Leading By Example, Independent Producers Chart Course For Natural Gas In Transportation Sector

By Danny Boyd, Special Correspondent

U.S. independent oil and gas producers have spent the past decade accomplishing what once was thought impossible: substantially growing U.S. natural gas reserves and production. Vast onshore unconventional resource plays are driving new long-term opportunities for clean-burning, efficient natural gas produced in North America by American companies for American consumers.

The independent companies that cracked the geologic codes in shales and tight sands not only opened the way to huge new supplies, but have made a natural-gas centric U.S. energy economy a real possibility. The next big leap forward in developing the vision of a more environmentally friendly, efficient and self-reliant energy future is on the demand side, particularly consumption-heavy, high-emitting markets such as power generation and transportation.

Amidst a groundswell of support for natural gas as a transportation fuel, leading North American independent oil and gas producers and operators are proving the economics of converting thousands of their fleet vehicles to compressed natural gas. Meanwhile, they also are investing in CNG and liquefied natural gas technologies and refueling stations in their own operating areas and corporate headquarters, and even public facilities in urban areas.

If they build the infrastructure and chart the course to a natural gas-fueled transportation sector, producers trust the industrial, governmental and private market sectors will come.Through America’s Natural Gas Alliance, independent producers are working closely to spur the conversion to natural gas through projects such as the Texas Clean Transportation Triangle, a potential $42 million investment to develop refueling stations on major corridors connecting Dallas-Fort Worth, Houston, San Antonio and Austin.

But separately, independents have a more immediate target: converting an estimated 75,000 fleet vehicles industrywide. Such an undertaking gives industry movers and shakers a huge platform for demonstrating the benefits of natural gas over gasoline and diesel. The companies report that documenting advantages such as fuel cost savings, superior vehicle performance, less wear and tear, and lower emissions ultimately should help spur a broader shift that allows natural gas to take its rightful place as the dominant transportation fuel on North American roadways.

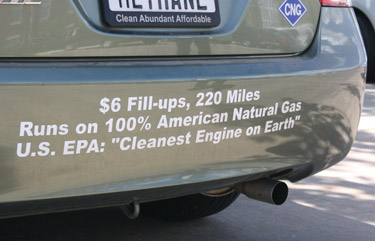

Other fleet vehicle operators and consumers may be primed to notice. With gasoline prices averaging nearly $4 a gallon across the country in late April and diesel already eclipsing that mark, CNG ranged from $1.39 to $1.88 a gallon of gas equivalent (gge). One Mcf of gas equals eight gges of compressed natural gas.

Ambitious Program

Chesapeake Energy Corp. has embarked on an ambitious program to convert its entire fleet of 4,200 work vehicles by 2014, says Norman Herrera, manager of corporate development, who oversees the Oklahoma City-headquartered independent’s national conversion program.

In preparing to convert its vehicle fleet to natural gas, Chesapeake is working with retailers to add natural gas fueling stations to public facilities in Oklahoma, including one CNG station at a convenience store two blocks from the state capitol. Chesapeake and its retail partners opened 14 public stations throughout Oklahoma in 2010, bringing the state’s natural gas refueling station count to 42. The company is forming similar partnerships in other states.

In early April, the company marked its 800th vehicle in Oklahoma equipped with the latest bifuel technology, in which pickups and SUVs can burn CNG or gasoline. Once fully implemented, Chesapeake expects to save $11 million annually in fuel costs, assuming the bifuel vehicles use CNG 80 percent of the time, Herrera says, adding that achieving 80 percent utilization has been easier than expected.

“We surprisingly found that prior to a strong directive, utilization was already 75-80 percent in places where there was enough available fuel,” he says.

Chesapeake plans to replicate its success in Oklahoma by continuing to partner with local retailers to build public CNG fueling stations throughout its operating footprint, he adds.

