Record Gas Production Gives U.S. Market Stability Even With Growing Demand

By Dena E. Wiggins

WASHINGTON—The week of the Thanksgiving holiday began with temperatures in the 50s as far north as Minneapolis and Boston. However, as Americans were preparing to embark on one of the busiest travel days of the year, the forecast turned colder, with the first sustained Arctic cold front of the season anticipated to slide over much of the country and linger for several days.

It was a stark reminder that winter was waiting just around the corner, and that a new heating season was already underway. What does the upcoming winter have in store for domestic natural gas markets, and what factors are driving the market this winter? The Natural Gas Supply Association’s annual Winter Outlook report assesses five key market variables to provide insights into these big-picture questions and project likely impacts on natural gas price fundamentals.

NGSA’s Winter Outlook report analyzes production/supply trends, winter weather forecasts, expectations for the national economy, demand projections, and storage/withdrawal patterns to understand the overall implications of the winter heating season on the natural gas market. The weight of each of these variables is assessed as a determining factor that could either increase, decrease, or maintain pressure on natural gas prices.

Overall, the report indicates flat pressure, with upward and downward pricing pressure variables largely offsetting and other variables remaining neutral. For example, while demand from U.S. LNG exports is expected to add an anticipated 3.8 billion cubic feet a day (Bcf/d) to reach record demand pull for feed gas, supply is also expected to hit a new record with new highs in U.S. production augmented by an ample buffer of storage and Canadian import flows. The Winter Outlook concludes that while unexpected weather, changes in the economy, or other “wildcards” could quickly tighten balances and influence prices, the confluence of market variables indicates a stable market with winter price spikes less likely, reassuring markets and consumers alike.

The Big Picture

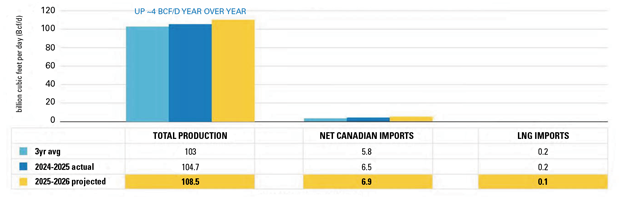

U.S. natural gas production is expected to average a record 108.5 Bcf/d over the winter months, a year-over-year increase of 4 Bcf/d, driven by continued drilling efficiency and a strong supply response to both domestic and export demand needs (Figure 1). Current storage and production output levels appear sufficient to balance incremental winter demand and record LNG exports. Net Canadian imports also remain strong at 7 Bcf/d, up ~0.5 Bcf/d from last year, reflecting the reliance on cross-border inflows and the interconnected nature of the U.S. natural gas pipeline system.

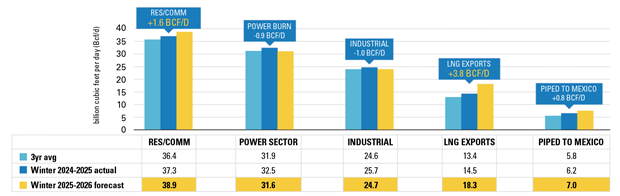

On the demand side of the ledger, total consumption is set to rise by 4.2 Bcf/d year over year (Figure 2). Weather is expected to be moderate across much of the lower 48, but 3.2% cooler than last winter and 4% cooler than the average of the past three winters. Consequently, the Winter Outlook forecasts 3,475 heating degree days this winter versus 3,408 heating degree days last winter. Residential and commercial space heating demand should climb by 1.6 Bcf/d versus the winter of 2024-25.

Industrial consumption is projected to remain flat, although energy-intensive sectors could see strengthened demand later in the season. Power burn will see a modest 0.9 Bcf/d decline, mostly due to efficiency improvements and coal/gas fuel switching economic dynamics. Demand for gas-fired generation this winter will include a structural gain of nearly 10 Bcf/d from new capacity compared to the baseline in winter 2015, reflecting the growing role natural gas plays in our nation’s electricity mix, accounting for roughly 40% of U.S. generation.

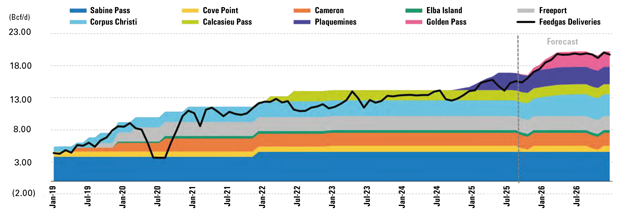

However, the big story continues to be U.S. LNG exports, which provide the largest incremental demand call of 3.8 Bcf/d as new U.S. liquefaction and export capacity ramps up (Figure 3). New Gulf Coast LNG facilities are lifting total export demand toward 18 Bcf/d, serving as the structural growth driver and positioning LNG exports as a critical balancing factor for U.S. supply. Growing LNG exports and slightly higher weather-related heating demand could tighten balances as winter proceeds despite the increased production.

Storage entered the heating season near 3.9 trillion cubic feet on Nov. 1, slightly below last year’s start-of-winter volumes but 3.2% above the five-year average. This elevated storage level reflects strong production through 2025 and relatively moderate summer injections. End-of-winter inventories are projected to close next spring at 1.8 Tcf, representing a net withdrawal totaling 2.1 Tcf, and exit the heating season within the historical five-year average range, underscoring the resilient supply picture.

While this growing production and demand tell the story of how important natural gas is to our economy and energy system, it highlights the need for meaningful permitting reform to meet the demands of the future.

Economic fundamentals are somewhat mixed. Gross domestic product growth is forecast at 3.3%, up from 2.8% last winter. However, industrial utilization is down slightly, and unemployment has edged higher over the past year. Overall, the economy is expected to have little to no impact on seasonal pricing pressures.

