Independent Operators Plan Their Return To The ‘More Drilling’ Mode In Outlook 2010

By Bill Campbell

Independent oil and gas producers can sit on the drilling sidelines only for so long, it seems.

During the first 10 months of 2009, the Energy Information Administration estimates the number of U.S. oil and natural gas well completions declined by 39.8 percent compared with the same period in 2008. Respondents to “The American Oil & Gas Reporter’s” annual Survey of Independent Operators have announced their intention to turn that around, predicting they will drill 38.2 percent more wells in 2010 than in 2009.

This indication that many operators are itching to get back in the game in 2010 is corroborated, at least anecdotally, by initial 2010 budget announcements from several publicly held independents as well as a general mood swing as year-end 2009 rig counts headed north.

That dogged optimism–for which America’s independent producers and operators are famous–was best reflected, perhaps, in the comment of one intrepid survey respondent, who penned at the bottom of his survey form: “Prices have to go up, right?”

The American Oil & Gas Reporter mails the Survey of Independent Operators annually in November to oil and gas producers nationwide, selected at random from the magazine’s circulation list. No attempt is made to identify survey respondents, and The Reporter’s staff compiles and analyzes the data. The Survey of Independent Operators does not account for dry holes, and merely asks operators what the intended target is when a well is spudded.

While oil operators (those survey respondents who indicated they drilled more oil wells in 2009 than natural gas wells) are predictably more upbeat in their outlooks for the coming year, the enthusiasm spreads across all operator classes.

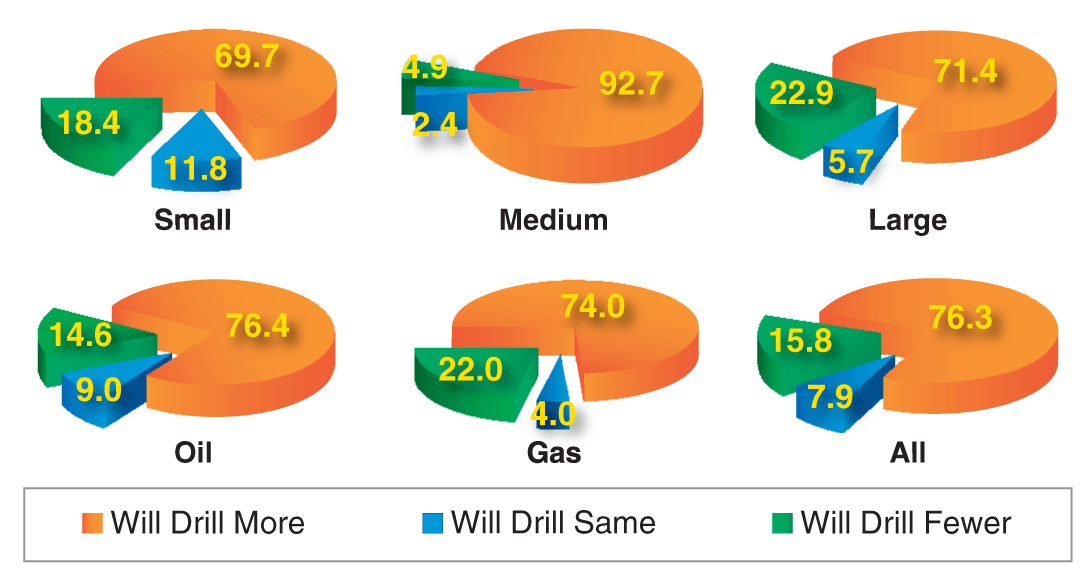

Figure 1

Change in Operators’ Planned 2010 Drilling Compared with 2009 Actual Drilling

Operators designated as small are those who plan to drill 0-4 wells in 2010. Operators designated as medium plan to drill 5-10 wells this year, while those designated as large plan to drill more than 10 wells. Operators designated as oil targeted oil on more than half their 2009 wells, while those designated as gas targeted natural gas on more than half of their 2009 wells.

The Reporter groups survey respondents who indicate they will drill four or fewer wells in 2010 as “small” operators, those who say they will drill 5-10 wells this year as “medium” operators, and those who expect to drill more than 10 wells as “large” operators.

