Greater Demand Plus Less Capital Equals One Tight Market

By Richard Spears

Three major factors define U.S. oil and gas drilling and completion activity in 2023: producers’ spending discipline, continuing oil and gas demand growth, and the scarcity of capital for oil field service companies. If we reduce these to a single factor, it is continuing oil demand growth.

Despite the massive political push across the globe to wish away hydrocarbons, people want more of what we make today than they did yesterday and tomorrow they will want more still.

Want proof? Most years during the last three decades, global oil demand has risen one percent each year except for a few one-year hiccups that accompanied economic collapses. In 2022, oil demand climbed two percent. And we have a war. And we have stunning inflation. Our firm’s forecast assumes one percent global oil demand growth in 2023.

Pivotal Population

Eventually the annual demand growth will end, but not because the political elite has decreed it. Demand will fall when the world’s population declines.

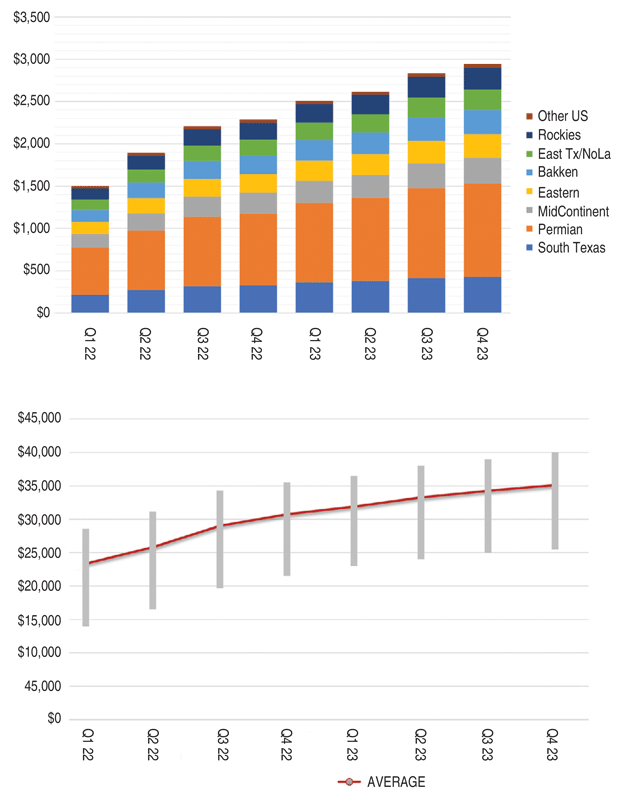

In 2023, the U.S. land contract drilling market likely will continue gradual but sustained growth, with the Permian Basin expected to lead the uptick. Mirroring trends in onshore drilling activity, U.S. land rig day rates are projected to continue edging higher throughout 2023. These results are based on a review of 40 land contract drilling contractors and exclude shallow vertical hole drilling rigs. Spears & Associates attempted to include only a rig’s day rate and not ancillary services that are sometimes added to that rate.

The United Nations predicts this will happen in 50-75 years, but the United Nations’ own population census indicates that every continent except Africa has seen birth rates nosedive in the last eight years. Europe’s population already is shrinking. North American population will start shrinking in 5-10 years, as will that of Latin America. Asia’s population shrinks in 10-15 years.

Our firm thinks it is quite likely that the world’s population will start to fall in a decade or two and that will be the cause of a gradual decline in demand for all types of energy. If you are skeptical, travel around the planet and ask people of childbearing age how they feel about bringing a baby into the world.

Until then—let’s say 2035—demand for what the industry makes will rise another 10 million barrels a day. We have work to do.

A Matter Of Money

The two other major factors defining U.S. drilling activity in 2023—upstream discipline and scarcity of capital to oil field service companies—can be boiled down to a single factor: Lack of money.

Despite being quite profitable, the industry has limited capital to spend. Investors and lenders have forced that limit on the industry. We like to complain about the federal government’s negative impact on the U.S. oil and gas industry, but it is far more constraining that investors and lenders want us to deploy less capital. If this was not the case, we all would be seeing multiple financiers with plentiful amounts of capital in the form of equity and debt ready to fund the industry, which is currently the country’s most profitable sector.

Consider that exploration, drilling and production company management teams got the message in early 2019 to stop outspending cash flow, reduce debt and return capital to shareholders. The industry already was slashing drilling activity in 2020 when the Covid-19 pandemic hit. Covid merely accelerated and exacerbated what was already underway. By early 2021, production companies were financially healthy, cash flow positive, and well on their way to becoming an industry that, for all practical purposes, was debt free if it wanted to be.

But oil field service companies are unlike their customers. Upstream oil and gas companies can almost eliminate capital expenditures and produce their way to prosperity. Service companies, by contrast, must work to earn money—service firms are the recipients of oil and gas companies’ CAPEX spending—and work was scarce for a year.

To stay alive, service companies robbed parts from idle trucks and rigs to keep a few units running, they shuttered cash-losing districts and product lines, merged with competitors and auctioned off equipment. Most service companies survived, but their equipment did not, and when cash-rich production companies started calling to put rigs and fracturing crews to work, the inventory of field-related gear plunged and service providers’ cash reserves were consumed with hiring people and preparing equipment.

Historically, service companies have turned to their lenders or equity partners for growth capital, but the banks are not interested, and the equity providers actually want out. As a result, an oil company may want to put another rig to work, but additional rigs are hard to find in 2023. Frac service companies are in the same boat. Good luck finding a frac crew that can work 24/7 on a four-well pad.

This raises a question: Is producers’ discipline actually limiting spending on new well drilling, or is it more about their inability to actually get a drilling rig without first providing the $2 million necessary to stand up a high-spec rig that has been idle for five years?

2023 Prices

Spears & Associates assumes that the price of oil will average about $80 a barrel in 2023 and natural gas will be about $6 an MMBtu. Those prices are not truly an activity driver—production companies spend as if the respective prices were more like $60 and $4.

As long as oil and gas prices are higher than $60/bbl and $4/MMBtu, our forecast points to an additional 50 rigs working at the end of 2023 compared with the end of 2022. On the frac side, about 300 frac crews were working across North America at the end of 2022 and 15-20 more will be active at the end of 2023.

One last point: When customers have more money in their pockets than they are able to spend, if demand exceeds supply, Economics 101 tells us that the price of the thing in demand rises. We believe that production companies want to deploy more rigs than are available and want to hire more frac crews than exist, which means that drilling rig day rates and the cost of frac treatments will continue to rise through 2023.

And if that is true, then the ability to produce more oil and more gas will remain constrained while demand for oil and gas will continue to rise. What does Econ 101 say about that?

RICHARD SPEARS is one of the managing directors of Spears & Associates, an oil field market research firm that was founded in 1965 and has 250 corporate clients around the world. Spears is also on the boards of several oil field service companies, including Varel Energy Solutions, Pruitt Tool, APS Technologies and Latshaw Drilling. The nonprofit boards on which he serves include Regent Preparatory School and Fellowship for Performing Arts, a Broadway theater company based in New York City.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.