Digital Technology Promises To Revolutionize Tubular Inspection, Management

By Lonnie Smith

SPRING, TX.—It is time for oil and gas operators to reimagine how tubulars are inspected and managed.

For decades, tubulars—and the risks to the budget they represent—have been evaluated on an individual inspection basis, and inspection data has been captured by an independent company and provided to the operator with individual joint disposition at the end of the inspection. Typically, this data is siloed either in a pdf or Excel document, with data related only to one rig and often using only the most recent inspection information.

While the bottom-hole assembly is the most expensive downhole equipment on a per-item basis, the tubulars that make up the drill string between the BHA and the surface represent more than 90% of overall downhole tools. As lateral length increases, so does this percentage. Between washouts, twist-offs, and general wear and tear replacement costs, tubulars can have an enormous impact on the drilling budget. Relying on one individual inspection prior to installation is an outdated process that causes operators to miss out on significant cost savings.

To optimize the process, the siloed data must be unlocked and integrated with previous inspections, as well as inspections from other rigs in the drilling program. With new technology in digitization and data science, the ability to manage drill pipe across the entire rig portfolio is now easily available at a low cost. These new capabilities allow oil and gas companies to:

- Track individual joints and cradle-to-grave changes (from the first appearance at the rig until that joint is downgraded);

- Create benchmarks for repairs/downgrades for all rigs within the drilling program; and

- Develop predictions of future damage, allowing additional control and planning over budgeting and contract negotiations.

Implementing Serial Numbers

Implementing serial numbers is a fundamental component to achieving tubular program cost savings through data science. Until recently, serializing tubulars was not viewed as critical. As long as each joint was evaluated before it was used to drill, operators did not consider it necessary to know what happened to a joint before it arrived on location. The effort to manage this by a company man with a spreadsheet was unrealistic, nor was it advantageous, and most inspection reports were either handwritten or pdf files.

With the advent of digitization and modern business intelligence tools, it is now easy to trace and evaluate individual joints and their histories from the time they arrive on site until they eventually are replaced (Figure 1). This capability hinges on tracking individual serial numbers for each joint. This simple, yet crucial, improvement is an investment that will pay dividends far into the future with a few best practices.

Managing serial numbers enables the operator to assess the exact condition of a joint from the beginning of use and track the component during the time it is in use. When a joint is downgraded or lost, current industry practice calls for charging the replacement cost to the current user at the point the joint reaches the end of its life. Consider this: If a joint shows up for the first time, and 10% of the wall is already gone, why would it make sense for the operator to pay 100% of the replacement cost? In a 700-joint string at a replacement cost of $1,500 per joint, if 10% of the joints are downgraded, that could be a $105,000 replacement bill on one inspection.

Creating a serial-number-based database to track the condition of each joint from the moment it arrives to every time it is inspected or shipped off for repairs can lead to substantial savings. In fact, referencing the life of the joint from the moment it arrives can open the door to replacement cost savings of 25% or more.

In addition, combining serial numbers with a database that shares all information across all rigs in a drilling program allows for optimized management techniques. Without standardized serial numbers, and the ability to look at the portfolio as a whole, joints rejected on one rig may pop up on another rig without any way to identify the event.

To further complicate this occurrence, operators frequently use multiple inspection companies within a drilling program. If the inspection companies are different, they are even less likely to catch the same problem joint found at two separate rigs. Adding this capability unlocks levels of accountability previously inaccessible from siloed inspection reports and lowers the chances for washouts and twist-offs, potentially savings hundreds of thousands, or even millions, of hours in nonproductive time.

Best Practices

Ensuring serial numbers for all drill pipe can be trickier than it sounds at first. Most tubulars are not owned by the oil and gas company. Within one portfolio, a rig can receive tubulars from multiple drilling contractors. In addition, that same portfolio can utilize rental pipe from a separate third-party supplier. Moreover, multiple inspection companies may be ensuring tubular quality, and those inspections most likely are being requested by rotating contractors for company men. From one inspection to the next, a company may be relying on completely new eyes. All these inconsistencies can increase NPT and unnecessary cost.

The good news is that these problems can be avoided by adopting a few best practices. First, operators need to develop a formal quality control policy for tubular serial numbers. Serial numbers should be unique for each joint and that serial number should never change. While this may seem like common sense, some companies’ inspection standard operating procedures call for assigning a new serial number every time a joint is inspected. This is completely counterproductive to the goals of an inspection and management program.

A good policy will establish a naming convention for each serial number to avoid duplications. When this process is adopted, users will discover many joints within a drilling program lack a serial number or have one that does not meet a company’s requirements. Make sure to have a policy that anticipates this and avoids separate people on separate jobs creating the same serial number. Also, ensure that the serial number is stamped in a location that provides the greatest life.

Consider following the guidelines of DS1 Fifth Edition, Volume 3, which can be located in 3.35.5.1b. Any joints that are potential duplicates, lack a serial number, or are identified by multiple numbers, should be stamped in accordance with the serial number policy. The person performing this job should record the existing identification number present on the joint (should the number exist) into the database to ensure that future analysis can be performed if necessary. This policy should be communicated to all tubular providers. As new contracts are written, the policy should be a negotiated requirement for tubulars to include serial numbers when the joints arrive.

Second, to enforce the serial number policy, inspection companies should be provided the policy and they need to provide assurance that they will verify this as part of the inspection process. During inspection, all tubulars that do not meet the policy should be noted in the inspection report and a correction procedure should be applied. Depending on the decided location of stamping and drilling conditions, the policy can consider a process to restamp serial numbers that have begun to wear, rather than waiting for them to disappear.