In 2008, the company formed its natural gas vehicle team to look at how the company, in conjunction with other independent producers, could make a major impact on nudging the U.S. transportation sector toward natural gas, says Taylor Shinn, senior director of corporate development.

“Chesapeake and our independent producer peers are not experts on selling fuel to the consumer on the corner, and we are not experts on making natural gas-powered vehicles and selling them to the public,” says Shinn. “But we are experts on drilling and exploring for natural gas. We are saying to motorists, ‘You can put your trust in this product.’ If we are not driving natural gas vehicles, we are like dairy farmers who don’t drink milk. We have to practice what we preach.”

Top company executives, including Chairman and Chief Executive Officer Aubrey McClendon, drive CNG vehicles to set an example for employees and the public to follow.

“With gasoline and diesel prices expected to exceed $4 a gallon nationwide this summer as unrest continues in the Middle East, if ever it was time for American-produced natural gas to begin replacing expensive OPEC oil, it is now,” McClendon declares. “We are pleased the president has acknowledged the environmental and economic benefits to our country from the increased use of natural gas as a transportation fuel.”

Converting The Masses

In the first phase of Chesapeake’s program, the company converted a fleet used chiefly by field operations teams overseeing the company’s drilling programs in the Anadarko Basin in western Oklahoma.

Currently, the company is in the process of converting 435 vehicles in North Texas at Fort Worth, Cleburne and Ark Park, as well as farther east at Marshall. The change is expected to save the company $2.4 million in fuel costs in Texas alone, Herrera notes. In phases three and four, Chesapeake will convert the rest of the masses, including vehicles in Colorado, Pennsylvania, West Virginia, South Texas and elsewhere, he explains.

Chesapeake’s fleet consists of 88 percent light-duty trucks and SUVs that collectively travel more than 100 million miles annually and cost the company $25.4 million in fuel usage, Herrera says. Each of Chesapeake’s half- and three-quarter ton pickups has the capacity to hold 21 gge. Its full-size SUVs and crossovers have a capacity of 9.2 gge. The pickups, which typically are weighed down with work materials, average 9.7 miles per gge on CNG versus 8.8 mpg on gasoline, Herrera points out.

Chesapeake also is testing a motor coach using new dual-fuel “fumigation” technology that blends LNG with diesel to reduce emissions in 18-wheelers and other heavy-duty, over-the-road trucks, Herrera reports. The technology also could be used on drilling rig engines, he says.

“If you are burning 1,400 gallons of diesel a day on a rig, and you are operating 155 rigs, and you have a cost advantage on what you are paying for the fuel, that becomes a strategic place to use our own fuel,” Herrera says.

Chesapeake and other members of the Clean American Transportation Alliance, a collaboration among ANGA and American Gas Association members, are working with automakers to develop more bifuel vehicles, he goes on.

For example, the Fiat Panda™, a bifuel crossover, is on the road in Europe and could appeal to U.S. consumers looking to save on fuel costs, yet retain the security of being able to switch over to gasoline if CNG is not readily available.

“The CNG cylinders are beneath the car in an area where it does not take up trunk capacity or sacrifice horsepower,” Herrera points out. “As an industry, if we can pursue fully-engineered, production-ready cars, that alliance map with a focus on 22 states becomes a 50-state strategy.”

In preparation for its fleet conversion, Chesapeake worked with several fuel retailers, including OnCue Express and Love’s Travel Stops, to add natural gas fueling stations to public facilities located on major streets and highways in Oklahoma, Herrera says.

Last year, the company and its retail partners opened 14 public CNG stations throughout Oklahoma, bringing the state’s available CNG stations to 42. Similar partnerships are being formed elsewhere, he says.

“Typically, a CNG station is looked at as something in an industry setting, but we are demonstrating that it can be next to a convenience store, bank or church,” Herrera comments.

