Five Market Trends Could Sharpen Future Recovery Rates

By Richard Spears

On my last day as the district engineer for Halliburton, I drove to a rig a bit southeast of Enid, Ok., where ARCO was drilling an unusual well. ARCO wanted to talk with the Halliburton engineer who would be responsible for the cement job they were planning to pump, and my understudy engineer, Dan Themig—who later invented the ball drop sliding sleeve—was not available. That day in May 1981 was beautiful, and I didn’t realize I was about to witness the world of oil and gas changing in front of my eyes.

I jogged up the stairs to the doghouse to see the drilling team and asked the driller to tell me where the bottom of the hole was. He pointed west toward the neighboring wheatfield and said, “About a thousand feet thataway.” I was uncomfortably familiar with grizzled drillers jerking my chain for being a young college boy trying to do a man’s job, but I wasn’t going to fall for that lie. “No, really, what’s the well depth?”

This was my introduction to one of the world’s first horizontal wells, revolutionary because it turned the bit 90 degrees to expose more reservoir rock. My imagination was not extravagant enough to forecast the impact horizontals would have on the global oil and gas industry, a technology that continues to change the industry in 2026.

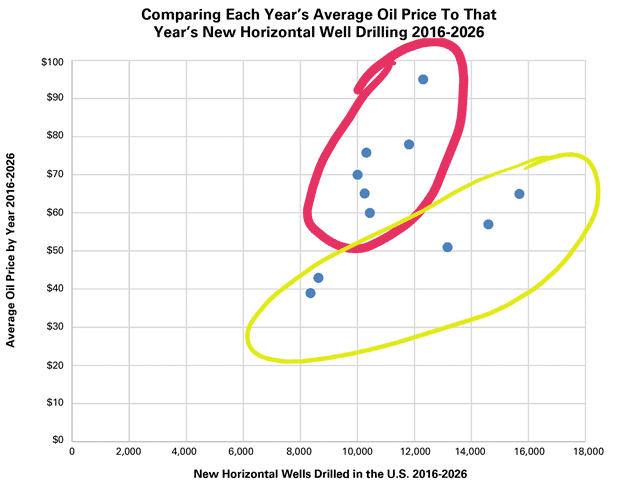

My team has identified five trends that will influence drilling and completion activity this year which, oddly it may seem, do not include the exact price of oil and gas. While natural gas prices do drive people toward or away from drilling dry gas wells in places such as the Haynesville, oil prices have had a muted effect on activity since about 2018 or so. Whether the price of oil is $60 a barrel or $100 a barrel, about 11,000 new horizontal wells will be drilled in the United States each year.

Of course, oil prices can influence individual producers’ decisions. This is especially true for small or mid-sized firms that have limited access to economies of scale and often drill with internally generated capital. But at a macro level, as long as oil seems likely to fall somewhere between $60 and $100, we need to look beyond prices to determine what will shape this year.

Natural Gas’ Ascent

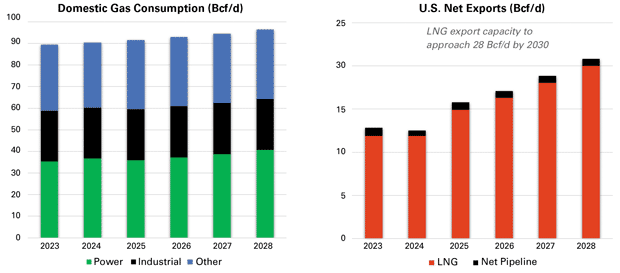

The first trend worth watching in 2026 is the move to natural gas. There is nothing like the convergence of three economic factors to bolster natural gas drilling activity: domestic consumption, LNG exports, and declining excess associated gas production from Permian oil wells. In 2026, all three factors will be positive for natural gas. Domestic consumption is slowly rising because the U.S. economy is doing okay, and the so-called renewables can’t make everything that gas makes, including underwear, car tires, and fertilizer.

Meeting the demand for natural gas created by growing domestic consumption and soaring LNG exports will require gas-targeted drilling. This activity will most likely occur in the Haynesville, South Texas, Oklahoma and the Marcellus/Utica, with potential for the Western Rockies to benefit as well.

LNG exports are good and getting better. Oil well drilling in the Permian is scaling back slightly, which means associated gas is dipping. Plus, much of that gas is going into power generation in West Texas.

The combination of growing demand and reduced supply will create a gap that will need to be filled by gas-targeted drilling. Most of that drilling should take place in the Haynesville, South Texas, Oklahoma, and the Marcellus/Utica, but the Western Rockies could also see more activity.

