Substantial Upside Potential Characterizes Oil, Gas Markets Over Summer Months

By Eli Z. Rubin

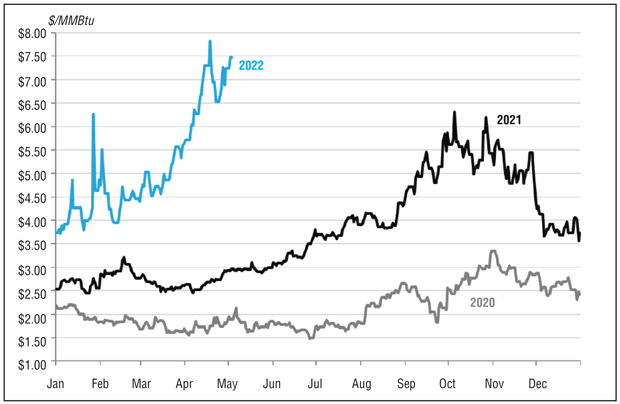

WASHINGTON-On May 4, natural gas prices on the New York Mercantile Exchange closed above $8.41/MMBtu. It was the highest front-month close since late June 2008 and was matched only by closing prices recorded during four other periods: late 2000 to early 2001, October 2004, autumn 2005 to early winter 2006, and the winter and spring of 2008. On the same day, crude oil closed at $107.81, extending a triple-digit pricing pattern experienced during a handful of times in the industry’s history: 1980, 2008, and 2011-14.

The only previous occasion when both natural gas and oil prices traded at such levels at the same time was 2008. In August of that year, U.S. rig counts surged past 2,000, with 1,600 rigs targeting gas, driven by emerging shale plays. Six years later, in September 2014, rig counts again approached 2,000, but this time the script had flipped so that 1,600 were drilling for liquids, thanks to the emergence of tight oil.

At the end of April, Baker Hughes counted 698 active rigs, with 144 targeting gas. No market observers expect the rig count to jump to anywhere near 2,000 in the foreseeable future, and there are numerous and essential reasons for the stark contrast between the drilling response to price prompts then versus now. Increased drilling is not simply a function of price alone. That said, prices undeniably remain a key activity regulator. So what lies ahead this summer for both commodities? Is the market signaling support for expanded drilling and field development?

The short answer is that the fundamentals indicate substantial upside potential for both natural gas and crude oil in the coming months. Natural gas rallied strongly in April and May to surpass recent highs as an early-season heat wave in Texas and near-term production woes sparked a technical move higher.

Near-Term Scenarios

Renewed consolidation is expected on fading weather-driven demand, rebounding production and peaking storage deficits. However, in early May the June contract jumped well past the previous key technical resistance point of $8.20/MMBtu, which may accelerate anticipated upside this summer.

In the most-likely scenario, the potential for one of the largest monthly storage injections on record in May could help alleviate building bullish pressure for NYMEX futures. Tremendous price swings remain possible from comparatively minor fundamental stimuli. If weather trends hotter or supply falters, significant upside is likely and double-digit NYMEX prices this summer should not be ruled out.

WTI is likely to extend near-term consolidation with continued coronavirus lockdowns in China, rising interest rates, and a strengthening U.S. dollar. By mid-summer, however, rebounding Chinese demand will coincide with peak seasonal demand in the United States, Russian supply may subside and OPEC gains diminish, and inventory concerns loom large as the market eyes the end of supply-side infusions from global strategic petroleum reserves.

Figure 1 shows NYMEX front-month natural gas prices since 2020. Before looking forward to the upcoming summer months, let’s provide context to trading activity in April and early May. The NYMEX front-month pressed higher on production woes and an early turn hotter in Texas, surpassing the $8.00/MMBtu threshold and surging well beyond the April 18 intraday high of $8.20. While modest bullish fundamental catalysts helped spark the move higher, technicals remain critical in a price-inelastic market.

We were watching in the first week of May to see if resistance near $8.20 would hold, which would have created a bearish double-top pattern, foreshadowing a period of consolidation. Obviously, resistance at $8.20 was tepid. With the front-month easily cracking that resistance point, significant further upside potential remains a distinct possibility. Any minor bullish catalyst can send the June contract hurtling higher.

