Goldsmith-Landreth Unit, Other ROZ CO2 EOR Projects Give Legacy Fields New Life

By Al Pickett, Special Correspondent

THE WOODLANDS, TX.–With more rigs now targeting crude oil than natural gas reserves, oil is spurring increased demand for all types of production and artificial lift equipment and services. While shales and “tight” oil formations may be driving the trend toward liquids in basins across the country–including in the Permian Basin–a significant development is quietly taking place in legacy West Texas fields that could add billions of barrels of new recoverable reserves in one of the nation’s oldest, largest and most productive oil basins.

Seeking to avoid high rates of water production, operators historically have limited drilling depths in the Permian Basin to structures above the defined oil/water contact (OWC). However, several projects are demonstrating that the residual oil zones (ROZs) below the oil/water contact hold vast oil potential. In fact, some resource analyses estimate that ROZs may ultimately yield as much cumulative oil as the total volume produced to date in the main pay intervals above the OWC!

These entirely untouched zones below the OWC are geologically distinct from the shallower main pay zones that have been targeted in the Permian Basin for 80 years. They have been the focus of secondary (waterflooding) and then tertiary (carbon dioxide flooding) enhanced recovery operations. The deeper ROZs will produce only water on primary or secondary.

Below the oil/water contact, the reservoir rock matrix has been naturally waterflooded, effectively sweeping vast fairways and leaving behind residual oil zones that often measure hundreds of feet thick with petrophysical characteristics that mirror or even exceed those found in the main pay zones (MPZs) above after they have been waterflooded, according to Bob Trentham, senior lecturer of geology and director of the Center for Energy and Economic Diversification at the University of Texas at Permian Basin in Odessa.

By injecting these naturally waterflooded ROZs with CO2, Trentham says old anchor fields in the Permian Basin are being expanded vertically to add an entirely new dimension of oil reserves that could not be exploited during primary production or secondary and tertiary EOR in the MPZs above the OWC. The fields that have been deepened are witnessing what some are calling a fourth phase of production, or a “quaternary” production stage.

“ROZs are the product of the Permian Basin’s depositional and geologic history, particularly two major episodes of tectonic uplifting that swept oil-filled reservoirs with freshwater,” he details. “About 240 million years ago, oil began migrating into Permian Basin reservoirs. Then 60 million years ago, there was a tectonic rise-up in the area to the west, between Van Horn and El Paso, Tx. Freshwater flushed into the intervals where oil had been deposited, mixing with the connate waters and pushing some of the oil out of the lower half. The water swept the oil as the Rio Grande Rift developed about 45 million years ago. About 25 million years ago, we had the Basin and Range uplifts, causing Mother Nature to again waterflood the lower interval.”

Trentham explains that ROZs have been interpreted historically as “transition zones,” where the fluid trapped within the reservoir rock progressively turns from oil to water. “Although the upper portions of these transition zones long have been assumed to contribute to some oil production in some fields, their deeper potential as a CO2 recovery target had never been exploited,” he says. “Some companies began to notice that the ROZ oil saturations looked like the MPZs after waterflooding and before initiating carbon dioxide flooding. They began to look at whether the lower part of the zone could be flooded with CO2. The answer, it turns out, is yes.”

Goldsmith-Landreth Unit

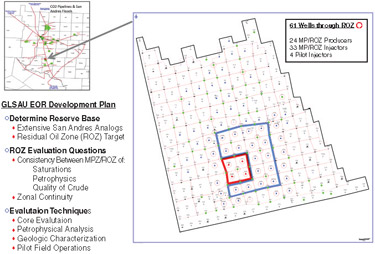

One of those companies is Legado Resources LLC, which purchased the Goldsmith-Landreth (San Andres) Unit northwest of Odessa, Tx., and conducted a detailed technical evaluation using core studies, petrophysical analysis and pilot operations before deepening existing wells to extend CO2 flooding from the main pay zone into the underlying residual oil zone (Figure 1).

Dane Cantwell, senior vice president for development at Legado Resources, says the characteristics of the ROZ in the San Andres formation in the Goldsmith-Landreth Unit are strikingly comparable to the MPZ, giving the company plenty of optimism about the project’s potential. “The rock properties are similar, the oil properties are similar, the lateral connectivity is similar and the oil saturation is similar,” he notes. “So why shouldn’t we expect similar production results?”

