Permian Embraces Produced Water Recycling

By Kelly Bennett

Once a significant challenge for producers, Permian Basin wells’ high water cuts have revealed a silver lining. With proper treatment and the right completion fluid additives, the abundant supply of produced water can eliminate or reduce the need to fracture wells using fresh or brackish water. In a region where freshwater is scarce, that capability is invaluable.

Add in recycling’s economic advantages, and produced water reuse is growing rapidly. In fact, 2023 is likely to be the first year Permian Basin operators use more produced water in completions than water sourced from fresh or brackish sources. This marks an important, seemingly overlooked, milestone in the oil and gas industry’s efforts to advance sustainability and resource stewardship goals. It also highlights a key sustainability achievement unique to the Permian Basin among America’s unconventional oil and gas plays.

To understand the scope of the Permian Basin’s water management challenges, consider a few statistics. In general, Permian Basin wells produce significantly more water than oil. The average is three or four barrels of water for every barrel of oil, but in some areas, the ratio can reach as high as 12 to one. These numbers put the Permian Basin’s average water cut higher than any other unconventional play.

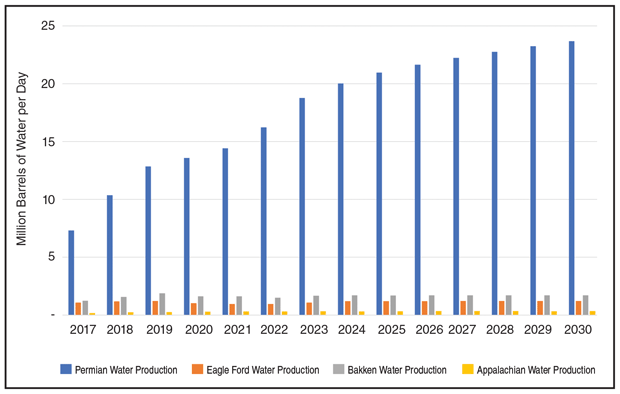

As advances in hydraulic fracturing revived activity in the Permian, the total water that needed to be managed soared from 6.3 million barrels a day in 2017 to 18.9 MMbbl/d in 2023. For context, water production in Appalachia grew from 0.17 MMbbl/d to 0.33 MMbbl/d during the same period (Figure 1). This incredible contrast with one of America’s other prolific basins illustrates the extent of the Permian Basin’s water management challenge.

Evolving Solutions

Historically, produced water would be gathered from production sites and transported to saltwater disposal wells for underground injection. The sheer volumes of water in the Permian necessitated development of pipeline systems to move produced water from production wells to disposal wells early in the basin’s unconventional production history. At first, producers built such pipelines to keep water-gathering needs from hindering drilling schedules.

By the mid-2010s, the opportunity to deploy the midstream infrastructure model in oil field water drew investment dollars to the basin. Now-incumbent water management companies, such as WaterBridge, Solaris Water Midstream (now Aris Water) and H2O Midstream, formed and purchased assets from producers as the basis for growing pipeline and disposal well networks.

At the same time, source water costs for hydraulic fracturing skyrocketed. Rapidly growing demand for freshwater drove prices ever higher. A price of $1 a barrel for freshwater became common, and in some cases, prices exceeded $2/bbl. A lucky landowner’s fortune could be made producing and selling water off a ranch, often on a long-term, take-or-pay basis.

In Texas, the law placed no limit on the amount of groundwater that could be sold, allowing large production facilities with the potential to deplete local aquifers. The cost associated with acquiring water, coupled with the acknowledgment that the Permian’s groundwater sources were far from limitless, helped motivate advances in completion fluid and chemical technology.

By 2014-2015, slickwater hydraulic fracturing took off in the Permian Basin, allowing for a broader range of source water quality, particularly the use of produced water with high concentrations of total dissolved solids. Regulators incentivized produced water reuse by easing recycling permitting requirements and encouraging operators to share produced water.

Maximizing produced water reuse requires technological innovation. In contrast to freshwater, which contains less than 1,000 parts per million of TDS, or even brackish water, which has 3,000-10,000 ppm, Permian Basin oil wells’ produced water can exceed 150,000 ppm. With such high TDS concentrations, completion fluid additives that work fine in freshwater can become unreliable or even harmful.

