Natural Gas Taking Off In Power Sector

By Gregory DL Morris, Special Correspondent

As part of $970 million modernization project, a 1,250-megawatt natural gas-fired turbine is expected to begin service in early June for Florida Power & Light at an electric generating complex near Cape Canaveral on the Sunshine State’s historical Space Coast. With a new era of plentiful natural gas supplies unlocked by the “rocket science” of horizontal drilling and multistage completion technology in unconventional resource plays, it seems fitting that the final countdown to launching one of the nation’s newest and largest power plants is being undertaken practically in the shadows of NASA’s Kennedy Space Center.

Described by Florida Power & Light as a “next-generation clean energy center,” the combined-cycle turbine will generate enough electricity to power 250,000 homes and businesses. According to FPL, the gas-fired plant will improve air quality by significantly reducing particulate emissions and slashing carbon dioxide emissions by 50 percent (the equivalent of removing 46,000 cars from the road each year over the plant’s life, the company says), while at the same time using 33 percent less fuel per megawatt of power generated.

FPL–Florida’s largest electric utility–reports that the Cape Canaveral project is the first of three scheduled upgrades to older facilities that will install massive gas-fired turbines. Work on FPL’s second project, a $1.3 billion gas-fired facility in Palm Beach County, Fl., was initiated last year, while construction of a third plant near Fort Lauderdale is scheduled to commence in 2014.

Nine hundred miles north of Cape Canaveral, Dominion Virginia Power is constructing the 1,329-megawatt Warren County Power Station in northern Virginia, west of Washington at the head of the Shenandoah Valley. Powered solely by natural gas, Dominion says the facility will be among the cleanest in the nation, while also saving customers more than $100 million in aggregate fuel costs in its first year of operation alone.

The plant’s three combustion turbines and one steam turbine are capable of providing power to 325,000 residential users at peak demand. When commercial operation begins in late 2014, Dominion says it will close its North Branch coal-fired power plant in West Virginia.

Dominion Virginia Power’s newest facility is a 1,329-megawatt plant in Warren County, Va., and has natural gas-powered turbines capable of providing power for 325,000 residential users at peak demand. When the Warren County Power Station begins commercial operations next year, the company will close its North Branch coal-fired plant across the state line in West Virginia.

The Florida and Virginia plants are prime examples of the capital investments utilities are making in natural gas-fired electric generation capacity. Power generators say natural gas’s economic and operational efficiencies are highly persuasive, but gas-fired generation also is demonstrating compelling environmental benefits. A case in point is a report from the U.S. Energy Information Administration that documents CO2 emissions related to U.S. energy usage declined to their lowest level in two decades during the first quarter of 2012, thanks largely to cleaner-burning natural gas displacing coal in the power sector.

Switching To Natural Gas

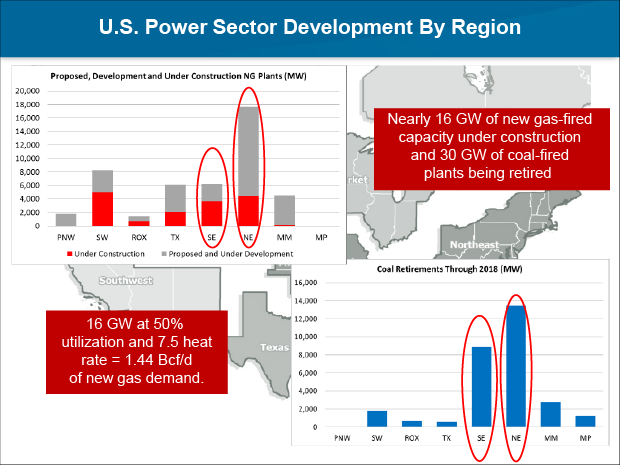

BENTEK Energy predicts that the population-heavy Northeast and Southeast will be the regions where the most coal-fired capacity is retired and eventually replaced with gas-fired plants, relates Anthony Sweet, senior energy analyst at the firm. Specifically, there are 4,000-5,000 megawatts of new gas-fired generation under construction in the Southeast, Northeast and Southwest United States, but more than 10,000 megawatts of generation is proposed or planned in the Northeast region alone, according to BENTEK’s analysis.