The modest production dip and short-term weather forecast shift sparking a 10%-plus move higher illustrates how minor fundamental catalysts can initiate significant price swings in a price-inelastic market. Natural gas is likely to remain exquisitely sensitive, with large price swings effecting little change in immediate-term physical supply/demand fundamentals. If early summer weather continues to trend hotter or supply disruptions extend deeper into May, prices may continue to barrel higher near term.

In contrast to the early April run higher, however, the rally in early May has been led from the front of the NYMEX forward curve–potentially suggestive of narrowing upside unless winter contracts can move higher. While the June contract has soared by more than $1/MMBtu to begin May, a smaller move in the winter contracts may indicate that bullish momentum may wane soon. By contrast, the enduring early April rally higher repeatedly was led by the late summer and winter contracts, indicating sustained momentum higher.

The most recent price action is typical with the largest magnitude price moves at the front of the strip. Still, the shift in trading dynamics from last month may be an early sign of a lack of long-term bullish conviction.

Seasonal Outlook

We maintain a low-conviction projection for near-term weakness set against medium- to long-term strength. Fundamentally, fading near-term weather-driven demand, a likely recovery in supply and a potential inflection point in storage deficits all may support postponing further upside for now. However, any effects of near-term weakness will be muted by the June contract breaking through resistance to above $8.40 on May 4. It is increasingly clear that the balance of price risks over the medium- to long-term outlook remain higher as upside price risks outweigh downside potential on a seasonal basis.

Weekly weather-driven demand for natural gas was expected to slump by 3.6 Bcf/d in the second week of May as heating demand faded. Notwithstanding the brief heat wave in Texas, weather-driven gas demand is expected to slide lower week-over-week as late-season overnight space heating demand cascades lower into mid-May, opening the door to repeated triple-digit weekly injections.

Still, the warming weather outlook has stirred bullish animal spirits, even though the fundamental outlook is little changed as early-season heat is fully offset by fading late-season heating demand. If Dallas hits 97 degrees Fahrenheit before May is halfway through, it will raise questions about what mid-summer may bring. Traders will continue to jump on any early signs of the summer ahead–and a similar weather shift, even if less consequential to the storage trajectory–is likely to similarly drive NYMEX futures sharply higher.

Dry gas production struggled as April turned to May. A slow recovery from late-winter freeze-offs in the northern Rockies; pipeline maintenance in Appalachia, the South Central, and Gulf of Mexico; and intramonth pipeline nomination patterns exhibiting phantom first-of-month declines all contributed to recent declines. Although we expect production to swiftly recover into mid-May, any lingering declines contribute to a constructive backdrop for NYMEX futures.

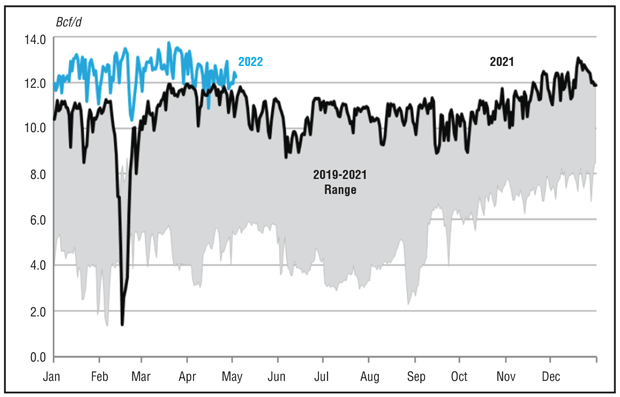

Feed gas to liquified natural gas terminals has remained seasonally weak, but rising activity at Calcasieu Pass continues to lift potential demand. LNG feed gas nationally has hovered in the low-12 Bcf/d range amid weakness at Cameron and Freeport (Figure 2). Still, Calcasieu Pass continues to commission new blocks and expand total LNG capacity ahead of schedule, lifting total potential LNG demand along the Gulf Coast.