The Goldsmith-Landreth project is a little different from other quaternary efforts because Legado is, from the onset of CO2 flooding, simultaneously injecting into both the MPZ and the deeper ROZ in an attempt to produce both at the same time, points out Tom Thurmond, engineering manager. “I believe we are the first to develop the ROZ contemporaneously with the MPZ. It is an opportunity to do something that, on one hand, has not been done before, but on the other hand, is an extension of technology that has been around for 30 years. We have made that our niche, doing something that is a little bit new by taking existing technology and expanding its application.”

Steve Melzer, owner of Melzer Consulting, an engineering firm that advises companies on the business of CO2 EOR, says injecting carbon dioxide into the residual oil zones represents the next step in the development cycle of conventional Permian Basin fields, moving from primary to secondary to tertiary, and now to quaternary recovery.

“It stems from the interval that is appropriately viewed as ‘Mother Nature’s waterflood.’ The mobile phase in the reservoir pore space is water, the oil in ROZs is immobile and attached to the rock,” he states. “The CO2 liberates that immobile oil from the rock so it can be produced.”

Melzer says there are nine active “brownfield” CO2 ROZ projects in many of the major San Andres fields in the Permian Basin, including the Wasson, Seminole, Vacuum, Means and Hanford fields, as well as the Goldsmith-Landreth Unit, all of which have started injection. Three more have been scheduled to soon begin injecting carbon dioxide.

“Just one of these projects could potentially recover hundreds of millions of barrels of oil,” he states. “It is a huge target.”

Legado Resources LLC is injecting simultaneously into both the main pay zone and the deeper residual oil zone from the onset of CO2 flooding at the Goldsmith-Landreth Unit in the Permian Basin in an attempt to produce both at the same time. The main pay and residual zones have similar rock properties, oil properties, lateral connectivity and oil saturations.

Exactly how huge remains an open-ended question for now, but Trentham adds that everyone agrees the numbers are very, very big. “The residual oil zones may contain 100 billion barrels of oil in place and 10 billion-30 billion barrels of recoverable oil, and some argue that it could be even larger,” he states, referencing the fact that the Permian Basin has cumulatively produced 30 billion barrels since the discovery well was drilled more than 80 years ago. “Every additional 1 percent increment of reserves that we can recover is an additional 1 billion barrels of oil. That is the size of the prize.”

One reason ROZ development is all so new is that the information coming from these projects has been difficult to access, Melzer notes. To try and address that problem, Legado has agreed to be part of a U.S. Department of Energy project examining the technology and response characteristics of simultaneously CO2 flooding the MPZ and ROZ. The University of Texas of the Permian Basin is the prime contractor and the project is now under way.

Classic Oil Field

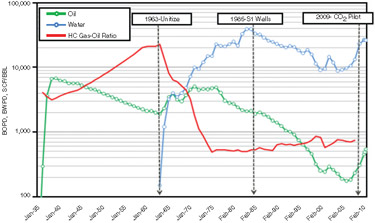

Cantwell describes the Goldsmith-Landreth Unit as a “classic” Permian Basin legacy oil property. The 6,200-acre unit is a collection of more than 50 individual tracts that were discovered as early as 1934, with most of the initial development occurring in the 1940s. Cantwell says the combination of primary and secondary production from the main San Andres pay in the Goldsmith-Landreth Unit is 74 million barrels.

Goldsmith-Landreth has had myriad operators over the years, and was unitized by Amoco before it initiated waterflooding in the early 1960s. Legado purchased Goldsmith-Landreth in 2008, one year after a management team with extensive experience in miscible gas injection formed the company through a funding commitment from EnCap Partners.

“We suspected ROZ upside. Most San Andres fields have ROZ potential,” Cantwell explains, noting that Legado puts the combined reserves potential from CO2 flooding the MPZ and ROZ in the Goldsmith-Landreth Unit at an estimated 70 million-100 million additional barrels.

“The existence of residual oil zones was understood in the early and mid-1980s, but economics and conventional wisdom of the time slowed its maturity,” Cantwell continues. “We did not fully appreciate the target we had. We are not smarter today as an industry, but we have gained perspective. Time has moved on, and the industry is recognizing that the ROZ is no different from the MPZ after waterflooding.”

