Mid-Continent Update

New Play Concept ‘Merges’ SCOOP And STACK Trends In Red-Hot Central Oklahoma

By Al Pickett Special Correspondent

Long before it became the 46th state, oil was discovered in Oklahoma by happenstance while drilling for brine to extract salt–a fundamental necessity of pioneer life. Nearly 160 years later, the Sooner State’s geology continues to surprise with a rich endowment of the oil and gas essential to the modern American way of life.

In fact, oil production and proved reserves have both more than doubled since 2005, when oil output had ebbed to its lowest level since shortly after Oklahoma was granted statehood in 1907. By year-end 2016, U.S. Energy Information Administration estimates indicate, Oklahoma had grown proved oil reserves to 1.7 billion barrels and proved gas reserves to 34.4 trillion cubic feet, 70 and 220 percent higher, respectively, than in 1981.

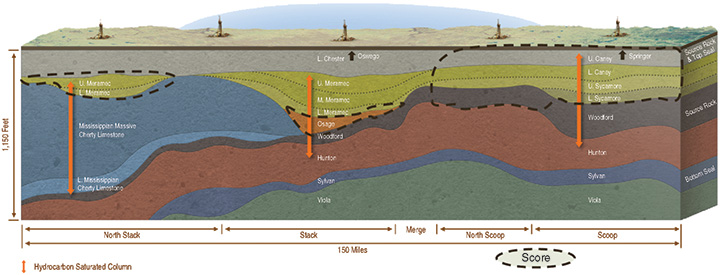

The turnabout in Oklahoma’s energy fortune is driven by the emergence of significant new resource plays that encompass both unconventional and conventional formations across the state. While the Hunton and Mississippian, Granite Wash/Cottage Grove, Maramaton, Caney Shale and other plays continue to attract operator interest, SCOOP and STACK quickly have become world-class horizontal hot spots. And a couple more names now can be added to industry lexicon: SCORE (Sycamore, Caney, Osage Resource Expansion) and Merge.

SCORE is the brainchild of Newfield Exploration Co., which discovered STACK in Canadian and Kingfisher counties in 2013, shortly after Continental Resources Inc. had announced its discovery of the adjacent SCOOP. With SCORE, Newfield is expanding development into multiple prospective horizons within its STACK acreage. The company also is among the early entrants in the Merge play in the Anadarko Basin region between SCOOP to the south and STACK to the north, effectively “merging” the two prolific trends.

“When we first developed the STACK play, some 40 companies bought into the play and moved in around us,” says Steve Campbell, Newfield’s senior vice president. “SCORE was our idea. We looked at some bolt-on acquisitions, but we decided to explore the acreage we already owned. We realized we had additional pays to test, and have had good success to date in the Caney and Osage.”

So, in 2017, Newfield allocated $100 million to test its SCORE concept, and Campbell reports that the results in developing the Sycamore, Caney and Osage have been encouraging. He notes that Newfield also has extended its North STACK (Meramec) play to the northwest and its North SCOOP oil play to the east (Figure 1).

“Almost all of our SCORE position is held by production,” Campbell describes. “We are focused on the Meramec, but in time, we will develop the other horizons. We continue to get better and better as we drill faster and safer. We still are in the early innings in STACK, and are tackling optimization and the push for improved returns on every well we drill.”

While Newfield has 350,000 acres under lease in the Anadarko Basin, Campbell says it is the equivalent of 1 million net effective acres when all the multiple stacked horizons are considered. “The SCORE program, along with North STACK and North SCOOP, expands our total net effective reservoir acres with a high-quality inventory in the Anadarko Basin. We plan to invest $365 million in 80-90 wells to delineate the play expansion over the next three years.”

Having lime, shale and carbonate formations stacked one atop the other in both STACK and SCOOP–including the Oswego, Atoka, Morrow, Springer, Meramec, Osage, Woodford, Caney, Sycamore and Hunton–provides multiple horizontal oil and gas targets, mitigates risk and increases recoverable reserves, he says.

“We are running 11 rigs, seven in STACK and the remainder in SCOOP,” Campbell offers. “We will drill 150 wells this year, which represents 80 percent of our company’s drilling budget. We are investing $1 billion in Oklahoma in 2018.”

