Well Design

Right Approach Boosts Margins, EURs

By Don Ritter

ADDISON, TX.–The dramatic shift in oil prices over the past year is a reminder of how quickly the commodity price environment and general well economics can change. Companies that can figure out how to drill economic wells at $60, $50 or even $45 oil will be better-positioned to weather the industry’s cycles and grow efficiently when prices recover.

Fortunately, with the right geology, technology and people, it is possible to prosper even at modest prices. To illustrate the point, Endurance Resources is running two rigs targeting the Avalon, Bone Spring and Wolfcamp formations on its 22,000-acre position in Lea County, N.M. If prices hold steady around $60, we may add a third rig later this year.

In early April, Endurance was operating one rig. We have been able to add a second largely because we recognize a truth that applies in any price environment, but becomes critical as well economics tighten: 90 percent of the opportunities to optimize a well’s production occur before it is drilled. It is then that operators have the best opportunity to maximize reservoir contact and select artificial lift systems for the life of the well.

At the planning stage, operators have the chance to ensure a well is successful and maximize their well economics. In particular, they should:

- Understand local stress fields so they can orient the well in the direction that will maximize production;

- Design a completion that optimizes reservoir contact and provides the conductivity necessary for production to flow through the relatively narrow holes in the tubing;

- Select an artificial lift system that balances production and cost, and make sure the pipe program provides enough space for an electric submersible pump, if it is the best choice; and

- Build production and processing infrastructure ahead of the well to minimize initial lease operating expenses.

By keeping these factors in mind as we plan wells, Endurance has significantly reduced the capital expenditures and lease operating expenses (LOEs). At the same time, we have achieved a 25 percent increase in estimated ultimate recoveries, compared with direct offsets.

EUR’s Importance

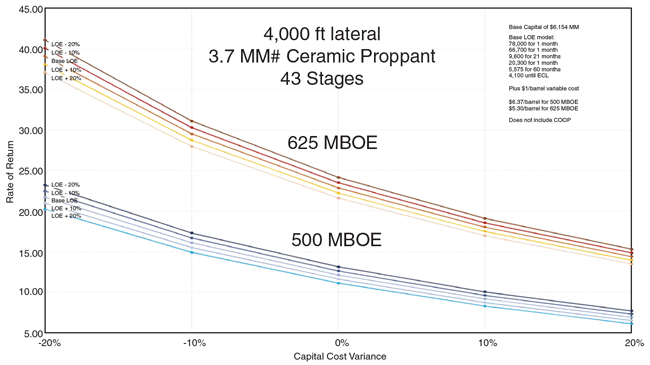

Endurance emphasizes increasing ultimate recoveries over obtaining capital and operating expense savings because EURs play the biggest role in determining a well’s rate of return.

Consider a well with an EUR of 500 million barrels of oil equivalent. Assuming the well costs $6.15 million to drill and has LOEs typical for Endurance’s area, it would provide a rate of return around 13 percent at $45 oil. As shown in Figure 1, reducing LOEs by 20 percent would only increase the ROR by 2 or 3 percent.

Capital cost reductions would have a much greater effect. A 20 percent reduction would increase ROR around 10 percent, and even a more obtainable 10 percent reduction would increase ROR by 4-5 percent.

A 10 percent increase in ROR is impressive, but the biggest gains come from boosting EURs. Bump the well’s EUR to 625 million boe and the ROR will jump from 13 to 25 percent. Combine that with 10 percent decreases in capital costs and LOEs, and the ROR will exceed 30 percent.

Of course, getting returns that high at current oil prices takes hard work. Fortunately, it is work worth doing. In the short term, it is allowing Endurance to continue to grow while keeping its employees and business partners busy. In the long term, it is giving us a suite of tools we can use to provide even greater returns as prices recover.

Maximizing Recoveries

Because increasing ultimate recoveries has such a large impact on well economics, maximizing EURs is vital. Several factors contribute to that effort, including well orientation, proppant deployment, and artificial lift selection.

