Natural Gas Prices Should Be Upward Bound

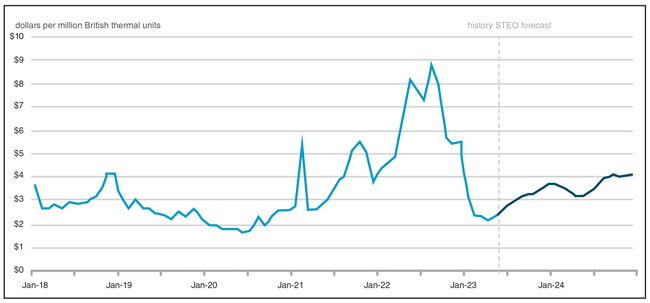

The U.S. Energy Information Administration is predicting the U.S. benchmark Henry Hub natural gas spot price will increase throughout 2023. Although April’s Henry Hub price averaged $2.16 per million British thermal units, EIA forecasts it will rise more than a dollar and a half by year’s end.

“We expect the monthly average Henry Hub price to reach 3.71/MMBtu in December,” EIA says.

That recovery may well be particularly welcome for natural gas producers, with EIA noting that even improvements throughout the rest of 2023 appear unlikely to approach the preceding year’s going rates. The agency points to its May Short-Term Energy Outlook to illustrate the contrast, saying, “Forecast prices throughout the rest of the year remain much lower compared with last year, averaging $2.91/MMBtu for the year, a more than 50% decline from the 2022 average price of $6.42/MMBtu” (Figure 1).

FIGURE 1

Monthly U.S. Benchmark Henry Hub Natural Gas Spot Price (Jan 2018 - Dec 2024)

Source: U.S. Energy Information Administration, Short-Term Energy Outlook

EIA attributes that to the combination of a relatively restrained heating season consumption and robust output from U.S. operators. “The Henry Hub spot price declined throughout the 2022-2023 winter due to mild temperatures in much of the Lower 48 states that reduced demand for natural gas for heating and resulted in less-than-average natural gas withdrawals from storage,” it says. “U.S. dry natural gas production grew during this period, reaching a monthly average record in February 2023 of 101.5 billion cubic feet per day.”

Therefore, the agency continues, spring gas storage inventories were exceptionally strong. At the end of April, the 2.114 trillion cubic feet of gas in U.S. storage was 19% above the previous five-year (2018–2022) average. It predicts the country’s gas storage inventories will continue to exceed their five-year averages throughout 2023.

Nevertheless, EIA says it foresees a bullish direction for natural gas prices. “Although we expect the Henry Hub price to average less than $4.00/MMBtu in 2023, we forecast natural gas prices will increase from their recent lows of close to $2.00/MMBtu as demand for natural gas increases,” it says. “We forecast that natural gas consumed for U.S. electricity generation this summer (May–September) will average 38 Bcf/d, the second most on record behind last year.

“We also expect U.S. liquefied natural gas LNG exports to increase from the first-quarter average of 11.6 Bcf/d to 12.2 Bcf/d this summer,” EIA continues. “We forecast U.S. dry natural gas production to decline from recent highs to average 100.4 Bcf/d this summer.”

Under those trends, it projects, gas market fundamentals are poised to tighten. “Because of the increased demand and reduced production, we expect less natural gas to be injected into U.S. storage this summer, resulting in natural gas storage inventories that are closer to the five-year average,” EIA concludes. “We expect inventories to end the injection season (April 1-Oct. 31) 4% higher than the five-year average, at 3.762 Tcf.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.