Taking the individual daily record intake demand at each individual LNG facility now totals a startling 14.6 Bcf/d–2.2 Bcf/d-2.4 Bcf/d above current levels. We do not expect the market to reach this level before the fall, but upside LNG demand potential remains greater than widely recognized.

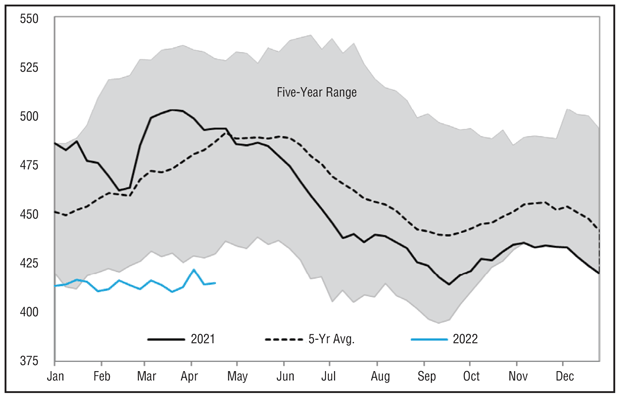

Lingering regional storage deficits should begin to recede, with the storage deficit versus the five-year average declining as much as 90 Bcf by the end of May. Projections for receding deficits have been postponed repeatedly amid late-winter cold and most recently production woes, spotlighting the margin of error surrounding even near-term forecasts. Still, evidence of easing deficits may help sap some of the bullish momentum for NYMEX futures.

Some forecasts were calling for cooler temperatures through May in the Upper Midwest and waning warm anomalies across Texas and the South. The outcome may prove critical at a key inflection point for natural gas, with the most-likely scenario suggesting further consolidation, but the risk of hotter temperatures posing increased odds for another price breakout higher.

Increasingly Weather-Sensitive

The balance of price risks continues to point higher for NYMEX futures once the July contract assumes the front-month role and the storage trajectory comes into clearer focus. Although deficits may recede during May, the market will become increasingly weather-sensitive as summer progresses and will become at the mercy of Mother Nature. Natural gas storage inventories could still be more than 225 Bcf below the five-year average in early June with rapidly dwindling time (and capability) to make up deficits in the refill season. If a hot summer ensues, recent activity from a comparatively minor and brief early May heat wave in Texas may provide indications of likely market reaction. The possibility exists for double-digit NYMEX pricing by late summer.

On May 4, the July contract closed near $8.50/MMBtu, higher not only than the June front-month contract, but also above both the November 2022 and February 2023 contracts. The inverted curve may present an interesting set of market incentives for marketers. Salt storage operators are likely to withdraw supplies to capture higher prices in mid-summer as they do each year, but the relatively small summer/winter spreads may not incentivize sufficient market-driven injections by late summer.

We continue to emphasize that natural gas fundamentals are relatively inelastic with respect to price–at least in the short term–and significant price swings are possible from comparatively minor fundamental stimuli. Tremendous price volatility is likely to result from minor fundamentals shifts. Price risks remain high in both directions. If production swells higher faster than expected, for example, the projected storage trajectory may rise and winter storage adequacy fears will abate, enabling prices to return back to the $4-5/MMBtu range. More likely, however, is that tremendous upside price risks for winter 2022-23 begin to be more fully priced in to the NYMEX forward curve, carrying near-term contracts higher.

Key Appalachian natural gas producers have reaffirmed prior commitments to capital discipline and maintenance production in recent earnings calls, leaving projected production trends falling short of the supply growth needed to balance the market ahead of next winter. In addition, the embattled 2.0 Bcf/d Mountain Valley Pipeline has postponed its in-service date to the second half of 2023–slashing bearish hopes for an early startup that can help alleviate supply woes.

ExxonMobil, Chevron and several independents continue to accelerate investments in the Permian Basin, leading to an increase in associated gas. But these gains are likely to prove insufficient to meaningfully change the long-term narrative by mid-to-late summer.

