Extending Well Life

Production Rejuvenation Poised To Transform Performance Of Wells In Unconventional Plays

Sergey Kotov and Hans-Christian Freitag

HOUSTON–Unconventional resources have made the United States the world’s largest oil and natural gas producer, hands down. But if developing North American tight oil and shale gas plays is to remain sustainable at lower commodity prices, the industry must think and act differently to improve production, optimize long-term reserves recovery, and enhance overall development economics.

The first wave of the unconventional oil and gas revolution was driven by extensive horizontal drilling and hydraulic fracturing. It was aided by high demand, strong commodity prices, and ready infrastructure from America’s conventional oil and gas plays. The goal for the next wave of unconventional development is to enhance production and improve recovery rates at lower operating costs.

The most popular approach to developing shale assets was built on continuously drilling and fracturing horizontal wellbores on multiwell pads. Because production from shale wells comes on so strong and declines so rapidly–with annual decline rates as high as 80 percent–new wells can become uneconomic within 18 months of initiating production. To offset volumes lost to decline and to maintain constant production streams to meet revenue targets, operators have had to repeat the drilling and fracturing cycle in quick succession.

This, in turn, has driven business models that require operators to recoup all of a well’s capital costs–which can exceed $7 million or more, depending on the play–within a short period. That, understandably, has put the operational focus on achieving the highest possible initial production rate.

However, the IP-focused continual drilling/fracturing approach to developing unconventional resource plays has left as much as 90 percent of a well’s potential production untapped. Even at high prices, this approach is not sustainable. At prevailing commodity prices, it also is unprofitable, requiring the industry to adopt a new strategic mind-set.

As oil prices began retreating last year, many shale operators were faced with three rather unappealing options to stay in the game:

- Temporarily halting the drilling/fracturing cycle until prices rebounded (recognizing that the decline curve invariably would take a toll on output from existing producing wells);

- Continue drilling new wells, but leaving them uncompleted until prices improved (indefinitely postponing revenue streams from new drills while also experiencing production declines on existing wells); or

- Refracturing wells without sufficient data or proven methods to produce consistently favorable results.

Strategic Rejuvenation

In the past, the production and net present value performance of refractured wells have been so varied and unreliable that some in the industry question its future role in unconventional resource development. While significant inroads have been made in reducing construction costs on new wells, the opportunity for economic improvement may be even greater for operators who implement a strategic rejuvenation approach to leverage their existing well inventories.

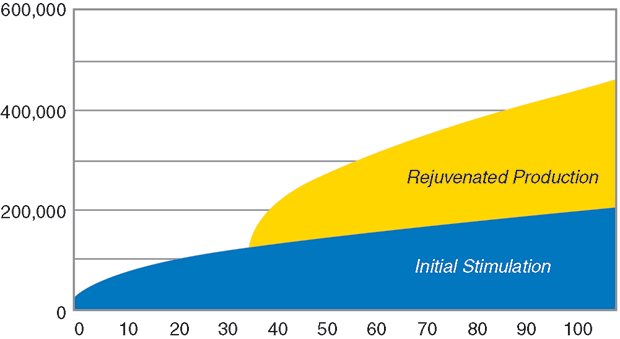

The steep decline curves in unconventional reservoirs typically result in 10 percent or less recovery of available reserves. By restoring connections to previously stimulated intervals and tapping into zones that were missed in the initial stimulation treatment, a properly planned well rejuvenation program re-establishes production levels and significantly increases total reserves recovery.

To be effective, strategic rejuvenation efforts must address the complex interactions among the well, the stimulated reservoir, and the chemistry of produced fluids. There are several key premises underpinning the feasibility of a comprehensive strategic rejuvenation program. First, far more analysis, as well as a new and more strategic way of thinking, are necessary to avoid disappointment from refracturing efforts.

Operators also must keep in mind that not all hydraulically fractured wells are good candidates for rejuvenation, so the first step to successfully improving the results of rejuvenation is to efficiently screen and select those wells with the greatest potential and the least amount of risk.

