New Technology Allows Mid-Continent’s Operators To Capture New Reserves

By Al Pickett, Special Correspondent

Bob Murdock calls the Mississippian formation “perhaps the most prolific hydrocarbon-producing rock in North America.”

Murdock is president of Hutchinson, Ks.,-based Osage Resources LLC, one of dozens of independent companies targeting the expansive Mississippian Lime play across Oklahoma and Kansas. The region has a long history in oil and gas production, dating to the early years of the previous century. That development led to the formation of Phillips Petroleum Co. and Continental Oil Co. in Bartlesville and Ponca City, Ok., respectively.

Now, some 90 years later, the Mid-Continent is enjoying a renaissance as operators are finding success again, only this time with horizontal drilling and multistage hydraulic fracturing projects in areas that have seen thousands of vertical wells drilled.

“I drilled 200 wells in the Mississippian Lime in the 1980s. Who knew we were drilling in the wrong direction?” quips Steve Antry, chief executive officer of Tulsa’s Eagle Energy Co.

The move to horizontal drilling and multistage fracturing has reinvigorated not only the Mississippian Lime, but also the Granite Wash and Woodford Shale plays. This comes as no surprise to Rick Bott, president and chief operating officer of Continental Resources Inc.

Referring to the Woodford, he says, “We are applying precision horizontal drilling and multistage stimulation to reservoirs that everyone knew were there,” he says. “These rocks were too tight or didn’t have the porosity to be economic. But using made-in-America technology, we are starting to unlock the value held in these reservoirs. We have brought an entrepreneurial solution to unlock the immobile phase of the hydrocarbons. With our manufacturing mindset driving down costs, we have turned source rocks into reservoirs to produce oil that otherwise would have been left behind. It is a renaissance driven by technology and innovation.”

Mathewt Grubb, president and chief operating officer of Oklahoma City-based SandRidge Energy Inc., agrees.

“It is one of the best plays in North America,” he says of the Mississippian Lime. “It is half oil, and there is low reservoir risk and low-cost structure. It is a classic story of applying new technology to capture more reserves.”

Lower Drilling Costs

Although the wells don’t seem to be producing the results matching the prolific Bakken Shale play in North Dakota, the Mississippian oil play is attracting increased interest because of its potential size and lower drilling costs, says Paul O’Donnell, energy equity analyst at business information and analytics provider IHS.

The Mississippian oil play spans more than 17 million acres, from northern Oklahoma through western Kansas and into southern Nebraska.

“This is a shallow carbonate play, with depths ranging from 3,000 to 6,000 feet,” says O’Donnell, the author of the IHS Herold Mississippian Oil Play Regional Play Assessment. “Since it is shallower than other U.S. conventional plays, operators can employ less expensive, lower horsepower rigs to drill it.”

He says costs range from $2.9 million to $3.5 million to drill and complete wells in the Mississippian Lime compared with $8.0 million-$11.0 million in other unconventional plays.

Production numbers are improving, too, O’Donnell point out, as companies become more experienced in the play. He says several companies reported 30-day initial production rates of more than 1,000 barrels of oil equivalent a day. He adds estimated ultimate recovery rates for most Mississippian oil wells range from 300,000 to 500,000 boe, although one company has reported an EUR of more than 600,000 boe.

O’Donnell, who calls the Woodford Shale the “source rock” for the Mississippian Lime, says there is not a clear trend yet as to what state or area eventually will be called the “sweet spot” in the play. “Results vary greatly in each state,” he adds, noting the play is “sizeable enough to have significant impact on a number of companies.”

Leader of the Pack

SandRidge, which has 1.7 million acres in its Mississippian Lime leasehold stretching more than 300 miles from northwestern Oklahoma to northwestern Kansas, was one of the first companies to jump into the play, and it remains an industry leader. As of mid-2012, there had been 872 horizontal wells drilled in the Mississippian Lime, and Grubb says SandRidge drilled 392 of them.

“We are a 6-year-old company,” he comments. “We drilled our first vertical well in the Mississippian Lime in the fall of 2007, and our first horizontal well in late 2009. We will drill 380 wells in 2012.”

Grubb says three things make it such an attractive play: the Mississippian Lime’s expansiveness, its relatively shallow depth and the formation’s track record. He notes that there have been 15,000 vertical Mississippian wells drilled, so “we are very familiar with the play. We have a high confidence level that the reservoir is present across our acreage position, thus minimizing drilling risk.”

The typical length of Eagle Energy’s Mississippian Lime laterals is 3,500 feet, but the company says some of its laterals stretch 6,000 feet, with eight fracture stages the norm. The company has drilled 60 wells and has identified another 600 locations in Oklahoma.