Legado’s initial work focused on a comprehensive technical evaluation of the property, including core evaluation, petrophysical analysis and geologic characterization. It then implemented an $8.3 million pilot program in 2009 to begin injecting 15 million cubic feet of carbon dioxide a day into both the MPZ and the ROZ through four injection wells. The project included deepening and recompleting 22 wells and drilling three wells, and installing 3.5 miles of 8.0-inch CO2 service pipeline, 700-horsepower in recycle compression, and separation equipment.

Within a few months of initiating injection in July 2009, Cantwell says the pilot project improved oil production by 260 barrels a day with a sevenfold increase in oil cut and a stable gas-to-oil ratio. Two injectors were added to the pilot area in 2010.

“By late 2010, we were producing 650 bbl/d,” he reports. “We have taken engineering surveys and determined that the recovery is out of both the MPZ above the oil/water contact and the ROZ below it. Industry experience has proven ROZ a valid target, so it makes sense to flood both the MPZ and ROZ at the same time. Clearly, it is more economical to get the oil as fast as you can. It is easier to work on the wells–drilling, deepening and completing–before you begin injecting CO2.”

Thurmond agrees that there are advantages, both technically and in terms of capital intensity, to flooding the main pay and residual zones at the same time. “It impacts the capital intensity to do all the well work before you start injecting the CO2,” he reasons. “That is a beneficial factor. Another factor is the placement and sweep of CO2 in the reservoir is easier to manage when you start to flood both intervals simultaneously.”

Cantwell says the wells in the San Andres formation are approximately 4,000 feet deep. Legado is deepening the wells by a couple hundred feet. “Once we are finished with all phases of the project, we expect to have 124 injector wells and 150 producers,” he adds.

“In terms of scope, the San Andres is a world-class oil reservoir,” Thurmond observes. “ Industry’s evolved understanding of its geologic history and willingness to continue to stretch the application of technology is opening a new and exciting exploitation path in the ROZ.”

Development Phases

Legado followed its pilot program with the first commercial phase of development at Goldsmith-Landreth last year, according to Cantwell, and began injecting carbon dioxide in December. He explains that the first phase uses 20 five-spot patterns, with each one having one injector surrounded by four producing wells. The company now is working on the second phase of development, which includes 22 five-spot patterns. In total, Cantwell says the Goldsmith-Landreth Unit will be developed in five or six distinct phases.

“The majority of the wells are equipped for CO2,” he states. “We have drilled a few new injectors, but the majority of the wells are workovers rather than new drills.”

At present, Cantwell says Legado is injecting 50 MMcf/d. It purchases the carbon dioxide from Kinder Morgan, with most coming from the McElmo Dome Field in Colorado and Utah, which provides 1.3 billion cubic feet a day total to the Permian Basin. “We have tailored our development plan to match the CO2 available,” Cantwell offers. “The trick is running at the right pace. We are working on wells at a reasonable pace that we can accomplish comfortably without tripping over ourselves or getting ahead of our available supply of injectant.”

Thurmond acknowledges that managing the supply of injectant is critical to the overall success of any CO2 flood, whether targeting above the oil/water contact line or below it. “Success of CO2 EOR in the Permian Basin has driven demand, resulting in periods of tight supply,” he points out. “But we have a contracted volume. We know what our availability is, how our volumes will increase over time, and we have a well designed integrated plan. As the industry further develops these opportunities, new CO2 sources, such as anthropogenic supplies from a variety of sources, may become viable. We are keeping an eye on these developments.”

Cantwell says it is too early to have production numbers from the first phase of the project, although Legado expects an overall recovery rate of 12-17 percent. He says the company anticipates achieving peak production in 18-24 months, similar to the timelines for CO2 floods of MPZs in other fields.