Well orientation illustrates the degree to which even simple decisions can affect EURs. In areas where horizontal stresses differ from one direction to another, orientation has a dramatic effect on completion effectiveness. In a strike slip or normal faulting environment, fractures propagate in the direction of the maximum stress, so if a well’s lateral goes in that direction, the fractures will turn and run parallel to the wellbore a short distance after they are created, forming a wide, shallow and highly-connected fracture network.

While such a network still improves production, the completion will be far more effective if the well’s lateral parallels the direction of minimum horizontal stress (SHmin). With the low-stress areas perpendicular to the wellbore, the completion will create transverse fractures that penetrate deep into the formation, maximizing reservoir contact, and therefore, recovery.

A study of wells targeting the second Bone Spring on or near Endurance’s acreage shows how big the difference between orientations can be. The 10 wells drilled with the lateral going east or west (parallel to the maximum horizontal stress) had longitudinal fractures that yielded normalized EURs of 131,000 barrels of oil and 182 million cubic feet of gas. The 32 wells drilled with the laterals going north or south (parallel to SHmin) performed much better, with a normalized EUR of 502,000 barrels of oil and 1.002 billion cubic feet of gas.

In other words, correctly orienting the lateral tripled these wells’ oil production and quintupled their natural gas production.

Completion Design

Correctly orienting the well is critical, but maximizing EURs also requires an effective completion. For Endurance, this means using ceramic proppants. While such proppants add $1 million to a well’s upfront cost, we have found they provide more natural conductivity for the fluid than natural sand, increasing initial flow rates.

By using ceramic proppants, Endurance has achieved 30-day initial production rates per 1,000 feet of lateral that exceed 400 boe, or twice those of the offset wells in the area. In general, the proppant pays for itself within six months.

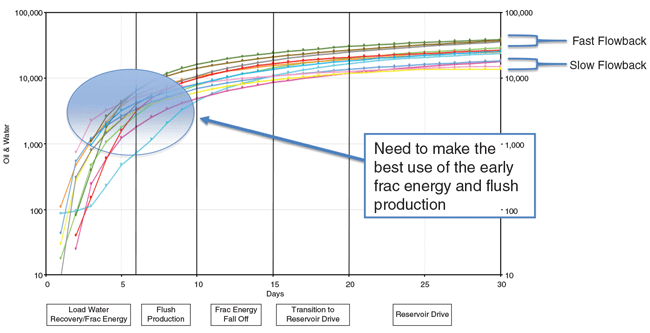

The ceramic proppant yields such high initial flow largely because it has a reduced beta factor, which keeps it from flowing back. In Endurance’s experience, high initial flow rates improve the well’s long-term recoveries (Figure 2). We believe using the initial frac energy to accelerate production leads to higher recoveries than choking production back to sustain lower production rates.

In our most recent wells, we have moved from traditional plug-and-perf completions to a relatively new method centered on cemented sleeves that can be opened and isolated with a coiled tubing-deployed assembly. The assembly contains a mechanical device that locates the sleeves, so unlike ball drop methods, it does not require us to narrow the casing from sleeve to sleeve. When the device finds a sleeve, the assembly’s resettable bridge plug activates, the sleeve opens, and fluid is pumped through the coiled tubing annulus to initiate the fractures.

This approach concentrates sand more effectively than a traditional plug-and-perf completion. In a plug-and-perf completion, we would pump sand into a cluster with three entry points. In many cases, because of differences in the strength of the formation, most of the sand would go into one or two of the clusters. The other one might not get any sand at all, leaving a third of the wellbore in that particular stage untreated.

With the new approach, there is a sleeve for every cluster, ensuring that every cluster is stimulated. Furthermore, the stimulation creates deeper fractures. In a plug-and-perf operation, we would have to pump 75 barrels a minute for each cluster to receive 25 barrels, the amount needed to create a fracture with a propped height of 100-150 feet. Using the cemented sleeves and coiled tubing, we are able to get 35 barrels a minute across each cluster, a feat that would previously have required flow rates exceeding 115 bbl/minute. The more concentrated flow can extend fracture height to 300 feet and increase total reservoir contact by one-third.

The CT-based approach has one other advantage: During treatment, the coiled tubing acts as a dead string that transmits treating pressure to the surface. This allows us to adjust pad size, sand concentration and ramp, and pumping rates in real time.