Low cost makes the play even more economic, Grubb says.

“In a lot of plays, the acreage cost is high,” he states. “In the Mississippian, we leaped into large position for less than $200 an acre. The wells are only 5,000 to 6,000 feet vertical depth, and laterals average 4,000 to 4,500 feet. Cost correlates to depth.”

SandRidge lists the EUR of its Mississippian Lime wells to be 456 million barrels of oil equivalent, which translates to about 204,000 barrels of crude oil and 1.5 billion cubic feet of natural gas for each well. This is about 45 percent crude oil in the production mix. Grubb says 30-day IP rates average 275 boe/d.

“We haven’t necessarily identified a sweet spot,” he continues. “We are making good wells over a large area. That is the beauty of this play, which creates long-term value. It is the growth engine for our company.”

Grubb adds another key is that economic saltwater disposal in the Arbuckle formation is easily accessible, giving the company a 75 to 80 percent rate of return.

“We have taken the lead in building infrastructure to handle produced water,” he says. “We have drilled a lot of water disposal wells. We now have one disposal well for every five producers. But when we get into full development mode, it will drop to one disposal well for every 10 producers.”

Mississippian Newcomer

Tug Hill Operating, a privately held independent oil and gas exploration and production company that is a division of Fort Worth-based Tug Hill, may be a newcomer to the Mississippian Lime play, but it has gotten involved in a big way.

Originally active in the Marcellus Shale gas play in Pennsylvania, Michael Radler, president and chief executive officer of Tug Hill, says he wanted to get into an oil-rich play and decided to jump into the Mississippian Lime.

“We were really attracted to the low drilling and completion costs of the Mississippian Lime,” he states. “The beauty of the Mississippian Lime is it is a very mature oil field. There have been more than 17,000 wells drilled through the Mississippian Lime in Kansas and Oklahoma. There is a lot of data and history to understand. The Mississippian Lime has produced more than 1 billion barrels. It is a big field. It is a carbonate reservoir, and the largest fields in the world are carbonate reservoirs. This is an old, mature basin that still retains a lot of potential.”

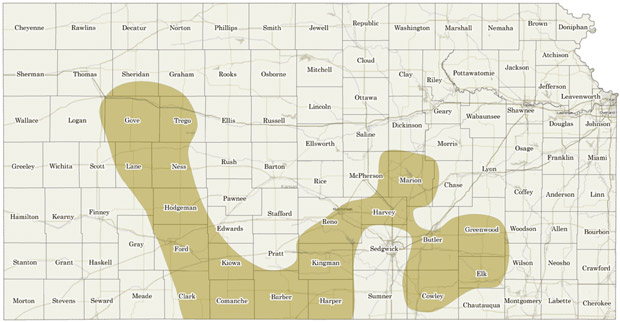

In early 2010, a consortium of partners led by Tug Hill began acquiring Kansas leases under the names of Cheyenne Exploration and Tug Hill Kansas. To date, Tug Hill Operating reports it has acquired more than 800,000 net acres over 26 counties targeting the Mississippian Lime formation, making it the third-largest leaseholder in the play. Its acreage begins across four South-Central Kansas counties near the Kansas/Oklahoma border and extends both northwest and northeast (Figure 1).

Much of the acreage encompasses the Central Kansas Uplift, where Radler says “the reservoir has defined itself around the perimeter. Eventually, it pinches out to nothing,” he explains. “Shale was laid over the top as a trapping mechanism. It pinches out as it comes up, but it extends miles and miles into the deeper basins. It is a big area.”

Chief Capital, BP Capital, Providence Energy Corp. and ARAD Energy are partners with Tug Hill in the project, with Tug Hill serving as the operator. Radler says the Mississippian Lime wells are 50 percent oil and 50 percent gas, although that can vary depending on where one is in the play.

Eagle Energy reports it bought its Oklahoma assets intending to target the Hunton Lime, but soon decided the Mississippian Lime, about 1,000 feet above the Hunton, made a more appealing focus.

“One of the reasons we like the play is that it is a mature area for infrastructure,” Radler adds. “There are many gas gathering systems and oil pipelines already in place.”

Tug Hill has two rigs drilling horizontal wells in the play, according to Radler, and it plans to add a vertical rig drilling saltwater disposal wells. The company drilled its first five horizontal wells earlier this year and has plans to end the year with 11 horizontal and nine saltwater disposal wells. Its initial focus is on Comanche and Kiowa counties in southern Kansas.

“Our goal is to drill in areas with the highest potential,” Radler says. “We want to define an area, then park a rig and develop that area. This will be success driven.”

Early Involvement

Murdock says Osage Resources’ entry into the Mississippian Lime came well before there was any serious interest in drilling horizontally on the Kansas side.

