Independents International

Independents Transforming U.S. Resource Play Expertise Into International Success

By Robert “Bob” Fryklund

HOUSTON–The development of onshore unconventional resources has shifted the trend lines on future U.S. natural gas supply projections and has dramatically changed the game in domestic exploration, drilling and production. Independent companies have led the charge into the unconventional oil and gas frontier in North America, and the skill sets they have acquired position them to be strong players in international resource play opportunities.

Multinational supermajors and national oil companies are looking to U.S. independent operators like never before to leverage technological expertise and “best practices” developed through years of experimentation in lower-48 unconventional plays. Independents with large acreage positions in North American shale gas plays and successful track records in developing those resources are in demand–for their corporate knowledge as much as their assets.

Industry headlines have been full of announcements of partnerships between leading U.S. unconventional gas players and supermajors, including:

- Chesapeake Energy’s joint ventures in the Marcellus Shale with Norway-based Statoil, as well as in the Barnett Shale with France’s Total;

- Quicksilver Resources’ strategic alliance in the Barnett with Italy’s Eni;

- EXCO Resources’ alliance in the Haynesville Shale with U.K.-based BG Group;

- Total’s acquisition of a 50 percent share in American Shale Oil, which has a 10-year lease on 160 acres of federal land in the oil shale-rich Green River Formation in western Colorado; and

- Anadarko Petroleum’s joint venture in the Marcellus with an affiliate of the Mitsui Group, a Japanese corporate conglomerate.

But not only are multinationals entering North American onshore shale gas plays, but U.S. independents with technical proficiencies in unconventional gas are beginning to make news internationally as they undertake joint ventures focused on emerging resource plays around the globe.

Dominant Exploration Force

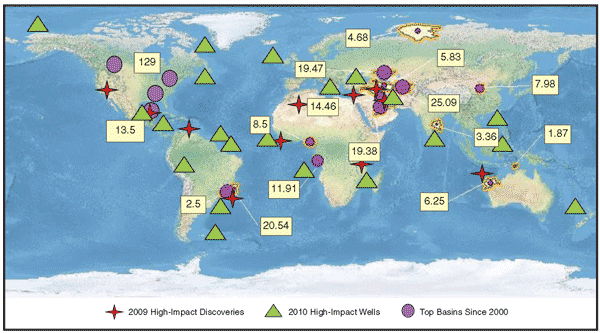

Although national oil companies have increased their risk tolerance, independents continue to be a dominant force internationally in exploration, in large part because of their willingness to take on risk. A review of the top basins over the past 10 years and projections for 2010 bear this out (Figure 1). Top basins can be grouped as deep water, thrust belts and rift basins.

Deep water continues to be the leading producer. As a result of the capital requirements and time schedules for bringing discoveries to production, Brazil’s Petrobras and the majors continue to dominate global deepwater activity. With total project costs typically between $5 billion and $10 billion, independents involved in deep water tend to be explorationists who sell their interest positions when discoveries move to the development stage.

Basins in thrust belts are producing in Latin America, Iran, Iraq and Papua New Guinea, while rift basins are concentrated on the African continent. A rank order of basins shows Turkmenistan on top, followed by presalt deepwater Brazil, the Caspian, Iran and Iraq, and the Gulf of Mexico. Independents have focused on the transform margin from Africa to Brazil and in regions such as the Falklands and Southeast Asia.

Classifying basins according to risk illustrates why independents continue to play a leading role in terms of making discoveries. To minimize risk exposure, supermajors tend to focus exploration on either well established petroleum systems, or areas with some elements of a hydrocarbon system but that are incomplete and unlikely to yield more than 10,000 barrels a day. Independents, on the other hand, are more willing to pursue higher-risk/higher-reward exploration prospects in areas with no established production that lack the complete elements of a hydrocarbon system.

Recent examples include Anadarko’s deepwater Venus and Windjammer discoveries in frontier basins offshore Sierra Leone and Mozambique, respectively; Noble Energy’s ongoing exploration success in the Komar Basin offshore Israel; and Heritage Oil’s Kingfisher discovery in Uganda.

Looking at projections through the rest of this year, a mixture of independents, supermajors and national oil companies are expected to drill “high-impact” wells that represent a new play or basin, or have a prospect size of 100 million barrels of oil equivalent or larger. Eastern Canada, Greenland, Falklands and East Africa are among the international areas where independents are expected to make high-impact discoveries in 2010.

