Vision 2020

Shaping Tomorrow’s Technology

By John W. Gibson

HOUSTON–If we are honest with ourselves, before 2015, few of us in the C-suite gave a hoot about either the threat or the tantalizing potential of so-called “disruptive” technologies in oil and gas. We were blowing down the road, pedal to the metal, the sun on our faces, and a cloud of dust rooster-tailing behind us.

Right up until we collectively drove off the cliff.

After the crash, nothing was the same. Suddenly, we understood we couldn’t keep doing things the way we had before, with minimal attention to efficiency and cost. We realized, too, that incremental improvement would never save us. Chief executives grabbed the steering wheel and started driving a different direction at high speed.

“We have to disrupt ourselves,” says Tim Dove, chief executive officer of Pioneer Natural Resources. “That is why transformation must be driven from the top down.”

Of course, change is risky. How does an inherently conservative industry disrupt itself without shooting itself in the proverbial foot? We have to think outside the lease lines, move in different circles, dance with different partners.

I believe energy is entering a new era. We are facing a moment like we did at the dawn of the shale revolution, when a disruptive model from the Barnett irrevocably altered the landscape.

Today, however, transformation isn’t being birthed by the fortuitous union of our own bright ideas, such as horizontal drilling and hydraulic fracturing. It’s emerging from the unlikely marriage of Silicon Valley and Cotton Valley, if you will–technology and Texas.

It only makes sense that the industry would continue to leverage the investments it already has made over the years in technology for as long as they pay dividends. That said, a truly disruptive technology makes existing systems and methods obsolete. We see unmistakable signs of technologies taking disruptive form in upstream oil and gas: artificial intelligence, machine learning, cloud computing, predictive analytics, robotics, the Internet of things. Other examples include nanotechnology, composites, chemistry and even genomics.

Here’s the thing with disruptive technologies: You never quite know where they are going to come from or when they will come calling. However, let us look at a few of the offspring of the Silicon Valley-Cotton Valley union, still in their infancies, that I consider both imminently and eminently disruptive.

Subsea Robots

Veterans of NASA’s robotics laboratory founded a Houston startup in 2014, combining their expertise in low-bandwidth and long-distance communications, robotic operating systems, and autonomous vehicles. Then they went looking for costly commercial problems to solve. Right down the road they discovered a $2 billion annual market ripe for disruption: subsea services.

In the Gulf of Mexico alone, we have drilled 53,000 wells and installed enough pipelines on the seafloor to circle the Earth. The North Sea is much the same.

Energy companies must inspect, repair and maintain an astounding amount of subsea assets every year, regardless of whether any new development takes place. Yet, there is absolutely zero technological differentiation between the dozens of remotely operated vehicles working in the Gulf.

Every player in this fragmented market–including the few dominant ones–will send a big, unwieldy vessel off shore, drop overboard a refrigerator with cameras and manipulator arms, and assign a crew of six or seven to remotely operate this “robot” by way of a long, complex tether that threatens to tangle at every twitch of the joystick.

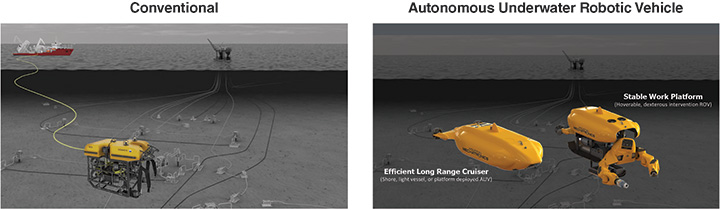

Houston Mechatronics had a disruptively different idea: Get rid of the ship, remove the tether, and replace the ROV with an AURV (autonomous underwater robotic vehicle) capable of transporting itself to a job site as far as 200 kilometers from shore, navigating pipelines like so many branching roadways. Once there, transform the hull from an efficient long-range cruiser to a stable work platform. This could effectively slash the majors’ $227 million average annual payment in half.

Using very low-data distillation techniques developed for communication with autonomous robots in space and model-based software that creates a complex immersive environment in real time, a single specialist can “supervise”–rather than laboriously control–a small fleet of autonomous robots with a few clicks of a mouse.

Mechatronics has replaced an unwieldy, tethered remotely operated vehicle with an autonomous underwater robotic vehicle capable of transporting itself as far as 200 kilometers from shore. Using very low-data distillation techniques, a single operator can supervise a fleet of autonomous robots.

The autonomous subsea vehicle is only one of the intelligent robots to emerge from this union of tech and Texas. A pipe inspection robot crawls inside certain types of pipe and acquires data no one has collected before. An advanced manufacturing robot performs craftsman level work, adapting its behavior based on experience, effectively removing humans from harm’s way.