“States in the Northeast are retiring more than 13,000 megawatts of coal-fired generation through 2018, so much of the almost 18,000 megawatts of planned gas-fired capacity is expected to be completed,” Sweet says.

In contrast, the Southeast is retiring 9,000 megawatts in coal-fired generation through 2018, but only 6,000 megawatts of new gas-fired power has been proposed to date. “That potential shortfall puts the emphasis on the Southeast as new projects are announced,” Sweet remarks.

BENTEK estimates that nearly 16 gigawatts of new gas-fired capacity is under construction nationwide, but says 30 gigawatts of coal-fired plant capacity is expected to be retired over the next five years (Figure 1). Assuming 50 percent utilization and a 7.5 heat rate, that 16 gigawatts of capacity will add 1.44 billion cubic feet a day in new gas demand, according to Sweet.

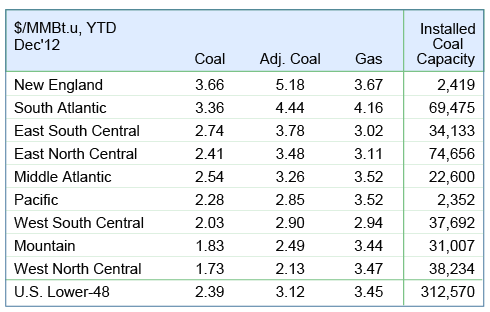

Natural gas clearly is playing a growing role as a fuel source in the power sector, but Teri Viswanath, director of commodity strategy at BNP Paribas, says new generating capacity will not consume natural gas automatically, particularly in the Southeast, where the delivered price for natural gas is similar to coal on a Btu-normalized basis.

“Gas is in a ‘Goldilocks’ moment for these huge combined-cycle generating units,” she says. “Over the past several years, we have seen gas leap over coal in percentage of power generation. A large part of that was price, but also new environmental regulations on coal-fired plants, as well as the advanced age of some of the coal fleet.”

According to Viswanath, plant operations data indicate utilities are paying anywhere between $1.50 and $6.50 an MMBtu for delivered coal. That wide dispersion (Figure 2) suggests gas prices would have to rise significantly to shift a sufficient amount of load back to coal, she calculates. Using cost as the only input in the fuel switching decision, plotting delivered coal prices against plant capacity levels suggests about two-thirds of the installed coal capacity could theoretically operate at a profit at a fuel price of $4.00 an MMBtu.

“Of course, fuel cost is only one factor to consider when deciding which fuel to burn, albeit an important one,” Viswanath comments. “But this year is proving to be somewhat of a bump in that road, as we expected. Gas’s share of power generation peaked in July 2012 at 33 percent, and then declined to 25 percent by December and January. Some of that relative change is a normal seasonal fluctuation, but we are seeing the year-over-year contribution percentage of gas start to slide. We are anticipating increased percentage losses through 2013.”

Still, gas producers should not get too upset, Viswanath asserts. Today’s gas price environment of $4.00-$4.50 an MMBtu still affords a competitive advantage for operating gas-fired combined-cycle plants, she notes, stating, “We expect electric-power gas demand to remain relatively well supported through 2015.”

Demand Up In All Sectors

More importantly, Viswanath stresses, “From 2015 to 2020, there is not a single gas-consuming sector that is not expected to increase demand. That is not only power generation, but also industrial and even residential demand.”

She points out that the rock-bottom gas prices that began after the 2008-09 recession occurred at a moment when natural gas was able to sweep up all the fuel-switching conversions that were easy to make.

However, for the coming two or three years, Viswanath says there is a “bricks-and-mortar” limitation on further switching. “Coal will recover some, especially in regions where it can be delivered inexpensively, but the long-term trend is very clear,” she comments. “About one-third of existing coal-fired power plants are not able to comply with new environmental regulations. As much as 50 gigawatts of coal-fired capacity will be retired early across the country.”

BENTEK’s Sweet concurs. “Last year was a big one for natural gas, but this year is not as big,” he says. “Prices are up, storage has emptied somewhat, and the gas burn for generation is lower. But it is still stronger than it was in 2011.