Moreover, it is important to recognize that refracturing is not the only method of rejuvenating the performance of unconventional wells. Other methods include wellbore clean-outs, chemical treatments, recompletion, and artificial lift. To be successful, the operator must understand what type of rejuvenation is required to meet his specific recovery and business objectives.

Therefore, a thorough economic analysis of the technological solution is required to maximize the value from underperforming wells. The approach must view unconventional wells as “renewable” assets, and it requires a fact- and science-based workflow focused on both the well and the reservoir. The good news is that a holistic, data-driven approach can make rejuvenation a viable business alternative to drilling new wells in tight oil and shale gas plays.

Approaching unconventional wells as renewable assets helps oil and gas companies maximize value from their existing wells by following a four-step workflow designed to significantly increase profitable recovery without drilling a large number of additional wells. The data-driven workflow makes it possible to look at the operator’s universe of wells, and then zero in on the highest-potential candidates for rejuvenation, implementing the best technological and economic solution for each well, based on a thorough analysis of its production history.

In some cases, production can be restored to desired levels with a simple well clean-out program or artificial lift technology, and/or chemical treatments. Refracturing to restore connections to previously stimulated intervals or to tap into zones that were bypassed by the initial completion and stimulation treatment can not only restore (and potentially increase) production, but also decreases the slope of the decline curve to improve ultimate recovery and extend economic well life.

Four Prescribed Steps

The four prescribed steps in the strategic rejuvenation process are:

- Screening and selecting the best possible candidate wells (i.e., those wells with the greatest production potential);

- Diagnosing the condition and specific rejuvenation needs of each candidate well;

- Selecting the optimal rejuvenation treatment for each well; and

- Efficiently executing the rejuvenation treatment at the well site.

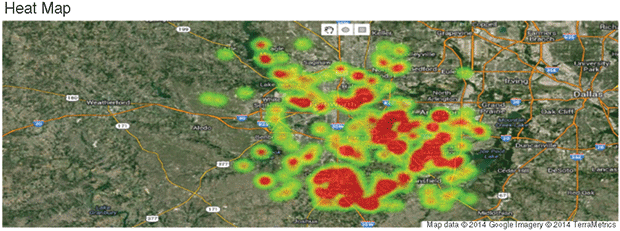

Properly screening and selecting rejuvenation candidate wells requires mining historical reservoir and production data, applying advanced statistical methods, and estimating each candidate well’s production potential. Often, the best rejuvenation candidates are located in a field’s sweet spots with historically high-performing wells. However, because of the heterogeneity of unconventional reservoirs, pinpointing the best candidates is challenging.[

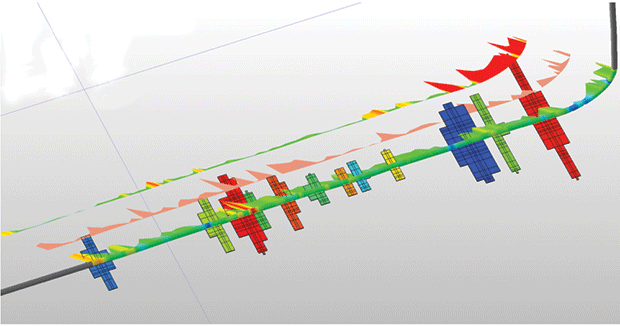

The process for selecting rejuvenation candidates includes estimating remaining reserves, assessing current reservoir conditions, characterizing flow from existing fracs, and identifying untreated or understimulated zones. As illustrated here, combining production logs with reprocessed seismic data and cuttings analysis helps identify the best intervals along the lateral for restimulation.

The amount of information available around a well has grown from a few key data points to hundreds of variables related to reservoir geology, field production, overall recovery, decline rates, well architectures, completion tools and techniques, pumping schedules, stimulation fluids, and production schemes. Taken together, these data can generate an almost infinite number of combinations. An iterative process and advanced analytical tools, including predictive models, are required to help pinpoint the best candidates.

Advanced data mining techniques can provide a look into virtually any play in North America, enabling operators to study key production drivers. However, datasets involving large well counts often contain many variables that are not ideally distributed, or have missing values, bad values or other problems. Therefore, it is crucial that the tools and techniques used in data mining be able to flag any potentially compromised data.