This policy also should be communicated to all repair services, such as machining and hard-banding, to make certain everyone’s paperwork records the correct serial number. The goal is to ensure that every party that touches the tubular verifies that the serial number is present and meets the operator’s policy. That includes the owner of the tubular, the inspection company, the thread repair company, the hard band repair company and anyone else with a role in the tubulars’ movement and management.

There is no other way to say it: This process will be an undertaking and require commitment to realign the joints, vendors and culture to value serial numbers for each joint. However, the economic return for this investment will be seen for years to come in the form of reduced replacement costs, as well as significant insights into the joints across a rig portfolio.

Single Database

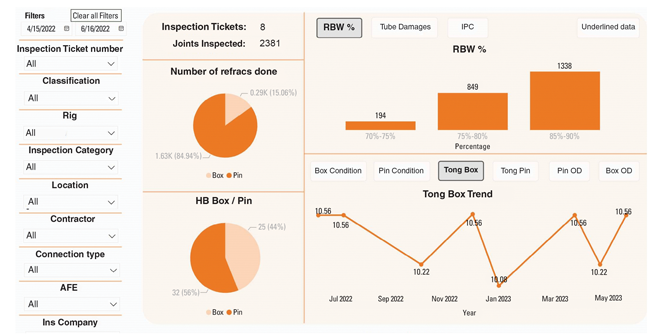

To further reimagine tubular management, there now is an opportunity to collectively gather all rigs’ inspection reports and compile them into a single database or “pool” (Figure 2). By recording this information in one uniform format, one can evaluate each inspection report against the entire pool. As data is collected, patterns will emerge that can be used to develop inspection baselines.

For example, after compiling a group of inspections, users can see the extent of damages with the performance of each inspection. By building a dashboard and giving company personnel access to the data, operators quickly can compare the results of an individual inspection report’s repair costs versus the baseline average for that region or drilling program. This can provide the company with profound feedback and can prove especially powerful with the challenges associated with the great crew change. Baseline data can be leveraged to compare tong lengths, wall thickness, outside diameters, connection dimensions and several other characteristics.

These baseline comparisons can be signals for comparing inspection companies. If an operator uses multiple inspection companies across a drilling program, it can compare companies to understand if one appears to charge an excessive number of field thread repairs, or even inspectors, to determine if one inspector calls damages at twice the rate of another, to cite only a couple examples.

Baselines also can be utilized to compare rig crew performance. Is one rig seeing uneven wall loss at a much higher rate? This may signal that pipe is not being rotated properly. Is there excessive damage to connection faces? That could be a sign that stabbing guides are not being followed. In the past, this type of analysis was left to human intuition and experience, but now operators have hard data on which to build their understanding.

Finally, baseline data can be used to compare repair service performance. For example, if one rig is running a specific brand of hard band material and another is running something different, the results can be compared quickly to understand what is most cost-effective for the entire drilling program.

Moreover, leveraging the power of baseline data to evaluate the performance of the various parties is a game-changing tool for company personnel, but the tool needs to be easy to use and accessible at the rig site. The answer is a Web-based platform that easily can be leveraged from the rig floor or office with a simple, intuitive dashboard. Adoption is the key to success and a tool that can be used without a week of training is the best approach.

Establishing KPIs

It is worth sharing one final note on baseline trends to manage tubulars: Never has it never been so easy to electronically record and report in near real time the tubulars’ performance as they are utilized on rig sites. Baseline trends give management the ability to establish key performance indicators.

Combining individual cradle-to-grave tubular data with baseline trend data allows companies to see into the future. Eventually, every tubular will reach a threshold at which it is deemed no longer usable. This is an accepted reality, but to reimagine the management of tubulars is to not only accept this unavoidable truth, but to predict when that downgrade will happen (Figure 3). A great set of data can accomplish this with relative ease and certainty.

To start, the oil and gas company must know a joint’s most recent condition. For example, a joint may have 90% of its remaining wall while the operator’s criterion requires rejecting anything inferior to 85% wall. Finally, we know that the baseline shows 2.5% wall loss with every drill string inspection. By incorporating this information, users can predict this fictitious joint has two more inspections before its wall will deteriorate to 85% or worse.

Because we know the interval of when the joint will be inspected and the replacement cost of the joint upon rejection, it is possible to budget for the moment at which that joint’s replacement is likely. Leveraging a dashboard quickly provides an automated process for achieving this for each joint and rolling up the information to the financial team with minimal calculation or reporting effort by the field team.

The result is a reimagined, science-based approach to tubular management. A dashboard view that allows for cradle-to-grave joint tracking with established baselines from the entire drilling program and the ability to predict the budget with a high level of certainty into the future is valuable insight. Tracking KPIs that can be used to communicate and improve performance for all stakeholders offers significant cost savings in an area of inspections that often is overlooked.

LONNIE SMITH is president and co-founder of Turnco, a nondestructive testing specialist, and the inventor of the B.R.I.T.E. and D90 portal for providing real-time data on BHA performance. With more than 25 years of experience, Smith excels at solving BHA challenges for operators and drilling contractors alike. Before founding Turnco in 2010, he worked as a supply chain manager for Dyna-Drill Technologies, a Schlumberger subsidiary, and as a global asset manager for Pathfinder Energy Services. Smith holds a B.A. in finance from the University of Houston and an executive education certificate in energy from The University of Texas Red McCombs School of Business.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.