Real-Time Drilling & Completions Data Drives Smarter Decisions Across Entire Well Cycle

By Robert Herrmann and Dan Wessel

In the oil and gas industry, competitive advantage is increasingly tied to how quickly and effectively companies can integrate, analyze, and act on operational information. From drilling and completions to production optimization, the shift toward structured, real-time data is transforming decision-making and field efficiency.

These efficiency gains matter not only for the oil and gas industry but also for the economy it supports. As innovators in every sector improve automation and test new use cases for AI, oil and gas producers face a dual challenge: meeting the growing power demands of digital infrastructure while modernizing their own operations with better data. This evolution shows up in spending patterns. Cloud-based oil and gas applications are forecast to grow from $8.77 billion in 2024 to more than $20 billion by 2030, for a compound annual growth around 15%.

The upstream sector is leading the charge. For upstream, cloud adoption isn’t just about moving storage off-premise. It’s about unlocking workflows that once required manual intervention, merging well site telemetry with corporate databases in near-real-time, feeding dashboards that reflect current rig status, and enabling analytics teams to run offset-well comparisons without waiting for end-of-day exports.

Despite the many efficiencies the cloud can unlock, adoption has not been uniform. Some operators hesitate due to cybersecurity concerns, bandwidth limitations in remote basins, or the need to retrain personnel on new workflows. Overcoming these barriers often requires a hybrid approach: critical operational data streams through secure cloud connectors, while non-time-sensitive processes remain local.

Fortunately, platforms for storing, accessing and analyzing oil field data in the cloud continue to improve. The strongest platforms use integration architectures that give companies the flexibility to fetch critical data in real time while leaving other data on-premise. This approach enables companies to move to the cloud gradually and without disrupting current operations.

The Efficiency Imperative

For many companies, migrating to cloud-based platforms that offer a holistic view of operations is no longer optional. Traditional data management processes that require people to spend time transferring data between programs cannot keep pace with the demands of modern well architectures or completion designs.

Consider the Permian Basin. In that hotbed of innovation, laterals now routinely exceed ~14,000 feet, compared with 5,000–8,000 feet a decade ago. Multi-well pad development, simulfrac operations, and optimized proppant strategies have materially improved field economics. As better completion designs boost production and better bits and BHAs speed drilling, the U.S. rig count has fallen dramatically. For example, between 2022 and mid-2025, the Baker Hughes rig count went from ~780 to ~540 even as national crude output periodically reached record highs.

Efficiency, not activity, is the new baseline.

This change didn’t happen overnight. Advances in rotary steerable systems, high-capacity frac fleets, and remote operations centers have enabled operators to do more with fewer physical assets. In turn, fewer rig moves mean less downtime between wells, and centralized control rooms allow engineers to monitor multiple pads at once. Again, structured data plays a pivotal role, coordinating service providers, maintaining consistent job execution, and creating the historical records needed for continuous improvement.

The global oil and gas workforce is roughly ~17.3 million, but mature markets face a steady decline in engineering and field roles. By contrast, digital roles such as cloud engineering, automation, and data analysis are growing rapidly as organizations lean into software and real-time analytics.

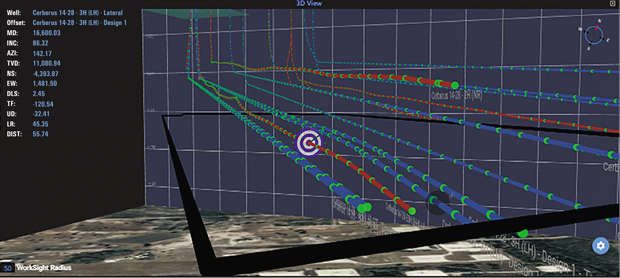

Thanks to cloud-based data storage, standardized data structures, and automated APIs, it’s no longer necessary for directional drillers to manually share survey data. Engineering and field teams can both track trajectories, events and directional performance while drilling takes place, allowing them to improve well placement.

This trend has two immediate impacts. First, knowledge transfer from retiring experts must happen faster and more systematically, with lessons embedded in workflows rather than passed down informally. And second, digital-native hires expect tools that are as intuitive as consumer apps. They want role-specific interfaces that allow them to focus on engineering, not file-hunting.

To keep pace, operators are prioritizing:

- Reducing redundant manual data entry;

- Automating routine data validation and integration;

- Aligning vendor inputs to company standards in real time; and

- Embedding operational best practices into software-driven workflows.