Since Endurance adopted the new approach, our wells have flowed longer and leveled at a higher rate. As a rough estimate, the combination of ceramic proppants and cemented sleeve completions increases each well’s long-term production by 40-50 bbl/d, which adds up quickly.

In some of the wells completed using the new method, Endurance may be able to switch from a 51⁄2-inch production liner to one that is only 4 or 41⁄2 inches in diameter. With the cemented sleeve completion method, that gives us adequate space to create fractures that are 200 feet high, which is sufficient to penetrate the productive interval on parts of our acreage. By using a smaller liner, we free enough capital to pay for 7 or 71⁄2-inch production casing, which will give us the room to run larger ESPs and optimize our long-term production.

Artificial Lift Selection

Whether we are looking at drilling, completion or production methods, Endurance focuses on maximizing margins, not production volumes. In a high-price environment, the revenue from incremental barrels can easily make up for the cost required to obtain them. But in today’s environment, strategies designed to increase production actually can decrease a company’s profit margin or increase profits so little that it is no longer worthwhile to invest time and capital implementing them.

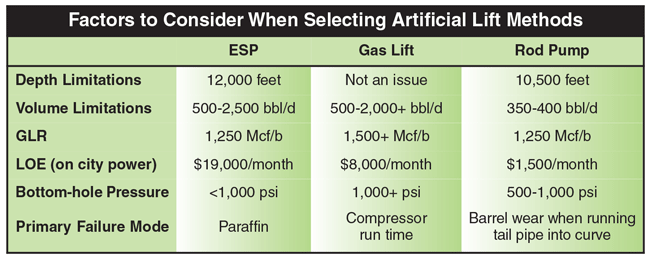

Focusing on margins rather than production can yield big savings. For example, last October, Endurance needed to decide whether to continue using ESPs or switch to gas lift on several wells. ESPs would produce 200 bbl/d, while gas lift only would provide 175 bbl/d. To determine if the 25 bbl/d gain from ESPs would be worthwhile, we took a hard look at the operating costs associated with each option.

Because we did not have access to electric utilities, we would need to rent and fuel generators to power an ESP. On average, a gas-powered generator would have cost $22,500 a month to rent and $10,000 to fuel, even if we were able to use lease gas, giving it a total cost of $32,500.

A diesel-powered generator would have cost only $14,000 to rent, but because diesel is more expensive than natural gas, acquiring fuel would bring the total cost back to $32,500. Since diesel works better in remote locations, we figured it would be the right choice. Unfortunately, Endurance experienced generator problems that could push the total monthly cost of powering ESPs to $40,000.

On paper, gas lift offered much better economics, for the requisite gas-powered compressor would cost only $4,000 to rent and $4,000 to fuel for a total monthly cost of $8,000. That made selecting gas lift an easy choice.

In the field, the costs associated with gas lift exceeded $8,000 because of compressor downtime. But even after taking that into account, switching to gas lift and eliminating the rental and fuel costs associated with powering ESPs cut our early LOE in half, dramatically improving margins.

Today, because we now have access to city power, we are able to use ESPs in the same area. Even without needing a generator, ESP wells have LOEs around $19,000, twice those of gas-lifted wells. However, the ESP’s ability to lift more oil and operate at lower bottom-hole pressures makes up for the difference in the right application. This assumes the gas-to-liquid ratio is low enough to allow the ESPs to run efficiently.

The right application is key. In deeper wells, those with high gas-to-oil ratios, or those with strong bottom-hole pressures, gas lift can make more money even when city power becomes available. As shown in Table 1, our experience suggests ESPs are best reserved for wells with low GORs.

Of course, it is also vital to maximize equipment run times. In the Bone Spring area, the number one cause of downtime for ESPs is paraffin. Hot oil treatments have proven ineffective at combating paraffin, so we are experimenting with microbial treatments. So far, they seem to be working. In the first three weeks after the initial treatment, production on the Telecaster No. 4H well went from 100 to 140 bbl/d. We continue to look at other chemical methods as well.

