Regional, National Indicators Suggest Greater Demand Call For Appalachian Natural Gas

By Danny Boyd

The Appalachian Basin remains the undisputed king of U.S. natural gas, accounting for 31% of total domestic marketed production in 2024. However, the one-two combination of constrained pipeline takeaway capacity to transport the 35.6 billion cubic feet a day of production out of the basin and last year’s historically low regional wellhead prices conspired to mute basinwide output in both 2023 and 2024, constricting growth to less than 1 Bcf/d for both years combined.

But the past is the past, and the future is all that matters. A confluence of favorable market indicators and upstream innovations have players in the nation’s largest gas province optimistic about answering the call for projected demand increases both in-basin and out-of-basin. The largest immediate difference-maker is in-basin demand growth from power generation to support artificial intelligence data centers. Included are two major power plant conversions from coal to gas at multibillion-dollar data center campuses in Pennsylvania at Homer City east of Pittsburgh and Shippingport on the Ohio River to the northwest.

Other projects that will need Appalachian gas are in process in West Virginia and Virginia, and producers are anticipating opportunities to backfill gas volumes diverted to major data center power projects. Looking outside the Northeast region, a growing list of new and revitalized pipeline projects are in the works to carry more Appalachian gas to market demand centers. One example is Boardwalk Pipelines LP’s proposed Borealis pipeline project, which could carry up to 2 Bcf/d out of western Appalachia to as far south as the Louisiana Gulf Coast.

On the upstream end, newly public company Infinity Natural Resources Inc. and established private player PennEnergy Resources are both eying aggressive double-digit production growth through the drill bit, while innovations deployed by the nation’s leading gas producer—Expand Energy Inc.—are breaking Marcellus drilling records and Seneca Resource is turning heads by developing the dry-gas deep Utica in Northeast Pennsylvania.

Fresh Off An IPO

Optimism about natural gas demand growth reinforced the appeal of Infinity Natural Resources as the Morgantown, W.V., company prepared throughout 2024 for an initial public offering in January after seven years as a private company, says Chief Executive Officer Zack Arnold.

Ohio oil assets checkerboarded among acreage held by EOG Resources garnered most of the early attention from potential underwriters, he recalls. As talks progressed, investment bankers began asking more about gas properties. By the time shares under the INR ticker were offered on the New York Stock Exchange, Infinity was considered a gas production company with oil assets.

Industry momentum from last November’s presidential election, a balanced asset base, and a focus on growth helped. This year, the company is anticipating 40% production growth after achieving 28% last year, Arnold reveals.

After successfully conducting an initial public stock offering in January, Infinity Natural Resources is projecting an anticipated 40% increase in production across its portfolio of Utica oil locations in Ohio and Marcellus dry gas locations in Southwest Pennsylvania, following 28% growth in output last year.

“The IPO was done with the expectation that our company is poised to grow both organically through the drill bit and is well positioned to do acquisitions,” he comments. “We are a small company, and it does not take a lot of growth to be meaningful. That is a component for sure, but our team has fought to bring locations forward, to drill faster, and to make sure we are drilling the most economic locations possible. That has really allowed us to grow quickly.”

Current daily output is 33,100 barrels of oil equivalent across 125,000 net acres with 150 Utica oil locations in Ohio (19.5 MBoe/d) and 170 Marcellus dry gas locations in Southwest Pennsylvania (13.6 MBoe/d). Break-evens are $27.80/bbl and $1.35/MMBtu. respectively.

Infinity plans to drill 20 wells this year with laterals averaging about 15,000 feet. Ohio acreage is especially suited for longer horizontals and completion designs are like those widely deployed in the basin.

Coupled with growth through drilling, the company is open to the right acquisitions, says Arnold, whose resume includes work on the first Marcellus and Utica wells drilled by Chesapeake Energy. With 15 years together in Appalachia, Infinity’s management team can readily identify the best acquisition candidates from potential companies with neighboring assets.

Previous transactions have included deals for undeveloped land, proved, developed and producing (PDP)-weighted assets, and everything in between, he notes, adding that any future deal would likely include acreage in Infinity’s home state of West Virginia.

“Our broad operational background lets us look across the entire basin and not have too narrow of a scope for A&D because deals in Appalachia are very difficult to do,” Arnold explains. “Many deals never transact. They just get held by the current owner and do not move forward, so we must be able to look at a lot of deals and feel confident in our ability to analyze them and come to the right number. You must take a lot of swings before you find the ball to hit out of the park.”