Those in the middle range (Figure 1) anticipate the largest increase in drilling activity, projecting a whopping 88.1 percent jump in the number of wells they will drill. Large operators say they plan to increase drilling activity by 34.1 percent, while small operators expect to be up by 26.3 percent. Oil operators are anticipating a 63.0 percent climb in 2010 drilling compared with 2009, while gas operators project an 18.3 percent increase.

More than three-fourths of the operators who responded to The Reporter’s survey indicate they expect to drill more wells this year than last (Figure 2). Another 8 percent say they will drill an equal number of wells, while only 16 percent anticipate a reduction in their 2010 drilling rates. In line with their survey-leading projection in the number of wells they plan to drill, medium-sized operators lead the way in terms of the number of respondents who expect to drill more, with 92.7 percent of those in the medium group saying they will drill more wells this year.

Oil- and gas-well drillers are neck-and-neck in this category, with 76.4 percent of respondents who drill more oil than gas wells predicting an increase in their 2010 programs, compared with 74.0 percent of respondents who drill more gas than oil wells.

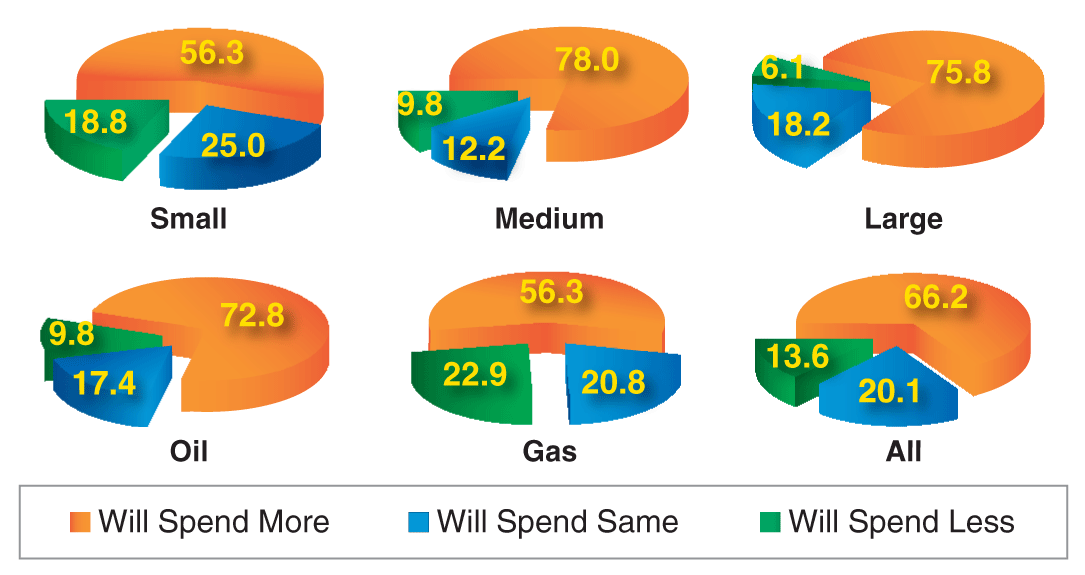

The positive outlook extends to respondents’ spending plans as well. Nearly two-thirds of survey respondents say they are allocating more funds to drilling wells this year than last year (Figure 3), while another 20 percent expect to spend as much this year as in 2009.

Again, it is companies with medium-size drilling programs that lead the way, with 78.0 percent of medium operators indicating they will have larger drilling budgets in 2010, compared with 75.8 percent of large operators who say they plan to spend more and 56.3 percent of small operators. Here, oil well drillers take a definite lead, with 72.8 percent of that group anticipating larger 2010 drilling budgets, compared with 56.3 percent of gas well drillers who say they will spend more.

Price Expectations

The rosy expectations for 2010 drilling revealed in the Survey of Independent Operators are not founded on pie-in-the-sky oil and gas price expectations, reflecting a conservative industry that is preparing to dig its way out of the trenches cautiously. Survey respondents report they base their 2010 drilling plans on a crude oil price of $67.65 a barrel (West Texas Intermediate spot at Cushing, Ok.) and a natural gas price of $4.39 an Mcf.

Survey respondents indicate a fair degree of latitude for changes in oil prices before they would make significant changes to their 2010 drilling programs. However, there is less flexibility for natural gas prices–at least on the downside.