In addition, building a single, multiple-source dataset can minimize the risk of information “gaps” and help ensure the most accurate and reliable screening. By using state-of-the-art data gathering and data filtering algorithms and geographic information system mapping, it is possible to merge data from multiple sources (both public and private), and then analyze them to determine well placement, original completion type, and original stimulation treatment details.

These methods can help operators better understand the impact of key well architecture, completion and stimulation parameters, and can enable them to create base lines for reservoir performance that can be used to explore the potential of various rejuvenation techniques within a specific area. Using this base line, operators can identify wells that have more production to offer, and that can be rejuvenated effectively and economically.

The comprehensive candidate selection workflow is used to assess all known attributes and arrive at a ranked list of the “best candidates.” The ranking process is based on analyzing three categories of important factors: reservoir, completions, and wellbore mechanics.

Diagnostics And Treatment

Following candidate selection, additional diagnostic analyses of each well can uncover unique production challenges and delineate issues that might preclude a specific type of rejuvenation treatment or render it uneconomic. A comprehensive examination of all formation evaluation data helps quantify the remaining reserves in a well, in addition to aiding in understanding reservoir conditions. If formation evaluation data are scarce or unclear, it may be necessary to gather new logging data prior to investing additional money into rejuvenation treatments.

Almost every wellbore will require a thorough cleanup prior to any rejuvenation attempt. With some wells, the clean-out is sufficient to temporarily boost production to desired recovery levels with no additional rejuvenation.

A detailed review of the original completion and stimulation design can help create a diagnostic profile of the existing fractures and help identify any areas that may have been left untreated or understimulated. The completion type and details on the stimulation treatment are analyzed to evaluate their effectiveness and to determine the optimum recompletion and restimulation program. Evaluating casing and verifying well integrity helps determine the most effective isolation method for restimulation.

As noted, production can be restored to desired levels with a well clean-out program, chemical treatment, and/or artificial lift technology in some cases. However, if additional rejuvenation measures are required, options include:

- Repairing or replacing a substandard completion;

- Enlarging fracture geometry and enhancing reservoir contact;

- Restimulating underperforming intervals with more suitable fluids and proppants;

- Extending well life by introducing flow assurance additives;

- Increasing conductivity in inadequately propped portions of fractures;

- Restoring and maintaining fracture conductivity lost because of proppant embedment, cyclic stress, proppant degradation, gel damage, or plugging from organic or inorganic depositions;

- Stimulating untreated or undertreated zones for greater reservoir exposure; and

- Recompleting the well to provide more access to the reservoir.

Selecting the best candidates for rejuvenation is not as simple as identifying underperforming wells. In fact, the best rejuvenation candidates often are the best performers in a field. Heat maps help reveal the highest-producing areas of a play (red). Wells located within these “hot spots” may represent prime rejuvenation candidates. Underperforming wells located within these areas also can be among the best candidates.

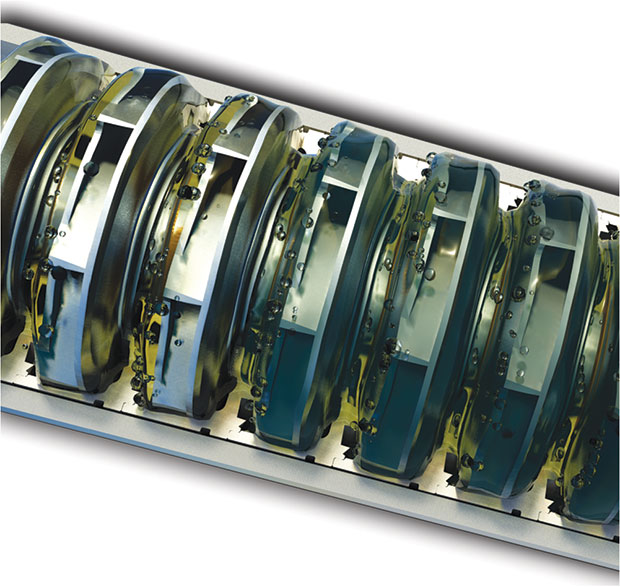

The rejuvenation program should be built on a process that weighs the technical feasibility and risk against the cost of intervention. Because of the importance of managing flowback in optimizing flow rates and production, it is also important to consider how the well will be put back on production after the treatment. Restimulating a well increases inflow performance, so by installing artificial lift systems after a well is restimulated, the well can be drawn down to further enhance production and increase estimated ultimate recovery.