What robots bring to oil and gas is the ability not simply to crunch big data, but to act efficiently on that data by manipulating the physical environment. Robots may well become the most iconic technology of the 21st century.

Nanoscale Sensors

If medical technologists can put tiny sensors in the human body to search for, say, cancer cells, why can’t we insert autonomous micro- or nanoscale sensors into the body of the Earth to interrogate oil and gas reservoirs? That is the question founders of the Advanced Energy Consortium asked themselves while attending a medical conference 10 years ago. Not yet a startup company, the consortium today, headquartered at the University of Texas, is ready to commercialize a distinctly disruptive technology known as “smart dust.”

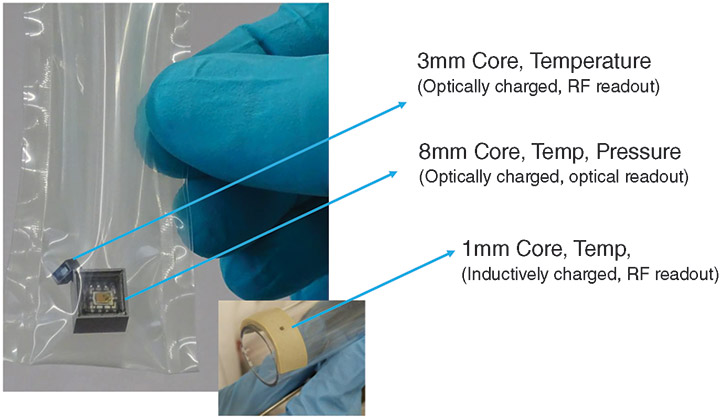

The size of a single letter on a dime, smart dust is the tiniest of several autonomous data collecting devices, each of which integrates one or more microsensors, a battery, memory, wireless communication, and steel, ceramic or polymer packaging. Could devices such as these eventually disrupt the wireline logging industry, at least in places where we cannot put a wire conveniently?

Consortium scientists and academics brought together a unique blend of energy industry experience and expertise in microelectronics from places such as Apple, IBM, Intel, Symantec and Motorola. To date, they have designed and tested three wireless temperature and pressure loggers from eight millimeters (the size of a sugar cube) to one millimeter (the size of glitter).

These devices incorporate both off-the-shelf components and groundbreaking innovations such as 380-micron antennae, which transmit up to four inches, and high-temperature, rechargeable microbatteries that should last up to 100 hours at 125 degrees C before the end of this year.

The smallest sensor actually dumps the battery and harvests power directly from its environment–similar to lichen eating a rock. Measuring temperatures in a brine well, smart dust has survived down hole for up to 24 hours. That, too, is likely to increase.

Microsensor Technology

Scientists at Advanced Energy Consortium have developed wireless temperature and pressure loggers ranging in size from eight to one millimeters. The eight millimeter logger can store approximately 700 time-stamped temperature and pressure data points, operating up to 12 hours in 100-degree C temperatures at 7,200 psi. The three millimeter logger can store 400 data points, operating in 100-degree temperatures at 10,000 psi.

There are multiple ways we can investigate the subsurface using autonomous microsensors. They could be attached to a plastic rod, slipped down and pulled out of the hole. We could embed power-harvesting sensors in cement and install them in the well. Encapsulated in a buoyancy-adjusting polymer with a clear front, thousands of them could be circulated in mud to deliver wireless logging on demand. Simply open a valve, flow in the sensors, produce them back to the surface and interrogate them as they flow by a readout station.

Imagine coating a nondissolvable frac stage ball with microsensors and shooting it down hole, where it hits the sliding sleeve and isolates a hydraulic frac stage. Leakage across the ball would show up in a time-pressure curve. Today, we are flying blind.

Finally, if the smallest sensors shrink a bit further, we can embed them in proppant and–with the right kind of infrastructure–talk to them while they are sitting inside fractures. This would be revolutionary.

In time, these tiny data collecting devices could disrupt the status quo not only in oil and gas, but also in environmental applications, mining, geothermal energy, aquifer monitoring, and underground storage and waste disposal.

Water Marketplace

Speaking of unconventionals, if we ever hope to get back to the heady blowing-down-the-road days of yesteryear, we are going to need a lot more water.

In a conventional well, produced water mostly is reinjected to enhance recovery, so water costs and logistics are negligible. Unconventionals, on the other hand, require huge amounts of water to fracture the well.

From 2009 to 2014–the boom years for shale–water volumes moving to and from the well pad, by truck or pipe, grew by 7,000 percent. Since the crash, even though total completions are still way down, typical volumes have risen from 100,000 to as high as 1 million barrels of water a well. To reduce time and gain efficiencies on multiwell pad completions, an operator may need to front load the site with 2 million-3 million barrels of water.