Potential Supply Shortage

Instead, with the end-of-season storage trajectory draws coming into clearer focus as the injection season wears on, a lack of sufficient production growth may amplify market fears of a potential supply shortage next winter, sending prices another leg higher to fresh highs.

The principal fundamental factors underlying the monster early April rally and a secondary rally in early May-a storage trajectory too low for market comfort and few levers to pull to quickly correct higher-remain intact. However, early projections suggest that the May monthly injection may total close to 500 Bcf, potentially reaching the largest cumulative May injection on record. For this outlook to come to fruition, however, production may have to rebound from early-month woes, LNG feed gas demand may need to remain weak amid continued maintenance, and weather-driven demand may need to remain bereft of extreme temperatures. In other words, record May injection is far from a lock.

The most likely scenario, suggests that a significant May injection may total 75-90 Bcf larger than the five-year average and soften the extent of recent bullish momentum. That would narrow storage deficits in the near term, but it would be a mistake to extend any near-term softness-should it materialize-into the summer. In a world without supply constraints, the market will probably enter next winter with closer to 3.8 Tcf or more in storage. The 350 Bcf difference implies that the current fundamental outlook is at least 2.0 Bcf/d tighter than the market ideally wants. Any early summer bullish catalysts could enable the forward curve to press higher.

In the medium term, power sector demand may soar on surging loads and coal supply concerns, LNG feed gas is likely to rebound, and production may remain slow to move higher. The long-term storage trajectory remains unacceptably low, and until it corrects, the balance of long-term price risks for NYMEX futures remains elevated. With NYMEX front-month prices already eclipsing 14-year highs in April and May, further upside price risks remain likely ahead of the start of next winter’s heating season.

Crude Oil Outlook

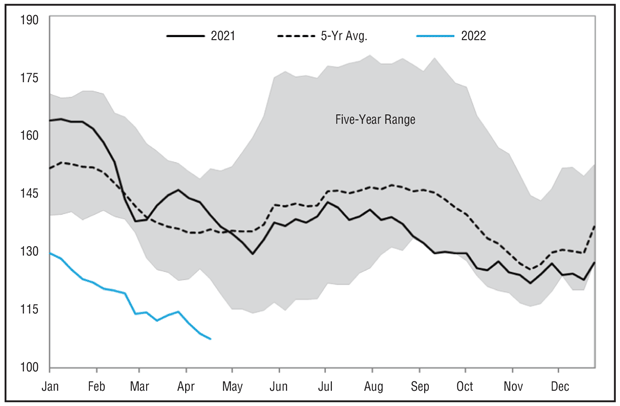

Paralleling the U.S. gas market, upside price risks driven by inventory shortages across both crude and finished products far outweigh the potential for a downside correction moving through the summer months (Figure 3). While total U.S. distillate inventories remain well below five-year minimum levels (Figure 4), global shortages are even more acute as Russian distillate supplies are restricted.

In the United States, Cushing inventories remain in danger of steep declines that can prompt “tank bottom” fears and renewed risks of price spikes.

Russian supplies may wither as sanctions and embargos begin to bite. While Asian buyers continue to pick up Russian barrels at a discount, supply contracts rolling off from Western companies are unlikely to be renewed and Russian output continues to trend lower. By mid- to late summer, declining Russian production may become even more evident, helping further ratchet tight market fundamentals and support the bullish outlook.

At the same time, the market will begin to look ahead to the end of Strategic Petroleum Reserve releases this fall. The Biden administration is aiming to release 1 MMbbl/d for six months, with another 60 million barrels from other countries, which is helping paper over massive near-term shortages. The question remains, however: What will happen when the SPR releases wind down? As the market increasingly looks beyond the current SPR supplies by mid-summer, returning upward pressure on global oil markets remains likely.

Eli Z. Rubin is a senior energy analyst at EBW Analytics Group, which conducts energy market research and analysis. An expert in econometrics, statistics, microeconomics and energy-related public policy, Rubin is instrumental in designing the algorithms used in the company’s models, and in assessing potential discrepancies between theoretical and practical market effects of models and historical results. He holds a B.A. in economics, environmental studies and Middle Eastern studies from the University of California, Los Angeles.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.