New Investment Models Have Operators Targeting Tight Oil And Hybrid Unconventional Reservoirs

By Vinod K. Dar

BETHESDA, MD.–The “hybrid model” is expanding in the North American natural gas market, driven by the prevailing economics of crude oil’s higher value relative to natural gas. The hybrid model is the joint production of natural gas and gas liquids, light oil, or all three from relatively narrow and fairly difficult to delineate “windows” within extensive shale and tight sands natural gas basins.

The marginal cost of producing the liquids or oil is quite low, while the gross profit contribution is very high because the liquids are several times more valuable on a Btu equivalent basis than the gas. This propels the total return on capital to attractive levels and encourages capital deployment and risk taking in U.S. gas shale basins despite low (very low in real terms) natural gas prices. In turn, this positively differentiates companies by helping them articulate a compelling theme to investors. Almost all the top 20 domestic natural gas producers are pursuing the hybrid model.

The hybrid strategy is part of a broader investment trend: the determined change in business mix by exploration, drilling and production companies operating in North America away from natural gas and toward gas liquids and light oil, reflecting the tremendous divergence between per-Btu prices of natural gas and liquids. It is, of course, cyclical. If (and when) natural gas prices soar, the trend will reverse.

For example, Chesapeake Energy has announced that its plans to make the transition from liquids accounting for about 10 percent of its output at the end of 2010 to about 25 percent by the end of 2015, while still expanding total output and reserves at double-digit rates. This is premised on notable success in developing liquids production from both shale and tight sands natural gas basins and from tight oil plays. As a leading player in unconventional natural gas development, Chesapeake was virtually an all-gas company two years ago and branded itself as such.

EOG Resources claims that it will be primarily a North American oil and gas liquids company by the end of 2011, compared with being a predominantly natural gas company at the end of 2007. Even a company as large as ConocoPhillips is shifting capital allocation away from natural gas to oil and gas liquids in the United States.

Adopting The Model

The hybrid model is barely four years old, but it has garnered not merely national, but international attention within the industry and the oil and gas investment community. It also has been a key factor in high-dollar acquisitions as majors buy independents to secure the necessary acreage positions to execute the strategy. An example is Chevron’s proposed $4.3 billion acquisition of Marcellus Shale-focused independent Atlas Energy, which was announced in early November. It followed on the heels of Shell’s purchase of East Resources, ExxonMobil’s joint venture with Pennsylvania General Energy, Exxon’s acquisition of XTO Energy, etc.

EOG Resources was a pioneer in developing, refining and extending the hybrid model, but the model has been enthusiastically adopted by companies ranging from small to very large independents, mini-majors and the biggest integrated majors, including Petrohawk Energy, Chesapeake, ConocoPhillips and ExxonMobil. Based on investor presentations, it seems that more than 200 companies now are pursuing the hybrid model. The operational and financial evidence does not, however, support these claims. The model is difficult to apply and execute.

Successful development and implementation of the model requires leveraging highly detailed and proprietary local knowledge with a substantial corporate competence in efficiently and safely producing from low-permeability natural gas and oil basins with widely varying geologic characteristics. At present, it is not at all clear that more than a couple dozen independents actually possess this required combination. Doubtless, the ranks will grow, but it is unlikely that the number of credible and successful independents will even double in the next three years. Consequently, mini-majors and majors will be able to use their tremendous access to capital, and their deep technological and business skills, to become very significant “fast followers.”

Many small- and medium-sized independents will end being on the highly lucrative front end of the hybrid model (discovery and proving the concept), while big to mega companies will be on the less well rewarded (on a return on investment basis) and much lower-risk profile back end of the model (rapid production and footprint growth, and efficient expansion of production and optimization of the gross margin stream). For large independents, the hybrid model is becoming a magnet for both domestic private equity and international industry capital. This capital enables the companies to monetize portions of their business positions on very favorable terms indeed. The large independent that can replicate this monetization across multiple basins can turn such financing into a significant contributor to earnings and enterprise value.