All that water has to come from somewhere and go somewhere for treatment, disposal or reuse. But where? Historically, water for hydraulic fracturing came from a surface use agreement with the parcel owner. Today, it’s a rare parcel that can source all the water we need.

Fortunately, within a radius of 10-30 miles–at least in places such as the Permian Basin–there are a multitude of potential sources: other surface owners with water from streams and groundwater to sell, operators with excess flowback and produced water to dispose of, midstream water pipeline companies and big players with extra capacity, water treatment facilities, municipal utilities–you name it.

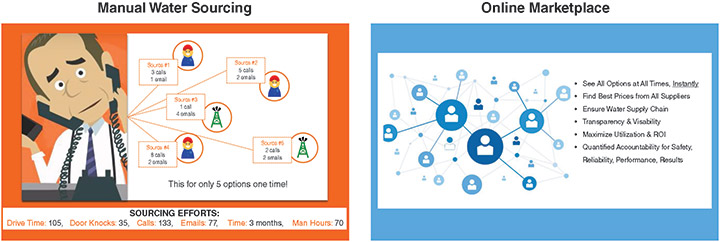

How do we locate all these sources, optimize the options and negotiate the best deals, all at the same time? Believe it or not, landmen and even completion engineers (who have other, quite demanding jobs to do) drag out their Rolodexes, call up their buddies from school, hoof it around the neighborhood, and knock on doors.

Consider this: Howard County, Tx., an active area in the Midland Basin, has 23,000 surface owners with properties large enough to source water, not to mention all those other options.

Enter Sourcewater, an online water marketplace for the energy industry founded at MIT in 2014 by a Sloan Fellow and entrepreneur with no knowledge whatsoever of the energy industry. He saw a single chart illustrating skyrocketing investments in hydraulic fracturing from 2005 through 2012 and detected an opportunity hiding in the water market’s profligacy.

An example of a “low-tech” innovation with dramatic disruptive implications, Sourcewater has created a database of more than 100,000 sources of water in the Permian Basin containing contact information, types and quality of water, dates of availability, locations, volumes, flow rates and rights of way. Making available all the data necessary to optimize time-sensitive water deals is changing the industry’s traditional relationship-based procurement.

Today, Sourcewater is disrupting the industry’s traditional “relationship-based” procurement with a smarter data-based strategy. For the first time, all the data needed to optimize time-sensitive water deals within a particular geographic range–contact information, types and quality of water, dates of availability, locations, volumes, flow rates, rights of way and so on–can be found in one place.

At present, Sourcewater has more than 100,000 listings and more than 1,000 users in Texas alone, and it’s growing. Think of it as the Amazon.com for water.

Online marketplaces are excellent examples of seemingly “low-tech” innovations with dramatic disruptive implications. It’s not all robots and rocket ships. Another example is RigUp, a marketplace for on-demand access to every imaginable rig-site contractor and service provider–a sort of Uber for oil. I suspect we will see more of these in the coming era.

Tipping Point

At Tudor, Pickering & Holt’s Energy Disruption Conference last November in Austin, I saw something that exemplifies our industry’s stimulating new relationship with the tech sector. Mingling among the gray hairs and suits were a couple of Millennials from West Coast startup Tachyus, one of whom proudly wore a T-shirt proclaiming: “I ♡ Fossil Fuels!” Some 300 people from both coasts and everywhere between–tech companies, oil and gas operators, venture capitalists–rubbed elbows for a day and went away energized.

Since 2000, something like 50 percent of Fortune 500 companies have disappeared. Why? Corporate mass extinction by digital disruption, like the asteroid that ended the era of the dinosaurs.

Our only hope for the future lies in filling these empty niches with something smaller and more agile, like our mammalian ancestors. “This year,” says Pioneer’s Dove, “is the tipping point for digital transformation in oil and gas. We have to invest in innovation. If you are standing still, you are falling behind.”

JOHN W. GIBSON is a senior adviser to Tudor, Pickering & Holt. He spent the first 10 years of his energy career working for Gulf/Chevron. Gibson’s background supports his focus on minimizing environmental impacts associated with energy development and digital innovation. He previously served in executive roles at Landmark Graphics, Paradigm Geophysical, Tervita and Halliburton. Gibson is a director of Orocobre Limited and I-Pulse Inc., and is on the University of Houston’s Energy Advisory Board, the Visiting Committee of the Texas Bureau of Economic Geology, and the USC Global Energy Network Advisory Board. He also is an adviser to Cottonwood Venture Partners. Gibson earned a B.S. in geology from Auburn University and an M.S. in geology from the University of Houston.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.