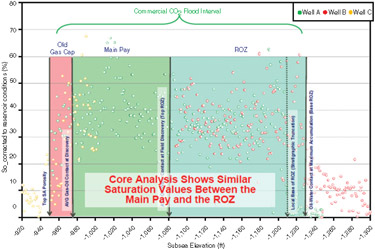

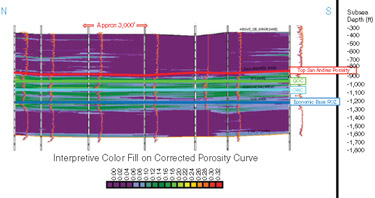

Some of the key issues in evaluating the ROZ at Goldsmith-Landreth included determining the consistency between the main pay and residual oil zones in terms of saturation (Figure 2), petrophysical variables, crude quality, zonal continuity (Figure 3) and other properties. In all cases, Cantwell reports, results indicate strong correlations between the reservoir interval above the OWC and the interval below it.

“For example, oil saturation measurements in core samples from the MPZ and ROZ are so comparable that one cannot look at the core results and tell where the ROZ begins,” Cantwell observes. “The saturation rates between the two intervals are basically indistinguishable. Reservoir quality, bulk oil properties and chemical process behavior are also consistent.”

Thurmond adds that it stands to reason that the saturation values appear to be the same in the MPZ and ROZ. “Considering that previous waterfloods have swept water through the main pay zone six times in most cases, it makes perfect sense that the saturation levels are practically identical to the ROZ,” he says.

Artificial Lift

While it is easy to get excited about the early returns from the work at the Goldsmith-Landreth Unit (Figure 4) and the broader potential of oil recovery below the oil/water contact across the Permian Basin, Thurmond reminds that CO2 ROZ projects are not without challenges of their own.

One issue that can be problematic in some cases is the corrosiveness of the injected carbon dioxide, but Thurmond points out that ROZ oil production presents no additional challenge compared with any other CO2 EOR project in the Permian Basin.

“We take prudent steps to protect our wells, tubulars, equipment and facilities. Production and injection strings are lined or coated, and pumps are generally stainless steel and sealed where appropriate. Our surface facilities are internally coated where necessary, as well as bare steel where conditions allow,” he says.

“In some parts of the country, corrosion is a chronic problem in wells with CO2 in the production stream. Perhaps as a result of the nature of the reservoir rock at Goldsmith-Landreth, and with proper equipment and chemical programs in place, we encounter comparatively few problems with corrosion,” Thurmond remarks.

Thurmond predicts that the Goldsmith-Landreth Unit’s artificial lift needs will change over time. In fact, he says that eventually some of the wells will flow on gas lift without any need for pumps as more carbon dioxide is injected into the reservoir. “The field has above-average reservoir quality in terms of permeability, which should allow select wells to flow as they mature,” he adds.

At the moment, however, all of the wells are on either electric submersible pumps or rod pumps, according to Thurmond. “The wells are equipped with a combination of ESPs in varying sizes and rod pumps on lower-volume wells,” he says. “The deliverability varies from well to well, so some pumps are larger and some are smaller.”

Another challenge is properly training employees involved in field operations, Thurmond goes on. “We are training our staff to do things many have never done before, and when we get three to five years into the development work, those employees will be training a new generation in field operations,” he notes. “Most of them have only modest CO2 operations experience. It is hard work, but it is amazing how quickly they pick it up.”

One of the trademarks of Permian Basin CO2 EOR projects is a long life cycle that spans decades, and Cantwell suggests that the Goldsmith-Landreth MPZ-ROZ development will be no different. “Look at the SACROC Unit in Scurry County, Tx. (the Permian Basin’s oldest CO2 flood, operated by Kinder Morgan),” Cantwell offers. “It started in 1972 and it still is going strong. We undoubtedly will be producing oil in the Goldsmith-Landreth Unit for at least 30 years.”

And if the huge recoverable resource estimates of the residual zones prove accurate, old sleeping giants such as Goldsmith-Landreth could be productive for even longer, eventually producing as much oil from below the oil/water contact as has been produced over the past eight decades from the prolific intervals above it.

“How much ROZ development will there be and what is the ultimate reserve target? Is it 30 billion barrels of oil? It will take time to get the answers and achieve that kind of reserve target, but we have the right technology and the right assets in these legacy fields,” Thurmond concludes. “The industry has been doing waterflooding and CO2 flooding in the MPZs of mature Permian Basin fields for 40 years, and now we have large new ROZ targets for carbon dioxide flooding below the OWC that brings new life to these same assets for many more years to come.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.