Fresh Round Of Deals, Drilling And Refrac Activity Shape Eagle Ford’s Future

By Nick Vaccaro Special Correspondent

The Eagle Ford Shale may be one of the more mature U.S. onshore resource plays, but operators see plenty of upside running room ahead. Current production trends reflect their optimism, buoyed by a fresh round of asset acquisition deals and evolving new well drilling and producing well refracturing programs.

According to the U.S. Energy Information Administration, oil production from the Eagle Ford play is expected to rally to 1.18 million barrels a day in March, a net increase of 4,000 bbl/d month over month and 34,000 bbl/d year over year. Meantime, natural gas production from the play was projected to grow 50 million cubic feet a day to 7.42 billion cubic feet, representing net growth of about 1 Bcf/d on annualized basis.

Baker Hughes counted 71 active rigs in the Eagle Ford during the week ending March 3, with 68 of them drilling for oil. That was 17 more active rigs than during the same week of 2022. Even though there six fewer rigs targeting gas, the number of oil-directed rigs was up by a solid 23 year over year.

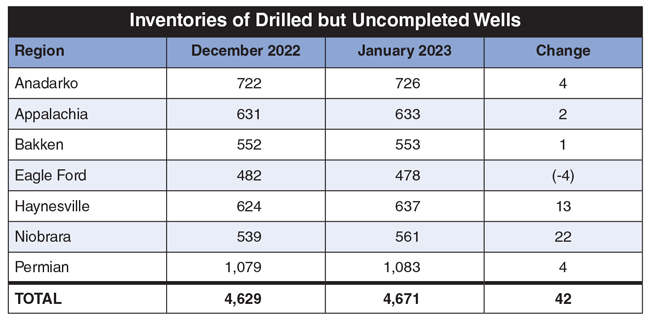

Rig activity will be a particularly critical barometer in gauging the Eagle Ford’s relative health going forward, and in judging how well operators are able to capitalize on their growth strategies. That is because the Eagle Ford region now has the fewest number of drilled but uncompleted wells of any of the seven major oil or gas producing horizontal shale basins.

That was not the case one year ago, when the Eagle Ford’s 657 DUCs ranked third behind only the Anadarko Basin and mighty Permian Basin. One year later, only 478 DUCs remain across the Eagle Ford, which is not only the lowest DUC count in any play, but a full 75 DUCs behind the region with next lowest count in inventory, the Bakken Shale. As shown in Table 1, the Eagle Ford was the only shale region to experience a net decline in DUCs between December 2022 and January 2023.

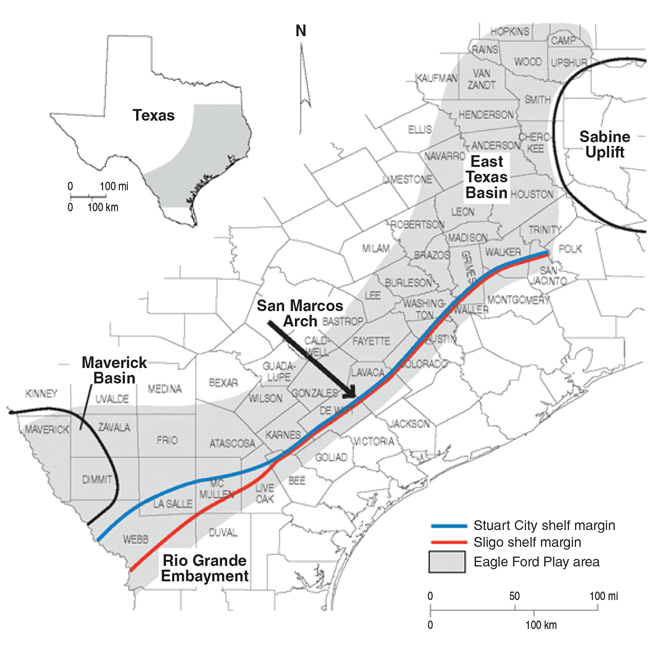

That implies sustaining the trend of the past several months toward incremental production growth will require much more reliance on newly drilled wells and refracturing of existing wells across the expansive Eagle Ford trend (Figure 1), a bullish setup for the in-basin drilling and well services sectors.