“We did not expect coal demand to simply fall off the table,” Sweet continues. “Coal actually has several competitive advantages, aside from price. But even within price, you have to remember that a gas plant runs 25 percent more efficiently than a coal plant, and that factor is headed toward 33 percent. Emissions are a big deal, but the coal industry is working to deal with that. Price remains the primary factor in fuel decisions.”

Each generating station has its own inflection point for fuel, but Sweet says there is no meaningful aggregate industry number that gas producers should keep in mind as they make projections for demand from the power sector.

“Price points vary by region,” he explains. “Central and northern Appalachian coal is the most expensive, and that is where gas will compete most aggressively. Coal from the Powder River Basin is the most economical, so in general, coal gets more competitive as you move west. The Southeast and the Northeast are where gas has the best advantage, followed by the Midwest. For the most part, for gas to be competitive in the West, it has to reach a very low price point.”

As a rough gauge, Sweet says that because of its thermal efficiency advantage, natural gas is competitive at $4.00 an MMBtu, delivered, versus coal at $3.00 an MMBtu. “You also have to bear in mind the variability in cost of production to the gas supplier,” he adds. “Even with the decline in premiums for natural gas liquids, it is easier for methane from wet-gas or associated-gas fields to be competitive with even low-priced coal because producers get the gain on the liquids.”

Sweet also observes that a significant amount of NGL and liquefied petroleum gas export capacity is scheduled to come into service soon along the Gulf and East coasts, which should help the liquids market recover, which in turn, should fortify the economics of “associated” methane.

Long-Term Trends

Looking across the economic cycles among all energy consuming segments of the economy, Skip Horvath, president of the Natural Gas Supply Association, predicts there will be some “nip and tuck” between coal and gas for favor in power generation over the next few years. Similarly, he says he anticipates demand in the power generation and industrial markets to alternate as the biggest end-use sectors for natural gas.

“It was no surprise that the power sector became the largest customer (for natural gas) last year,” he states. “The industrial sector had been the largest to that point, and we see more growth in both looking to the end of the decade. In power, the environmental regulations simply do not favor coal. Some coal generating capacity will be shut permanently, and some will be idled at least temporarily.”

In the nearer term, however, Horvath says he sees a temporary leveling in demand growth for gas in the electricity sector until more gas-fired plants come on line. “We saw that noticeable bump in demand through last year. We likely will not see that again until 2015 through 2018,” he surmises. “That is because it takes about three years for a power plant to be built, and that is after all the planning and permitting. The plants that were planned last year will start to come into service during that time frame. So this year will be flat to even a little down, but you cannot take that as a trend. It is the calm before the storm, or a short-term price signal. In the longer term, things will sort themselves out and gas demand in power generation will continue to increase.”

Louis D’Amico, president of the Pennsylvania Independent Oil & Gas Association, says he sees confirmation of that long-term growth trend every day. “I am working with one member company now on a request for a proposal from a power utility for a long-term gas supply contract,” he revealed in April.

It was not the first long-term contractual agreement for a PIOGA member company, and D’Amico says it will not be the last. He says producing members are happy to provide molecules to utilities under whatever terms the buyers prefer. “Our producers love the security of a long-term contract, and I am sure that some users would like that security of supply as well, but I do not know that a supplier would want to lock in a supply commitment at today’s prices,” remarks D’Amico.

“Our members are willing to sell on a spot basis, or short- or long-term contract–whatever the buyer needs–as long as the price is fair,” he adds. “Clearly, there is and will continue to be growing demand for natural gas in the power sector and other markets. Price is part of that equation, but environmental standards are a big part of the picture also. They make it very tough for some coal-fired plants to operate.”

There are several large, new gas-fired generating stations being considered for central Pennsylvania in what has become the Marcellus Shale fairway, but that for more than a century has been known as coal country, D’Amico observes.

Powering Pennsylvania

In fact, Pennsylvania is an interesting case study for the merits of gas-fired electricity generation, both because of its historical role as one of the nation’s top coal-producing states (and the only state that produces anthracite coal, preferred in power generation because of its higher heat value), but also because it ranks behind only Illinois in the amount of power generated from nuclear plants (the first commercial nuclear power plant in the United States commenced operation in the late 1950s in Beaver County, Pa.).

