Natural Gas Potential

Opportunity Abounds For Marcellus/Utica

By Kevin R. Petak, Ananth P. Chikkatur and Julio Manik

FAIRFAX, VA.–As the oldest producing area in the United States, the Appalachian Basin has made a roaring comeback over the past decade thanks to Marcellus and Utica shale gas. Production from the Marcellus/Utica now stands at roughly 20 billion cubic feet a day compared with only 2 Bcf/d in 2010–a 10-fold increase in only five years.

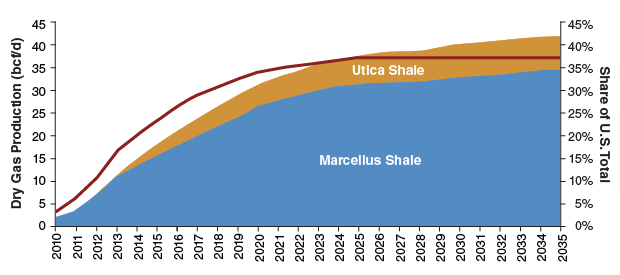

As projected in Figure 1, we anticipate Marcellus and Utica production continuing to grow rapidly, rising to upward of 35 Bcf/d by 2025 and to more than 40 Bcf/d by 2035. The Marcellus and Utica already account for 25 percent of total U.S. natural gas production, and this dominance should only increase over time, with production from the two plays expected to rise to nearly 40 percent of total U.S. natural gas output by 2035.

The emergence of the Marcellus/Utica as a new supply juggernaut is driven largely by its relatively low cost of development, with production from these plays ranking as the most cost effective in North America. Robust development of the area has been enabled by significant improvements in horizontal drilling and multistage hydraulic fracturing technology, and also is supported by the large resource base and high per-well productivities. Improvements in technology have driven the estimated ultimate recovery per completion from an average of 3 Bcf in 2010 to more than 7 Bcf today.

At the same time, technology enhancements have kept drilling and completion costs in check. Such improvements, including reductions in the number of days required to drill and complete wells and efficiency gains in hydraulic fracturing, have reduced completion costs by 30-40 percent over the past few years. Therefore, the unit cost of Marcellus/Utica production is relatively low, with most producers citing cost-effective production even at wellhead prices below $2 per MMBtu, as they have been in 2016.

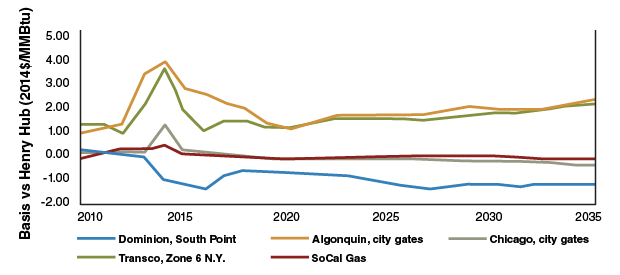

Together, these factors make the Appalachian Basin a game changer for North American gas markets. In fact, the dramatic increase in low-cost Marcellus and Utica gas production has effectively turned the market on its head. Relationships between Appalachian gas prices and regional gas elsewhere have been materially altered. As shown in Figure 2, the price of natural gas in the Northeast as represented by the Dominion South Point price has been trading at a significant discount to Henry Hub. Conversely, prices elsewhere have been trading at a premium to Henry Hub.

The Marcellus/Utica discount to Henry Hub is likely to continue, despite the upcoming pipeline buildout. In addition, price impacts from the region are likely to spill over into other areas. For example, we see that Chicago and Ontario prices will be driven down relative to Henry Hub, as Marcellus and Utica gas continues to make its way into those markets.

Likewise, New England and New York prices, which have been the highest in North America, are likely to soften as incremental Marcellus and Utica gas enters those areas. These dynamics are here to stay and are impacting buyers and sellers of gas across the continent.

Harnessing The Juggernaut

What does all this mean, and what are some of the opportunities and risks for market participants?

First, production from the Marcellus and Utica plays will need to find markets elsewhere, and those who facilitate the delivery of the Marcellus/Utica gas production are likely to benefit handsomely from such activity. With more than 20 Bcf/d of production growth projected through 2035, the local market is insufficient to absorb the incremental production. That means roughly 20 Bcf/d of new pipeline capacity will have to be built to connect Marcellus and Utica producing areas to markets outside the region, namely the Gulf Coast, South Atlantic and Midwest.