Pushing The Envelope

Expand Energy Corporation is relying on staff expertise and proven contractors to push the drilling envelope on its massive 1.26 million net acres in Northeast and Southwest Pennsylvania. And true to its name, Expand Energy is expanding. In its third-quarter earnings report issued in late October, the company announced that it acquired ~7,500 acres of undeveloped core Marcellus in Southwest Appalachia along with ~75,000 net acres in the Western Haynesville in the second half of 2025.

To achieve maximum value on its leasehold, the company is deploying AI and machine learning to help boost efficiencies and results, reports Tim Beard, vice president of drilling.

Expand Energy is deploying AI and machine learning to optimize drilling results. A multi-agent AI tool includes a large language model with self-learning capabilities that uses available data on current and prior wells to help engineers make decisions such as selecting the best bottom-hole assembly for various portions of the wellbore. Other tools monitor real-time downhole motor conditions to recommend changes such as increasing penetration rate or changing out the bit, and analyze drilling parameters to adjust wellbore inclination or identify whether to directionally drill in slide or rotating mode.

“You could have the best tools on earth, but if you do not have good people that are implementing what you are learning from the data, machine learning and AI, then it will not really matter,” he says. “We have a great team of engineers, we have an operations support center that watches our rigs 24 hours a day, seven days a week, and our field team is out there executing with good contractors.”

Formed from the 2024 merger of Chesapeake and Southwestern Energy, Expand maintains a nation-leading 7.3 Bcf/d of production while it shatters records in drilling feet per day in Northeast Pennsylvania and extends record lateral lengths in Southwest Appalachia and the Haynesville Shale, where it operates 664,000 acres.

Record operational performance is driving capital efficiencies as the Oklahoma City-based company is positioned to bump production to 7.5 Bcf/d in 2026 and looks ahead to supply some of the 4 Bcf/d of additional demand from data center-driven power demand in the Northeast, according to Beard.

AI is aiding operational achievements. Currently, employees are focusing on a drilling-related platform called KORAI™, formerly DrillOpsIQ. The multi-agent AI tool includes a large language model with self-learning capabilities that uses available data on current and prior wells to help engineers quickly identify drilling solutions that can include choosing the best bottom-hole assembly for various portions of the wellbore, he points out.

Tools include SEER and Build and Turn. SEER enables the team to monitor real-time drilling motor conditions downhole and consider making changes as needed, including whether to accelerate the pace of drilling or trip pipe.

Build and Turn can suggest changes to drilling parameters, including adjusting wellbore inclination through specific changes in weight on bit, rpm or flow rates, states Beard. It also analyzes steerable BHA tendencies in real-time to help identify which of two operational modes in directional drilling—slide or rotate—is best to control well trajectory.

In Northeast Pennsylvania, the tools allow the team to understand differential pressure on motors and BHAs in co-development of the lower and upper Marcellus intervals, including offering monitoring and performance adjustments when navigating the challenging geological structures, Beard says.

A data science and technology team representing drilling, completions, production, reservoir engineering and geosciences continually examines ways to utilize AI to optimize operations and achieve pre-determined economic thresholds, comments Dan Lopata, vice president of completions, facilities and production services, who heads AI deployment and development. Successful rollout in drilling operations will guide rollout for completions.

“We are close to getting to that point,” Lopata remarks. “We have some work to do on our data and on deploying sensors to the frac fleets themselves. However, the team has the skillset and the capabilities and understanding.”

Deep Utica Development

Innovation for Seneca Resources is helping the Houston company exploit the deep, dry gas Utica in Northeast Pennsylvania as it works to boost access to more markets in and out of Appalachia, says Justin Loweth, president of Seneca and National Fuel Gas Midstream, both subsidiaries of National Fuel Gas Co., which includes a regulated utility.

Producing over 1.25 Bcf/d across 1.2 million net acres, Seneca Resources plans to drill 25-28 wells this year as it accelerates deep Utica development, a strategy that is paying off handsomely. Average per-well production on the five-well Taft Pad in Tioga County is a choked-backed 30 MMcf/d, Loweth reports. The rate has remained constant for 10 months now with total average daily pad production of 150 MMcf.