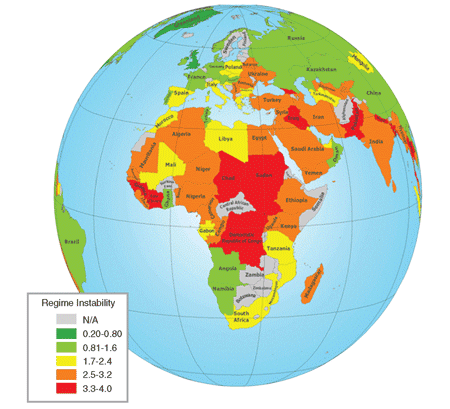

Of course, geological formations rarely respect national borders, and territorial disputes remain an issue in some regions. The most bothersome disputes are in the Falklands, Colombia/Venezuela, Caribbean, offshore Southeast Asia (between China, Cambodia and Malaysia) and the Arctic. Figure 2 shows a sampling of the political instability risk ratings for nations in Africa and the Middle East. But it should be noted that not every discovery has to be located in complicated, hostile environments or countries with high political risk. Major discoveries have been made, for example, offshore the East Coast of Africa, Brazil, Ghana and Australia.

Unconventional Potential

Not surprisingly, based on the North American experience, the hydrocarbon potential of unconventional reservoirs could dwarf conventional oil and gas deposits around the world. What was unconventional has become conventional in North America, and the focus is increasingly shifting to transferring resource play knowledge to other parts of the world to repeat that success on a global scale.

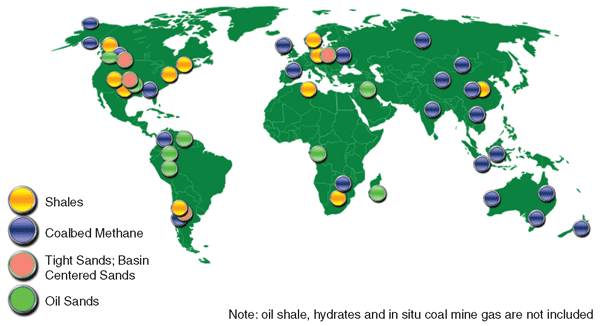

Figure 3 shows worldwide locations of gas shale, oil shale, coalbed methane and tight sands prospective areas. From a geologic perspective, it appears the United States and Canada are unique with respect to their concentrations of resource plays. The paleogeographic history and stratigraphic age of the North American continent mean CBM, tight gas sands, and oil and gas shales co-exist in relative close proximity to one another. In most regions around the world, one type or another is found. For example, while coalbed methane is prevalent in Australia, shale is a dominant geologic feature in Latin America. Only Europe and perhaps South Africa so far have the potential for two types–CBM and shale–close to each other.

The sheer potential of resource plays is staggering; the gas equivalent of the estimated reserves in North American resource plays is greater than all the oil deposits in Saudi Arabia! The estimated ultimate recovery in lower-48 natural gas resource plays is on the order of 1,800 trillion cubic feet, while the global ultimate recovery is 600 Tcf-700 Tcf. How much of these reserves can be recovered and at what cost remain the million-dollar questions, however.

Although independents pioneered resource plays in North America, the supermajors have been fast followers, spending $60 billion in these plays during the past two years alone. Supermajors are partnering with independents to get a piece of the action in North American plays as well as gain operational expertise applicable to international unconventional resource plays. In return, independents are receiving substantial capital commitments to develop their North American projects while gaining access to some of those international projects.

For example, the strategic alliance Chesapeake formed with Statoil in 2008 includes joint exploration in the Marcellus Shale as well as the Karoo Basin in Australia. Statoil acquired a 32.5 percent interest in Chesapeake’s Marcellus acreage covering 32,000 leases in Pennsylvania, West Virginia, New York and Ohio. Statoil receives 2.5 billion-3.0 billion barrels of oil equivalent under the deal, and the program is expected to support as many as 50 rigs drilling some 15,000 horizontal wells over the next 20 years.

Like all of the partnership agreements between independents and supermajors in unconventional plays, it is important to note that the Chesapeake-Statoil alliance in the Marcellus Shale includes technology exchange, particularly the transfer of drilling, completion and geophysics technologies.