“We entered Barber County (Ks.) in 2005 with 20,000 acres,” he recalls. “Over the next three years, we drilled 25 exploratory wells across the leasehold, through the Mississippian and deep into the Arbuckle formation. We completed zones of primary interest, including the Mississippian, and then we observed the production and established a great data set by the time other companies started drilling horizontally in the Mississippian Lime. In 2011, we decided to start drilling horizontal.”

Osage Resources has drilled four successful horizontal wells and is kicking off another four-horizontal-well program that will be completed before the end of 2012, reports Murdock. The company has one rig running in Barber County. He says production numbers in the Mississippian Lime are “highly variable, much like in the vertical wells,” ranging from 100 boe/d to more than 600 boe/d, peak 30-day average.

He adds that Osage’s four initial wells had a 30-day IP average of 80 percent crude oil and natural gas liquids, and the remainder is gas. “Generally, it will be about 50 percent liquids and 50 percent gas, but we have targeted the oily part of the reservoir with our first four wells,” he acknowledges.

Murdock says Osage Resources is drilling 3,500- to 5,000-foot laterals and has done as many as 17 fracture stages as it continues working to determine the best formula for development.

“The most significant thing we did to optimize the fracture design was run microseismic surveys,” he asserts. “We intend to increase our footprint in Barber County. We have 276 drill sites, and we plan to expand that over the next 12 months.”

Accidental Entry

Eagle Energy was one of the early companies following SandRidge into the Mississippian Lime, but Antry says that wasn’t the original plan.

“We bought our original assets for the Hunton Lime in Oklahoma, which is a natural gas play with substantial water movement,” he explains. “Basically, you are dewatering the reservoir, but it is a very prolific play.”

The Mississippian Lime is about 1,000 feet above the Hunton. Seeing the success that SandRidge was having in the Mississippian Lime, Antry says Eagle Energy re-entered one of its lesser-quality Hunton wells in northwestern Oklahoma. Finding success, Antry says his company redirected its focus to the Mississippian Lime.

Eagle Energy now has drilled more than 60 wells and has identified another 600 locations. It has 80,000 acres in Woods and Alfalfa counties in northwestern Oklahoma, as well as another 20,000 acres in just the Hunton play in Lincoln County. He points out that Eagle Energy typically drills 3,500-foot laterals, although it has drilled laterals as long as 6,000 feet in the Mississippian Lime. It normally employs eight fracture stages.

The low cost of drilling in the Mississippian Lime is one of the real attractions of the play, according to Antry, who says wells cost only $3.7 million to drill and complete, including $400,000- $500,000 for the total cost of the fracture treatments, which he says are “basically acid fracs.” He estimates the Mississippian Lime wells have about 500,000 boe EUR each.

In August, however, Eagle Energy agreed to sell all its producing properties and both developed and undeveloped acreage to Midstates Petroleum Co. for $650 million in cash and preferred stock.

“Midstates approached us,” Antry says. “We started talking and then came to terms. We have a 12-month transition service agreement, and will continue to operate the properties for 12 months.”

Antry says the 37 million boe of estimated proved reserves that it sold to Midstates is 63 percent oil and liquids (45 percent crude oil and 18 percent NGLs), with the rest dry gas. The Hunton acreage also was included in the sale. It is 92 percent gas, Antry says, and its wells have 30-day average initial production flow rates “a little north of 700 boe/d.”

Mid-Continent Expansion

In July, Tulsa-based Unit Corp. announced it had acquired oil and natural gas assets from Noble Energy Inc. The $617.1 million cash transaction includes 84,000 net acres primarily in western Oklahoma’s and the Texas Panhandle’s Granite Wash, Cleveland and Marmaton plays.

Larry Pinkston, Unit’s president and chief executive officer, says the acquisition includes 25,000 acres in the Granite Wash as well as 900 oil and gas wells and 44 MMboe of proved reserves located in western Oklahoma and the Texas Panhandle.

“This is an important growth step for Unit, and it represents a unique opportunity that benefits all three of our business segments,” he maintains. “For our upstream business segment, it will more than double our acreage in the Granite Wash/Texas Panhandle core area.”

The Granite Wash offers a “variety of lenses,” says Brad Guidry, Unit’s executive vice president of exploration, in describing the stacked pays that characterize the Granite Wash. He says Unit already had 22,000 acres of Granite Wash acreage in the Texas counties of Hemphill and Roberts, 15 miles northwest of the acreage acquired from Noble.

“We drilled our first horizontal well (in the Granite Wash) in 2008,” he recalls. “We drilled one in 2009, 10 in 2010, and 16 in 2011. This year, we had drilled 17 by midyear, so we are on pace to drill 25 or 30 horizontal wells in 2012.”