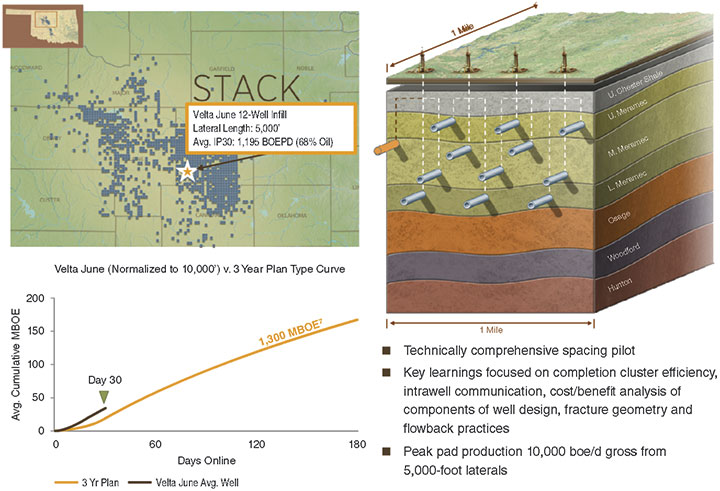

Infill Drilling

As the company shifts its STACK development program to infill drilling, Campbell describes Newfield’s most “technically comprehensive” spacing pilot to date, the Velta June project in southwestern Kingfisher County (Figure 2). The pilot has 12 wells on four pads drilled to the Meramec formation. According to Campbell, the wells had 5,000-foot laterals and averaged initial 30-day rates of 1,195 barrels of oil equivalent a day (68 percent oil) to reach a combined peak production rate in excess of 10,000 boe/d from all four pads.

“This play-leading development pilot included applying advanced technologies such as fiber optics, borehole microseismic, high-resolution pressure monitoring, formation ‘DNA’ rock sequencing, trial proppant and fluid variations, diverters, and fracture geometry imaging and identification,” he remarks.

Noting that key learnings focused on completion cluster efficiency, intrawell communication, cost/benefit analysis of well design components, diverter applications, fracture geometry and flowback practices, Campbell says the lessons from the Velta June pilot will be applied to the entirety of the company’s STACK development program.

“The Velta June is one of eight pilots that we have done so far,” he says. “Most have been 10 wells, but the Velta June was 12-well spacing. Newfield now has completed 80 infill wells in STACK, and has tested four-12 wells a section in the Meramec horizon.”

Finding the proper spacing between wells, Campbell notes, includes spacing both horizontally and vertically. “The pay is 400 feet thick, so we think of it as the development of a cube,” he states. “You have to find the right job size to maximize production. It is proven that if you pump a bigger job, you will get a bigger estimated ultimate recovery. But that is not always better for full-field development. You have to consider the right spacing and job size, the cost and the oil completion. That can vary with oil prices and geologic variability.”

Newfield’s results have shown the ability to generate strong returns across its acreage from the Stark 10-well development in the west to the Jackson/Florene spacing test located to the east.

“Some investors have viewed the future development of STACK with skepticism, but based on our well performance with the parent-child relationship between the first well drilled and the infill wells, along with our aggressive Velta June pilot, we are proving that skepticism unfounded,” he continues.

Leading Producer

Campbell points out that in the STACK play Newfield Exploration has gone from zero to 100,000 boe/d production in five years and expects to double that to 200,000 boe/d within the next three years. “We are the largest oil producer in Oklahoma, and we have more data than any other company,” he relates.

Average STACK wells produce 40 percent oil, 30 percent natural gas and 30 percent natural gas liquids, according to Campbell, with EURs averaging 1.3 million boe a well. “In the early life of the wells, it is about 80 percent oil, which leads to higher early returns,” he maintains. “Over the first five years of a STACK well’s life cycle, the cut is about 60 percent oil.”

Newfield’s STACK wells are drilled to total depths of 9,000-13,000 feet, while its SCOOP wells average 12,000-13,000 feet TD. Well costs are about $8 million in STACK and slightly higher in SCOOP, Campbell relates.

“There are three separate windows in SCOOP: wet gas, volatile gas and black oil,” he says. “The higher returns are in the wet gas window, which produces 10-12 percent oil. EURs in the black oil window average 1.3 million boe, with about 50 percent oil.”

Newfield has drilled highly productive wells in all three windows, Campbell points out, referencing the Larry 1H-22X, one of Newfield’s newest wells in the black oil window in McClain County along the eastern edge of Newfield’s North SCOOP play. Drilled to a total depth of 9,850 feet, the well had a 30-day initial production of 1,930 boe/d, with an 82 percent oil cut.

The windows and stacked zones provide a lot of optionality and flexibility for Newfield’s drilling and development programs in both the SCOOP and STACK. “The industry is capturing and analyzing data, trying to get to a ‘harvest’ mode,” Campbell comments. “That is what we have been trying to get to as well. We are able to pick and choose the best locations and best horizons, and plan to drill within our cash flow while doing so.”