Spreading Around Globe

Interest and activity in resource plays has spread rapidly around the globe, driven by high initial flow rates and the repeatability of drilling results. In a typical international project focused on conventional geology, the cost can easily exceed $100 million by the time a block is purchased, seismic is shot and the first well is drilled. While the costs to evaluate unconventional reservoirs are roughly equivalent, the advantage is in the “manufacturing mode” of unconventional field development, which allows operators to quickly scale from pilot drilling to full production of hundreds or thousands of wells while continuously reducing costs and increasing well performance over time.

On continental Europe, supermajors have made a strategic move into resource plays after realizing that a key to success is getting into a play early and locking up an acreage position. The primary objective is gas shales, and if the formations being examined hold significant recoverable reserves, it would obviously be a major development in a European natural gas market dominated by Russia’s Gazprom, the world’s largest gas producer and the supplier of a large percentage of the gas consumed by European Union member countries.

The ability to export liquefied natural gas from Queensland has opened resource plays in Australia, where the main source of unconventional gas is coalbed methane. Independents discovered Australia’s CBM fields, but the supermajors now have joined the effort. In Asia, China’s national oil company (CNPC) has led the development of resource plays, with companies such as Total, BP, ConocoPhillips, Shell and Chevron now partnering with NOCs in the Asia-Pacific region.

In other parts of the world, unconventional oil and gas development is in the nascent stage. In Argentina, for instance, majors and independents are involved in emerging tight sands, coalbed methane and shale opportunities under the direction of state oil company, YPF. In Colombia, CBM is the main resource play, while oil sands are well established in Canada and Venezuela, Peru, Colombia and Ecuador, with smaller opportunities in Iraq, the Congo and Madagascar. In South Africa, independents and super majors alike, including Colorado-based Falcon Oil & Gas and Shell, are engaged in both CBM and shale projects.

Falcon is a good example of an independent that has made international resource plays its core business strategy. The company focuses on large unconventional resource deposits, establishes an acreage position, conducts the science to prove a play concept, and then markets projects to joint venture partners. In addition to South Africa’s Karoo Basin, Falcon is active in Australia’s Beetaloo Basin and in the Mako Trough in Hungary.

International Entrance

Financing changed significantly for independents–particularly startups–over the past few years. Before the global economic downturn hit in 2008, the NOCs had become very aggressive, both within their home countries and outside of them. It largely remains to be seen how capital constraints will impact access to acreage or an independent’s ability to enter into a new international market. Certainly for 2010, those companies with financial muscle will have a competitive advantage.

Driven by factors such as the financial markets, the opening of new play types and regions (including resource plays), and technology advances, entry strategies and tactics have broadened. New entrants into plays can be classified in two categories: early entrant or fast follower. In the past, companies attempted to become “basin masters” to gain scale and drive profit. The scale has changed to continent master. China’s NOC is an example of a continent master because of its presence throughout Asia and Africa. Its new focus is on Latin America.

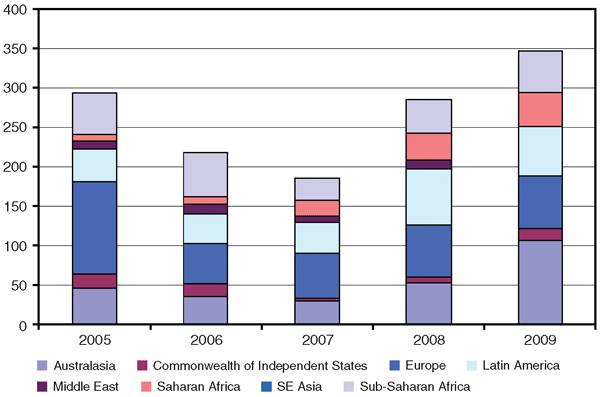

Longstanding and familiar entry tactics include participating in bid rounds, swaps, alliances, mergers/acquisitions, farm outs and direct negotiations. Of these, farm outs have seen a big uptick in activity as financial markets have tightened and countries and NOCs have reworked terms to boost activity levels (Figure 4). Limited-length licenses may be forcing “drill-or-drop” decisions, and normal portfolio management may dictate a need to farm out acreage in order to mitigate risk while retaining an interest on any potential upside.