Customer To Count On

In Oklahoma, Chesapeake has spurred development of CNG refueling sites by entering into take-or-pay contracts to purchase fuel at a given location, Herrera says. “We may tell a retailer we will buy 100,000 gge a year,” he explains. “We will be that one customer the retailer can count on to come to it 100 percent of the time. The retailer then has a built-in customer base and can use that as leverage to purchase equipment and open additional infrastructure. We have supplied the demand, and other fleet owners using CNG have benefitted.”

In early April, Chesapeake Energy Corp. added the 800th vehicle to its work fleet in Oklahoma that utilizes advanced bifuel technology to allow company pickups and SUVs to run on CNG or gasoline. Chesapeake plans to convert its entire corporate fleet of 4,200 vehicles by 2014. Once fully implemented, it expects to save $11 million a year in fuel costs at an average CNG utilization rate of 80 percent.

Refueling sites need only a natural gas line to the facility, he says. In Oklahoma City, one CNG refueling station at an OnCue Express convenience store is only two blocks from the state capitol. “It is pretty much at the heart of state government,” he says. “We had a grand opening and numerous dignitaries attended. Everyone really has rallied around what has happened at this station.”

Oklahoma is also among the most aggressive states in terms of offering incentives to spur converting to natural gas, including income tax credits up to $5,000 for CNG conversions that cost up to $10,000.

Chesapeake also offers employees a special lease program to drive CNG-powered vehicles such as the Honda Civic™ GX, Herrera notes.

Growth in using natural gas as a transportation fuel would boost the fortunes of the exploration and production industry, which in turn, would create domestic jobs and spur economic growth across the country, Herrera insists.

Transportation accounts for only 3 percent, or 50 billion cubic feet a year, of all U.S. natural gas consumption, according to information from Clearview Energy Partners cited by Herrera. Converting refuse trucks, transit buses, school buses, commercial fleets and semi trucks would boost consumption by 8 Tcf-12 Tcf a year, he says. But that targets only 10 percent of vehicles on the road, which consume 20 percent of the energy.

“Although it may be fanciful to expect a conversion on this scale, it does give you a target to hit,” Herrera comments. “It gives you an idea of what the market looks like as a whole.”

Herrera points to the vehicle fleet owned by the state of Texas as an example of potential cost savings on a large scale. In 2008, Texas operated 25,853 fleet vehicles and paid more than $61 million in fuel costs for vehicles that consumed 18 million gallons of petroleum. Converting gasoline- and diesel-powered vehicles to CNG could save the state about $18 million annually, assuming $2 a gge for natural gas versus an average $3 a gallon for gasoline and diesel. Such a change would boost gas demand by 2.32 billion cubic feet a year, according to Herrera.

Natural gas will continue to prove economical compared with gasoline and diesel even when prices rise, Herrera says. A futures price of $12 an MMBtu translates to $2.50 a gge. At an $8 futures price, CNG would be only $2 a gge. “Natural gas has an inherent price ceiling,” Herrera concludes. “Coming through the pipeline to the city gate, the product will be cheaper than gasoline or diesel.”

Jump-Starting The Market

Houston-based Southwestern Energy Co. is spending more than $1.5 million this year to build a CNG fueling station and converting a portion of its fleet of pickup trucks to CNG throughout its operating region in the Fayetteville Shale in Arkansas, says John Gargani, vice president of midstream planning and commercial operations.

“We expect fuel savings of approximately $5,000 per vehicle per year,” Gargani says. “There are a lot of benefits to CNG. We are using a cleaner fuel that has lower emissions than when using diesel or gasoline. We are creating domestic jobs. There is also the national security issue and over-reliance on imported oil from volatile regions of the world. It makes so much sense to do it. It is simply a matter of getting the market jump-started.”

Southwestern’s trucks will be fueled at a CNG station the company opened at Damascus, Ar., north of Conway, he says. Additional CNG refueling stations should be available in the area soon, including one in North Little Rock, Gargani adds.