Inherent Optionality

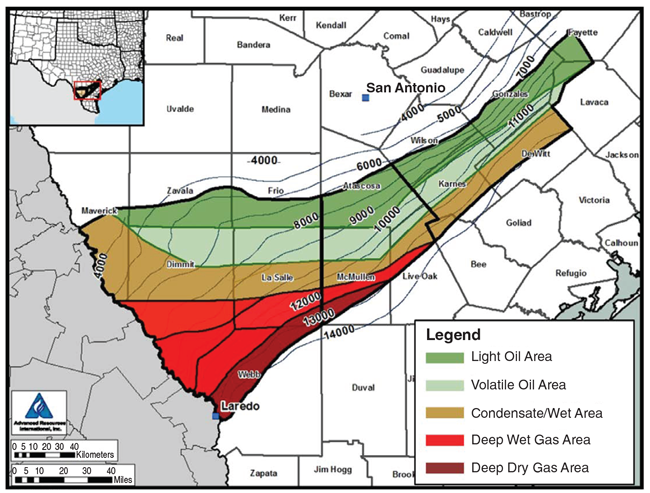

With WTI prices persisting in the $75-$80/bbl range while natural gas prices struggle to gain momentum above $3/Mcf as the winter heating season winds down and the summer driving season nears, it also sets up the likely intermediate-term continuation of the current oil-versus-gas drilling rig split of nearly 23-to-1. As the only major play with fairly well-defined crude oil (shallower), wet gas (intermediate depth), and dry gas (deeper) windows linked to the thermal maturity and depth of the shale, the Eagle Ford gives operators the inherent optionality to focus drilling investments on the parts of the play that offer the most compelling economics according to prevailing market conditions.

FIGURE 1

Eagle Ford Shale Play Area

Source: Bureau of Economic Geology, The University of Texas at Austin

The play’s flexibility, coupled with its ample pipeline takeaway capacity and short-haul proximity to nearby Gulf Coast refineries, petrochemical plants and liquified natural gas export facilities, also give it the ability to quickly respond to improving price margins for any or all of three hydrocarbon product streams and efficiently deliver that production to market.

Multiple recent acquisitions underscore the Eagle Ford’s favorability for both offering production upside potential and for getting supplies efficiently to market centers. They also signal a growing cosmopolitan flavor and international recognition of the play’s emerging role in satisfying global calls for energy supplies, while simultaneously underscoring the importance of the smaller private operators that have long played a defining role in Eagle Ford activity.

The first acquisition was privately held WildFire Energy’s $1.4 billion purchase of Chesapeake Energy’s Brazos Valley region Eagle Ford assets. That was followed by INEOS Energy’s $1.4 billion buyout of Chesapeake’s remaining Eagle Ford assets, marking the U.K.-based petrochemicals manufacturer’s entry as an operator into the U.S. onshore upstream market. The third deal, valued at $2.5 billion, is an acquisition by Canada-based Baytex Energy Corp. of Eagle Ford operator Ranger Oil Corp. These three deals follow on the heels of last year’s blockbuster move, which saw Marathon purchase Ensign Natural Resources’ Eagle Ford assets for $3 billion.

Then in late February, Repsol, an international operator headquartered in Spain, announced that it had acquired the Eagle Ford position of INPEX, a Japanese exploration and production company. The financial terms of that deal were undisclosed, but the assets are concentrated in the oiliest parts of the play.

Meanwhile, home-grown private players such as Houston-based Crescent Pass Energy LLC are adding production using horizontal well refracturing programs in core acreage positions, and capitalizing on the robust opportunity the Eagle Ford presents in further developing their portfolios through focused drilling campaigns.

Unconventional Stronghold

According to Chris Jeske, senior asset manager for Repsol, the company entered the Eagle Ford nearly a decade ago after acquiring longtime Canadian stalwart Talisman Energy. That put Repsol in a 50/50 partnership with Statoil, with each operating half of the investment. Statoil later would transform into Equinor and exit the venture in 2019. At that point, Repsol purchased Equinor’s share in the venture and focused on the Eagle Ford properties as a second asset base to complement its Marcellus holdings and establish itself as a significant player in horizontal resource plays.

“Repsol identified the Eagle Ford as a lucrative opportunity to secure an additional stronghold in North American unconventionals and a complement to its global exploration and production portfolio,” says Jeske.

After gaining total ownership and control of its Eagle Ford assets, Repsol aggressively instituted an organic plan to increase production, he explains. The company’s drilling campaign received significant attention, and rigs were dispatched to various areas of the asset.

“We commenced drilling activity in 2021,” Jeske comments. “We currently have three drilling rigs active in the Eagle Ford.”

Jeske indicates that while the company’s drilling program remains vital to increasing production, other means also exist to accomplish the task. In a recent transaction, Repsol acquired producing properties from INPEX that span Karnes County, Tx., in the core of the crude oil window within the greater Eagle Ford petroleum system. Following the acquisition, Repsol’s total production is 49,000 barrels of oil equivalent across 126,000 net acres.

