Natural Gas White Papers

LNG Giving Producers New Options

By David A. Franklin

HOUSTON–Technology has proven critical in expanding domestic natural gas supply by opening a new frontier of unconventional shale and tight sands plays. Can technology play a similarly dramatic role at the other end of the business for producers by enabling operators to maximize the value of their natural gas production?

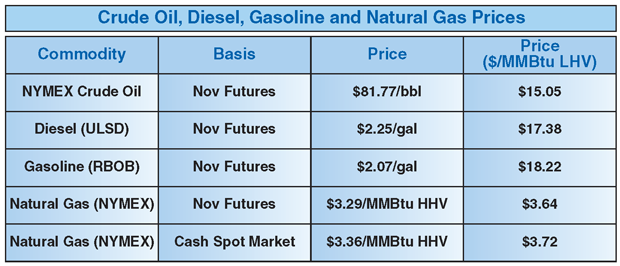

U.S. natural gas prices lingered around $3.00-$4.00 an MMBtu on the New York Mercantile Exchange much of this fall, despite relatively strong crude oil prices in the range of $80.00-$85.00 a barrel. This divergence of pricing between petroleum-based products and natural gas is astounding. Table 1 indicates that natural gas is trading at only 20-25 percent of diesel and gasoline prices on a lower heating value basis.

The key question for many gas producers–particularly smaller independents–is whether options exist that can allow them to tap into niche markets to capture premium prices and improve profitability. In the right situations, small producers can bypass midstream service costs and enter directly into supply contracts with small specialty customers, perhaps even forming producer cooperatives to play at a larger and more cost-effective scale. This article explores some of the emerging markets and opportunities for small gas producers.

Over the past five years, the North American natural gas market has been transformed from one with constrained supply to one with surplus. U.S. gas in storage totaled more than 3.6 trillion cubic feet at the official start of the winter heating season on Nov. 1. Unconventional shale, tight sands and coalbed methane production have added significant volumes of reserves and production, reversing the trend lines on U.S. supply curves after years of incremental declines.

National Treasure

Giant new discoveries and increasing recoverable reserve estimates in North America make natural gas a true national treasure. Such abundance and low pricing have been a blessing for American consumers, reducing the cost of heating, electricity, chemicals and other goods and services. Natural gas is beginning to displace coal for base load power generation, and the combination of affordability, efficiency, environmental friendliness and supply surety could position natural gas to emerge as the real “alternative energy” source for the domestic market over the long term.

According to the U.S. Energy Information Administration, natural gas supplies about 20 percent of the U.S. electric generation load and is projected to expand to 25 percent by 2015. Shale and coalbed methane projects are being developed worldwide. A plethora of new, large-scale liquefied natural gas facilities are planned, under construction or coming on line around the globe. The International Energy Agency has stated that the gas glut will continue for at least 10 years as the economies adjust to use more natural gas. If world demand cannot absorb all of this gas, then low-cost LNG from the Middle East could be landed in the U.S. market, suppressing natural gas prices for several years.

Despite low gas commodity prices, the North American rig count is increasing, with the majority of the active rigs focused on gas well drilling. Are producers simply drilling to maintain their leases? Are they drilling in wet gas regions to supplement their dry gas revenues with liquids? Over the past few years, majors have acquired assets and reserves with economics based on gas prices between $5.00 and $8.00 an MMBtu.

Even during the lowest point of the recession, some industry participants and observers were predicting prices in the $6.00-$8.00 an MMBtu range by mid-summer 2010. With prices hovering around $3.00-$4.00/MMBtu, many companies that acquired assets with debt and without price hedging may be suffering some form of financial distress. Smaller players have found it difficult to compete for drilling, production and space in pipelines that larger producers are filling to or near capacity.

Emerging Opportunity

Liquefied natural gas and compressed natural gas already are being used as transportation fuels, paving the way for producers to participate in this growing market segment. Consider the potential for small producers to enter the transportation fuels market and sell natural gas to truck fleets at a significant discount to diesel.