Optimum production and reliable operations are ensured by managing a well’s life cycle. Optimized production can be managed holistically from the perforations, through the pump, and through wellhead and surface equipment to ensure that a well or an asset operates with the lowest cost per barrel of oil equivalent produced. A strategic approach to a rejuvenation program design limits second- or later-round investments to viable candidate wells that can be rejuvenated at a fraction of the cost of drilling and completing new wells.

Improving Performance

Field execution is the final step in the rejuvenation process, and is crucial to the overall success of any project. To ensure a successful job, fracture propagation monitoring technology is used during refracturing. Real-time data monitoring during treatment plus post-refrac analysis are crucial to refining and enriching reservoir models for the next refracturing operation.

If the operator is working with a service company that offers a full spectrum of completion, stimulation and production technologies, it is recommended that the service company provide a dedicated well site coordinator and project manager to oversee the project. This person can serve as a single point of accountability for the project, typically delivering improved communications and more efficient job execution.

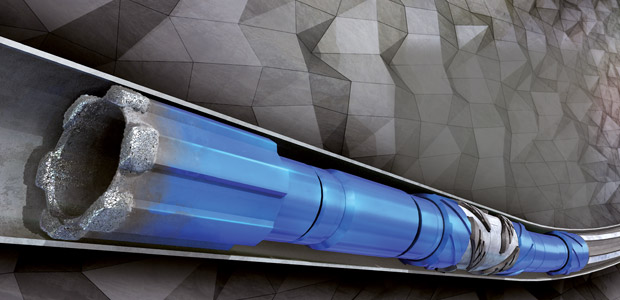

Artificial lift technology is one of the primary means of rejuvenating production in existing wells. Deploying the right lift solution based on well-specific application objectives can increase production and boost recovery while lowering operating expenses.

Strategic rejuvenation techniques have been effective at generating production rates that equal or even exceed a well’s initial production–and often with less rapid decline rates–while offering numerous economic and health, safety and environmental benefits over continually drilling and completing new wells to maintain production volumes. Although the solution is new, operators are beginning to see results that indicate excellent prospects for improving financial performance through well rejuvenation, even at lower commodity prices.

At the same time, the industry is working to address another key issue: If refracturing campaigns are to be implemented on a large scale in unconventional resource plays, wells must be completed initially to make subsequent recompletions much easier and generate more consistent results.

In the future, the pathway to success may be “refrac-ready” wells, based on learnings from current and upcoming rejuvenation projects. Regardless of the technique chosen for each well, new science-based and data-driven workflows will enable operators to replace raw horsepower with brainpower, and to rely on detailed analysis and planning processes rather than field experimentation to ensure more productive and economic wells over an asset’s full life cycle.

SERGEY KOTOV is manager of integrated technology for the global products and services group at Baker Hughes. He has 20 years of oil and gas industry experience, specializing in production enhancement. He started his career in Russia, and has held positions in all aspects of pumping operations across the globe. Kotov leads Baker Hughes’ NextWave™ production rejuvenation initiative to maximize value from unconventional reservoir assets. He is an instructor for the Society of Petroleum Engineers’ unconventional completions and fracturing course, as well as for the Baker Hughes Shale Academy. Kotov holds an M.S. in petroleum engineering/oil and gas geology, and an M.A. in linguistics.

HANS-CHRISTIAN FREITAG is vice president of integrated technology for the global products and services group at Baker Hughes. He began his career at Atlas Wireline Services in 1989, and worked in operations, geoscience and management positions around the world. He joined Baker Hughes in 2002, overseeing the development of advanced logging-while-drilling technology. Freitag then held senior and executive management positions in North America, the Middle East and Asia Pacific. Before assuming his current role, he served as vice president of Baker Hughes’ unconventional resources group in the Eastern Hemisphere. Freitag holds a B.S. in physics and an M.S. in geophysics.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.