Looking forward, Campbell notes that with 14,000 total identified locations, Newfield has more than a decade worth of drilling activity on its STACK and SCOOP acreage. “At a busy drilling pace of 150 wells a year, it will take a while to drill our existing inventory, let alone drill new opportunities that we identify going forward,” he says. “And as we have seen over the past several years, there is no shortage of opportunities in the STACK and SCOOP play areas.”

Pure STACK Player

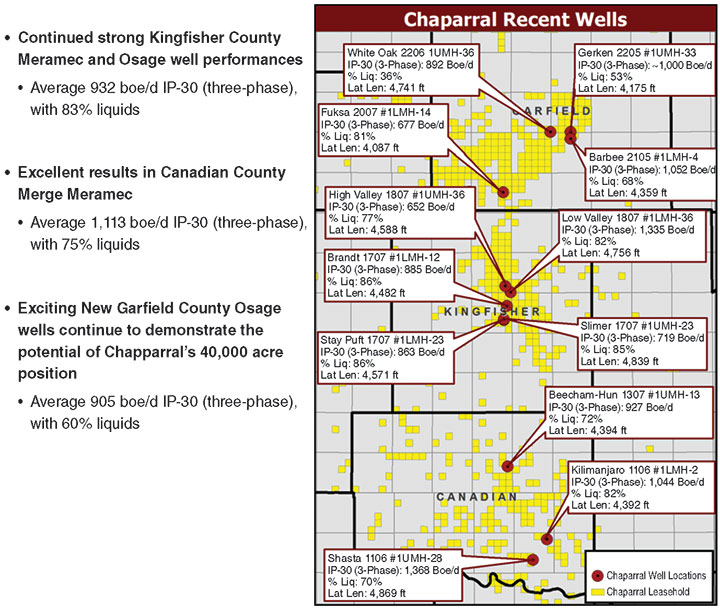

Chaparral Energy Inc. is all about the STACK play. Since emerging from Chapter 11 financial restructuring in March 2013, the company has sold its enhanced oil recovery business and transitioned to a pure-play STACK producer. Its operations focus solely on its 117,000-acre lease position in the play that includes the Merge area where the STACK and SCOOP intersect.

“We consider STACK all one oil fairway down into the SCOOP in Grady County,” says Chaparral Chief Executive Officer K. Earl Reynolds. “The two plays come together in Canadian County.”

The company has 23,000 acres in Canadian County, most held by production. Reynolds adds that Chaparral has 32,000 net acres in the STACK core in Kingfisher County, and the company also is expanding the play to the northeast into Garfield County, where it has another 40,000 acres. Chaparral’s remaining acreage is in an expansion of the play to the west and northwest into Blaine, Dewey, Major and Woodward counties.

Chaparral has drilled 85 wells in the STACK over the past five years, but Reynolds says that number will grow significantly as it ramps up drilling activity (Figure 3). “We plan to drill 61 wells this year,” he states. “We are running three rigs, primarily in Canadian and Garfield counties and a bit in Kingfisher County. These wells are in the normal pressured black oil window, and have an outstanding rate of return.”

With more than 3,000 potential drilling locations identified on its leasehold and a low-operating cost structure, Reynolds says Chaparral is positioned to generate significant returns over the long term with its focus on the STACK strategy. “This is a new and prosperous time in Chaparral’s storied history,” he says. “We are a rapidly growing company.

“With a deep inventory of STACK locations and robust well economics, our wells generate 40 to 80 percent internal rates of return. We have grown at a 79 percent clip over the past two years,” he says. “Our vision, however, is to not only be a pure STACK player, but to be the lowest-cost producer in the play.”

Joint Venture

Chaparral entered into a 30-well joint venture agreement with Bayou City Energy in late 2017. In total, the company says the program consists of 17 wells in Canadian County and the rest in Garfield County. Bayou City will invest $100 million and pay 100 percent of the well costs. Chaparral will receive a 15 percent upfront working interest. Once the program’s return requirements are met (14 of the wells have been drilled, with four wells now on production), Chaparral will have a 75 percent working interest in the 30 wells. In addition, the company retains all acreage and reserves outside the wellbore.

Reynolds points out that the Woodford formation is the source rock for the STACK’s multiple pay zones. “You learn what rocks work,” he states. “These plays expand until you hit the boundary.”

