Uncertainties Aside, Bullish Market Sentiment Underpins 2022 Forecasts

Prices for both crude oil and natural gas ended 2021 much stronger than they started it; industry employment expanded; activity indicators ticked slowly but steadily upward; and energy emerged as the S&P 500’s best-performing sector. Nevertheless, although many considerations, variables and experts point toward the possibility of an exciting new year in the sunny uplands of prosperity, there seems to be no shortage of more sobering factors and voices. So what else is new?

And yet, the industry’s relatively restrained response to healthier commodity prices suggests something new under the sun. That is because Wall Street’s preference that companies emphasize free cash flow over production growth has further scrambled the equation. This time around, rig counts have not merely lagged price behavior, but seemingly ignored it to an extent that jostles the conventional wisdom.

Higher prices have always meant higher rig counts, and 2021 certainly saw a drilling activity response, although muted by historic standards. Where rig counts go from here obviously depends in large part on the direction of commodity prices. Predicting future prices is always an exercise in imprecision, but with so many wildcards in play as the year begins, it seems fair to say that the crystal ball may be bit harder to read than in year’s past.

However, there is at least one certainty that can be counted on no matter what: depletion. It is the one iron-clad rule in a business in which little else about the future can be guaranteed. The U.S. rig count is up nearly 70% year-over year, according to Baker Hughes. But with DUC inventories diminished, analysts say sustained higher rig counts have become a matter of necessity.

“Rig activity across the five largest U.S. oil plays would need to increase by about 36 weekly through year-end to reach a sustainable plateau to hold current oil volumes in 2022,” analysts at Mizuho Bank said in December, underscoring the fact that depletion never rests.

A New Game Plan

Independents have spent the past two years restructuring, cutting costs, slashing debt, rationalizing assets and otherwise fortifying their balance sheets. As the new year progresses, depletion may go a long way toward determining the degree to which these same companies will ramp development drilling and even dust off postponed tests of step outs and new field prospects.

Beyond that, there are also what some call the “unknown unknowns.” Decades ago, British Prime Minister Harold Macmillan responded to a question about the most influential factor facing his administration by identifying “Events, dear boy, events.”

As usual, events far beyond the control of independent operators–whether working tight oil in West Texas or Marcellus dry gas in West Virginia–will prove pivotal. Anything from a possible Russian invasion of Ukraine, a new U.S.-Iran nuclear deal, and the waxing or waning of the Covid-19 pandemic likely will figure heavily into the direction America’s oil and natural gas producers take in 2022.

The Path For Crude Oil

Oil and gas companies hoping for a year of stronger prices certainly can take solace from the fact that the contingent of bullish voices in the choir seems much louder than a year ago, when West Texas Intermediate was trading some $25 a barrel lower at the Cushing, Ok., hub.

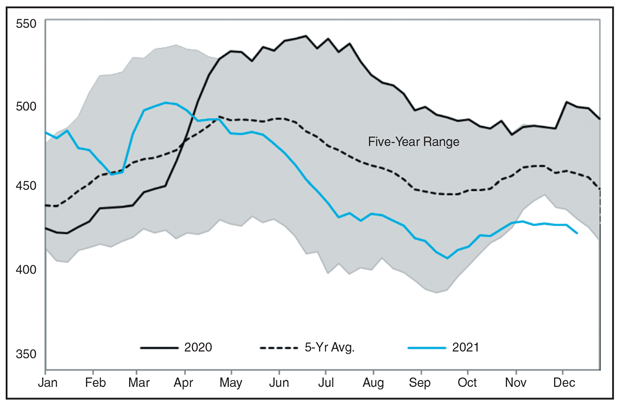

Eli Rubin is a senior energy analyst at EBW Analytics Group. He notes that the oil market has continued to withstand bearish pressures as the omicron variant has spread rapidly across the globe, suggesting a resilient market resting on firm underlying fundamentals, including historically low oil inventory levels (Figure 1).