He says Unit has drilled and is producing from seven sands, or targets, in the Granite Wash. About 60 percent of the wells that Unit has drilled are in the Granite Wash A and B sands, reports Guidry. He says the rest have targeted the other five sands.

“Our 30-day IP rates in the Granite Wash over the past 18 months have averaged 5.4 MMcfe/d, with an EUR of 4.0 Bcfe a well, which is 50 percent liquids (13-16 percent oil and 34-37 percent NGLs) and 50 percent residue gas,” Guidry points out.

Average drilling costs for Granite Wash wells are $5.5 million. Unit typically is employing 4,500-foot laterals, using 11-13 frac stages, Guidry reports. He says Unit won’t start drilling on its newly acquired acreage until January 2013.

“We plan to have one Unit rig running on the new acreage in January, but by the end of the year we would like to have four to seven Unit rigs on the new acquisition, subject to acceptable commodity prices,” Guidry continues. “We can pick our drilling schedule because most of the acreage is held by production. We had four rigs drilling on our Granite Wash acreage when the year began. We dropped to three by midyear, and we have dropped to two in the fourth quarter, just to get everything lined up for the new year and our new acquisition.”

Marmaton, Cleveland Plays

Unit has been involved in the Marmaton play in Beaver County, Ok., since 2010 and has two rigs running there. Guidry describes the Marmaton as a carbonate reservoir 6,500 feet deep. The average 30-day IP rates have been 300 boe/d, he says, adding Marmaton production is 91 percent liquids (79 percent oil and 12 percent natural gas liquids).

“It is a fractured play,” he offers. “There have been lots of vertical wells drilled in it, but the horizontal wells are much more effective because of the fractured nature of the play.”

Unit has 109,000 net acres in the Marmaton and expects to drill 30-35 wells in 2012. Guidry says the Marmaton wells cost $2.6 million-$2.8 million to drill and complete, and average 130 MMboe EUR.

“In the second quarter, we drilled the first extended laterals in the Marmaton–9,500 feet,” he lauds. “It had a 30-day IP rate of 960 boe/d and cost $4.5 million. Sometimes we are limited by our acreage as to how long a lateral we can drill. We use open-hole packers for the 16 fracture stages in the Marmaton, but we still are experimenting with the sand and water volumes. We continue to experiment and evaluate different methods to optimize our fracture stimulations.”

In its deal with Noble, Unit also acquired 60,000 net acres in Ellis, Caddo and Custer counties in western Oklahoma. Those wells mostly target the Cleveland, Skinner, Red Fork, Tonkawa and Cana Woodford zones.

Since becoming involved in western Oklahoma’s Anadarko Woodford Field in 2008, Continental Resources Inc. reports it has drilled 104 wells on the 330,000 acres it has under lease. Its production in the second quarter of 2012 was four times comparable 2011 output.

“We think the Mid-Continent will be a great place to drill horizontal wells for years to come,” Guidry asserts. “The package we acquired from Noble includes the Buffalo Wallow Field, where we have identified nine stacked pay zones.”

He anticipates that Unit will utilize pad drilling and drill 10 or more wells from the same pad in Buffalo Wallow in the future. “We already are drilling multiple wells from a pad in the Granite Wash and Marmaton plays, but nothing near that magnitude,” Guidry offers.

Pinkston points out the acquisition included Noble’s midstream operations.

“Noble had all the gathering system in Buffalo Wallow, as well as the Shattuck Field, the Cleveland property in Ellis County, Ok.,” he states. “Our midstream company will have the opportunity to process all of the Buffalo Wallow gas by the end of 2014.”

Another Acquisition

Houston-based Citation Oil & Gas Corp. announced in August it was acquiring Noble Energy’s conventional Kansas properties. Those include 250 producing wells on 14,000 net acres. Net production of the assets is 1,000 boe/d, with net proved reserves of 7.0 MMboe, according to a news release from Noble. Production is almost entirely crude oil.

The acquisition increases Citation’s footprint in the Mid-Continent, which began in Oklahoma in 1985 with its purchase of the Healdton II Unit, west of Ardmore. Citation has continued to expand its asset base in southern Oklahoma with numerous acquisitions of mature, shallow oil properties. Most of Citation’s fields in southern Oklahoma are mature waterfloods once operated by major oil companies.

Activity Everywhere

Devon Energy Corp.’s Kris Goforth is a busy person these days. She is the business unit vice president for the Anadarko Basin, which for her company includes Oklahoma, the Texas Panhandle and Kansas. She says all three of the Mid-Continent’s unconventional plays–the Cana-Woodford, Granite Wash and Mississippian Lime–are big drivers for Devon.

