Independents International

Realm Energy Targeting Continental Europe As Newest Shale Frontier

By James Elston

VANCOUVER, BRITISH COLUMBIA–The advent of new technology allowing oil and gas producers to recover hydrocarbon resources from shales is both well known and well developed in North America. The impact of these new oil and gas supplies has been felt throughout the markets–everything from natural gas prices to stock markets, and even in government energy polices. Outside of North America, however, unconventional oil and gas resource development is only in its infancy. The availability of new technologies to unlock resources previously not accessible is creating a wave of new interest all over the world.

Continental Europe, perhaps more than anywhere else, is coming into focus as the next frontier for developing unconventional plays. Many European countries have high-potential source rocks and there are approximately 50 basins on the continent with hydrocarbon potential. By some estimates, there is more than 700 trillion cubic feet of gas in place across these deposits on licensed acreage alone, and significant potential for oil as well. In addition to the geology, many of the right pieces are also in place both politically and economically to reward companies that drive the development of unconventional production: relatively high gas prices, existing demand, a well established pipeline infrastructure, stable political and legal environments, and the political will to see the success of unconventional projects in order to decrease reliance on foreign oil and gas imports.

All of these factors combine to create a very compelling investment environment, so the advent of an increasing number of companies turning their attention to European shale plays should come as no surprise. The reward that potentially awaits companies that are able to turn these resources into producing assets is, quite simply, huge.

As many operators have learned through experience over the past decade, each shale deposit has its own unique characteristics and challenges that must be overcome to achieve economic production. And while enabling technologies have moved forward at an incredible rate over the past decade, lessons continued to be learned with each new play. Developing shale resources in Europe is, therefore, not as simple as replicating the drilling and completion methods utilized throughout North America.

Shale Learning Process

But along with the high potential rewards that Europe presents come new risks that must be managed. With the benefit of North American experience, there are expectations from many stakeholders (governments, industry, the public and shareholders) of getting it right quickly. Shale gas development is starting in a much more advanced position because of the big head start the North American experience has provided, but companies such as Realm Energy International Corporation nevertheless expect that there will be a learning process when it comes to successfully bringing European shales into production

In addition, there are specific issues that must be addressed with certainty before European shale can be deemed a success. Some areas in Europe that are targeted for exploration are much more densely populated than, for instance, the U.S. states and Canadian provinces that are home to the Bakken Shale oil play. Properly addressing surface, environmental and drinking water safety will play a high level of importance in getting the support of the general public and ensuring development approval and sustained production over the long term.

In most European nations, oil and gas exploration and production rights are held by federal governments. These governments, in turn, grant corporations the right to conduct exploration and extraction activities through multiyear concessions. Normally, continuation of these concessions is tied to fulfilling mutually-agreed work programs, and payment of any applicable fees and taxes.

Realm Energy International was formed in 2008 with the objective of taking the technology refined in North American shale plays and extending it to enable the development of European shale deposits. As one of several independent companies with these objectives, Realm Energy came into the public eye in October 2009, when it went public on the Toronto Stock Exchange’s Venture exchange. The company now has raised $5 million (Canadian) to fund its initial work programs.

To ensure that the highest level of technical evaluation is applied, Realm Energy has engaged Halliburton to assist with its initiatives. Halliburton’s extensive experience in all aspects of exploring and completing shale projects in the United States and Canada adds another dimension to the background work being conducted. Realm Energy has been collaborating with Halliburton since 2009, which has enabled the company to employ a level of technical sophistication that is uncharacteristic of such a young exploration firm.

Investigations by Realm Energy and Halliburton have, to date, resulted in identifying more than 2.5 million acres of high-potential land in multiple distinct basins in several European countries. Realm Energy is in the process of acquiring the oil and gas exploration rights over these lands and designing work programs to develop the resources.

Lower Saxony Concession

In May 2010, Realm Energy was granted its first exploration license by the Lower Saxony Mining Authority in Germany. The Company anticipates that this will be the first of many concessions obtained in 2010.

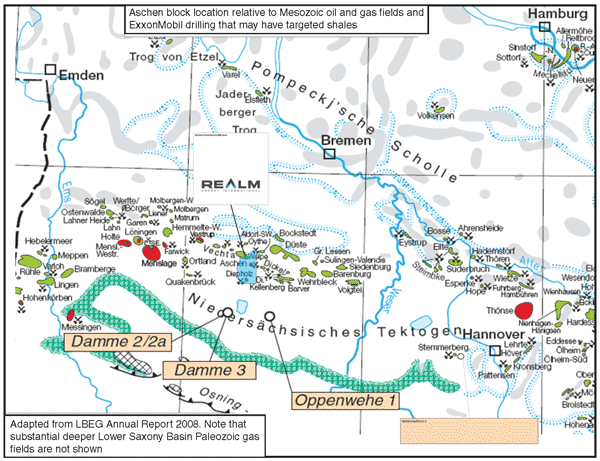

The company’s target in the Lower Saxony region consists of 15,888 contiguous acres known as the Aschen concession (Figure 1). Realm Energy intends to target primarily the two organically rich shale oil and gas resource plays on Aschen: the Lower Cretaceous Wealden Shale and the Lower Jurassic Posidonia Shale. Both shales appear to be mature for oil and/or gas, and also may exhibit desirable overpressures. In addition, the company will focus on conventional zones that it believes are underappraised in oil discovery areas (the Diepholz and Bollermoor oil discoveries), as well as the Aschen sweet gas field.