Initially, recyclers addressed high TDS concentrations by blending fresh and lower-TDS brackish water into produced water, marginally reducing groundwater consumption. Today, completion chemicals have become so robust that some operators minimally treat produced water on site—primarily removing suspended solids, oils and greases, metals, hydrogen sulfide and bacteria—then immediately use the water in another completion. Combined with massive investments in infrastructure, this capability has turned the Permian Basin’s distinctive high water cut challenge into a unique environment, sustainability and governance opportunity.

Adoption Drivers

The technological advances allowing hydraulic fracturing fluids to be built with a wider range of water qualities marked critical milestones in preserving the region’s fresh and mildly brackish groundwater. Several market factors, from earthquakes to investor demands, have accelerated the Permian Basin’s adoption of these technologies.

Those factors include regulatory pressure, particularly in New Mexico. The New Mexico Oil Conservation Division effectively prohibited new shallow SWDs in much of the New Mexico portion of the Permian Basin based on research suggesting that shallow produced water injection was “watering out” producing oil wells in the Avalon formation. Deep disposal is not restricted in New Mexico, but deep wells are expensive and typically considered risky and uneconomic, particularly given the relationship between deep injection and seismicity.

In Texas, no such restrictions have been placed on shallow disposal (i.e., disposal above the main oil and gas producing horizons), outside of recent rules relating to seismicity, and the SWD permitting process is relatively fast. As a result, it has been much easier to develop disposal capacity in Texas, some of which now handles large amounts of water that originate in New Mexico.

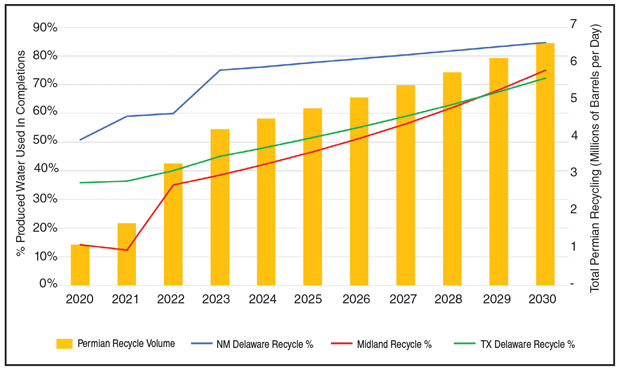

In New Mexico, recycling has become a vital way to keep drilling schedules from being disrupted by produced water offtake constraints. We expect New Mexico producers to satisfy 75% on average of their completions’ water demand with recycled produced water in 2023, while operators on the Texas side of the Permian achieve 45%. These figures represent remarkable growth since 2019, when they stood at 40% and 20%, respectively.

Injection Concerns

In 2018, a team of drilling managers from Guidon Energy (since acquired by Diamondback Energy) gave a presentation titled “The San Andres Problem,” which highlighted rising pressures in the formation commonly targeted for shallow disposal in the Midland Basin. The team laid bare an issue that people rarely discussed openly: In some places, rising pressures create sizable and costly risks to new oil wells.

The resulting conversation raised questions the industry still grapples with. If pressures continue to rise in injection formations, how much capacity remains, where is it and what can be done to mitigate the related risks? Maximizing produced water recycling and targeting deep disposal stand out among the recommendations.

The seismicity issues the Permian Basin has experienced for the past several years limit how widely deep disposal can be deployed. Between 2017 and 2022, the number of earthquakes in the basin with magnitudes greater than 2.5 rose 1,500%, from 42 in 2017 to 671 in 2022. During the same period, the basin had two quakes with magnitudes above 5, an intensity level that can cause structural damage to buildings and infrastructure. Regulators and researchers linked the seismicity to injection in deep SWDs, prompting calls to curb disposal activity.

The response was quick, with Texas forming Seismic Response Areas in 2021 and New Mexico establishing a corollary. SRAs are large regions delineated based on recent earthquakes above certain magnitudes. They tend to have subareas with different constraints on injection, ranging from cessation of injection in particularly high-risk locations to reductions in capacity or onerous permitting requirements in others. Collectively, these restrictions affected more than 200 SWDs in New Mexico and Texas, taking 1.3 MMbbl/d in injection capacity out of play.

While Texas established a process for the industry to convene and develop management plans for SRAs, New Mexico took a much more draconian approach, requiring the nearly immediate cessation of SWD operations in certain cases. Although seismicity seems to be abating, the lingering threat of future capacity loss from earthquakes further motivates operators to seek an alternative to disposal, including the use of third-party disposal.

