Stations To Enable Natural Gas Powered Trucks To Go From Coast to Coast

By Colter Cookson

If natural gas was an Internet video, it would be on the verge of going viral. While many consumers have yet to consider filling up with the domestic wonder, fleet operators across the United States are asking how they can leverage its remarkable ability to reduce expenses, cut emissions, and promote U.S. energy independence. Their calls are flooding the phone lines of the companies that have stepped up to build the infrastructure needed to turn natural gas vehicles from a promising idea into a national sensation.

While there are only 1,100 natural gas fueling stations in the United States today, that number is growing at a faster pace each year. For now, the companies that build compressed natural gas and liquefied natural gas stations are focusing on areas where natural gas can do the most good: in densely populated regions and along major thoroughfares where everyone from taxi drivers to transit authorities, truckers and couriers drives mile after mile.

“We are going like gangbusters, building CNG stations to serve the needs of metropolitan areas as well as the refuse industry,” reports Greg Roche, the vice president of national accounts and infrastructure at Clean Energy Fuels, the United States’ largest provider of CNG and LNG infrastructure.

He says the company plans to build far more stations this year than last, and predicts that trend will continue.

Roche attributes Clean Energy’s accelerating activity in part to a growing awareness of natural gas’s abundance and benefits. “When our market development team met with potential customers, it used to have to cover everything about natural gas, from what it is to where it’s produced,” he recalls. “Today, people generally are aware that we have an abundant supply of natural gas and that it is cheaper and cleaner than traditional fuels, so we can focus more on the brass tacks of vehicles and infrastructure, and the economics of how to make it work.”

In areas with limited infrastructure, Clean Energy will build stations for the client, provided it is economic to do so, he says. “What it takes for a station to be economic can vary, but for a CNG station, we like to see a minimum of 25,000 gasoline gallons equivalent (gge) a month, and for a liquefied natural gas station, we might want to see 50,000 gallons,” Roche says.

“It does not take much for a station to reach those volumes,” Roche reports. “For example, with trucks that burn 2,000 gallons of LNG a month, it only takes 25 trucks for a station to be worth looking into.”

Trucking

According to Roche, the time is right for long haul truckers to switch to natural gas. “The engines and vehicle technology have been proven, and the benefits are compelling,” he says. “Truckers can save 25-35 percent on fuel and reduce their emissions while buying an American product.”

To enable more trucking companies to switch to natural gas, Clean Energy is building a network of fueling stations that spans the United States. “This project, which we call ‘America’s Natural Gas Highway,’ is the first deployment of natural gas stations that will allow trucks to travel from coast to coast and from border to border on natural gas,” Roche states.

The stations will be placed every 300 miles along the major trucking-route interstates, Roche details. He says the company plans to build 150 within the first two years, with half expected to be complete by the end of 2012. Many of the stations will be at Pilot Flying J travel centers and other sites that already serve the trucking industry.

Turnkey Provider

AmericaCNG.com states a simple goal: to provide a cost effective means for large companies to convert to natural gas. “Our target market is Fortune 500 companies that are involved in the fleet service, hauling or logistics business,” says Joseph Farley, the company’s director of business development.

“Many of these companies do not want to deplete their capital or take on debt to buy NGVs, so we put together a $1.15 billion line of credit that lets us offer a turnkey solution, where we buy the vehicles and roll the price into the fueling contract,” he says. “In most cases, the contract costs far less than what the companies were paying for diesel. They also get brand new trucks, which greatly reduces their maintenance expenses.”

In addition to providing financing, AmericaCNG has worked with several large natural gas companies to lock in the price of fuel for 5-10 years. “Fuel charges are the number one expense for large trucking companies, so taking the fluctuation out makes a big difference,” he observes.

For some customers, AmericaCNG may be able to reduce total fuel costs to less than zero, Farley says. “A large national grocery store we sent a quote to actually could make money on each of its stations because they contain not only private dispensers, but also public dispensers,” he explains. “The public side of the station would pay rent to the company, reducing the station’s costs and potentially turning a profit.”

For the public station to generate revenue sufficient to offset the company’s fuel costs, Farley calculates it must sell 5,000 diesel gallon equivalents a day. “Our market research indicates that as long as there is someone willing to pay for fleets to convert to natural gas, reaching 5,000 a day will not be a problem,” he says.

Demand

In mid-August, AmericaCNG said it was pursuing contracts with companies across the United States. “Together, these companies have an inventory of 35,000 trucks ranging in size from concrete trucks to long haulers,” Farley reports. “They have said they would switch to natural gas as long as we show them a package that makes sense, and we are doing that.”

In addition to pursuing fleet operators, AmericaCNG is partnering with convenience stores and truck stops to install CNG fueling stations on site. “We will buy and install all of the equipment, pay the store 10 cents for every gallon equivalent we sell, and encourage our group of 35,000 vehicles to go there to fill up, so it’s a win-win for the owner,” Farley states.