As Chaparral first began delineating its position in Kingfisher County, Reynolds says, the company drilled single, two- and four-well pads, depending on the target and where they were in the cycle of delineation.

“We are not at full-scale development yet, but when we get there, we will drill eight-16 wells a pad and potentially up to 21-well pads,” he says. “We have drilled in every quadrant of our acreage. When we get into full-section development, there probably will be as many as 16 wells a section.”

He maintains that most of the company’s 117,000 surface acres have stacked-pay potential in the Oswego, Meramec, Osage and Woodford formations. To date, Chaparral has drilled 20 wells in the Oswego.

Reynolds also notes that technology has evolved as the company continues to develop its leasehold. For example, he says Chaparral has gone from 15 to 30 stages per one-mile lateral and has increased proppant loading from 300 to 2,500 pounds a linear foot in the Meramec. Reynolds adds that the company also is using cutting-edge chemicals as part of its fracture fluid to get good diversion.

Overall, Chaparral continues to focus on one-mile laterals, although it has tried a 1.5-mile lateral and has participated in a well that employed a two-mile lateral. Reynolds says well costs for a one-mile lateral are $4 million in Garfield and Kingfisher counties and about $4.5 million in Canadian County.

As a result of its continuous optimization of its drilling and completion designs, Reynolds reports that Chaparral has increased EURs by 20 percent in its Meramec wells in Kingfisher County and 40 percent in the Osage in Garfield County.

Focusing On Merge

The Merge play in Canadian and Grady counties, straddling the defined boundaries of the STACK and SCOOP, is also the focus of Jones Energy Inc. The company, based in Austin, Tx., has legacy assets, with 152,000 net acres in the Cleveland play in the western Anadarko Basin in far western Oklahoma and the Texas Panhandle, but it is focusing its efforts on the Merge.

Jones Energy has 22,500 net acres in the Merge. According to its operations report released in February, the company has spud 31 wells and has 23 Merge wells on line. It is operating a two-rig program with much of its attention on delineation and early development strategy.

Jones Energy claims Merge offers “best of both” attributes, including a Meramec extension from STACK and an Upper Woodford extension from SCOOP. Based on available geologic data and the results of offset operators and its own operations, the company says it thinks the Merge play has multiple landing points within several stacked pay horizons, including the Oswego, Cherokee, Ataka/Morrow, Springer Sands, Chester/Caney, Meramec, Osage/Sycamore, Woodford and Hunton. The company says it is focusing on the Woodford and Meramec delineation.

Jones Energy highlighted the results of 12 Merge wells in February. Those wells include lateral lengths from 4,196 feet in the JONES-Bomhoff 1H well to more than 10,000 feet in the LINN-Braum 28-1XH and the EOG-Curry 1VH wells. Initial 30-day production rates for those wells ranged from 653 to 1,730 boe/d, with oil cuts ranging between 25 and 84 percent.

Jones Energy says its initial 30-day productivities per 1,000-foot of lateral in Merge wells are comparable to STACK and the Permian Basin. It also notes that it is testing a “generation four” well design in the Woodford formation. Its generation three completions employed 30 percent more proppant and 15 percent more fluid compared with its generation two completions.

The company lists more than 5,400 potential gross drilling locations in Merge.

Enormous Resource

Another company focusing on the Merge/SCOOP/STACK play area is Roan Resources LLC, which was formed last fall by LINN Energy and Citizen Energy II LLC. Each company contributed 70,000 acres for a combined 140,000 total net acre core position that is largely contiguous in eight Anadarko Basin counties: Canadian, Carter, Cleveland, Garvin, Grady, Kingfisher, McClain and Stephens.

The combined company was operating five rigs in the Merge at the time the deal closed, and forecast year-end 2017 production to exceed 40,000 boe/d.

Citizen Energy II, a private company formed in 2014, is majority owned by various funds managed by JVL Advisors. In addition to its position in Roan Energy, the company retained 50,000 acres in the Anadarko Basin, which it is actively developing. According to CEO Greg Augsburger, Citizen Energy’s first operated well–the Governor James B. Edwards, drilled in September 2015–was the discovery well for the Merge play.

As in the SCOOP and STACK, the production column of the Merge area contains multiple stacked targets. “This is a completely charged Mississippian column sitting on top of an actively generating Woodford source rock, a 2,200-foot continuous hydrocarbon charge from Upper Devonian to Middle Mississippian,” Augsburger says.