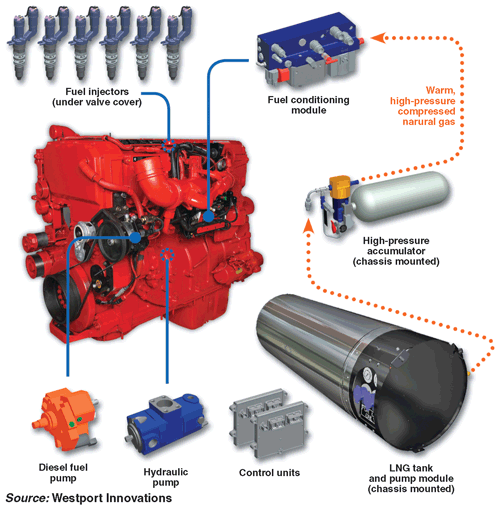

Figure 1 shows a Westport Innovations LNG fuel system for a diesel engine. Of particular interest with this dual-fuel engine option is the capability to allow a significant amount of ethane to remain in the fuel. This could solve some ethane disposal issues for wet gas producers.

The National Renewable Energy Laboratory, Westport Innovations, Energy Conversions Inc., Waste Management, PACCAR, Dallas Area Rapid Transit, Clean Energy, Chesapeake Energy Corp., and others have demonstrated the practicality of displacing diesel with natural gas. Major food suppliers HEB and Sysco are running fleets of trucks that displace 90-95 percent of their diesel usage with liquefied natural gas.

Using natural gas for vehicle fuel also improves air quality. NGVAmerica estimates that converting vehicles to natural gas can result in up to a 70 percent reduction in greenhouse gas emissions. Based on air pollution research, the ports of Los Angeles and Long Beach have created incentives for drayage trucks to use LNG and CNG. Clean Energy has constructed an LNG liquefier and several LNG/CNG fueling stations to support the initiative. California, Arizona, Nevada and Utah are cooperating to build demonstration corridors for the region. The port projects have demonstrated improvements in emissions and fuel economics.

The trend appears to be igniting interest in Canada and New England states. Robert Transport of Boucherville, Quebec, has announced the purchase of 180 LNG-fueled trucks and the installation of three refueling stations along the 401 corridor between Mississauga and Quebec City. Some major pipeline companies are expressing interest in developing LNG transportation corridors in both the United States and Canada. State and federal regulations and incentives are in place to encourage fuel suppliers, and truck and fleet operators, to make the change to LNG. Given the expected growth, many of the major U.S. truck routes could potentially have LNG refueling coverage within the next 10 years.

Rail yard switching engines and haul locomotives are also excellent candidates for LNG. ECI and Burlington Northern have demonstrated LNG fuel use on locomotives hauling coal. Some LNG-fueled switch engines are operating in Los Angeles. LNG tank cars are available to serve as tenders and to transfer LNG product to distant markets.

Coal and mineral mining operations have a continuous demand for fuel, and the increase in the cost of diesel fuel along with the threat of additional taxes for carbon and greenhouse gas emissions, have mining companies looking for alternate clean fuel sources. Large, modern mine haul trucks use diesel engine-driven generators with electric traction drives similar to locomotives. Figure 2 shows a 400-ton class Bucyrus MT6300AC mine haul truck with electric traction drive. Converting the onboard diesel generators on these trucks to gas engines or turbines is straightforward and can provide significant savings in mine operations.

Win/Win Proposition

Producers in parts of the Rocky Mountains–where price basis differentials are historically highest–are dealing with the lowest natural gas wellhead prices in the country, while at the same time, some of the large mines in the region are paying premiums for delivered diesel fuel. Converting gas to LNG for fueling mining trucks is a win/win proposition for both gas producers and mining companies.

Large mining operations can reduce their overall operating costs significantly by converting mine haul trucks to LNG. In fact, some mining operators are beginning to request LNG fuel options for equipment. Natural gas can be supplied to the mines by pipeline with onsite liquefaction, or LNG can be transported by truck or rail to the site from a nearby producer or pipeline.