Encana Corp. is replacing gasoline-powered pickups and SUVs in its work fleet with bifuel vehicles, as well as converting drilling rigs and eventually even hydraulic fracturing trucks. The company has 16 natural gas-fired drilling rigs working throughout its North American operations, and estimates a savings of $1 million a year for each larger-horsepower rig using natural gas instead of diesel. Encana also is building fueling infrastructure in both the United States and Canada, including this mobile LNG station for servicing heavy-duty trucks in the Haynesville Shale play.

“The CNG station is open to the public,” he notes. “It is designed primarily to handle our fleet of trucks out of our Damascus field office, but we thought it was important to show our support for natural gas as a transportation fuel by giving the public access to the facility. We are encouraging other companies to follow suit and start using the station for their own vehicles.”

Southwestern also has partnered with a local auto dealership to donate a CNG-powered vehicle to the Conway Chamber of Commerce.

So far, the company has 40 new pickups that can run on both CNG and gasoline, and expects to have at least 60 more in place by the end of this year. An additional 100 are expected to be converted by the end of 2012, Gargani updates. “Ideally, we would like to convert as many as we can, if not all of our approximately 400 field trucks,” Gargani says.

The company anticipates a CNG utilization rate of 85-90 percent with an initial CNG price of $1.60/gge, saving as much as $2 a gallon at first. “We want our trucks to run on CNG as much as possible, but drivers have the option to use gasoline if they are in remote areas without CNG refueling options around,” he says. “That certainly would be an exception. We did the economics of building the station and converting the trucks. We are making a reasonable return on our investment.”

Big Iron, Big Savings

In an effort to save money and promote natural gas as a transportation fuel, Encana Corporation, which produces natural gas both in the United States and Canada, is busy on both sides of the border, working to convert its fleet vehicles as well as “big iron” and “big wheel” equipment such as the drilling rigs and supply trucks, as well as building the necessary fueling infrastructure, according to Eric Marsh, executive vice president, Encana Corporation, and senior vice president of Encana’s USA division.

“We are converting a fleet of 1,300 work vehicles to bifuel to replace gasoline-powered pickups and SUVs,” Marsh reports. “We are doing this because it is a common sense approach to save money. We want to reduce our operating costs by taking advantage of every opportunity we get. The first step is to completely convert our smaller vehicles and some of our rigs. We also are working on having fracturing equipment run on natural gas and working with the service sector to convert their vehicles.”

Encana expects to have as many as 150 bifuel vehicles in place by the fall, he says. The conversion is expected to accelerate as the company builds additional fueling stations to supply its fleet, Marsh notes.

Encana will have five fueling stations in operation in Louisiana, Colorado, Wyoming, Alberta and British Columbia by the end of this year. The company’s station at Fort Lupton, Co., is available to other company fleet vehicles, such as those owned by Anadarko Petroleum Corp. and Noble Energy Inc.

“At some point, Anadarko and Noble Energy will build additional stations and they likely will allow us to use them,” Marsh says. “We have credit card readers at the pumps just like any gas station, so the more stations that get built, the faster you can convert vehicles.”

Encana is buying replacement vehicles at the factory and shipping them to a third-party conversion shop, but Marsh says he expects that to change in the near future. “Within a couple years, we hope we can buy them directly as bifuel vehicles from General Motors, Chrysler and Ford,” he offers.

Conversion costs per vehicle range between $8,000 and $10,000, and fuel savings average 30-50 percent, Marsh says. In late April, Encana’s Fort Lupton station was selling CNG at $1.88 a gge.

At those costs, payout for the investments takes two to three years per vehicle, Marsh goes on. While conversions may not be feasible in remote areas where a lack of demand makes building a CNG station impractical, he says Encana can build stations designed to support 60-70 trucks a day.

Encana and other independent companies’ CNG vehicle conversions are part of a larger statement to the public that technological breakthroughs in horizontal drilling and hydraulic fracturing have made natural gas abundant and inexpensive, and represents a new and practical solution for lowering automobile emissions, Marsh says.

