Natural Gas White Papers

Colder Temperatures, Increased Gas Demand Bring Rays Of Sunshine

By Bill Green

WASHINGTON–With the forecast calling for a return to more normal winter weather, natural gas demand is expected to be stronger this heating season. In fact, combined demand from all major consuming sectors–residential, commercial, industrial, electricity generation and exports–is projected to be a record 92.3 billion cubic feet a day during the winter of 2016-17.

This strong demand, in turn, is expected to support higher prices compared with last winter, when unusually warm temperatures across much of the United States left Henry Hub average wholesale natural gas prices at their lowest level in a decade and a half.

Winter temperatures are forecast to be 12 percent colder on average this year than last across the nation, increasing total U.S. gas demand across all sectors by 1.6 Bcf/d compared with winter 2015-16. The biggest seasonal demand growth is anticipated in the weather-sensitive residential and commercial sectors, where the colder weather is estimated to boost consumption by a combined 4.0 Bcf/d.

These are among the key findings of the Natural Gas Supply Association’s assessment of the natural gas market as the heating season gets under way. Using published data and independent analyses, NGSA evaluated the combined impacts of weather, U.S. economic growth, customer demand, storage inventories and supply on the direction of natural gas prices this winter.

The picture that emerged for the upcoming winter is one of a flexible natural gas market that is able to respond to changes in weather and customer demand with ample supply and storage facilities. Because of colder weather and increased demand, NGSA anticipates upward pressure on prices, compared with last winter.

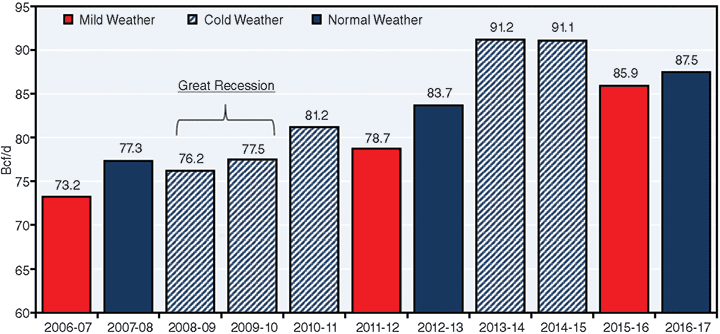

FIGURE 1

Winter Natural Gas Demand for All Sectors

Source: Images courtesy of Energy Ventures Analysis Inc.

Figure 1 contrasts the natural gas demand forecast for winter 2016-17 with actual consumption over the past decade. While demand should be significantly higher than last winter, a winter-time forecast calling for temperatures averaging normal to slightly warmer than historical averages will keep demand below the levels set during the colder-than-normal winters of 2013-14 and 2014-15.

Even with the greater seasonal consumption, reduced natural gas imports and slightly reduced domestic production expected this winter, supplies are ample to meet winter-time demand. Reliability of supply is enhanced further by the record amount of natural gas in storage at the start of the heating season. In fact, for the week ending Nov. 4, the U.S. Energy Information Administration reported 4.017 trillion cubic feet in total inventory, ranking as the highest volume ever recorded in EIA’s weekly database.

It also is important to keep in mind that the upward pricing pressure is in relation to last winter, when wholesale prices averaged $1.98 an MMBtu, which was the lowest average winter wholesale price since the 1990s.

La Niña Conditions

On Nov. 10, the National Oceanic & Atmospheric Administration issued a report noting that La Niña conditions with below-average sea temperatures were present in most of the eastern and central Pacific Ocean. According to NOAA, La Niña conditions were forecast to continue through winter, influencing temperatures and precipitation across the United States.

NOAA’s seasonal outlook favors below-normal temperatures and above-normal precipitation in northern parts of the country, but moderately warmer and drier than normal weather in southern states.