Longer Laterals

The second trend is the industry’s embrace of four-mile laterals. Today, about 5% of all horizontal wells have these super long laterals. That makes the wells the exception rather than the rule, but remember when a 10,000 foot lateral was the exception? That was just a decade ago.

We think the four-mile lateral will be the primary driver of the future of the U.S. land oil and gas industry. Why are E&P companies combining? To build vast, contiguous acreage positions so they can drill four-mile laterals. What is spurring directional drilling and drill bit advances? The need to efficiently drill four-mile laterals. What is the biggest component of future frac demand? The desire to quickly and safely complete groups of four-mile laterals.

If readers dismiss every other trend I’ve noted in this article, do not dismiss the sea change of the four-mile lateral. It is more immediately impactful than the ARCO horizontal well I visited in 1981.

AI’s Side Effects

The third trend: AI is constraining the growth of frac service companies. Perhaps this is counter-intuitive, but consider this: At the end of Q3 2025, the public frac service companies who have e-frac fleets and their associated power generation packages saw share prices skyrocket when investors heard they were expanding their power generation fleets and reducing spending on their frac fleets. Investors in frac service companies want more power and less frac.

If you are on the board of a frac service company with e-frac capabilities, where are you going to invest your next spare dollar? Power generation for data centers, or replacing a frac spread? Power generation!

While commodity prices always matter, oil prices can almost double today while drilling hardly increases. This is evident by comparing past price responsiveness (the yellow circle) with more recent years (the red circle).

For frac companies, data centers are an appealing customer. The centers are willing to pay a premium for reliable power generation because they need it to enter service. Once they’re operating, they need continuous power, and the power generation equipment can stay in one place rather than moving from site to site. Thus, the more AI the world wants, the tougher it is to justify new investments in e-frac crews.

In the short term, the competition for capital between e-fleets and power generation may have a minor effect on fleet availability and pricing. The industry has spare frac spreads, and ongoing improvements in completion efficiency mean that it can complete the wells it wants to drill with fewer fleets.

But even the most well-designed and maintained fleets wear out over time. If investors continue to reward frac service companies for building power generators instead of frac fleets, the industry will reach a point where the demand for fleets exceeds the supply.

Middle Eastern Consolidators

The fourth trend: The Middle East will leverage its abundant capital to build oil field service behemoths. In many cases, these consolidators will be able to outbid U.S. and Canadian firms that are also looking to bring innovative technologies under one umbrella. That may sharpen domestic companies’ efforts to identify undervalued acquisition targets or ones that are a particularly strong fit for their capabilities and vision.

Even so, domestic producers and operators who are accustomed to working with U.S.-based service firms may discover that many of their future partners hail from abroad. At the same time, service companies that have long prioritized opportunities in West Texas and other U.S. plays may find themselves eying multiyear contracts in Saudi Arabia and other lucrative international onshore and offshore arenas.

Changing Geopolitics

The final trend relates to the Trump administration’s penchant for using the American war machine to lower oil prices. What happens to the price if democracy in Venezuela is restored, if Russia and Ukraine reach a peace agreement, if Iran starts playing nicely, or if Nigeria stabilizes? In every case, more oil comes on the market, not less.

At the start of this article, I wrote that the price of oil doesn’t affect domestic drilling activity if the range is $60 to $100, but what if West Texas Intermediate falls to $50? Or $40? At those levels, domestic activity will slow, with the potential for the drop to be precipitous.

If there was ever cause to tolerate lower prices, a less tumultuous and freer world would be it. Chaos bolsters prices, but it is a disaster for the planet and its people. We are all better off when peace and free trade, the rule of law and minority rights, and capitalism and free speech prevail.

The chance that all five trends outlined above will emerge fully formed this year is probably zero. However, each trend is already underway, with measurable impacts on the domestic oil and gas industry that bring both challenges and opportunities.

Stay on your toes, and remember, we are all working together to provide low-cost energy to the world and help lift everyone out of poverty.

RICHARD SPEARS is a vice president at Spears & Associates, an oil field market research firm that was founded in 1965 and has more than 500 corporate clients around the world. He is the primary author of the firm’s Oilfield Market Report, which examines industry trends and key companies’ market share within 32 equipment and services markets associated with exploration, drilling and production. Richard sits on the boards for several companies, including Activ Chemicals, APS Technology, Latshaw Drilling, ignis H2 Energy and Varel International Energy Services.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.