“We think natural gas prices will be affordable for the foreseeable future, and when you look at the economics of CNG, it simply makes good sense,” he says. “It is a very smart and viable way to reduce the operating costs of fleet vehicles.”

Encana is taking its CNG conversion efforts a step further by converting rigs to burn the natural gas produced in the same fields in which the units are drilling for new supplies. Marsh reports that the company has 16 drilling rigs fueled by natural gas. “In the case of our larger rigs (2,000 horsepower and greater), we are seeing $1 million savings a year for each rig by using natural gas instead of diesel,” he says.

Since 2006, the company has drilled 550 wells using rigs powered by field gas in its Jonah Field operation in Wyoming. The total fuel savings is about $30 million, according to Marsh.

In the Haynesville Shale, Encana has three rigs powered by LNG, which is trucked in because there is some carbon dioxide and hydrogen sulfide in the field gas stream. Savings are slightly lower, with LNG costing about $3 a gge versus $4 for diesel in late April. The LNG is vaporized to natural gas to power the rigs and is not mixed with diesel, although Marsh says the company has several rigs capable of using fumigation technology that mixes natural gas with diesel.

“As the load on the engine increases, computer controls increase the amount of natural gas feeding the engine. For example, when we pull pipe out of the hole, there is a heavy load on the engines and natural gas use increases in the fuel mix. When load is reduced, the engines consume a higher percentage of diesel. Overall, we are seeing a mix of 60 percent natural gas and 40 percent diesel when drilling a typical well. ”

Designated Corridors

While talk of promoting natural gas as a broader transportation fuel is picking up steam in the United States, Encana has joined industry, government, academia and environmental groups in Canada to lay out a plan to use natural gas as a transportation fuel for the trucking industry to reduce emissions on designated transportation corridors that are targeted for developing refueling infrastructure, Marsh notes.

A large amount of electricity in Canada is produced by hydro, which has no emissions, making transportation the key to reducing overall emissions, he points out. Designated natural gas corridors connect Quebec City, Quebec, with Windsor, Ontario, which neighbors Detroit. In the west, plans are being developed to establish a corridor that connects the Edmonton, Alberta, area south to Calgary and then Vancouver to the west.

“These are two corridors where we would help lay out infrastructure so the trucking industry could start to convert trucks to LNG,” he says.

The company also supports efforts to establish fueling infrastructure in U.S. corridors that connect Los Angeles to Denver, as well as the Texas Clean Transportation Triangle to Shreveport, La., and points farther east, Marsh says.

Apache Corporation is doubling the size of its CNG vehicle fleet this year and more than doubling the number of CNG stations it operates. One of the planned new stations is a CNG refueling facility for the fleet of buses that transports passengers to and from economy parking lots at Houston’s Bush Intercontinental Airport. Apache also is offering incentives to employees who convert their personal vehicles to natural gas.

Encana has agreed to supply an LNG mobile refueling site and two fixed stations for Heckman Water Resources, a water hauling services company in the Haynesville Shale that has purchased 200 LNG-powered trucks from Peterbilt. “We are working with other trucking companies to see how we might locate those same facilities in areas that make the most sense for them as well,” Marsh reports.

It especially makes sense to use LNG or natural gas as a fuel in return-to-base trucking runs in which trucks regularly make deliveries and return to base, where an LNG refueling site could be easily located, Marsh says. With return-to-base trucks and drilling rigs operating 24 hours a day, he adds that Encana has a built-in base load and can expand refueling sites to assist additional service providers.

Encana has a CNG station in Coushatta, La., that is open to the public, and is in the process of obtaining final permitting approval for a fueling site near Shreveport, Marsh says.

“At Encana, we really believe that natural gas needs to be the foundation of North America’s energy portfolio,” remarks Marsh. “At the end of the day, what we try to get across is that we have to move to natural gas in the transportation sector because it is really the only choice we have. But it is also a good choice. It is cheaper than gasoline and diesel. It gets the United States away from more imported foreign oil, reduces costs and reduces emissions.”