Farley says building stations through this program has allowed AmericaCNG to approach fleets that otherwise would be reluctant to switch to CNG. “For example, we contacted a company in Texas with a fleet of 400 pickup trucks and vans. It said, ‘We would love to switch our vehicles to natural gas, but we only will do that if there are enough stations in our markets for our guys to pull in and fill up.’ So we identified 58 locations in the Dallas area where we could place stations. We are not going to use all of them, but we hope to have 12 stations done in 2013.”

Partnerships For Success

For Kent Wilkinson, vice president of Chesapeake NG Ventures and head of Peake Fuel Solutions, a Chesapeake subsidiary that works to expand the United States’ CNG and LNG infrastructure, partners are key to unlocking market expansion. To illustrate, he points to the company’s agreements with GE, which has worked with Peake to develop an integrated fueling system that reduces CNG station costs; and to DeBartolo Development, a real estate firm that has offered to fund as many as 1,000 stations during the next five years.

Peake Fuel Solutions has partnered with GE Oil & Gas to develop an integrated compressed natural gas fueling solution designed to minimize costs. The companies say they are producing several units a month, a move that has allowed them to build an inventory and adopt more efficient manufacturing processes.

“These partnerships give us the ability to meet the whole spectrum of needs someone might have,” Wilkinson says. “For a sophisticated user that only needs equipment, we have equipment ready to go. For someone who needs both equipment and the financing to buy it, we have arranged financing at 2.9 percent. And for someone who says, ‘Listen, all I want is cheap fuel in my operating area,’ we can go to our developer relationship and offer a complete build-to-suit solution.”

Dalbir Utal, senior product leader with GE Oil & Gas, describes the integrated compressor-and-dispenser package GE developed with Peake, called the CNG in a Box™ system, a market-disrupting technology. “We worked closely with Peake to address the day-to-day challenges and develop a product that minimizes capital and operating expenses,” he explains.

As part of that effort, Utal says GE concentrated on making the CNG in a Box system convenient and user friendly. “With our extremely fast fill rate of almost seven and a half gge a minute, the consumer experience is positive and quick. It’s actually faster than filling up with gasoline, in most cases,” he reports.

To minimize the product’s cost, GE standardized the design, Utal says. “We are building several units a month. We use an assembly line, helping save time and money,” he adds.

To reduce installation costs, GE handles as much as possible at the factory so little needs to be done on site, Utal continues. He says the CNG storage tanks are installed on the unit, using a plug and play type concept designed to simplify initial setup and decrease the installation time. “The overall idea is for easy, reliable and lower cost installations,” he remarks.

Utal says the CNG in a Box system also addresses common problems that raise operating expenses, such as variable power quality. “With many compressors, when a power surge occurs, the unit could shut down and the owner has to send out a technician to reset it. That is a hassle and an extra cost, and by the time the technician arrives, the unit may have been out for a couple hours,” he relates. “To eliminate that, we added an uninterruptable power supply that is affordable and reliable.”

Wilkinson says Peake’s partnership with GE enables the company to make a unique commitment to bring inventory to market rather than building to order, which should speed station construction. He adds that GE has a strong and widespread reputation for quality and service.

“When people talk about NGVs, they always talk about the chicken and the egg,” he observes. “Our partnership with GE is one way for us to tell fleets, ‘We realize the challenges you face, and we believe we can eliminate many of those barriers. You have a supplier of equipment, and you have engine and vehicle choices. You can switch. You can do so quickly, with quality products and affordable costs.’”

Financing

To help companies secure the financing to build natural gas fueling stations, Peake Fuel Solutions has partnered with DeBartolo Development, which is committed to funding as many as 1,000 stations during the next five years.

Keystone, which has a long history with DeBartolo, structures opportunities so they meet DeBartolo’s investment criteria. “We do that in a number of ways,” outlines Keystone President Erik G. Hector. “For example, we aggregate fuel contracts from several smaller fleets or approach fleets with investment grade credit and offer to install CNG stations on their properties under a variety of models.”

According to Hector, the models include private access stations, which only the owner can use; limited access stations, which a group of companies can use; private or limited access stations with a public fast-fill unit outside the gate; and public access stations such as those at convenience stores.

“If we meet certain conditions, DeBartolo not only will fund the physical station and the equipment, but also in many cases the vehicles,” Hector says. “If an opportunity does not meet DeBartolo’s return requirements, Keystone will draw on its relationships with other financial providers, such as regional banks and private investors that believe in promoting NGVs.”

At first, he relates, Keystone planned to test each model using 10 stations. However, Hector reports that even without any marketing beyond a press release, the company has received numerous inquiries. “In the next 12 months, I hope we will have dozens of stations,” he says.

Compressor Maker

Arrow Engine Company, a compressor and engine manufacturer based in Tulsa, is one of the many oil and gas related companies that have entered the CNG space. “When we saw people starting to take a serious look at NGVs, we knew there would have to be infrastructure built to support the market over time, so we thought we would be one of the first companies in and diversify our business,” relates Arrow Engine President Len Turner.