The company has 570,000 net acres in the emerging Mississippian Lime and Woodford Shale, including 150,000 acres in a joint venture with Sinopec. Goforth says the Mississippian Lime is especially attractive because it is a “nice light oil play” with 42 gravity oil. She adds that the company is able to truck the oil to nearby Oklahoma facilities in Cushing or Ponca City.

“We have nine rigs running and have drilled or have interest in 52 wells in the Mississippian Lime and Woodford Shale,” she says, noting the Woodford Shale is the source rock for the Mississippian Lime. “When you have both zones that are economic, we have drilled two separate well bores and one saltwater disposal well.”

Devon is drilling horizontal wells exclusively. Well costs range from $3.0 million-$3.5 million, says Goforth, with 30-day IP averages of 300 boe/d and gross EUR of 300,000-400,000 boe. She adds the vertical depths of the wells range from 3,000 to 8,000 feet, with the Woodford Shale wells normally 6,000-8,000 feet.

“In 2012, we expect to have 100 operated wells, 35 saltwater disposal wells and 30-40 participated wells,” she reports. “That number depends on how much we ramp up. We plan to increase our activity in 2013, but we still are working on the budget.”

She says 60-75 percent of its wells’ production is liquids. Goforth says Devon is testing across all its acreage, but most of its activity has been in Oklahoma, with only a couple wells drilled in Kansas

Meanwhile, Devon has 254,000 net acres and seven to 10 rigs running in the Cana-Woodford play, west of Oklahoma City and southwest of its Mississippian Lime acreage. Devon also operates its own gas processing plant near El Reno, Ok.

“We have drilled 270 operated wells in the Cana-Woodford and have interest in more than 500 wells,” Goforth continues. “That play is well into development. We are doing infill development, drilling nine wells a section. The average laterals are 4,000-5,000 feet, although we have done some as long as 10,000 feet. We are using 10-12 fracture stages a lateral in both the Cana-Woodford and the Mississippian Lime.”

Devon plans to drill 130 operated horizontal wells in the Cana-Woodford this year, which are expected to average 10 percent crude oil, 30 percent NGLs and 60 percent gas. Net production from the Cana-Woodford Shale averaged 280 MMcfe/d in the second quarter, Goforth reports. Liquids production increased 59 percent year-over-year, accounting for 30 percent of total Cana-Woodford production.

“Our Cana acreage has lean gas areas with no condensate, and other areas that are more liquids rich,” she says. “We are not drilling any lean gas wells right now.”

Goforth points out Devon has built a “wonderful water recycling program” to serve its infill drilling program, with a 500,000-barrel water holding facility. Produced water is piped to the facility, treated and piped back for use fracturing new wells.

“The Cana water requires minimal treatment,” she adds. “We have recycled more than 2 million barrels of water so far in 2012, and estimate we will recycle more than 4 million barrels by year end. This is good for everyone.”

The third area of Devon’s Mid-Continent drilling program is in the Granite Wash in Hemphill, Wheeler and Roberts counties in the Texas Panhandle.

“Our current drilling focus is on the upper Granite Wash, Cherokee and Granite Wash A,” Goforth offers. “Everyone identifies these zones a little differently. These are true washes off the mountain fronts. More recently, the zones above the traditional Granite Wash interval, called the Missourian Wash, are seeing some encouraging results.”

Devon has a pair of rigs testing the Missourian Wash, she reports, adding, “These are stacked pays with multiple target sands, but they come and go. Not every zone is economic everywhere. It is complex. We are determining the porosity, permeability and production of each zone and how they were deposited.”

So far, Goforth says Devon is seeing 12 percent oil, 30 percent NGLs and 58 percent gas in its Granite Wash wells. Devon brought six operated Granite Wash wells on line in the second quarter and initial 30-day production averaged 1,270 boe/d.

“There is a lot of excitement in the Mid-Continent,” she exudes. “We will have areas of oil and gas production for a long, long time.”

Hugoton Field

LINN Energy LLC has announced $2.8 billion in acquisition and joint-venture agreements during 2012, including $1.2 billion for the acquisition of properties in the Kansas Hugoton Field from BP.

“The Hugoton Field is the largest conventional gas field in the country,” offers Arden Walker, chief operating officer of LINN. “We took over operation of the field on July 1, and we now have 110 new employees from BP.”

He says the Hugoton Field produces 110 MMcf/d of natural gas and has a low decline rate of just 7 percent, which made it attractive to LINN. The field has 2,400 operated well bores and 600,000 contiguous net acres, Walker reports.