U.S. crude, gasoline and distillate inventories were a combined 59.7 million barrels below the five-year average the week before Christmas. “Although coronavirus headlines have taken over the news cycle, recent crude data has been robust,” Rubin comments. “The 4.6 million barrel draw for the week ending Dec. 17 was the largest in three months, despite a 2.0 MMbbl barrel Strategic Petroleum Reserve release. Strength in crude exports undergirded the fundamental tightness, with 3.6 MMbbl/d of exports the largest since early July.”

The market followed up with withdrawals across the board in both crude oil and product inventories the week leading up to Christmas. The U.S. Energy Information Administration reported another healthy 3.6 MMbbl draw, along with declines in gasoline, distillate and propane/propylene inventories. In all, total commercial petroleum inventories decreased by 18.9 MMbbl for the week of Dec. 24, with crude oil and product stocks all well below their seasonal five-year averages.

Furthermore, with European and Asian natural gas prices trading 10 times higher than Gulf Coast prices and repeatedly setting new record highs, U.S. refineries are the beneficiaries of cheaper feedstock that may increase run rates and physical demand for U.S. crude exports, Rubin explains.

The million-dollar question, of course, is the impact of the omicron variant, but the underlying severity of the disease remains a huge wildcard, according to Rubin. “The storm clouds are gathering for a significant surge in the highly transmissible variant nationwide. The critical unknown, however, remains the possibility that omicron is far less severe than prior coronavirus variants,” he offers. “Given the contagiousness of omicron, case counts may peak within the next month as the variant races through the population. But from a crude demand perspective, even if near-term demand weakens as a result of omicron, it appears possible that lost demand could rebound rapidly by the latter half of winter.”

As the omicron cloud lifts, a burst of optimism would help support WTI prices, he goes on. “By late spring, with the seasonal peak of the coronavirus in the rearview mirror and recent SPR releases already absorbed by the market, oil may move sharply higher.” Rubin says.

While acknowledging that elevated inventories and rising supplies from the Organization of Petroleum Exporting Countries plus Russia during the next three months may dampen bullish sentiment at the start of 2022, it likely will not persist for long. “A renewed global economic rebound, firm supply/demand fundamentals, and a crude market that has absorbed a new coronavirus variant, an ill-timed SPR release, and steadily rising OPEC+ production will likely be poised to turn significantly higher into summer and the back half of 2022.”

Oil Price Projections

How high could prices conceivably go under the right circumstances? Late 2021 saw a pair of major U.S. investment banks predict that oil prices could top triple digits in the near term. First, in the final days of November–right as news of the Covid-19 Omicron variant sent the stock and commodity markets into a tailspin–media reports noted that J.P. Morgan analysts nevertheless were insisting that crude could hit $125/bbl in 2022 and $150/bbl in 2023.

Published reports cited the firm’s contention that OPEC+ “has returned to a position of positive leverage, which it will defend by keeping inventories low, the market in balance and taking action to support optimal reservoir management through paced volume growth.”

According to press accounts, JP Morgan analysts also warned that their estimates showed that OPEC+’s spare production capacity was not a widely presumed 4.8 MMbbl/d, but probably a much more modest 2.0 MMbbl/d. The analysts also expressed doubt the coalition would fully make good on promised output increases.

“They don’t have the barrels. It’s a mirage,” Christyan Malek, head of the firm’s EMEA oil and gas research is quoted. “Look back at history. When we’re in a scenario where the market goes, ‘Oh (shoot), we don’t have spare capacity,’ that’s where you see overshoots.”

A few weeks later, experts at Goldman Sachs said they could see realistic scenarios that would push global crude above $100 in 2022. During a Dec. 17 media briefing that noted global crude demand had reached new heights before Omicron surfaced, Damien Courvalin, Goldman Sachs’ head of energy research, suggested that trend would continue in 2022 and ’23.