Deeper Dive

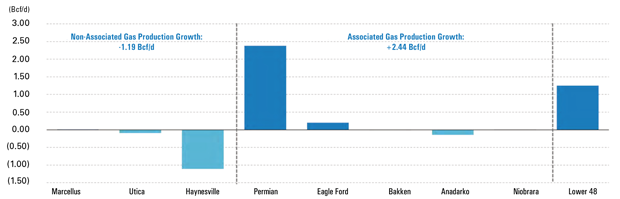

Diving a bit deeper into the factors underpinning the story on both supply-side and demand-side variables, the influence of associated gas volumes on overall domestic production continues to expand. This is primarily driven by the Permian and Eagle Ford basins accounting for more than 2.5 Bcf/d of growth winter over winter (Figure 4). While associated gas production is expected to grow, non-associated gas is expected to drop slightly winter over winter, reflecting interbasin dynamics and LNG export-focused production. Understanding these basin-level shifts helps explain why supply is stable, yet sensitive to changes in oil prices, leaving overall production increases more dependent on oil-driven drilling and development activity.

FIGURE 4

Winter 2024-25 Versus Winter 2023-24 Year-Over-Year Production Growth By Basin

Source: Energy Ventures Analysis

In terms of getting production to market, pipeline expansions are helping ease constraints. The Mountain Valley Pipeline is fully operational, boosting Appalachian Basin takeaway. In the Permian, new takeaway capacity is also helping to relieve some of the bottlenecks, but constraints will likely continue to exist as long as production continues to grow at its current pace.

Pipeline exports from the United States will continue to anchor Mexico’s growing energy demand, with new cross-border pipelines, gas-fired power plants, and industrial projects expanding Mexico’s gas infrastructure. This winter, U.S. exports to Mexico are forecast to average 6.6 Bcf/d, up from an average of 5.75 Bcf/d last winter. Long-term contracts, cross-border infrastructure integration, and other factors are continuing to grow exports, although tariff risk does introduce added uncertainty for future expansion.

Between 2025 and 2030, more than 23 new or expanded industrial projects are scheduled to commence operations, led by fertilizer and petrochemical plants. Collectively, these facilities could add 0.7–0.8 Bcf/d of incremental gas demand. The Gulf Coast remains the hub, with favorable access to low-cost supply and proximity to export markets. Current reindustrialization efforts in the steel, chemicals, and imported fuels sectors are further encouraging domestic buildouts, creating additional pull on U.S. gas supplies.

Data centers represent a rapidly expanding demand sector, with U.S. data center capacity projected to grow from 30 gigawatts in 2024 to more than 41 GW by 2027, an increase of nearly 40% in just three years. By 2027, this demand growth could add 35-40 terawatt-hours (TWh) of annual electricity consumption, and recent announcements show a growing preference for natural gas to support hyperscale data center expansions.

While renewables and coal will offset some natural gas use in the power sector, overall gas-fired generation remains critical for reliability during peak demand cycles. By year’s end 2025, total coal retirements since 2018 are expected to surpass 75 GW. During the 12 months of 2025, a total of 28 GW of solar, 6.5 GW of wind, and 13 GW of storage were scheduled to be installed, along with 5 GW of net gas-fired capacity—largely from combined-cycle plants brought online to partner with the growing amount of renewables.

Circling back to the biggest single demand growth driver, U.S. LNG exports are projected to rise to 18 Bcf/d by late 2025, reflecting both growing global demand and new liquefaction capacity entering service. U.S. LNG feed gas demand should average roughly 18.3 Bcf/d this winter, nearly 3.8 Bcf/d higher on a year-over-year basis. European and Asian markets are expected to remain the primary buyers of U.S. LNG this winter, driven by energy security and emissions reductions goals.

The addition of the Plaquemines LNG terminal keeps the United States on track to maintain its position as the world’s top LNG exporter, with export capacity projected to exceed 30 Bcf by 2030. With ongoing capacity gains, U.S. LNG is positioned to remain a cornerstone of global supply as international buyers seek dependable volumes amid weather volatility and ongoing energy security concerns.

Taking all these factors into consideration, the Winter Outlook forecasts that market pressures will apply flat pressure to Henry Hub prices, which means we expect prices to average near last year’s $3.76/MMBtu.

Overall, NGSA’s annual report demonstrates the resilience of the U.S. gas market and its ability to efficiently balance seasonal supply and demand variables to offer a reliable, affordable source of energy to all domestic consuming market sectors while also enhancing international energy security and meeting global demand requirements. It also shows, however, that we are entering a relatively “normal” winter heating season with tight supply-demand dynamics. To ensure a resilient and reliable energy future, projected future demand must be met with increased natural gas storage capacity and additional natural gas infrastructure.

Editor’s Note: The preceding article was adapted from the Natural Gas Supply Association’s 25th annual Winter Outlook report, which was developed using data from Energy Ventures Analysis Inc. NGSA does not project wholesale or retail market prices.

DENA E. WIGGINS is president and CEO of the Natural Gas Supply Association, leading NGSA’s efforts to advance the natural gas industry’s economic and environmental agenda with member companies, regulators, legislators, and other key stakeholders. Wiggins has spent much of her professional career engaged in representing producer/marketers before the Federal Energy Regulatory Commission and has been involved in every major natural gas rulemaking since Order No. 436. She is deeply involved in the National Association of Regulatory Utility Commissioners, particularly the Committee on Gas, where she has advocated for the benefits of natural gas in a lower-carbon energy future. Prior to NGSA, Wiggins was a partner at the law firm Ballard Spahr and served as general counsel to the Process Gas Consumers Group. She holds a B.A. from the University of Richmond and a J.D. from Georgetown University Law Center.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.