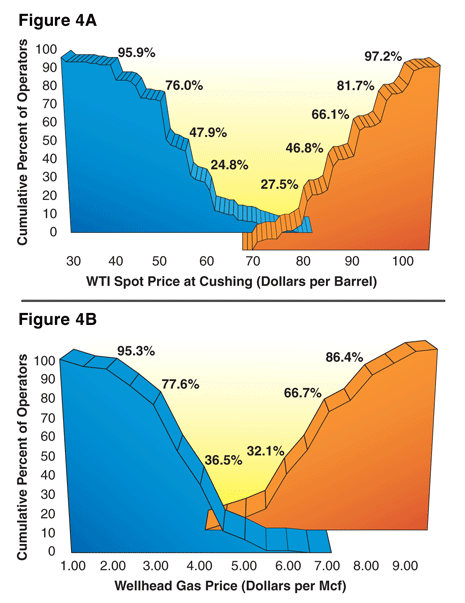

Crude oil prices can slip to $60 a barrel before a quarter of survey respondents indicate they would drill fewer wells this year than they have projected (Figure 4A), and oil prices would have to fall to $53 a barrel before half of them would trim their drilling plans. Should oil prices drop to $45 a barrel, 84 percent of respondents say they would drill fewer wells, and at $40 a barrel, almost 96 percent would cut back their drilling programs.

Oil Prices at Which Operators

Would Alter 2010 Drilling Plans

Percentages in Figures 4A and 4B represent the cumulative total of survey respondents who indicate they would have altered their 2009 drilling plans by the time the spot price for West Texas Intermediate crude oil delivered at Cushing, Ok. (Figure 4A), or the wellhead natural gas price (Figure 4B) reached the indicated amount. Prices at which drilling would decrease are plotted to the left of the graphs in downward curves; prices at which drilling would increase are plotted to the right of the graphs in upward curves.

On the positive side of the oil ledger, 27.5 percent of survey respondents say they will increase the size of their 2010 drilling programs if oil reaches $80 a barrel, and 50.5 percent will drill more wells at $86 a barrel. That number reaches two-thirds of respondents when oil tops $90 a barrel, and should oil prices break the $100 mark, 97.2 percent of survey respondents say they would drill more wells.

For natural gas drilling, however, negative price movements could impact drilling plans pretty quickly (Figure 4B). If gas prices fall to $4.00 an Mcf, 36.5 percent of survey respondents say they will drill fewer wells. That percentage grows to 54.1 at $3.50 an Mcf, 77.6 at $3.00 an Mcf, and 87.1 at $2.50 an Mcf.

If natural gas prices rise, 32.1 percent of respondents say they will drill more wells at $6.00 an Mcf. That increases to 45.7 percent who will drill more wells at a gas price of $6.50 an Mcf, 72.8 percent at $7.00 an Mcf, and 86.4 percent at $7.50 an Mcf.

Comments And Concerns

In spite of all the enthusiasm for the new year indicated by the 2010 Survey of Independent Operators, there are some notes of caution expressed, if only anecdotally. The survey form has a space at the bottom in which respondents may write comments. Of the slightly more than one in eight respondents who took the time to send a note, nearly one-fourth express nervousness about President Barack Obama’s proposal to eliminate virtually all of the oil and gas industry’s federal income tax deductions, while another quarter worry about natural gas supply and demand.

Typical of those concerned about the direction of federal energy and tax policy is a survey respondent who writes, “Will change investment strategy based on congressional action.”

Another points out that “everything depends on (the ability) to expense intangible drilling costs and (take) the depletion allowance.” A third flatly states, “Not drilling until Obama leaves office!”

Indicative of operators worried about natural gas supply and demand is the survey respondent who comments, “The natural gas industry needs to deal seriously with the ongoing glut of gas. Any future large-scale drilling to create more gas reserves without adequate demand would be ill-advised.”

Another remarks, “Natural gas projects are being held in inventory until prices (reach) the $5-$6 an Mcf range.”

Natural Gas Production

In a question unique to the 2010 Survey of Independent Operators, The American Oil & Gas Reporter attempts to shed some light on the debate regarding the supply response to last year’s drop in natural gas drilling. Respondents were asked how their mid-November 2009 gas production compared with year-ago levels.