In addition to the United States, top countries in the various regions of the world for international farm out opportunities are Indonesia in Southeast Asia, Colombia in Latin America, the United Kingdom in Europe, and Tunisia and Egypt in North Africa.

As discoveries have opened opportunities in new countries, direct government involvement has increased. Local communities experience major structural changes and growing pains as they figure out how to go forward, who manages the relationships, and how they get their slices of the pie. This phenomenon is prevalent in Ghana, Sierra Leone, Uganda, Israel and Mozambique.

Some governments have adopted proactive hydrocarbon policies, often in attempts to reverse declining production. Colombia has a very aggressive, but fair program (administered by ANH in concert with national oil company, Ecopetrol) that has resulted in significant growth. Canada-based Pacific Rubiales, for example, has grown its Colombian production from 6,000 to 120,000 barrels a day, ranking it as the nation’s largest independent producer. This is a policy model that other countries will emulate in the future.

Other entry tactics include providing market access, rigs, creative financing, infrastructure commitments and technology. All of these tactics bring advantages to sweeten deals, such as capital, deepwater rigs or building roads, bridges, and hospitals for local communities. Independents are well positioned to offer technology in partnerships. Their experience in technical areas such as multistage hydraulic fracturing and horizontal drilling are highly sought after and the basis of many joint ventures. These technologies and their associated best practices are being leveraged in both conventional and unconventional plays.

Challenging Assumptions

Economic, political and technological changes present new opportunities for companies willing to challenge the fundamental assumptions used to judge new prospects in an increasingly unconventional world.

One approach is to simply look where hydrocarbons already exist, but may have been bypassed or overlooked completely–as is the case in many unconventional oil and gas deposits. In Colombia, Pacific Rubiales has successfully reworked an old field, and in Brazil, EnCana redrilled an old discovery to discover the Peregrino Field, estimated to hold 450 million barrels of oil equivalent.

One lesson the industry has learned time and again is that by applying technology, fields can produce much longer than originally forecasted and individual wells can recover much more oil and gas than anticipated.

Oil and gas companies are looking at deeper structures and are examining the source rocks beneath producing fields, as is the case in Argentina and the Eagle Ford Shale in South Texas. In the South Atlantic and other regions where there is no salt but plenty of source rock, operators are questioning conventional thinking on what limits production. Around the world, companies are “going deep,” sometimes testing subsurface structures all the way down to the basement.

The national oil companies clearly can be expected to join the search for resource plays, and virtually all operating companies will consider ways to improve production and recovery rates in conventional reservoirs using technologies perfected in unconventional plays, especially horizontal drilling and multistage hydraulic fracturing. Companies are increasingly focusing on technology transfer internally as well as externally as it becomes clear that the keys to unlocking resource plays also can revitalize conventional plays.

IHS has completed a comprehensive study of 30 plays and 20 subplays involving more than 1 million North American wells in shales, coalbed methane and tight sands. The study characterizes each play by performance and reveals such important statistics as the optimal number of frac stages per well, the preferred completion “cocktail,” estimated ultimate recovery factors, and quickest time to ramping to 1 Bcf a day. The study also benchmarks the learning curve. This kind of knowledge base is what the industry needs to optimize efficiency and maximize the return on investment in both conventional and resource plays.

Incidentally, the record for ramping production output to 1 Bcf/d is one year. Compare that quick uplift on the balance sheet to the multifield Independence Hub in the deepwater Eastern Gulf of Mexico–which took five years to reach that level of production–and it is not difficult to understand why the global market is following the lead of U.S. independents and going unconventional.

ROBERT “BOB” FRYKLUND is vice president of research for IHS CERA. He joined the company in July 2006 after serving as Libya president and Brazil country manager for ConocoPhillips. With more than 30 years of both international and domestic industry experience, Fryklund also has held senior leadership positions with British Borneo, Union Texas and Amerada Hess. Based in Houston, he focuses on strategic solutions for the upstream arena and advises national oil companies, independent, majors and investors. He also serves on several boards and committees within the industry, including the Independent Petroleum Association of America and the American Association of Petroleum Geologists. Fryklund holds a bachelor’s from Hamilton College and an advanced certificate in management. He also has completed advanced studies in business and geology from the University of Houston and the University of Tulsa, respectively.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.