“We have identified 800 additional locations, but we won’t be extremely active (drilling new wells) with the current gas prices,” he says. “But this field definitely has an upside, and there is a lot of optimization work to be done as well.”

Walker notes that LINN also has 100 percent control of the Hugoton Field’s assets, including a gathering system and the Jayhawk Gas Plant, just east of Ulysses, Ks.

“It is an area we are excited to be in,” he adds. “We plan to jump in and let it become one of our core assets. We have 1,200 wells on the Texas side that we call Brown Dolomite, but they are actually an extension of the Hugoton with shallow, low-pressure wells. We are taking what we learned in that field in Texas and are applying it to Kansas.”

Granite Wash

LINN Energy’s two primary growth and exploration areas are the Wolfberry in the Permian Basin and the Granite Wash in the Texas and Oklahoma panhandles. Although they both have the similarity of stacked pays, Walker says his company’s approach to the two is very different.

He says LINN has opted to continue to drill vertical wells in the Wolfberry, but it has moved to horizontal drilling in the Granite Wash because each zone in the stack is 200 to 400 feet thick, making each a perfect target for horizontal drilling.

“We got into the play through an acquisition from Dominion in 2007,” Walker says. “At that time, it was a vertical play. We have 300 operated and 200 nonoperated vertical wells in the Granite Wash. That means we have a lot of data, and a lot of good well control and understanding. We have done a good job of mapping each interval.”

From shallower to deeper, Walker reports the Granite Wash play offers multiple zones, beginning with the Tonkawa. It includes the Lansing, Hogshooter, Cleveland, Carr, Britt, Granite Wash’s A-F intervals, and Atoka, which is the deepest.

“We had been focused on the upper Granite Wash zones, namely the Carr, Britt and Granite Wash A,” he continues. “Those are more liquids rich and produce a fair amount of condensate. We got extremely good results. We drilled our first horizontal well in 2010, and our second well was a record setter.”

Walker says the Black No. 50-1H produced 60 MMcfe/d, including 3,190 barrels of crude oil, 3,500 barrels of NGLS and 27 MMcf of natural gas.

“So we immediately ramped up rig activities,” he recalls. “We have 110 operated producing horizontal wells and 32 nonoperated producing horizontal wells.”

He says the company has 70,000 net acres in the Texas Panhandle and 25,000 net acres on the Oklahoma side of the play, although LINN’s focus has been exclusively in Wheeler and Hemphill counties in Texas. Walker asserts in part that is because the company has higher net interests in its Texas acreage.

Walker says LINN Energy learned of other companies’ success in targeting the Hogshooter interval some 30 miles east of where it was operating. So it started mapping the formation. In the first quarter of 2012, LINN drilled three successful wells targeting the oil-rich Hogshooter interval. Average initial production rates were 2,500 bbl/d of oil, 500 bbl/d of NGLs and 3 MMcf/d of natural gas, Walker reports.

Cimarex Energy Co. is focusing its Mid-Continent drilling program on the Cana-Woodford Shale. Since it began targeting the play late in 2007, the company says it has drilled or participated in 414 gross (155 net) wells. From the spring of 2011 to spring 2012, Cimarex reports it has boosted its net Cana production 36 percent.

“We had eight rigs running in the Texas Panhandle, but after the results of those three Hogshooter wells, we did a quick turnaround,” he points out. “Now all eight rigs are drilling in the Hogshooter. That is price-driven. The gas plays work, even at the current prices. But why bore through gas intervals when you can get a way-better return on the oily intervals?”

Walker calls the Hogshooter a Missourian-aged interval. He adds that LINN also is evaluating shallower oil-bearing intervals in the Texas Panhandle, such as the Lansing, Cleveland and Tonkawa.

He says the Hogshooter is about 10,000 feet vertical depth. LINN’s earlier targets of the Carr, Britt and Granite Wash A were 11,000-13,000 feet in depth. Wells targeting the Atoka can be as deep at 15,000 feet.

“There is a 3,000-foot section that is productive within the Granite Wash,” he adds.

Walker says LINN is drilling 4,200- to 4,500-foot laterals, using 10-12 fracture stages with 150,000-200,000 barrels of slick water and 3 million pounds of sand a well. Costs to drill and complete the Granite Wash wells are $8.5 million, according to Walker.

“We have the drilling down to an art, with enough repeatability to get the cycle and drilling times down to reduce costs,” he applauds.

To increase the efficiency of production operations, provide additional takeaway capacity, and maximize the realized price of its natural gas and NGLs, LINN constructed a 63-mile gas-gathering system in the Granite Wash in 2011, Walker reports. This year, he says the company is installing an additional 43 miles of pipeline, along with compression stations and associated facilities.