Closing the Data Gap

To turn those priorities into reality, companies must address a familiar but previously challenging problem: data silos. For years, fragmented systems, inconsistent formats, and vendor-specific portals slowed analysis and decision-making. Directional surveys, bottom hole assemblies, stage-level frac data, and cost allocations often lived in PDFs and spreadsheets, detached from corporate systems. Even with central databases, engineers spent hours reconciling versions and filling gaps, limiting the value of dashboards and delaying reporting.

Consider a typical pre-integration workflow: A completions engineer requests a stage summary from a pumping vendor, who exports a CSV (a text file containing data separated by commas) that must then be emailed, transformed for operator-specific data conventions, and manually loaded into an internal database. If a wireline log arrives later with timestamps that differ from the ones the pumping vendor used, reconciling the two could take another day. Multiply that across vendors and pads, and days of productive engineering time disappear.

Fortunately, there is a better way. With standardized data structures and rigorous automated checks that catch deviations from expected values, companies can progress from raw manual data collection to automated and structured sensor analysis for continuous improvement. At the same time, they will lay the foundation for real-time decision-making.

A modern cloud platform offers a practical starting point. It acts as the backbone for many data management programs, providing a single source of structured, trusted data across drilling, completions, and production. This platform is easy to transition to, allowing companies of all sizes to automate every step of data’s journey, from capture to analysis.

Real-Time Drilling Data

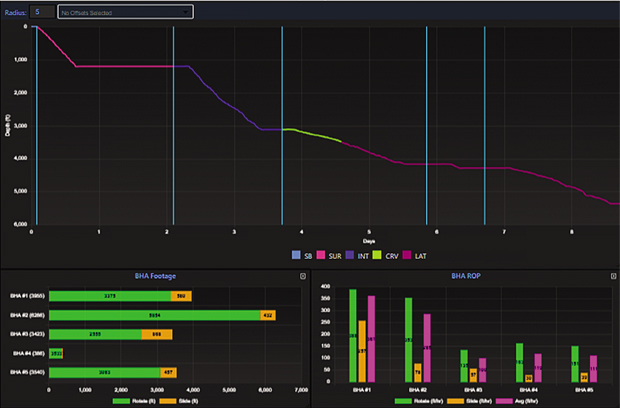

Directional drilling is one of many areas where rapid access to data can lead to meaningful savings. Historically, directional service providers emailed flat files of BHAs and surveys, which were cleaned and re-keyed, introducing latency and variability. With the cloud, directional data automatically flows directly from the true source into corporate systems. There, standardized BHA libraries ensure consistency. Engineers simply approve incoming data, rather than wasting valuable time and redundant resources parsing PDFs to get the information they need.

When companies invest in strong data governance and modern cloud platforms, they gain access to accurate data about their wells’ performance during drilling, completions and production. This data is displayed in a consistent format, making it much easier to compare designs and identify potential opportunities for improvement.

Built on open ETL standards (Extract, Transform, Load) leveraging modern tools such as APIs or Direct Data Warehouses, these workflows can operate with sub-minute latency, supporting timely decisions while drilling. They also enable component-level traceability, linking specific tool runs to performance outcomes, a critical capability for investigating nonproductive time and planning offset wells.

Within the platform, an AI-assisted bit-grading workflow analyzes drill bit images using trained computer-vision models to produce objective, repeatable dull grades. By pairing visual analysis with operational context, consistent grading helps identify cutter wear patterns and potential dysfunctions sooner, improving post-run reviews and informing future BHA design choices. For operators drilling extended laterals in abrasive formations, catching cutter wear early can be the difference between finishing the section in one run or tripping out early.

Completion Insights

Completion vendors frequently use different sensors, logging systems, and data formats. Historically, reconciling these across service providers took days and often produced summaries that didn’t align with internal cost models.