Realm Energy has acquired the Aschen concession for an initial period of three years. Throughout that period, the company will continue to evaluate the geological and geophysical characteristics of the area. While Aschen was explored for conventional resources as far back as the 1950s, the application of modern horizontal drilling and hydraulic fracturing technologies could well enable the recovery of significant new resources on the property.

The company expects to soon begin evaluating the considerable data set on the area developed during previous exploration targeting oil in Cretaceous and Jurassic formations at depths of 3,200-6,500 feet. The data set includes data from 21 wells drilled on the license (mainly in the 1950s-60s), extensive 2-D and 3-D seismic, and 182 cores. The evaluation will give Realm Energy considerable insight into the area’s characteristics and potential before undertaking any seismic or drilling campaigns.

The Liassic Posidonia Shale is thought to have been deposited in an extremely restricted marine environment, and its thickness varies from 50 to 100 feet, averaging 75-80 feet (it is interesting to note, however, that the entire Liassic sequence is 1,960-2,460 feet thick in the Aschen area). The organic matter consists of algal remains (Type II kerogen, the genetic potential [S1+S2] can be as high as 140 kilograms of hydrocarbons per ton of rock and averages ±60 kg HC/t rock). The total organic carbon is variable, with a mean content estimated at 8 wt. %. Although not thick by shale play standards, this shale is analogous to the Schist Carton/Domerian Shale in the Paris Basin, where shale oil exploration is being pursued by various players.

The bituminous Wealden Shale (Papershale) lies within the generally lacustrine Berriasian sequence (Bueckeburg formation). This source rock is restricted to the western part of the Lower Saxony Basin (west of the Weser River). The amount of organic matter is highly variable. Mean total organic carbon values are 7 percent in the western area and 4 percent in the area just west of the Weser. However, values as high as 14 percent are reported. The genetic potential can be as high as 120 kg HC/t rock, but it averages about 40 kg HC/t rock. The kerogen is Type I in the western part of the basin, but tends toward Type II as the Weser River is approached (where the Aschen concession is located). The mean thickness of the source rock is believed to be 75-80 feet, but it can be much thicker.

High-Potential Acreage

At 15,888 acres, the Aschen concession is comparatively small compared with Realm Energy’s other land acquisition initiatives. However, management believes that Aschen is strategic and offers high potential. The Aschen concession has good proximity to a base of pipeline infrastructure, an extensive data set available, and multiple organically rich and mature shale formations that have been associated with successful oil and/or gas production in the past.

The strategy for exploration that will be deployed on Aschen is characteristic of how Realm Energy is executing its business plan. Prior to applying for acreage positions and making work commitments, the company carries out detailed analysis of log and geochemical data already available. Deciding whether to acquire land in a specific play is determined by indications such as clear curve separation on log interpretation that may indicate substantial free gas columns.

Disciplined preliminary analysis then shifts the question from “if” the lands being pursued have oil or gas potential to the “how” of determining and maximizing the potential for resource recovery. The company’s intentions are to then conduct significant exploration efforts only on the areas it has determined to have the lowest risk. To further derisk projects, exploration is likely to be facilitated through joint ventures and collaborative arrangements.

As companies involved in European shale projects begin to move forward and conduct drilling activities, we expect that it will only improve the overall economics in the region. At present, there are relatively few drilling rigs available and little direct shale completion experience to draw on. This dearth of equipment and local expertise in some European nations makes drilling and completion expensive, compared with North America. Over time, however, experience gained will drive efficiencies, lowering project break-even points and benefiting companies such as Realm Energy that are at the forefront of European shale development.

And not to be overlooked are the higher natural gas prices in Europe, which allows higher-cost wells to still be economic. All things considered, we expect the economics will improve over time.

JAMES ELSTON is chief executive officer of Realm Energy International Corporation. With 19 years of broad-ranging oil and gas experience in industry, banking and consulting, he is a director of Fallingwater Energy and Palladian Energy Ltd., where he advises investment banks, private equity firms and energy companies on a variety of issues largely relating to equity capital markets, mergers and acquisitions, and equity research. Elston has assisted with floating eight energy companies over the past few years on London’s AIM market, making him one of the most active pre-IPO analysts. He has worked with numerous unconventional gas players and their advisers, and has assisted in bringing Great Eastern Energy and Green Dragon to AIM. Prior to forming Palladian Energy, Elston was a director at PFC, an equity analyst at DLJ, an analyst at Wood Mackenzie, and an engineer at Shell. He holds a degree in chemical engineering.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.