Citing 11,000-13,000 psi bottom-hole pressures and pressure gradients exceeding 0.8 in Citizen’s RLP No. 2A well (the deepest STACK well drilled so far) and the Anderson Half No. 1-30-19XH well (the deepest well Continental Resources has drilled to date in STACK in a subplay it calls Deep STACK, where the Meramec is encountered at depths of at least 13,000 feet), Augsburger points out that the thickness of the productive column and pressures at depth indicate a large resource in place in the STACK/SCOOP/Merge play area. “This truly is an enormous resource,” he offers.

Improving Drilling Efficiencies

In its fourth-quarter operations report, Devon Energy said the Showboat project, its initial multizone STACK development, consists of 24 wells across two drilling units in the overpressured oil window in Kingfisher County. The five-rig drilling Showboat program concluded in January with average rig productivity of more than 1,000 feet drilled a day.

That represents a 30 percent increase in daily footage drilled, translating into a savings of $500,000 a well compared with prior activity in the play, according to the company. The Mosasaurus No. 13-H well highlights the drilling activity, with a spud-to-rig-release time of only nine days.

Completion activity at Showboat began in early February with four frac crews on site, utilizing zipper fracs on as many as three wells concurrently with the same crew. On May 1, Devon announced that Showboat had achieved first production in the first quarter 40 days ahead of plan. Showboat’s efficiencies were driven by a 30 percent improvement in drilling time and the doubling of completion stages in a day compared with prior activity in the area, the company points out.

In addition to its high-rate STACK wells, Devon reports that it also is making history in the Delaware Basin in West Texas. In the first quarter, the company started producing two of its Boundary Raider wells, which achieved a combined 24-hour IP rate of 24,000 boe/d (80 percent oil), making them the highest-rate Delaware Basin wells ever brought on line.

“Devon delivered oil production at the high end of guidance and accelerated efficiency gains across the portfolio in the first quarter,” Dave Hager, president and CEO, comments. “Our performance was highlighted by commencing production on the highest-rate wells in the 100-year history of the Delaware Basin and efficiencies at our STACK Showboat project, which resulted in savings of $1.5 million a well and first production 40 days ahead of plan.”

Devon, which has a 600,000 net-acre position in STACK, reports that it commenced production of 12 high-rate wells in the first quarter that averaged initial 30-day rates of 3,500 boe/d (55 percent oil). The most prolific STACK wells produced in the first quarter were four wells in the Coyote development that delivered average 30-day rates of 4,400 boe/d. The initial well from the seven-well Coyote development in Blaine County was flowed back earlier this year at a 24-hour initial production rate of 8,200 boe/d (60 percent oil).

Devon says its Lookabaugh No. 25-1H STACK well achieved a 30-day IP of 5,100 boe/d. The Upper Meramec well extends the economic core of the oil window farther into Blaine County, according to the company report.

The Cassowary well in Kingfisher County was Devon’s first three-mile lateral and is the longest-producing lateral in Oklahoma. It had a 30-day IP rate of 4,850 boe/d. The company’s Faith Marie 1H well had a 30-day rate of 4,700 boe/d, marking the highest productivity of any well to date targeting the Lower Meramec interval.

Farther to the west in Blaine County’s condensate window, the Birch 36-1H well achieved peak rates of 4,600 boe/d, Devon reports. Meanwhile, the company says the Marcia 11-H well, which targeted the Woodford formation in the liquids-rich gas window, utilized a larger completion design that drove the 30-day rate to 4,000 boe/d.

Devon says it expects to invest $700 million in STACK during 2018, with 95 percent allocated to oil-driven Meramec activity. As Devon’s STACK assets transition from appraisal to full-field development, the company reports that an increasing amount of future capital will be devoted to larger, multizone projects. Devon adds it expects to bring on line more than 100 operated wells in 2018, concentrated in the overpressured oil window.

Besides Showboat and Coyote, Devon has eight multizone development projects scheduled for 2018 in STACK and the Permian Basin. They include the 16-well Kraken and 10-well Horsefly projects in STACK and the 10-well Anaconda and 11-well Boomslang projects in the Delaware. The multizone development projects include improved 3-D seismic interpretation, high-graded location selection, optimized landing zones, geospatial optimization, cyber-geosteering, “flat in-zone wells,” fiber optic sensing, prolonged drill-bit life, coiled-tubing drill outs, and cutting-edge frac modeling, the company says.

As part of its “Vision 2020” initiative, Devon says it is allocating more of its capital spending to development drilling, focusing particularly on multizone STACK and Permian projects, and it plans on keeping drilling rigs busy well beyond 2020. The company says it has a multidecade drilling inventory in the STACK and Delaware basins, with more than 30,000 potential locations identified.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.