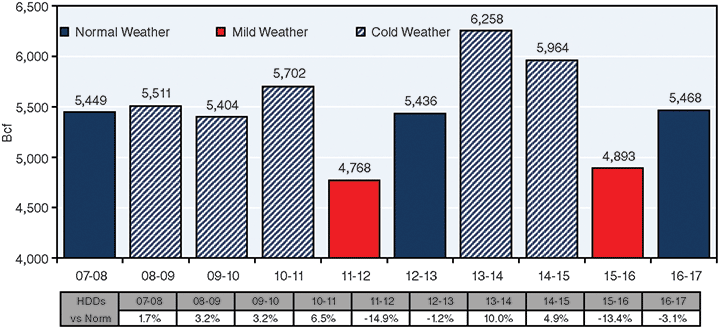

Changes in winter weather can have a significant impact on gas demand in the residential and commercial sectors. For example, the difference in gas demand for the winters of 2013-14 and 2011-12 was 1.855 Tcf, or 16 percent. The long-range forecast is 12 percent colder than last winter, but still relatively mild in comparison with the 30-year average (3 percent warmer).

Last winter ranked as the second-warmest on record with only 3,042 heating degree days (13.4 percent below the 30-year average). This winter is expected to have 3,408 heating degree days, or 12 percent more than last winter (3.1 percent below the historical norm). As a result, the residential and commercial sectors are anticipated to consume 575 Bcf more gas this winter than last, averaging 4.0 Bcf/d in increased demand (Figure 2).

In addition to weather-related demand growth in the residential and commercial sectors, industrial demand is projected to expand by 700 million cubic feet a day (2.4 percent) this winter, thanks to the startup of new-build facilities and capacity expansions to plants in the natural gas-intensive petrochemical, fertilizer and methanol industries.

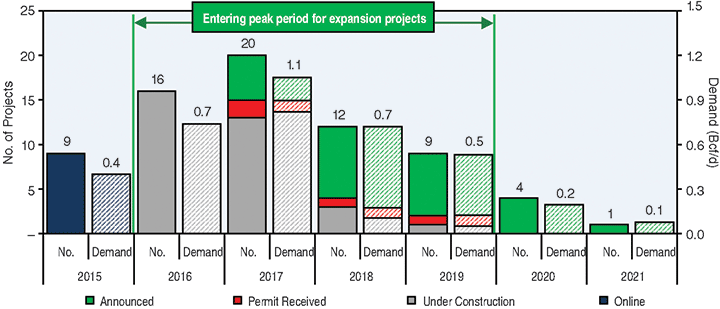

Between 2010 and 2014, 38 fertilizer, petrochemical and methanol projects costing a total of $19 billion commenced operation, adding 1.1 Bcf/d in demand. Another nine projects came on line in 2015.

However, the peak period for annual capacity additions in the industrial sector has only begun. In 2016 alone, 16 projects were scheduled to enter service by year-end, expanding gas demand within the industrial sector by 550 MMcf/d. Between 2017 and 2021, an additional 46 new-build and capacity expansion projects are scheduled to begin operating.

Combined, the 71 new facilities expected to begin operations between 2015 and 2021 will consume an estimated 3.7 Bcf/d of gas annually (Figure 3). These facilities represent an estimated $121 billion capital investment.

Exports And Power Generation

Natural gas exports are expected to grow as well, contributing to the winter-over-winter demand increase. Pipeline exports to Mexico are forecast to increase by 800 MMcf/d, and overseas exports of liquefied natural gas also are projected to average an additional 800 MMcf/d this winter.

The era of U.S. LNG exports began in February 2016, when Cheniere Energy shipped the first cargo from its Sabine Pass facility in Cameron Parish, La. When all five trains at Sabine Pass reach full commercial operations between now and late 2019, the facility’s capacity will be about 3 Bcf/d.

The first wave of U.S. LNG export projects includes several other facilities, including Cameron in Louisiana, Freeport in Texas, and Cove Point in Maryland coming on line over the next two to three years.

While LNG exports remain a small slice of the overall market, they will continue to grow and add incremental demand. Total U.S. LNG export capacity should reach 8.6 Bcf/d by 2020 and reach 15.5 Bcf/d by 2030, establishing the United States as one of the world’s largest LNG exporters.

On the other side of the ledger, gas demand in the electric sector is anticipated to decline by 3.3 Bcf/d (13 percent) this winter, somewhat offsetting growth in other sectors. The drop in consumption to generate electricity is attributable to significantly less short-term fuel switching because of higher natural gas prices expected during the winter months.