“North America is key to Repsol’s portfolio strategy,” says Jeske. “The Eagle Ford offers excellent infrastructure, so additional acquisitions could continue to be a viable means of increasing our stake here.”

Multiple Striking Points

Heightened drilling activity on an upsized asset base is one avenue to growing production across Repsol’s Eagle Ford asset, but the firm has subscribed to a blueprint that encompasses multiple striking points of its offensive, Jeske relates. This includes extending lateral lengths in new wells and enhancing and improving production from existing wells.

“We are working on increasing lateral lengths,” he comments. “As the lateral becomes longer up to certain limits, the more cost-effective the well becomes.”

According to Jeske, optimizing Repsol’s artificial lift program in Eagle Ford wells is a crucial foundational piece to maintaining optimal production in maturing wells. The proper form and functioning of the lift system helps ensure desired production rates as natural reservoir pressures drop over time, he explains, adding, “Through the combination of gas lift and plunger lift, we are working hard to increase production efficiency in all wells.”

Repsol also has refined its primary completion designs to maximize new well production rates, especially as its laterals lengthen. The current hydraulic fracturing campaign has experienced improvement with advancements in frac stage spacing and proppant loading. With thousands of wells across its Eagle Ford leasehold, Jeske adds that the company also is analyzing data to identify candidates and evaluate the effectiveness of refracturing to restore production in mature wells.

“We continually look where we can implement safe and responsible improvements to optimize asset performance,” he states.

Looking forward, Jeske says Repsol is excited about its future in the Eagle Ford, especially with the INPEX acquisition adding expanded oil-weighted running room to its Eagle Ford portfolio, which had been focused more on the wet gas window.

“The INPEX acquisition, along with our drilling and completion optimization programs and continuous improvement processes in artificial lift and production practices on existing wells, provides Repsol with an excellent opportunity to learn and leverage our knowledge base as an operator in the Eagle Ford,” Jeske concludes.

Refracturing Program

Houston-based Crescent Pass Energy LLC planted roots in the northern quadrant of the Eagle Ford in 2021 when it purchased assets held by Armor Energy LLC. The company then began to zero in on a strategy to refracture horizontal wells that was initiated in the second quarter of 2021. Its refrac program resulted in a year-end 2022 exit field production rate that was 15% higher compared with the original base production forecast, according to Tyler Fenley, co-founder and chief executive officer of Crescent Pass.

With fairly well-defined crude oil, wet gas and dry gas hydrocarbon windows linked to the thermal maturity and depth of the shale, the Eagle Ford gives operators optionality to focus drilling investments on the parts of the play with the most compelling economics. The play’s flexibility, coupled with its ample pipeline takeaway capacity and short-haul proximity to nearby premium Gulf Coast markets, also gives it the ability to quickly respond to improving price margins for all product streams.

Source: Advance Resources International

“We are executing refracturing techniques to improve recovery factors, including experimenting with a variety of proppant diverter technologies deployed at specific points in the fracture treatment to create near- and far-field diversion,” he says.

The private independent company has completed eight successful bullhead refracs on existing wellbores. “The results so far have surpassed expectations, yielding internal rates of return greater than 65%,” Fenley reports.

As a lower-cost alternative to refrac designs using liners or other mechanical isolation methods, bullhead refracs pump an engineered fluid and proppant design through existing perforations with the assistance of chemical and physical diverters. The technique has offered an economic way to improve the eight wells’ incremental and production rates and overall recovery factors, according to Fenley.

Crescent Pass also is preparing to conduct refracs using liners to isolate existing perforations and stimulate untreated lateral segments in two wells. “We are planning to continue our bullhead refrac program in some wells, and perform two cemented liner refracs this summer,” he says.

But when initiating production of a refractured well, Fenley says one of the most challenging hurdles is mitigating potential proppant flowback damage during the initial restart phase. If not properly managed, sand production can degrade the integrity of rod pump artificial lift equipment and restrict wellbore flow, thereby reducing the well productivity improvement that a refrac is designed to achieve.

“We have addressed both inherited and new sand production through a combination of wellbore cleanouts utilizing a workover rig and by installing sand screens and desanders to prevent blockages and damage to the downhole pumps,” Fenley explains. “Crescent Pass has also designed a pump-in treatment to clear heel section blockages that do not require a rig or well intervention.”

According to Fenley, Crescent Pass has developed an early detection strategy utilizing real-time pump dynamometer tracking to identify sanding issues before they can become significant problems. “Real-time monitoring and diagnostics of the rod pump operation allows us to optimize performance,” Fenley offers. “Our engineers in Houston and our well operators in the field have access to real-time data through their mobile devices with custom alarming features set on a well-by-well basis so they can respond immediately to any anomaly the data presents.”