Seneca Resources is accelerating deep Utica development, a strategy that has in part helped it grow production by 20% while reducing capital spending by 18% over the past three years. Wells on its five-well Taft Pad in Tioga County, Pa., have averaged a constant choked-backed rate of 30 MMcf/d apiece for 10 months and counting.

Overall, production has grown 20% in three years and capital spending has been lowered 18% as the company takes advantage of time-saving advancements in drilling, continual improvements in drilling sequencing, more efficient facility design and a 20% reduction in water costs.

More is being spent on completions with changes in frac design, Loweth says. Stages of 150 feet are being stimulated with up to 3,000 pounds of proppant per foot. In-depth studies have led the company to adopt an average 1,800-foot spacing between laterals that extend to an average 13,000 feet on Utica wells and 10,000 feet on Marcellus wells. Across Seneca’s position, total integrated operating costs, including taxes, lease operating expenses, and general and administrative, are $0.47 per Mcf, he points out.

Competitive advantages include higher returns on Utica wells. Also, more pipeline capacity is expected to open as producers that signed long-term sales agreements 10-15 years ago now weigh other options as contracts expire, he adds.

At the same time, the region is looking at the possibility of multiple new pipeline projects that would provide additional access to out-of-basin markets and provide more transportation to less-served markets inside the region.

“We have been spending the past two and a half years educating those pipeline companies about the amount of growth we think we could have within our area of operations given the quality and depth of the resource and the number of wells we have to drill,” Loweth remarks.

Additional out-of-basin takeaway includes the proposed 190 MMcf/d Tioga Pathway, an affiliated project Seneca expects to supply. Earlier in the year, the company announced a separate shipping agreement to move an additional 50 MMcf/d to the Gulf Coast.

In-basin demand from reindustrialization projects in Pennsylvania will provide additional markets. National Fuel Gas Supply is providing services to the Shippingport project expected to need 800 MMcf/d when fully completed in 2029, he adds.

In addition to data center demand growth, especially over the next five years, power needs are climbing for the PJM electrical grid serving Pennsylvania and other states, which is expected to drive gas demand even higher, Loweth offers. Behind it all there are plans to continually assess growth prospects, including the potential for acquiring companies active in the same area, he concludes.

Co-Development Strategy

Doubling in size from the 2018 acquisition of Rex Energy, PennEnergy LLC is anticipating 50% growth over the next five years as it co-develops the Upper Devonian and Marcellus on liquids-rich acreage north of Pittsburgh, according to President Ben Bates.

“This is an organic growth story,” he comments. “We expect to be making distributions to our shareholders the whole time, as we are growing 50% and still have a lot of inventory left.”

PennEnergy is anticipating 50% growth over the next five years as it co-develops the Upper Devonian and Marcellus on liquids-rich acreage north of Pittsburgh. The company uses a wine-rack well configuration with Upper Devonian laterals evenly spaced at 450 feet between each Marcellus lateral below, which are spaced 900 feet apart. In late October, EnCap Investments and affiliated partners closed on more than $2 billion in commitments to PennEnergy through a continuation fund.

The company was recapitalized with over $2 billion in commitments through a continuation fund with EnCap Investments and affiliated partners, as announced by EnCap on Oct. 28. Launched in 2011, the private Pittsburgh player in 2014 began co-developing the Marcellus and Upper Devonian, which includes the Genesee, Middlesex and Burket Shale formations completed and produced as one bench.

Co-development is done in a wine-rack configuration with deeper Marcellus laterals 900 feet apart, Bates explains. About 200 feet shallower, Upper Devonian laterals are evenly spaced at 450 feet between each Marcellus lateral below. The Marcellus and the Upper Devonian group do not communicate, he points out, and completion designs are similar.

“We think we are effectively stimulating a lot of those upper formations, which have some amount of organic content,” Bates says.

NGL output makes up about one-third of the company’s total production and on average about 45% of co-developed wells. About 70% of remaining inventory with a duration of 20-25 years will be co-developed at a planned clip of 25 wells annually.

With net production of about 660 MMcfe/d, PennEnergy is one of the basin’s largest private producers and expects to turn in line 26 wells this year. A 12-well pad now under development includes six Marcellus and six Upper Devonian wells, Bates notes.

About three quarters of remaining inventory includes wet gas, but the company can readily intersperse dry gas development, depending on commodity cycles, he states, adding that the company’s PDP decline rate of about 15%, excluding additional production from new wells and completions, is one of the lowest in the basin.