“We will have to wait for this wave to pass, but international travel should recover further next year,” Courvalin is quoted. “You see how we will average a new record high in demand in 2022, and again in 2023.”

Media reports note the firm predicts Brent prices will average $85/bbl in 2022, with a possibility they could go as high as $110 under scenarios reflecting oil field inflation and flagging supply. “There’s inflation everywhere in the economy, and eventually there is inflation in oil services,” Courvalin reportedly assessed, deeming it “quite conceivable” that the appetite for oil in a soaring, post-pandemic world economy could exceed supply.

Ultimately, he told reporters, “There’s insufficient supply in the face of strong demand. Oil prices have to be higher to overcome the higher cost of capital to fund projects.”

Although geopolitical unknowns always have the potential to send crude prices soaring, several bearish factors could come into play in 2022. Along with scenarios in which the pandemic continues to cast a long shadow on the world economy, or a new U.S.-Iran nuclear deal adds new production to global supplies, press accounts point to a possible renewed trade war between the United States and China, a stronger dollar, and rising inflationary pressures as variables that could potentially pressure crude prices to the downside.

All things considered, Raymond James & Associates points toward relative market equilibrium during the next couple years.

“After a sizable inventory draw in 2021, we forecast an approximately balanced market in both 2022 and 2023,” the firm says in a Jan. 3 report. “We forecast WTI averaging $75/bbl and ending 2022 at $80 (in contrast to the backwardated futures strip), followed by an average of $80 in 2023, with Brent at a modest premium.”

Meanwhile, a Reuters report indicates that an internal OPEC+ document expects a supply surplus of 2 MMbbl/d in January, 3.4 MMbbl/d in February and 3.8 MMbbl/d in March.

The U.S. Energy Information Administration seems to expect 2022 to look much like 2021, stating in the Short-Term Energy Outlook released on Dec. 7 that it projects Brent prices to average $73 in the first quarter of 2022 and $70 for the full year.

“We revised down our forecast of consumption of petroleum and liquid fuels for 4Q21 and 1Q22, partly as a result of recently announced travel restrictions following reported outbreaks of the omicron variant,” EIA says. “The potential effects of the spread of this variant are uncertain, which introduces downside risks to the global oil consumption forecast, particularly for jet fuel.”

That same report, however, observes that the main driver of increased 2021 crude oil prices was the steady draw on global inventories, which the agency says averaged 1.4 million barrels per day throughout the first three quarters of 2021.

All About The Weather

Like anyone hoping to fly a kite, spend a day at the beach or go skiing, those watching natural gas prices repeatedly emphasize that so much depends on the weather. If temperatures during the rest of the winter remain mild, U.S. natural gas prices may lose some of the strength they have shown during parts of 2021. By contrast, a week or so of unusually frigid temperatures, such as those that hit middle-America during mid-February 2021, could serve as a reminder of how much gas the country can burn in a short period.

A Nov. 22 analysis by J.P. Morgan Research emphasizes this point, noting that U.S. gas demand can surge 50 billion-70 billion cubic feet, if not more, during a typical winter week. “The current situation is so stressed that finding even 1 Bcf of additional supply is becoming increasingly difficult,” the firm warned on Nov. 22.

Although J.P. Morgan Head of Global Natural Gas and Natural Gas Liquids Strategy Shikha Chaturvedi says U.S. temperatures are an important factor, he notes that unusually cold temperatures in other parts of the world, including Europe or Asia, can throw the global gas market off balance.

“Watch Russia’s weather,” Chaturvedi advises. “This is an important risk factor to highlight because winter weather in key producing regions (such as Russia and the United States) will be an important driver in price formation for the global gas market. Russia already has warned that it will prioritize its domestic needs over exports, and the United States potentially could attempt to price higher to close the wide-open LNG export arbitrage should its balance tighten further.”