Crescent Pass, which is financially partnered with Talara Capital Management, is keeping an eye open for bolt-on acreage acquisition opportunities in the Eagle Ford, Fenley adds. “Our long-term plan is to continue growing through accretive acquisitions where we can focus on operational excellence and create value for our shareholders,” he concludes.

After Crescent Pass Energy LLC entered the northern part of the Eagle Ford play through a property acquisition in 2021, the company began zeroing in on a strategy to refracture horizontal wells. Its refrac program resulted in a year-end 2022 exit field production rate that was 15% higher than the original base production forecast. Crescent Pass plans to continue a bullhead refrac program using chemical and physical diverters, but also has two cemented liner refracs scheduled for this summer.

Infusion Of Innovation

With a large chunk of assets changing operator hands in the most recent round of Eagle Ford dealmaking, the play’s future no doubt will be shaped by the same forces that have driven activity during the 15 years since its commercial discovery: an infusion of innovative thinking and new technology application to optimize the productivity of oil and gas wells in the shadows of Gulf Coast market centers.

INEOS Energy’s entry in the play encompasses 172,000 acres and 2,300 wells producing 36,000 barrels of oil equivalent a day. The acquisition is expected to close in the second quarter, with an effective date in October 2022.

“The deal marks our entry into the U.S. market and is another significant step in the INEOS Energy journey,” INEOS Energy Chairman Brian Gilvary said in announcing the transaction with Chesapeake. “Over the last two decades, U.S. onshore oil and gas production has provided security of supply for the global market and a competitive advantage for the U.S. industry. We believe this acquisition will help us to serve our internal and external customers today as we continue to position our business to meet the energy transition.”

Baytex Energy’s definitive agreement to acquire pure-play Eagle Ford operator Ranger Oil is also expected to close in the second quarter. Commenting on the move, Baytex President and CEO Eric T. Greager described the Ranger acquisition as strategic. “We are acquiring a strong operating capability in the Eagle Ford, on-trend with our nonoperated position in the Karnes Trough and driving meaningful per-share accretion on all metrics,” he related.

The transaction gives Baytex 12-15 years of quality oil-weighted drilling opportunities in a premier basin, more than doubles its EBITDA, and nearly doubles its free cash flow while enhancing its quality scale and lowering breakeven cost.

“The additional asset inventory immediately competes for capital in our portfolio,” Greager remarked. “We are building an even stronger Canadian energy company with a high-quality diversified oil-weighted portfolio across the Western Canadian Sedimentary Basin and the Eagle Ford.”

The transaction includes 162,000 net acres in a premier basin in the crude oil window in Texas’ Gonzales, Lavaca, Fayette, and Dewitt counties, and production of 67,000-70,000 boe/d (72% light oil, 15% NGLs and 13% natural gas) with 174 million boe of proved reserves (including 120 million barrels of oil) and 258 million boe of proved plus probable reserve upside.

According to the company, the 741 estimated net undrilled locations include 523 Lower Eagle Ford opportunities and 218 additional Upper Eagle Ford and Austin Chalk opportunities. Lower Eagle Ford locations are expected to generate internal rates of return greater than 75% and payouts sooner than 18 months at a $75/bbl WTI price, and Baytex projects that it can grow production modestly from the acquired assets with two rigs and 50-55 net wells a year.

In January, privately held WildFire Energy announced the acquisition of 377,000 net acres and 1,350 wells in the Brazos Valley region from Chesapeake Energy. With the acquisition, WildFire will operate some 2,000 gross wells on approximately 600,000 net acres in the eastern Eagle Ford in Texas’ Burleson, Brazos, Robertson, Madison, Lee, Washington, and Grimes counties.

The acquired Brazos Valley acreage had an average net daily production of 27,700 boe (85% liquids) during the third quarter of 2022 and net proved reserves of 96.8 MMboe as of year-end 2021. The deal follows WildFire’s acquisitions of MD America Energy in March 2022 and Hawkwood Energy in August 2021.

“This acquisition is highly synergistic with our existing assets and the combined size of the overall business positions WildFire as a leading operator in the eastern Eagle Ford,” President and Chief Operating Officer Steve Habachy remarked. “The consolidation of 600,000 contiguous acres is transformative to the business and will drive economies of scale to deliver more high margin barrels to the advantageous Gulf Coast market.”

“We look forward to future development of the area as we grow the business in a safe, efficient and environmentally conscientious manner alongside our service providers and landowners,” added Wildfire CEO Anthony Bahr. “We are extremely appreciative of our sponsors, Warburg Pincus and Kayne Anderson, who have shared our vision of building strategic scale in the eastern Eagle Ford Basin and have supported us throughout the process.”

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.