So far, the model has been dominated by Texas basins, but it is spreading geographically. The first application of the model was in the Barnett Shale by EOG Resources. It was then applied in the Cleveland Sands in the Granite Wash, spreading from Texas to Oklahoma, and within the Granite Wash to the Des Moines formation. It now is being most vigorously, profitably and famously applied in the very young Eagle Ford Shale (so young, in fact, that the first well was drilled barely two years ago by Petrohawk).

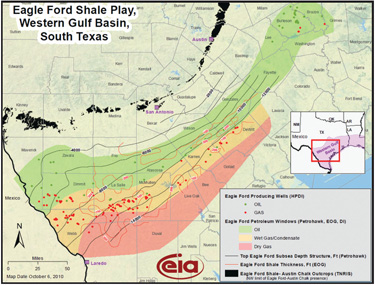

The Eagle Ford play (Figure 1) now is believed to have the best natural gas economics in North America because of the liquids window, beating even the Marcellus Shale. Industry participants expect natural gas production from this new, but strategically important area, to exceed 1 billion cubic feet a day and oil production to hit 35,000 barrels a day by the end of 2012, inducing new infrastructure investments as well. Already, 50 companies are active in the Eagle Ford, compared with around 60 in the much older Barnett. The Eagle Ford is viewed as a corporate “resume enhancer” for even large companies. Several of the bigger players who accumulated skills and experience in the Barnett are also now prominent in the Eagle Ford.

Strategic Questions

The two strategic questions investors and operating companies alike are asking now are:

- Can the hybrid strategy be economically replicated on scale outside the Barnett, Granite Wash and Eagle Ford plays?

- Does the hybrid strategy face competition from emerging oil plays in North America?

The answer to the first question can be based on informed speculation, at best. Public documents and investor presentations are lagged revealers of true strategic intent by the more astute and successful independents, and the majors are traditionally reserved about forward-looking activities and nascent investments.

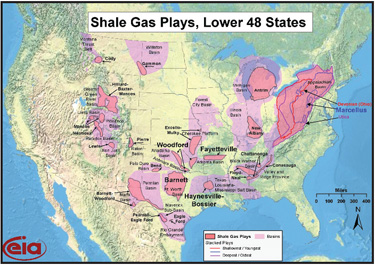

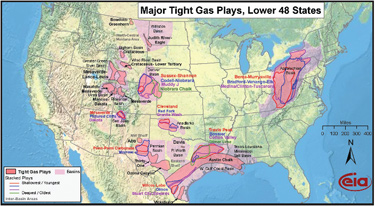

Several independents are very reticent about disclosing their investment and operational plans for new shale or tight sands gas plays (Figures 2 and 3) or new tight oil plays. They realize how great of an advantage accrues to the first and second entrants. They understand how every promising play will be swarmed by competent and financially capable companies, and the mini-majors and majors will be swift to amass formidable business positions.

Small- and medium-sized independents no longer have time on their side once they have made the serendipitous effort and taken the risk to be resource pioneers. The window of opportunity between opening the unmarked frontier and having it thickly settled is quite narrow.

There is evidence, often tenuous but sometimes supported by actual drilling success and financial results, that outside the initial three areas, the liquids window is being discovered in Bienville Parish, La. (Haynesville Shale); the Horn River basin in British Columbia; the Bone Spring trend in the Delaware Basin in western Texas and eastern New Mexico; and the Collingwood/Utica Shale in the Michigan Basin.

An investor presentation by Quicksilver Resources states that it has encountered significant mobile oil saturation (based on sidewall core results) in the Exshaw/Bakken in its extensive Horn River holdings. A horizontal test well is planned in 2011. As usual, the oil is at a shallow depth (±4,000 feet) above the deeper dry gas. If there is an oil or liquids window in the vast Horn River, it could be developed swiftly. Oil take-away infrastructure is nearby and capable independent companies surround Quicksilver’s position, including EOG Resources, EnCana, Nexen, Apache and Devon Energy, all of which have extensive lease holdings.