Infrastructure’s Importance

The dramatic shift in artificial lift economics once city power becomes available demonstrates a broader point: To minimize capital expenditures, wells must be planned with infrastructure in mind. For example, Endurance tries to schedule drilling so city power is already available. This requires us to know the utilities and keep up with their plans, but when it is possible, it can be a tremendous economic driver.

In general, Endurance builds tank batteries, installs production equipment, and connects the pad to pipelines before completing a well. That way, when we turn a well on, we do not need to worry about setting up temporary tanks, flaring natural gas, or transporting oil by truck. In addition to protecting the environment, this gives us more gas to sell and increases our margins by reducing transportation costs.

Reducing infrastructure costs is one of the best tools for minimizing capital expenditure. While more efficient construction and operations make a difference, the biggest lever operators can apply to infrastructure costs is concentrating assets. A $1 million tank battery would unduly burden one well, but it is far easier to justify as a $250,000 cost spread across four wells.

Concentrating infrastructure also allows operators to work more efficiently. When an operator drills three or four wells in a row, the last one might cost 10-15 percent less because the rig crews have gotten acclimated to the area. Highly-concentrated assets also are easier for pumpers to visit, reducing long-term operating costs.

Building production facilities, obtaining key equipment, and arranging transportation for oil, natural gas and water before drilling significantly reduces LOEs. While LOEs have less impact on RORs than EURs or capital expenditures, learning to optimize them can make a noticeable difference in well economics, especially over the long term.

More importantly, operators need a strong understanding of LOEs to evaluate wells. In particular, they must recognize that expenses change through the life of the well and understand when and why those changes occur to calculate a proposed well’s ROR and decide whether it is worth drilling.

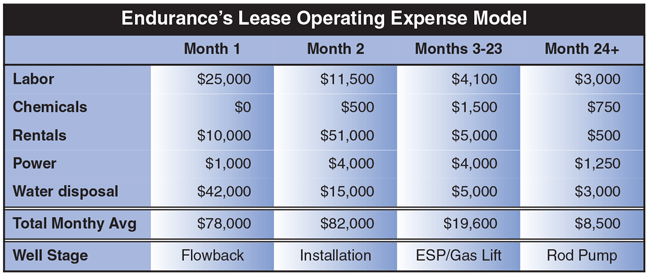

Endurance’s LOE model breaks a well’s life into four stages. In the first month, when the water from the completion and the flush production are flowing in, total costs average $78,000 (Table 2). In the second month, water disposal costs and labor costs drop, but artificial lift equipment has to be rented and installed, bringing the average cost to $82,000.

From the third month to the 23rd month, the typical well remains on gas lift or ESPs. As the well’s production declines, equipment can be downsized, reducing rental costs. The chemical costs triple, but they remain small enough that the average monthly LOE drops to $19,600.

After two years, the well’s initial artificial lift system is replaced by a rod pump. As noted in Table 2, virtually every cost goes down, reducing LOE to $8,500.

These numbers come from Endurance’s experience and will vary widely across basins and market conditions. Operators should develop and periodically update an LOE model that accurately reflects the realities of their specific areas to determine how profitable a well will be.

In theory, price forecasts also should play a part when deciding whether a well’s returns will be sufficient. I generally recommend assuming a price below the current price, even if the prevailing wisdom suggests a higher price will materialize. This would be the prudent course with any well, given oil and natural gas prices’ unpredictability, but it is especially important with horizontal wells, which yield the majority of their production within the first year, when the present price is most likely to be accurate.

Fortunately, by planning wells carefully to maximize estimated ultimate recoveries, minimize capital expenditures, and reduce LOEs, it is possible to drill economic wells in almost any price environment. It takes work and the guts to try new technologies, but it can be done. Do it well enough, and it is possible to thrive even at lower commodity prices.

Don Ritter is the chief executive and co-founder of Endurance Resources LLC, an independent oil and gas company with a 22,000-acre leasehold in the Delaware Basin. He spent the first 20 years of his career at Mobil, where he served in engineering and management roles in the United States and internationally, developing expertise in drilling engineering, completion design, and project planning. Before co-founding Endurance’s predecessor in 2008, Ritter led engineering, business development and sales for GeoMechanics International, a technology firm focused on helping companies maximize success in horizontal resources plays.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.