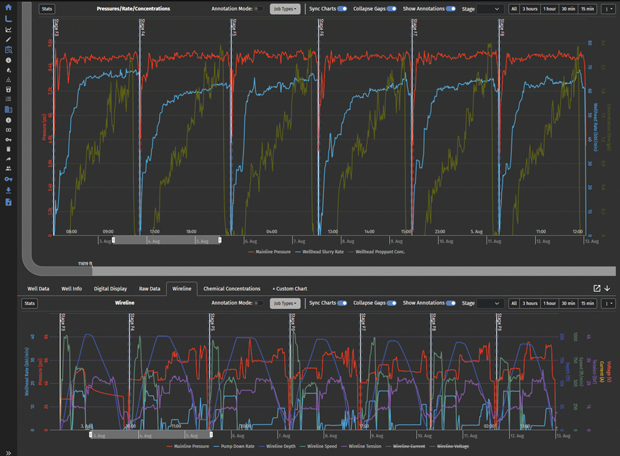

The modern data platform solves this problem by normalizing real-time data from frac, wireline, and pumping providers, then generating standardized stage summaries: proppant and fluid volumes, rates, additives, and time logs across running in hole, pump down, plugging, perforating, pulling out of hole, and frac intervals. The result is faster decisions, better material tracking, and cleaner audit trails.

In one example, a multi-vendor simulfrac project used the platform to align streaming stage data with company standards in real time. Engineers could see both frac fleets’ performance side by side during execution, enabling adjustments on the fly and reducing post-job reconciliation from days to hours.

Over time, the rapid analysis the platform enables can contribute to significant performance gains. This proved true for Riley Permian, one of the many operators that use the platform to support its drilling and completion operations.

With automated data collection providing rapid access to post-job data (such as mainline pressures, wellhead slurry rates and wellhead proppant concentrations, as well as wireline parameters for each stage), completion teams can accelerate learning. In some cases, the resulting insights enable them to reduce completion costs without sacrificing production.

Riley Permian focuses on applying modern horizontal drilling and completion techniques to conventional oil-saturated and liquids-rich formations in the Permian Basin, with most of its acreage in Yoakum County, Tx., and Eddy County, N.M. By using the platform to automate data capture, reduce manual errors and accelerate reporting workflows, the company has standardized how it looks at data. It credits this change with helping it make more efficient and reliable decisions.

That has translated into stronger field operations. For example, since 2022, the data has helped Riley Permian achieve meaningful reductions in completion stage costs while maintaining or improving well performance.

Scalable Optimization

Riley Permians’s accomplishments illustrate a broader trend. With structured data, companies can shorten cycle times while raising confidence in their decisions. The data enables like-for-like comparisons across pads, vendors, and formations, and it makes tuning AI models to local characteristics practical when global models don’t transfer cleanly (as may be the case when applying the same model to the Bakken and the Haynesville).

Published studies still show that nonproductive time can account for ~20–30% of drilling time in some shale programs. Structured, real-time data helps bring that number down by reducing guesswork, enabling earlier detection, and supporting root-cause analysis. The payback isn’t just in rig hours saved. It’s in improved equipment utilization, more accurate authorizations for expenditure, and faster learning curves for new plays.

Crucially, shared data standards tighten collaboration between engineering and data teams. When analytics tools speak the same language as drilling and completions platforms, adoption rises, magnifying the impact.

The value of structured data will only grow as AI’s capabilities improve, for AI readiness begins with data readiness. Industry projections put AI in oil and gas growing meaningfully through 2030, but models only deliver value when fed clean, contextualized, timely data. That is exactly what platforms that govern data, normalize real-time feeds and leverage modern cloud infrastructure are designed to deliver.

Looking forward, operators that standardize their well data lifecycle will be best positioned to deploy advanced optimization, whether that’s automated torque-and-drag modeling, predictive maintenance on frac pumps, or closed-loop drilling parameter control.

But companies need not look into the future to justify investing in integration, automation and standardization. Field results show that doing so reduces nonproductive time, improves decision quality, and unlocks team capacity. In the process of setting the stage for the next wave of analytics, it delivers measurable value today.

ROBERT HERRMANN is the well data life cycle product manager for Peloton, the creator of a cloud-based well data management platform that extends from well site construction to plugging and abandonment. Herrmann began his career as a wireline engineer, working across Canada and the United States, including the lower 48 and Alaska. He later joined Peloton, where he has spent more than 22 years in a range of roles. Herrmann holds a B.S. in chemical engineering from the University of Alberta.

DAN WESSEL is the chief executive officer and founder of Innova Drilling & Intervention, which provides a suite of engineering tools, anti-collision systems, and real-time visualization software for optimizing drilling operations. Wessel began his career as an MWD engineer working across Europe and East Africa before moving into directional drilling in the North Sea and South Atlantic. He holds a master’s in mechanical engineering from the University of Strathclyde in Glasgow, Scotland.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.