This natural gas fueling station is one of 10 that uses compressors made by Arrow Engine Co. Arrow reports that inquiries about its CNG compressors, which use a vibration-minimizing design, have become more frequent as fleets’ interest in the fuel grows.

To enter the market, Arrow Compression Products modified its field gas compressor for use in CNG stations. “We only needed to modify our field gas compressor with a high-pressure cylinder and add a more sophisticated control panel,” says Brent Witte, the company’s vice president of finance. “Arrow uses ASME-stamped vessels for longevity, along with a spill containment system, in all of our skid designs.”

Witte describes the compressor as bulletproof, noting the company has had 600 units of the field gas version in operation without any major failures. “All the design and development work on the compressor has occurred within the past 10 years, so it is one of the most current designs in the industry. We have been able to use modern technologies and incorporate changes that needed to be made,” he adds.

As an example, Witte points out that the compressor uses a three-throw crankshaft configuration that eliminates cylinder offset and the vibration associated with traditional designs. Less vibration means less wear, he notes.

Turner says that in the past two years, Arrow Compression Products’ sales of CNG units have doubled. “Many of our sales have been to municipalities and fleets that prefer to work with an in-state supplier,” he reports.

In the past year, the company has received more frequent inquiries about its CNG compressor. “NGVs are beginning to catch on, but I think it will take more vehicles coming out with dual fuel capability for the market to really go full throttle,” Turner predicts.

Cost Reducer

According to J-W Power Company, which has packaged compressors for CNG stations since 1994, most customers look first at the price tag when they evaluate CNG compressors. “The CNG market is more focused on cost than the oil and gas market, so packagers such as us need to find a way to meet customers’ needs while being extremely cost competitive,” says Shayla Martin, the company’s manager of CNG sales and service.

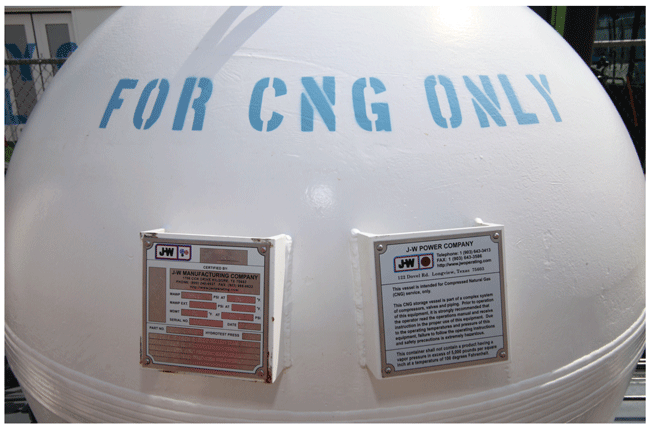

This CNG storage vessel was manufactured by J-W Power Company, which also offers CNG compressors. The company says it makes both products with a focus on affordability and safety, factors that are particularly important in an emerging market.

Rick Poorman, J-W Power Company’s manager of application engineering, concurs. “Price is huge,” he says. “We have continued to look at component cost and design to try to maintain safety and quality standards, but drive costs out,” he says.

As part of that process, Poorman says J-W Power Company has standardized its designs. “We have standard models that are built on common platforms so we can accommodate different conditions without changing many of the components,” he says.

The company also has tried to remove unnecessary components and use less durable but more affordable parts where possible, Poorman adds. “For instance, we have incorporated Society of Automotive Engineers flanges rather than the American National Standards Institute flanges we frequently use in the oil and gas industry, which are tougher but more expensive.”

Poorman estimates that in the past few years, J-W Power Company has cut the cost of its standard CNG compressor by 15-20 percent.

Other Factors

In addition to trimming direct costs, Poorman says J-W Power Company has looked at ways to deliver faster fill rates at lower horsepower. “Most CNG stations fill vehicles using differential pressure. The gas in the station’s storage tank is at a higher pressure than the vehicle’s fuel tank, so it flows into the vehicle tank,” Poorman relates. “To decrease fill time, we are developing a product where the compressor will turn on during periods of high demand and pull gas from the station’s storage tank to recompress it and push it into the vehicle.”

For the CNG market to prosper, Martin says using CNG stations needs to be as convenient as filling up with gasoline. “In addition, safety is very, very important. It would hurt the acceptance of CNG as a fuel if a fire started at a station or someone got injured while filling up.”

Poorman says designing safe CNG compressors comes down to understanding the application and duty cycle, following applicable codes, and using multiple fail-safe and backup systems. “On a high-pressure unit, an alarm will sound if the pressure climbs too high. If it continues to climb, the unit will shut down. If it still climbs, a mechanical relief valve will reduce the pressure,” he illustrates. “The idea is to build multiple safeties into the system to ensure a single failure will not create an unsafe condition.”

“We see this market as one that is going to grow and grow,” Martin describes. “There are opportunities with fleets and transit stations, but that is only the beginning. As stations become more available, the public will see the low price of natural gas compared with gasoline and want to know more.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.