“We do not have to spend as much money to hold production flat or to grow, so our reinvestment rates are very low,” Bates offers. “Coupled with really good cost control and productive wells, we are able to grow the company without outspending cash flow, which is excellent.”

Where possible, the company continues to look for options to acquire adjacent acreage to extend laterals. Management will assess potential deals as they arise, but the core focus will remain on organic growth.

“If it is an accretive acquisition, we are very likely to do it,” Bates says. “We have the financing capability, and we have the team, so if something were available that makes sense, we would certainly pursue it.”

In the meantime, the current operating position and EnCap’s newly announced funding continuation vehicle will allow PennEnergy to take advantage of expected growth in gas demand.

“We have an excellent team and excellent backers,” Bates concludes. “We are reloaded and recharged, ready to create a lot of value.”

Adding Takeaway Capacity

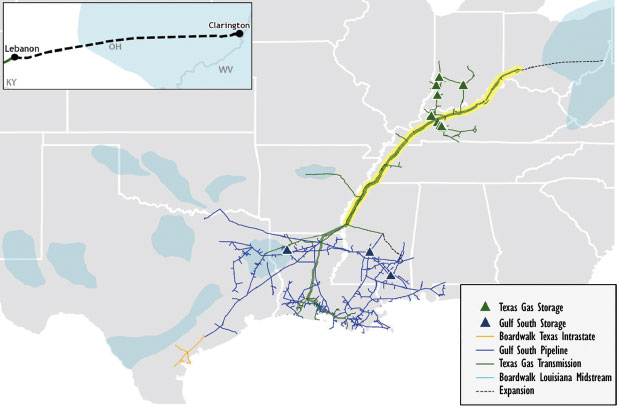

As producers look to growth options backed by funding commitments, Boardwalk expects to make a final investment decision in the first quarter of 2026 on its proposed Borealis pipeline project, capable of transporting an additional 2 Bcf/d of Marcellus and Utica natural gas out of Appalachia as far south as the liquified natural gas terminals on the Louisiana coast, says Chief Commercial Officer Steven Tramonte.

“We think it is a fantastic project that is critical to getting incremental gas supply out of our nation’s largest natural gas resource base,” he says.

Boardwalk’s proposed Borealis pipeline project is capable of transporting 2 Bcf/d of Marcellus and Utica natural gas out of Appalachia as far south as the liquified natural gas terminals on the Louisiana coast. Borealis is part of the company’s Texas Gas Transmission system, which supplies markets in the Midwest and farther south. Boardwalk expects to make a final investment decision in the first quarter of 2026.

Borealis is proposed to be a part of and supply Boardwalk’s Texas Gas Transmission system, which already supplies markets in the Midwest and farther south. The expansion would include two distinct segments. A brand-new 42-inch, 2 Bcf/d pipe would originate at Clarington, Oh., located on the Ohio River near multiple gas processing and pipeline operations accommodating production from Ohio, Pennsylvania and West Virginia.

This greenfield line would extend 200 miles westward to Texas Gas’ existing system at Lebanon outside of Cincinnati. Expansion farther down the line would include looping and additional compression of Texas Gas’ existing system as far south as Mississippi. During an open season, multiple customers and potential new ones—including Midwest power producers and local distribution companies working to supply growing demand—have expressed interest, according to Tramonte. LNG terminals on the Gulf Coast are also expressing interest.

While other proposed pipeline projects focus on moving more gas mostly out of Northeast Pennsylvania, Borealis aims to transport more Marcellus and Utica gas out of Southwest Appalachia, he says.

“We have talked to a lot of producers that are very interested in the project,” Tramonte points out. “While they have options now with more in-basin demand, we are bringing a new pipeline in to reach into the heart of the country and get more Marcellus and Utica volumes out to supply demand growth throughout the country. It is needed.”

Utilization of industry gas transportation infrastructure headed south is at an all-time high, with Texas Gas being one of the few systems capable of adding capacity on much of its existing system, he goes on. Early engagement is helping the Borealis project move forward, Tramonte says.

“Over time, the industry has learned that early engagement with stakeholders is critical to the success of any project,” he remarks. “Our primary focus is to engage early and often with stakeholders along the route and work with them to develop the best project possible.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.