Clean Energy and Oklahoma Natural Gas offer CNG filling stations for small vehicles. Taxis, commuter vehicles, local delivery vehicles, utilities and municipalities are great candidates for CNG conversions. CNG options are available from Honda Civics™ to buses. CNG stations provide natural gas at high pressure to quickly fill a customer’s CNG storage tank. The CNG can be supplied by compressing natural gas to high pressure or by pumping LNG to pressure and then warming the gas to meet the vehicle filling guidelines. Natural gas producers can offer LNG to the self-contained CNG service station market with no requirements for connecting to the local gas utility grid.

How can small gas producers participate in these premium markets? Unlike large integrated companies, small gas producers typically are not directly invested in midstream and downstream operations. Service providers generally take care of day-to-day midstream operations, maintenance, liquids trucking, gas treating and compression. Adding natural gas liquefaction is not difficult. In fact, normal gas pretreating and processing typically require only slight modifications to meet LNG liquefaction specifications, and then the gas is simply chilled until it condenses.

Modular equipment is available that can liquefy natural gas in the range of 500 Mcf to 5 million cubic feet (6,000 to 60,000 gallons of LNG) a day. The equipment can be purchased or leased, or the liquefaction, storage and truck loading operations can be provided by third-party service companies for a tolling fee.

Small producers already truck crude oil and condensate to market. LNG is another liquid fuel that can be transported by truck or rail. So the real issue is selling or structuring fuel supply deals that match the production profile of small gas producers with the local or regional transportation or mining companies that are eager to reduce their costs. Can LNG provide an economic alternative to local pipeline constraints? Can LNG provide a solution to a nearby fleet of vehicles to create a win/win cost structure for both parties? The economics support LNG transportation fuel and the technology exists to bring it to market.

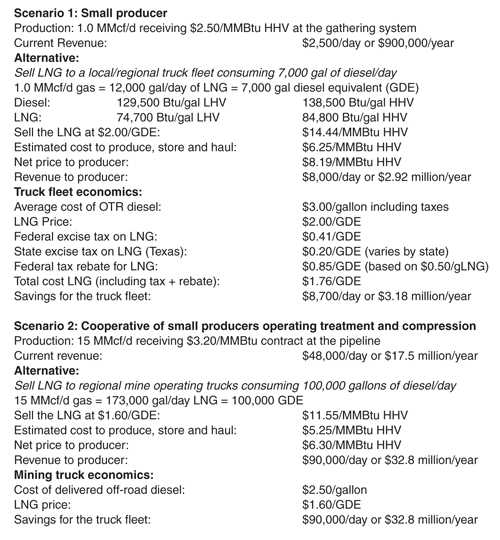

Table 2 shows two scenarios to illustrate the economics, the first with a single small gas producer and the second with a cooperative of small producers operating treatment and compression facilities.

Natural gas sells at an 80 percent discount to gasoline and diesel on a LHV basis, while also reducing vehicle-source greenhouse gas emissions by as much as 70 percent. Utilities, municipalities, buses, ports, refuse operators, taxis, and local delivery vehicles are utilizing CNG or LNG fuel in several locations across the country, and significant interest is developing for natural gas fuels in North America with local, state and federal regulations and incentives in place.

Over-the-road truck fleets, commuter and delivery vehicles, municipalities and off-road agricultural, construction and mining vehicles represent a growth market that can be served by LNG delivery trucks or small gas pipelines and on-site liquefaction by local producers. A gas producer within logistical economic distance of these markets can receive much higher value for the produced gas than is available from the local gathering grid and compression stations.

Editor’s Note: The preceding article is the first in a two-part series on applying LNG technology to enhance the value of produced natural gas by accessing local transportation markets. Part two appears in the January 2011 issue and examines the pretreatment, gas processing, liquefaction, storage, transportation and dispensing options available to small producers seeking to enter the LNG transportation fuel market.

DAVID A. FRANKLIN is LNG facilities manager for Mustang Engineering in Houston. A 1979 graduate of the University of Missouri-Rolla, he has 29 years of experience in engineering, design, fabrication and construction. Franklin is a mechanical engineer, and his last 20 years of work experience has been in gas treating, cryogenic gas processing, LNG liquefaction and LNG regasification. That work has included acid gas processing, sulfur recovery, dehydration, LPG recovery, LNG peak shaving, and small- to mid-scale LNG projects onshore and offshore. He holds multiple patents and patent applications.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.