New Life In Permian Basin

The Bone Spring trend, which covers 5 million acres in the greater Permian Basin, is becoming documented as having a credible liquids window in its shale formations (called Avalon or Leonard, depending on the company) now that 250 horizontal wells have been drilled. Decades ago, the Bone Spring began producing oil and gas from conventional sandstones. Production then moved to carbonate lenses, then to low-permeability sandstones, and now to shales.

The Leonard-Avalon play in southeastern New Mexico and West Texas is very new, and production is about equally divided among natural gas, gas liquids and oil. The drilling depths are 6,500 to 9,000 feet. Its most enthusiastic proponents view it as the next great hybrid play after the Eagle Ford; such is the industry’s appetite for confirming that the liquids window is not confined to only the Barnett, Granite Wash and Eagle Ford.

Companies already drilling include Concho Resources, Marbob Energy, Cimarex Energy, SandRidge Energy, Clayton Williams Energy, Energen Corp., FieldPoint Petroleum Corp. and Vanguard Natural Resources, as well as the largest independents: Anadarko Petroleum, Devon Energy, Chesapeake Energy and EOG Resources, which has provided the most detailed and persuasive evidence so far.

EOG told investors that the Leonard-Avalon may hold more net potential after royalty (at 2.1 million barrels of oil equivalent per acre) than the Bakken/Three Forks, where the company also operates (720,000 boe per acre) or its Eagle Ford holdings(1.8 million boe per acre), but less than its Barnett combination play(2.5 million boe per acre). EOG has asserted that the Bakken, Eagle Ford and Barnett may rank as the fifth, sixth and 17th biggest oil fields in the United States. Given the per-acre potential and extent of the Leonard-Avalon shales, the Bone Spring trend may again emerge as a very important liquids play.

In the Collingwood/Utica Shale in the very well known and once important Michigan Basin, an EnCana subsidiary drilled a well that made 2.5 million cubic feet of gas a day with some liquids. The Utica lies above the Collingwood, a shaly limestone found at ±10,000 feet. The shale can be up to 40 feet thick. This discovery has impelled considerable interest in this play. At an auction last May, state-owned parcels collected $178 million in bonus payments, compared with the cumulative bonus payments of $190 million collected from 1929 to 2009!

Atlas Energy and Breitburn Energy Partners also have been acquiring shale acreage in the Collingwood for some time. Other companies that have received location permits include Whiting Petroleum, Merit Energy and Savoy Energy. As a large independent, EnCana is also present in other shale basins that have liquids windows.

Tight Oil Plays

The hybrid model and investment strategy, being a quest for oil and gas liquids in North America, is beginning to face competition from emerging or existing, but rapidly developing, tight oil or oily shale, or oil-prone shale formations and basins (these terms are used interchangeably by many). The realizations that the Cardium (in Canada) and Niobrara (in the Powder River and Denver Julesburg basins) tight oil plays could be highly significant, and that below the lower Bakken there is an entirely separate oil province, are causing scores of companies to yet again reassess strategic priorities and investment plans for 2011-12. There is also a nascent, but to some anyway, most intriguing oily shale play in western Newfoundland (another old province that technology and risk capital may revive).

The Cardium formation covers much of west-central Alberta, typically sandstone within shale. It is very complex and its hydrocarbon potential is immense, in theory. It is an old producing area, with the core acreage held by production by mostly small- to medium-sized Canadian independents. Technology, however, has turned this seemingly tired basin into a “frontier” oil and gas province, especially for light oil amenable to recovery in attractive volumes using horizontal drilling and multistage fracturing (as in the Permian Basin).

New entry into the core area is being accomplished through acquisitions, but outside the core, there is considerable activity and land accumulation opportunities. In addition to the small independents, companies pursuing this possible immense light oil play include SunCor, PennWest, Hunt Oil, Shell Canada, ConocoPhillips, Talisman, Imperial Oil, and Devon. This technology-driven play ultimately may exceed even the Bakken in terms of resource base and reserve potential.