“All of our wells are tied into a single off-loading point,” he says. “All our gas is processed by Enbridge, with a contract that runs through 2012. By the end of the year, however, we will be able to offload to four or five processors.”

Walker says LINN also has built water-handling facilities to increase efficiency and conserve water. “Using pipelines, we move water to each of our locations,” he continues, “and then flow the water back to a central location, where it is recycled. We hardly have any truck traffic any more on our property, except for hauling the oil out–and that is a good thing.”

LINN’s growth in the Granite Wash mirrors the company’s growth, Walker says, adding the company, which had no Granite Wash production in the first quarter of 2010, reported 160 MMcfe/d in the second quarter of 2012.

“Over the past three years, we have spent $5.5 billion in acquisitions, giving us 5.1 trillion cubic feet equivalent proven reserves and making us a $14.5 billion enterprises value company,” he says, adding although it is a master limited partnership, LINN is one of the top 10 independent E&P companies. “We have grown to more than 1,000 employees and we operate 15,500 wells across the country, from California to Michigan, with a focus on the Rockies, Permian Basin and Mid-Continent.”

Cana-Woodford Shale

While Denver-based Cimarex Energy Co. has some legacy production in the Texas Panhandle and southern Oklahoma, Mark Burford says his company’s drilling focus in the Mid-Continent is on an infill program in the Cana-Woodford Shale, primarily in Canadian County west of Oklahoma City.

Burford, the company’s vice president of capital markets and planning, notes that Cimarex initially drilled one well a section “trying to understand the area.” Since the Cana-Woodford play began in late 2007, he says Cimarex has drilled or participated in 414 gross (155 net) wells. Its second-quarter 2012 net Cana production averaged 156.2 MMcfe/d, a 36 percent increase versus the second-quarter 2011 average.

“We are now doing a seven-section infill development program, drilling an additional eight wells a section, going from east to west, drilling on 64-acre spacing,” he says.

Burford points out one thing that makes the Cana-Woodford play unique is its depth. Typical wells are 10,000-14,000 feet deep, he says, adding Cimarex has drilled wells as deep as 16,000 feet. All the wells are horizontal, with 4,500-foot laterals.

“To our knowledge, when we started drilling in the Cana-Woodford, it was the deepest shale play in the country at that time,” he states. “The well costs are $8.0 million, although they have come down to about $7.5 million a well.”

The Cana-Woodford wells produce 65 percent gas and 35 percent liquids (30 percent natural gas liquids and 5 percent crude oil). At the end of June, he reports Cimarex had 57 gross (24 net) Cana wells completed or awaiting completion.

Burford calls the infill development program a logistics issue, saying “We wanted a mile buffer between the wells drilled and wells completed.”

The Cana-Woodford wells typically come on line at 5 MMcfe/d-6 MMcfe/d with 6 Bcf-8 Bcf estimated ultimate recovery on its infill drilling program, Burford says. He projects Cimarex has $5 billion in future development capital in the play.

The 115 million cubic feet a day of carbon dioxide injected into the Postle Field by Whiting Petroleum Corp. includes 36 MMcf imported by the company’s TransPetCo pipeline from the Bravo Dome in eastern New Mexico. The rest of the CO2 is recycled.

He relates that Cimarex had 10 rigs working in the Cana-Woodford play, but cut that to seven in the second quarter because of depressed natural gas prices. In the fourth quarter, Burford says he expects the company will have seven rigs running in the Mid-Continent, but only four in the Cana-Woodford play. The other rigs will be drilling horizontal wells in the company’s other legacy oil fields.

“Our engineers have been charged with finding some running room in our legacy fields,” he adds.

Going More Oily

Continental Resources, which is the largest leaseholder in the premier Bakken oil play in North Dakota and Montana, also is active in shale plays in its own backyard in the Anadarko Woodford in western Oklahoma and the Arkoma Woodford in southeastern Oklahoma. Bott, who’s company president and COO, points out that Continental has trimmed some of its activity in the two Woodford plays and directed more attention to the Bakken, a move that can be directly attributed to depressed natural gas prices.

“Continental Resources started in the Arkoma Woodford in 2006,” he says. “It drilled 90 wells, and has 36,000 acres. But it has done no new drilling in the Arkoma since February. The acreage is too gassy. Internally, it doesn’t feel a need to feed a glut. But the company continues to do work there. In fact, it showed an increase in production in the second quarter, but that was from production enhancement, not new drilling.”

Meanwhile, Bott calls the Anadarko Woodford “one of our key focus areas for growth.” Continental Resources became involved in the Anadarko Woodford in 2008. It has drilled 104 wells and has 315,675 acres under lease, Bott says. He adds second-quarter production came in at 16,672 boe/d in the Woodford, four times more than comparable 2011 production.