Right at three-fifths of respondents indicated their gas production had dropped (Figure 5) to some degree, while one-fifth said it had held steady and one-fifth said it had increased. Among those who reported declines were 21.3 percent of survey respondents who said their gas production was down more than 20 percent, 16.9 percent who said it was down 11-20 percent, and 22.1 percent who said it was down 1-10 percent. At the same time, 8.1 percent reported gas production up 1-10 percent, 5.1 percent said it was up 11-20 percent, and 5.9 percent indicated up more than 20 percent.

There was very little difference in the percentage of respondents reporting declining gas production between those who targeted crude oil more often than those who targeted natural gas, although primarily gas drillers were much more likely to report increased production.

Among gas operators, 62.0 percent said their gas production had declined during 2009, while 28.0 percent said it had gone up. This compares with 60.8 percent of oil operators who reported declining gas production, but only 12.2 percent who reported increasing gas production.

Size, however, apparently does make a difference for maintaining gas production. Only about half (51.5 percent) of operators planning to drill more than 10 wells this year reported their gas production had dropped from a year earlier, compared with 62.7 percent of small operators (0-4 wells in 2010) and 64.0 percent of medium operators (5-10 wells in 2010). Furthermore, 39.4 percent of large operators reported their gas production was up in November from a year earlier, while only 12.0 percent of small operators and 13.9 percent of medium operators reported increased gas production.

On one other informational question, 35.8 percent of survey respondents say they anticipate hedging production volumes in 2010. Of those who do plan to place hedges this year, 26 percent say they will be hedging between 1 and 25 percent of their production, 43 percent will hedge 26-50 percent, 24 percent will hedge 51-75 percent, and 7 percent will hedge 76-100 percent.

As in previous years, large operators and those focused primarily on natural gas tend to be more active hedgers. Close to half (45 percent) of gas operators say they will hedge volumes this year, compared with only 30 percent of oil operators. Meanwhile, a full 70 percent of large operators say they will place hedges this year, compared with only 22 percent of medium operators and 27 percent of small operators.

Respondent Profiles

“Getting oily” probably best describes the profile of respondents to the 2010 Survey of Independent Operators. While respondents report 59.4 percent of their 2009 wells targeted natural gas and 40.6 percent were looking for crude oil, they say that will flip this year when 50.7 percent of their wells will target oil while 49.3 percent will seek natural gas.

By comparison, respondents to The Reporter’s 2009 Survey of Independent Operators reported 69.1 percent of their 2008 wells targeted natural gas, and respondents to the 2008 Survey of Independent Operators reported that 74.5 percent of their 2007 wells targeted natural gas.

Predictably, the switch from gas to oil is most marked among the gas and large categories of survey respondents, which also indicated the greatest preference for gas drilling in last year’s survey. Those that drill more gas than oil wells say they are going from 93.3 percent gas in 2009 to 85.9 percent gas in 2010. This compares with oil well drillers, who say they will remain nearly constant in the oil-to-gas mix at 86.5 percent oil wells last year and 86.4 percent this year.

In the size categories, large operators say 64.7 percent of their 2009 wells targeted natural gas while only 53.8 percent will do so in 2010. This compares with shifts of 32.3 percent gas in 2009 to 31.6 percent gas in 2010 among medium operators, and 34.8 percent gas in 2009 to 28.0 percent gas in 2010 among small operators.

Smaller operators are much more likely to spend their dollars exploring than are larger operators, according to the 2010 survey. The small category of survey respondents indicates 24.6 percent of their 2009 wells were wildcats; this percentage goes to 29.2 in 2010. Meanwhile, 23.3 percent of medium operators’ 2009 wells were wildcats and they project 25.9 percent exploratory wells in 2010, compared with 7.9 and 8.2 percent wildcats in 2009 and ’10, respectively, for large operators.

Oil operators were slightly more exploration focused than gas operators in 2009, reporting 11.6 percent wildcats compared with 7.8 percent for gas drillers. But the percentages narrow in 2010, going to 10.4 percent wildcats for oil drillers and 10.1 percent for gas operators. Overall, survey respondents report 10.1 percent of their 2009 wells were wildcats, and they project 11.2 percent exploratory drilling in 2010.

The search for oil and gas reserves will go a little deeper in 2010, according to survey results. The average well depth reported in 2009 was 5,714 feet, while respondents indicate their average well depth in 2010 will be 6,355 feet.

The average respondent to the 2010 Survey of Independent Operators drilled 12.0 wells in 2009 and expects to drill 16.5 wells in 2010.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.