However, pipeline development is not likely to occur without obstacles and challenges. Furthermore, such development will change the transport dynamics across North America, resulting in significant impacts on the asset value of existing infrastructure in various parts of the country. Those who are involved in the new projects will enhance the value of their infrastructure, and those who are not will be left behind.

A second critical point is that market evolution is paramount for both producers and infrastructure developers. The importance of capitalizing on export opportunities (i.e., liquefied natural gas and pipeline sales into Mexico), as well as demand growth outside the Appalachian Basin in industrial gas applications and gas-fired electric generation are key factors for producers and infrastructure developers alike. Lacking such market growth, Marcellus/Utica gas prices would remain depressed, and pipeline infrastructure to support gas exiting the area would eventually be decontracted, leaving producers and infrastructure developers with low or negative returns on their investments.

Regional diversification also is imperative. While the area’s gas prices are low today in relation to prices in other North American basins, the pendulum can always swing the other way at some point. Regional price behavior is always uncertain, emphasizing the point that both producers and consumers are well served by regional diversification. As with large consumers with diversified portfolios that do not rely on gas from a single basin, Marcellus and Utica producers would be wise to diversify into different basins to capture positive price changes elsewhere. Such regional diversification is both a hedge against negative price changes within an area and a means to capture positive price changes elsewhere.

Large consumers are realizing that purchasing decisions should not be made without looking at the Marcellus/Utica as an option. The impacts of Marcellus and Utica gas will be widespread, affecting prices across the continent. Pipeline projects will eventually move the area’s molecules directly to Great Plains and South Atlantic states, perhaps even as far west as Iowa and Nebraska and as far south as Florida.

It is important to point out that new and yet-unforeseen gas and liquids applications could be spurred by Appalachian production growth, and those on the forefront of such activities could stand to benefit most. There are many different types of gas use that could evolve in this market. For example, small-scale LNG applications are being pursued, most notably in rail and marine applications. Gas-based ammonia production may occur in some areas where it historically has not. Ethane use in power plants could be a consideration. Gas-based distributed generation is on the drawing boards for many industry planners, driven in part by broader market trends and interests. Dimethyl ether (DME) has made its way onto the list of emerging applications, along with small-scale gas-to-diesel conversion.

The possibilities seem to be limited only by imagination and the willingness to take risks. Anything is fair game for a play area like the Marcellus/Utica, where supply is growing so robustly that producers are continuously looking for new outlets for their production. Stay tuned. The opportunities continue to emerge, and no doubt there will soon be more items to add to the list of potential possibilities for Appalachian shale gas production.

KEVIN R. PETAK is vice president of natural gas and fuels market modeling at ICF International in Fairfax, Va. He has more than 30 years of experience in the energy industry. Petak also directs ICF’s gas market subscription services, which are the source for much of the information provided in this article. Prior to joining ICF, Petak worked for Halliburton. He holds a B.S. in petroleum and natural gas engineering from the Pennsylvania State University and an M.S. in business from the University of Texas at Dallas.

ANANTH P. CHIKKATUR is a manager in the natural gas and fuels markets division at ICF International. He has more than 10 years of industry experience. Chikkatur has supported developers, private equity firms, utilities, governments and international organizations, and has led projects in LNG market assessment, pipeline infrastructure, and gas supply/demand balance in North America. Prior to joining ICF, he conducted research at Harvard’s Kennedy School of Government. He holds a B.S. in physics from University of Rochester and a Ph.D. in physics from the Massachusetts Institute of Technology.

JULIO MANIK is a technical specialist in the natural gas and fuels market division at ICF International. He has 20 years of experience in energy modeling, engineering economic evaluations, and reservoir engineering. He is the lead analyst on hydrocarbon supply curves, oil and gas drilling and production, gas supply/demand modeling, and midstream infrastructure analysis. He holds a B.S. in gas and petrochemical engineering from the University of Indonesia at Jakarta and an M.S. and Ph.D. in petroleum and natural gas engineering from Pennsylvania State University.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.