness in near-term oil balances and the corresponding upward pressure on oil prices,” EIA adds. “In addition, we forecast global oil demand to grow by 1.4 million bbl/d in both 2024 and 2025. Higher or lower demand growth would affect global inventory levels and oil prices.”

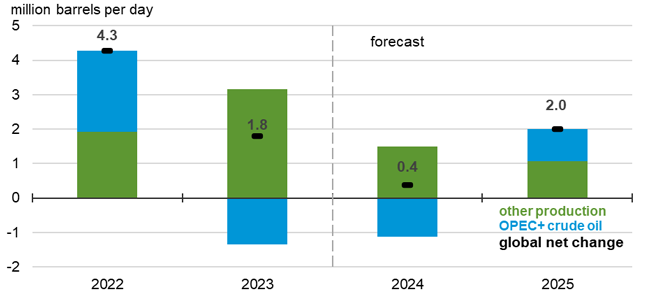

Global Oil Output

After OPEC-plus incorporates the new voluntary output cuts, EIA predicts global liquid fuels production will climb by 400,000 bbl/d in 2024, down from growth of 600,000 bbl/d in the February STEO and down from an increase of 1.8 MMbbl/d in 2023.

FIGURE 2

Global Liquid Fuels Production Growth

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook, March 2024

Much of the new supply, the agency says, will originate in the Western Hemisphere. “Although OPEC-plus production cuts limit overall growth in 2024, production outside of OPEC-plus grows by 1.5 MMbbl/d, driven primarily by four countries in the Americas—the United States, Guyana, Brazil and Canada,” it says. “This growth counteracts the decline in crude oil product subject to the OPEC-plus agreement, which falls by 1.1 MMbbl/d in 2024.”

Assuming OPEC-plus turns the taps back on next year, EIA says, global crude supplies will grow considerably. “Global liquids fuel production increases by 2.0 MMbbl/d in 2025 in our forecast, driven by an increase in OPEC-plus crude oil production of 900,000 million bbl/d as existing OPEC-plus production targets expire at the end of 2024, while production that is not subject to the OPEC-plus agreement increases by an additional 1.1 MMbbl/d,” the agency details (Figure 2).

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.