Gas demand in the electric generation market reached record levels this past summer, and while NGSA anticipates temporary fuel-switching to natural gas will continue this winter, it should be about half the volumes that occurred during last winter’s record-setting fuel switching, when gas prices were at modern-day lows.

Looking longer term, gas-fired generation continues to broaden its market share. On a net basis, coal-fired generating capacity has declined 38 gigawatts over the past several years, while combined-cycle natural gas capacity has increased 22 gigawatts. This trend should continue, as another 20.2 gigawatts of coal-fired capacity is expected to retire on a net basis during 2016-17, while new-build combined-cycle gas units add 17.8 gigawatts.

On a regional basis, the southern United States accounts for more than one-third of the combined-cycle capacity additions and nearly two-thirds of gas-fired peaking capacity additions.

Supply-Side Factors

Turning to natural gas supply fundamentals, NGSA projects a slight drop of 500 MMcf/d in winter-time production from last year’s record high. The shale revolution has ushered in a remarkable era, as evidenced by dramatic growth in production over the past decade.

Despite the low rig count, this winter’s supply is expected to remain robust because of drilling efficiencies, high-graded activity in the most productive sweet spots in plays, and new infrastructure coming on line to move natural gas to consumers.

Shale plays are expected to represent 57 percent of total domestic production this winter. However, growth in shale gas production has slowed significantly over the past three winters as a direct result of the decline in drilling activity. Shale gas production growth in 2016-17 is forecast to be only half the rate of the previous winter and more than 6.0 Bcf/d less than during winter 2014-15.

Similar to the start of last winter’s heating season, storage inventories stood at record levels in early November. On average, 16 percent of winter supply comes from storage withdrawals.

By far the greatest area of uncertainty in any winter gas market outlook is the weather, and storage withdrawals are the supply component that is most susceptible to changes in winter weather. Should actual weather patterns prove either colder or warmer than forecast, it substantially could impact the amount of gas in storage and have a subsequent effect on pricing expectations.

Because domestic production and net imports both are projected to average below the levels attained last winter, more gas is expected be withdrawn from storage this heating season than during winter 2015-16. However, storage withdrawals still should be 18 percent below the average withdrawals during the three winters prior to 2015-16.

But if the winter turns out to be very cold, similar to 2014-15, seasonal gas demand could be 3.6 Bcf/d higher than projected, when the additional structural demand for the industrial sector is included. If this happens, storage inventories likely would still be adequate, but season-ending storage levels would be reduced to below 550 Bcf by the end of March, closer to 2015 levels.

Alternatively, a very warm winter could reduce storage withdrawals about 1.9 Bcf/d, which would result in higher season-ending storage levels, but below prior end-of-season records.

In brief, NGSA’s analysis shows all individual natural gas pricing factors exerting either upward or neutral pressure. No factors appear to place downward pressure on prices.

The two factors with upward pricing pressure are the weather forecast (12 percent colder than last winter with 366 more heating degree days) and 1.9 percent winter-to-winter overall natural gas demand growth to 92.3 Bcf/d (punctuated by major growth of 12 percent in the residential and commercial sectors, and record seasonal demand in the industrial sector).

Neutral pressure is anticipated in the economy (U.S. gross domestic product growth is expected to be similar to last winter), storage (inventory volumes are high, but similar to last winter), and supply (production is down slightly, but also is similar to last winter).

The important take-away from this assessment is the strength and responsiveness of natural gas supply. When one takes into account the expectation for record storage, and the strength and flexibility of the natural gas pipeline system, the industry is well positioned to meet record demand this winter.

Editor’s Note: The preceding article was adapted from the Natural Gas Supply Association’s 16th annual “Winter Outlook” report, which was developed using research from Energy Ventures Analysis Inc., demand and supply projections from the U.S. Energy Information Administration, and economic projections from IHS. The analysis is based on publicly reported data. NGSA does not project wholesale or retail market prices.

BILL GREEN is chairman of the Natural Gas Supply Association, which represents integrated and independent companies that supply natural gas in the United States. Green is vice president of downstream marketing for Devon Energy Corp., with responsibility for domestic natural gas sales and transportation activities. He has more than 30 years of experience in natural gas marketing with Devon and Mitchell Energy Corp., both pioneers and major developers of shale gas. Green also is a member of the National Energy Service Association and the Texas Pipeline Association.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.