The Rocky Mountain oil and gas community is not reticent about proclaiming the Niobrara as being the most likely next big oily shale play. The Niobrara has produced for decades from natural fractures. It can be 150 to 1,500 feet thick. What is new and potentially very large and lucrative is the application of modern technology and operational/management practices to producing oil and gas from low-permeability formations. The Niobrara is particularly suitable to this application. The Powder River, North Park, Hanna, Sand Wash and portions of the D-J Basin are oil rich.

This is where the greatest industry attention is being directed and acreage is being bid up swiftly. Nearly 50 oil and gas companies operate in the Niobrara and many more are investigating entry opportunities. At least half a dozen of these companies are both skilled and experienced in identifying and developing oil and gas liquids windows in shale and tight sands basins, and in producing from tight oil formations (oil-prone shale). A couple already have very large net acreage positions across the Niobrara.

Even More Attractive

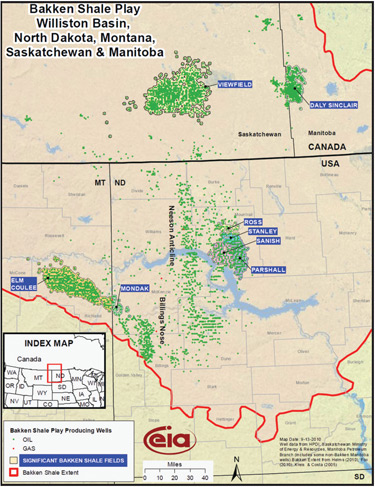

Whiting Petroleum and Continental Resources Company are among the largest producers in the Bakken Shale (Figure 4), but more than 70 companies are active in the play, including ConocoPhillips, EOG Resources, Marathon, Hess and Newfield Exploration. Already a magnet for operating companies, the Bakken has become even more attractive with the industry’s growing belief that an entirely separate oil province exists below the Lower Bakken: the Three Forks and Sanish formations. There is hopeful speculation that this province may rival or exceed the potential of the Bakken itself.

Some observers have suggested that there is, at least in some parts, a third province called the Lower Lodgepole just above the Upper Bakken Shale. Perhaps this is hasty extrapolation from some success reported by Marathon Oil in the North Murphy Creek Field. Marathon itself notes that there are five distinct “districts” in the Bakken, but has not claimed that these are entirely separate provinces.

It is clear to the global oil and gas industry that North America is once again a frontier province for oil and gas liquids reserves and production growth. Liquids-window and oily-shale plays are proliferating onshore, and the oil/NGL potential of both the ultradeep Shelf and the deep- and ultradeepwater Gulf are impressive offshore. There is a generational opportunity for America based on the imagination and drive of independent oil and gas companies, technological innovation unexpected even a decade ago, and risk capital to not merely arrest the decline in liquids production, but significantly expand it. The positive consequences for jobs, income, balance of payment and national security are obvious and tangible.

The most significant obstacles are egregiously bad public policy, Wall Street distortion of capital markets, and main street hostility based on both malice and ignorance. For many small and medium-sized independents, this is a toxic combination. However, independents have faced similar circumstances before and have not merely endured, but overcome. The U.S. independent has experienced multiple cycles of hostile and friendly business environments, and will no doubt experience more.

The current hostile cycle will end because ordinary Americans want domestic oil and gas, good jobs, a chance to make a decent living doing real things that are of national value, and reduced dependence on foreign sources of supply. In short, they want independents to succeed in these frontier hybrid plays to ensure greater domestic energy independence.

VINOD K. DAR is founder and managing director of Bethesda, Md.-based Dar & Company, whose clients include energy companies, utilities, financial enterprises and energy technology companies. His operating experience is in gas and electric trading, marketing, retailing and merchant generation. During his career, Dar has served as chief executive officer of two energy trading and marketing companies, and founded strategy and risk management practices at major energy consulting companies. He has served on the boards of five publicly traded energy and consulting firms. Dar holds degrees in engineering, business and economics from the Massachusetts Institute of Technology.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.