A Better Way

Apache Corporation is doubling the size of its CNG-powered vehicle fleet this year and more than doubling the number of CNG stations the company operates, says Chairman and Chief Executive Officer G. Steven Farris.

One of the planned new stations is a CNG refueling station for the fleet of buses that transports passengers to and from Houston’s economy parking lots at Bush Intercontinental Airport, Farris reports.

“At Apache, we are convinced that clean-burning natural gas must be a bigger part of the solution to America’s ever increasing reliance on imported crude oil, while reducing pollution caused by other, more carbon-intensive fuels used in transportation and power generation,” Farris comments. “CNG is a better way to move people and goods than traditional petroleum fuels.”

Frank Chapel, Apache’s director of natural gas transportation fuels, says the company expects up to 231 of its field pickups and SUVs (representing 26 percent of Apache’s vehicle fleet) to have bifuel capabilities by the end of this year. “We have a little more than 900 U.S. fleet vehicles and we hope to have 80 percent, or about 720 vehicles, on bifuel operation by the end of 2015,” he offers, noting that increased CNG use by operators and service companies will justify additional industry investment in fueling stations in more remote areas.

On average, Chapel says Apache is recognizing savings of 30 percent from lower fuel costs and slightly better miles-per-gallon performance with its CNG-powered fleet.

“Although the goal ideally is to use CNG in the vehicles 100 percent of the time, we are utilizing CNG between 80 and 90 percent of the time, depending on the field office,” he reports.

That utilization rate is being aided by a strategy to allocate replacement vehicles to field offices with adequate fueling infrastructure, Chapel adds.

To resolve refueling issues, Chapel says Apache has constructed seven CNG refueling stations and will have an additional nine on line by the end of this year, including stations near major offices in Houston, Tulsa, Midland, Tx., and Lafayette, La., where employees will be offered incentives to begin driving CNG-powered vehicles. The company plans five CNG stations in the Permian Basin.

“North America has more natural gas than Saudi Arabia has oil reserves, and it makes a great transportation fuel,” Chapel remarks. “With hopeful passage of the NATGAS Act (see story page 32) and states continuing to adopt incentives, we will continue to see big increases over the next few years in natural gas vehicles and infrastructure.”

Employees Incentives

With vehicle conversions costing up to $10,000 a vehicle, Apache is offering employees incentives that include $5,000 in free CNG to convert vehicles, Chapel says. In Oklahoma and Louisiana, the company and its employees can take advantage of state incentives that allow an income tax credit up to $5,000 on a $10,000 conversion. In prominent markets such as Texas and New Mexico that do not yet offer incentives, Apache is offering employees $5,000 to convert their vehicles to natural gas.

“The incentives not only encourage employees to use natural gas as a transportation fuel, but they also give them ownership in our program to promote natural gas as a transportation fuel,” Chapel notes.

Similar to other producers, Apache measures the rate of return on its conversion projects. Tax incentives help improve the economics of converting, says spokesman Bill Mintz. “Apache field people are incentivized to keep production up and costs down, so our people really like the idea that their operating costs with CNG vehicles are lower,” Mintz states.

Apache is identifying opportunities to convert stationary engines to natural gas as well, he points out. In its operations in the western desert of Egypt, the company is using natural gas engines to generate electricity for field operations, Chapel says.

In addition to being on the board of NGVAmerica, Apache has joined other independents in the Clean American Transportation Alliance devoted to promoting natural gas as a transportation fuel in the nation’s capital and across the country.

“I have been involved in the industry for about 20 years, and I have never been as optimistic as I am today that natural gas as an alternative transportation fuel will have a significant place in the North American economy over the next few years,” Chapel allows. “We have wonderfully improved technology and there is optimism that original equipment manufacturers are going to start producing factory CNG vehicles such as the Civic GX.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.