He adds that the company’s Anadarko Woodford wells typically produce 20 percent crude oil. He notes that his company doesn’t break out the NGL numbers that are included in the 80-86 percent natural gas component in the reported production.

“We have shifted our drilling activity from what we call the Northwest Cana to the Southeast Cana, where it is more liquids-rich,” he acknowledges, adding that the Lambakis 1-11H, completed in May 2011, validates the geological model for the Southeast Cana and extends its range 25 miles south of the previously known Anadarko Woodford and into oily areas.

The Postle Field, discovered in 1958, reached daily peak production of 23,000 barrels of oil equivalent before seeing output fall to 1,600 boe/d in 1995. After Whiting Petroleum Corp. bought the field in 2005, it employed enhanced reservoir monitoring and characterization, improved computer power, and expanded technology measures at the field and boosted production to 10,000 boe/d.

Despite its success in the area, Bott says Continental Resources has gone from 14 rigs operating in the play to six in the second half of 2012.

“We have been on a kick to apply capital discipline and push back on high service costs,” he explains. “Despite the reduction in drilling for natural gas, the service company prices aren’t coming down. So we have trimmed drilling to focus on capital discipline and push back on costs.”

Although it will keep its capital budget flat in the fourth quarter, Continental Resources will keep its six rigs busy for the remainder of the year in the Southeast Cana, reports Bott. It typically drills 5,000-foot laterals with 10 to 12 fracture stages, he says, adding, “We drilled the first multiunit well in Oklahoma under HB 1909 with a 10,000-foot lateral.”

Continental’s horizontal laterals and fracture stages in the Bakken have become standard on each well, but Bott says that will not necessarily be the case in the Anadarko Woodford.

Despite cutting back on its drilling program, Bott says Continental Resources remains “upbeat and optimistic” about its Anadarko Woodford play. “It is one of our focus areas,” he emphasizes. “It is a very proven oily basin, and it is in our own backyard. It is complicated drilling, but it fits what we like to do.”

He calls price volatility the biggest challenge to the Mid-Continent’s development, noting that propane prices are half what they were a year ago and bottlenecks remain in the delivery to the storage hub in Conway, Ks.

“But I am optimistic that balance will come back into the play,” Bott offers.

Postle EOR Production

Pete Hagist is vice president of operations for the Permian Basin for Whiting Petroleum Corp. Based in Midland, Tx., he is responsible for all the company’s enhanced oil recovery projects using the injection of carbon dioxide. Those projects include the Postle Field in Texas County in the Oklahoma Panhandle.

The Postle Field was discovered by Mobil Oil Co. in 1958, Hagist points out. Mobil instituted a waterflood in 1966, and in 1971, the field reached peak production of 23,000 boe/d. After its output declined to 1,600 boe/d in 1995, CO2 flood operations began. ExxonMobil sold the Postle Field to Celero Energy in 2004, and a year later Whiting purchased the field, then producing 4,200 boe/d.

“In 2004, it was a field in a state of decline,” Hagist says. “Whiting designed an expansion of the flood first installed by Mobil, expanding EOR CO2 operations fieldwide. We now are working on the final phase, HMU III. We got a textbook response. We took it from 4,000 boe/d to 10,000 boe/d, using enhanced reservoir monitoring and characterization, improved computer power and dramatic technology improvement.”

Using forecasting tools to manage and control the flood, Whiting can see results every 24 hours, he reports. “The precision to manage and control the flood has improved dramatically,” he points out. “The response has a lot to do with technology. We have gotten good response out of lower-quality wells.”

The Postle Field includes 26,000 acres, with 285 MMboe in place, and has 215 production and 150 injector wells in the Morrow Sandstone, at 6,100 feet. Hagist says the Postle Field still has a lot of life left in it.

“We achieved peak oil production at 10,000 boe/d in 2010,” he offers. “It is roughly at 8,500 boe/d on a flat production rate today. We expect it to remain flat for the next three years and then have a gentle decline for the next 15 years.”

He says Whiting is injecting 115 MMcf/d of CO2, of which 36 MMcf is new and the rest is recycled. Whiting owns the TransPetCo pipeline, the only pipeline that brings CO2 into Oklahoma from the Bravo Dome in eastern New Mexico.

Hagist calls the Postle a “wonderful EOR field. There is no issue with miscibility and it has excellent rock characteristics,” he says.

He reports the recovery rate is 18-20 percent, which he points out is higher than Whiting’s North Ward Estes Field in the Permian Basin. Hagist adds that there are other fields in the Mid-Continent that would be good candidates for CO2 EOR projects, but the “challenge is access to CO2.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.