S&P Global Platts also sees events abroad influencing U.S. natural gas prices. “Russia is the primary source of the world’s spare capacity, and delivering that supply to markets eager to meet demand and rebuild storage will dominate balances and prices in 2022,” the firm assesses. “The delayed Nord Stream 2 pipeline is essential to boosting Russian gas supply into Europe as Russia is shifting away from Ukraine transit and electronic sales platform sales.

“Despite the fact that Europe is desperate for gas supply, regulators appear to be in no rush to sign off on Nord Stream 2,” the firm continues. “While S&P Global Platts Analytics expects the pipeline will begin operations in June, further delays would cause European buyers to scramble for alternative gas supply, boosting not only European gas prices, but global LNG prices. Even U.S. prices would get an uplift from this, as U.S. LNG exports will ramp up further in 2022.”

EIA also acknowledges LNG exports’ importance, noting that just as November’s unseasonably warm temperatures stole some of U.S. natural gas prices’ October momentum, U.S. liquified natural gas exports mitigated the downward pressure. But much as it did with oil, EIA offers a restrained forecast for natural gas prices.

“The Henry Hub spot price averages $4.58 an MMBtu from December 2021 through February 2022 in our forecast and then generally declines through 2022, averaging $3.98/MMBtu in 2022 amid rising U.S. natural gas production and slowing growth in LNG exports,” EIA says. “We forecast the U.S. inventory draws will be similar to the five-year average this winter, and we expect that factor, along with rising U.S. natural gas exports and relatively flat production through March, will keep U.S. natural gas prices near recent levels before downward price pressures emerge.”

Noting that winter temperatures and seasonal demand can be unpredictable, EIA says it expects prices will remain volatile over the coming months.

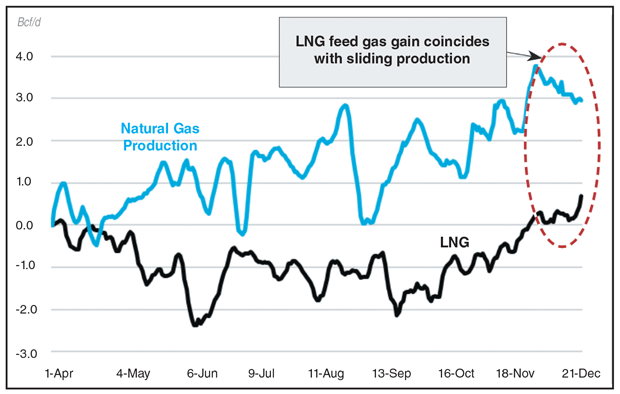

EBW Analytics Group’s Rubin agrees that the market will likely continue to experience some degree of volatility, but says the unusually warm start to winter and increased dry gas output in the United States has overridden the strong upward price pressure points in place at the start of winter and effectively redirected U.S. market dynamics to the downside despite historic global natural gas prices and record LNG export volumes (Figure 2).

FIGURE 2

U.S. Dry Gas Production versus LNG Feed Gas Demand (Bcf/d)

Source: EBW Analytics, Bloomberg

“As weather-driven demand approaches its climatological peak in late January, winter weather remains king. Extreme disruptions are always possible and can occur with only relatively limited warning,” he relates, reminding that as of Christmas, the domestic market had not yet been tested with significant cold weather. “The first notable cold outbreak in January could provide a significant demand boost and lift NYMEX futures.”

However, Rubin says, “the accumulated bearish effects from tremendously mild weather from October through December buoyed the most-likely storage trajectory and slashed winter risks. In our view, absent extreme weather, this weakness is likely to begin to play out in January as the March contract assumes the front-month role and carries natural gas pricing downward toward the low-to mid-$3.00/MMBtu range.”

Meanwhile, Raymond James predicts a relatively strong year for U.S. prices. “For U.S. natural gas, muted supply growth translates into continuation of lofty prices by the standards of the past decade, with 2022 averaging $4.00/Mcf (5% above the strip),” the firm says.