For more than 30 years, coal and nuclear dominated Pennsylvania’s electricity generation fleet, but that is changing rapidly. Ten years ago, coal accounted for 56 percent of the commonwealth’s total power generation market, with nuclear accounting for 36 percent and natural gas holding only 3 percent of market share, according to the U.S. Energy Information Administration. In the first half of 2012, gas-fired electric generation provided 25 percent of the total, with coal declining to 38 percent and nuclear to 35 percent.

And significant new gas-fired capacity is on the way. In central and southwestern Pennsylvania alone, at least nine new gas plants are scheduled for construction over the next few years to replace a dozen or more retired coal plants, according to industry reports. Omaha, Ne.-based Tenaska, with a regional office near Pittsburgh, reports planning two of those new units: a 950-megawatt gas-fired power plant in Lebanon County, east of Harrisburg, and a 930-megawatt facility in Westmoreland County, east of Pittsburgh.

“In Westmoreland County, we are getting everything in place,” says David Fiorelli, Tenaska’s president of development. “That includes control of land and easements for gas pipeline interconnections, as well as power transmission, water permits and approvals to interconnect with the transmission system operated by the regional independent system operator.”

Fiorelli says Tenaska hopes to start construction on at least one of the two plants by the end of this year or early next. “They could be built simultaneously, or one after the other,” he adds. “We plan our projects to have as long a shelf life as possible because we have to be certain of market conditions, so we may have to wait a year or two to start.”

He says he is not surprised that power generation has become the largest consuming sector for natural gas. “Just look at the burn compared to coal in 2012. That was very much driven by price, but also it must be remembered that industrial demand has not yet fully recovered from the recession,” Fiorelli reminds.

Tenaska, itself, is responsible for a considerable chunk of that growing gas burn in power generation, having built a total of 9,000 megawatts of “green field” capacity across the country, according to Fiorelli. “We have been building natural gas-fired power plants for 26 years; it is our core business,” he says. “There have been some lean years, but with the renaissance created by shale gas, the general view in the industry now is that gas supply is sustainable. We also like the environmental advantages gas provides.”

On pricing, the consensus among buyers is that gas in the range of $4-$5 an MMBtu is competitive for current plants, Fiorelli goes on. “The bigger question is where new generation is going to be built,” he offers. “When we talk long term, we mean a plant operating life of 30 years or more. So that is how far into the future we have to bet. Shale gas has made that calculation very different from what it was five or six years ago. Supply is no longer a great unknown.”

Burning A Lot Of Gas

Joe Nipper, senior vice president for government relations at the American Public Power Association, which represents more than 2,000 publicly owned utilities around the country, says, “We are pretty well synched with the idea that gas supply will be plentiful well into the future. What we do not know for sure is how affordable that supply will be.”

In buying fuel, he acknowledges that his association’s members have seen one extreme after another over the past decade. “The volatility has been difficult to deal with,” Nipper comments. “Recently, prices have been very low, but we do not expect that to last. We do not know how much prices will rise, but we do know we will be burning a lot of gas.”

Looking at the viability of coal versus natural gas plants, Nipper states, “Frankly, new coal-fired power is out of the question at this point. The only coal question is how many plants in the coal-fired fleet can continue to operate, given environmental requirements. Their operators are in the initial stages of evaluating whether they will retrofit or replace them. Lower gas prices have been very seductive in terms of planning new plants, but each operator will make his own decisions, based on individual factors for each station.”

Beyond the primary economic and emissions drivers, Nipper points to another regulatory trend that favors new gas-fired power: mandates on renewable energy capacity. “About half of the states have renewal energy mandates–mostly wind power, but some also have solar and hydro requirements. But the sun does not always shine and the wind does not always blow, so power companies need backup power, which invariably is gas-fired turbines.”

As with producers of natural gas, Nipper says his association’s members seek a fair price that is reasonable for both buyers and sellers of natural gas. With that in mind, he says electric power companies are hopeful that gas prices stay below $6-$7 an MMBtu. “We know the price is not going stay where it was last year or even where it is today, but we do not want to see it increase too much or too quickly.”

Editor's Note: Website photo courtesy of Siemens Power.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.