Investors’ expectations that oil and gas companies reduce their environmental impacts and address climate-related risks, including access to water, have reinforced recycling efforts. According to the World Resource Institute’s Aqueduct tool, which is used in most climate risk disclosures, a significant portion of the Permian Basin resides within areas of high or extremely high water stress.

Large, publicly traded companies have been especially responsive to water access concerns. In New Mexico, Devon Energy has met 86% of its completion water needs with produced water so far in 2023, according to available data. While recycling data remains opaque for much of the Permian Basin, an audit of sustainability reports and other public disclosures indicates a general shift away from freshwater use to a blend of produced and brackish water, with most companies seeking to ramp up produced water recycling.

A Bright Future

Given these market drivers, recycling has grown faster than many expected. Figure 2 illustrates the differences between the Permian Basin subbasins and shows the significantly higher rates of recycling in New Mexico. Of note, total water demand for hydraulic fracturing in the New Mexico portion of the Delaware Basin outstripped that of the Texas portion in 2021, meaning that New Mexico operators are satisfying a larger portion of a greater amount of demand with produced water. The jump in Midland Basin recycling between 2021 and 2022 and in New Mexico between 2022 and 2023 comes in part from SRAs.

Looking forward, we expect recycling in the Texas portions of the Permian Basin to grow at a slightly faster rate than in New Mexico. By 2030, recycling volumes in the Permian Basin will exceed the basin’s 2017 total water production level.

While recycling will continue to expand over the next decade, several factors may cap the rate below 100% of hydraulic fracturing water demand. Among them, tenuous relationships between landowners and the industry create both physical and economic constraints. Historically, landowners have derived significant revenues from selling fresh or brackish groundwater. Reuse directly challenges this income, and many landowners now demand significant fees for the rights of way needed to build pipelines that facilitate recycling. It is not uncommon for an operator to be required to pay its historic take or pay contract for unused groundwater alongside throughput royalties for recycling volumes.

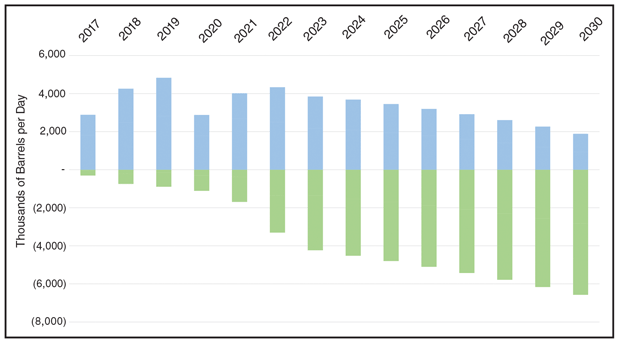

Such high costs make connectivity and thus recycling nearly impossible in some places. Unlike hydrocarbon gathering and transportation lines, oil field water infrastructure does not qualify for easements or eminent domain. This connectivity challenge and the inevitable location mismatch between where water is produced and where it is needed are the primary reasons we expect recycled volumes in the Permian Basin to reach 80% of total average Permian Basin demand by the end of this decade but then grow much more slowly after 2030 (Figure 3).

Even with these constraints, the industry should be proud of what it has accomplished. By reducing injection, recycling has the direct effect of mitigating seismicity and slowing pressure development. Furthermore, each recycled barrel frees a barrel of groundwater for households, farmers and other users.

In the Permian Basin, where numerous water wells have gone dry or required deepening as water tables fall, the unique opportunity to reuse produced water at a huge scale deserves attention. Thanks to recycling, the amount of fresh and brackish water used in Permian completions in 2030 will be 500,000 bbl/d less than in 2017, despite the basin’s oil production growing more than 325% over the same period.

Such dramatic growth is an incredible success story for the basin’s oil and gas producers and the water management companies that facilitate reuse. It lets them assure the broader Permian Basin communities that the industry is doing its part to conserve a precious resource.

KELLY BENNETT is chief executive officer and co-founder of B3 Insight, a provider of technologies and data-driven insights to support responsible and profitable water management decisions. Bennett is a board member of the Western Landowners Alliance and a past adviser to the Internet of Water Coalition at Duke University. He holds a B.S. in diplomacy and world affairs from Occidental College.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.