Activity And Investment

On the question of whether U.S. upstream oil and gas spending will generally climb, fall or plateau in 2022, many voices seem more confident that the pace will pick up compared with last year. Analysts such as Rystad Energy, Evercore ISI and Fitch Ratings all sing in harmony about a busier year for U.S. producers.

U.S. shale expenditure is projected to surge 19.4% in 2022, leaping from an expected $69.8 billion in 2021 to $83.4 billion, the highest level since the onset of the Covid-19 pandemic and signaling the industry’s emergence from a prolonged period of uncertainty and volatility, maintains a December report from Rystad.

The analysis acknowledges that most U.S. companies may hesitate to increase their investments amid pandemic-related concerns, but predicts U.S. land players still will loosen their purse strings. “Of the expected year-on-year increase, service price inflation alone is set to add $9.2 billion, with increased activity chipping in $8.6 billion,” Rystad calculates. “These increases will be partially offset by $4.2 billion in savings from efficiency gains. Efficiency gains are expected to be driven predominantly by further adoption of simulfracs.”

Artem Abramov, head of shale research at Rystad Energy, says even publicly-traded companies should ramp up activity this year. “Oil and gas activity and upstream spending in U.S. land has been exposed to significant volatility in the last two years,” he acknowledges. “Aggressive strategies from private operators in the U.S. shale patch have driven spending (in 2021), but we anticipate significant growth in 2022 from public and private operators alike.”

Rystad credits private companies’ uptick in exploration, drilling and production activity with increasing total U.S. shale capital expenditures by 16% in 2021 over 2020 levels. The firm says the Permian, Haynesville and Niobrara have seen the most vigorous activity growth in 2021, while growth has been more muted in Appalachia and the Eagle Ford.

“Looking ahead to 2022, the Eagle Ford, Niobrara and Anadarko regions are anticipated to beat nationwide average spending growth due to the rig activity expansion observed in recent months, which provides some momentum to the increase in the running rate of frac activity in 2022,” Rystad estimates. “The Bakken is forecast to have 19% spending growth next year, matching the national average growth rate, while the Permian is set to grow by 17%, slightly less than the national average as other basins are catching up. On the gas side, we anticipate a 15% increase in spending from Appalachia and an around 10% increase in the Haynesville.”

Meanwhile, press accounts note that analysts at Evercore ISI think U.S. upstream investment could grow even more, with the firm suggesting a 23.5% year-over-year growth, led by private companies which it foresees as increasing capital expenditures by 42%.

Like Rystad, Evercore ISI thinks some of that spending growth will manifest in higher service and supply costs, including costs related to cutting greenhouse gas emissions. “Operators are beginning to increase exploration budgets and expect service pricing to broadly increase, led by labor, tubulars and transportation, but also fracturing/stimulation, drilling and other services,” the firm is quoted. “While exploration and production companies remain hesitant to test and adopt new technologies, they are increasingly willing to switch and pay up for services or technologies that lower carbon emissions.”

In its look ahead, Fitch Ratings warns that the pandemic could contribute to market volatility, but suggests near-term U.S. oil production will continue recovering in 2022, though probably not to levels recorded shortly before the pandemic.

“The number of active oil drilling rigs in the United States has been increasing since September 2020, but remains around 30% lower than in early 2020,” the firm observes. “We believe the responsiveness of U.S. shale producers to oil prices has declined as they are now more focused on free cash flow generation, debt reduction and shareholder distributions, rather than investments in production growth.”

That may leave producers feeling the pinch this year, the firm estimates, but on the other hand, press accounts note that analysts at Bank of America predict the United States’ comparably low-cost energy supplies in an era of possibly surging global prices will give the country a significant leg up on the rest of the world.

“U.S. energy dominance will be in the hydrocarbon sphere,” Bank of America Managing Director of Global Commodities Research Francisco Blanch was quoted in a December presentation. “The United States should have a good run in the 2020s and perhaps the 2030s.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.