Shale Plays Driving Logistics Solutions

By Tim Beims

Logistical complexities in horizontal resource plays are stretching the upstream supply chain to new limits to fit the scale of field operations that consume vast quantities of pipe, proppant, chemicals and other goods around the clock.

History teaches that it was a simple logistics failure–not the harsh Russian winter nor brilliant military tactics–that really brought Napoleon to his knees in 1812. It was a lesson for the ages in supply chain management, demonstrating what can happen when the pace and scope of frontline operations outrun the logistical framework supporting them.

Oil and gas companies certainly can relate to Napoleon’s dilemma. Horizontal rigs are drilling farther and faster, achieving daily penetration rates of a mile or more. Fracturing fleets move just as quickly, with even high-intensity stimulation designs placing treatments at the clip of one stage every hour.

Logistics, truly, are half the battle in tight oil and shale gas plays, and safely getting equipment and materials to location on time to keep up with pad operations that are moving faster and consuming more is the stuff that keeps logistics managers awake at night. No one wants to find himself waving a white flag because field operations overwhelmed the supply lines that were supposed to be backing them up.

“Pad sites can be a logistical nightmare,” says Todd Poulson, president of Golden, Co.-based Integrated Petroleum Technology, an independent drilling, completion and reservoir consulting firm. “We see issues every day with logistics trying to keep up with wellsite operations. The last thing an operator wants to see is a drilling rig or frac spread sitting idle, waiting for pipe or proppant. While operations cost a lot of money, waiting costs more.”

The numbers tell the story. In the Permian Basin, for example, Rystad Energy estimates the lateral lengths of wells drilled in the first quarter of 2017 were 1,600 feet (22 percent) longer, on average, than wells drilled in first-quarter 2014. Yet, the U.S. Energy Information Administration forecasts that new Delaware Basin horizontals will take five fewer rig days to drill in 2018 than they did in 2014, while Midland Basin wells are expected to slice two days off 2014’s average drill times.

Looking at well completions, the average number of frac stages effectively has doubled since 2014, and Rystad Energy calculates the amount of proppant pumped per Permian horizontal well has jumped from 6.3 million to 14.5 million pounds (with a corresponding increase in proppant intensity to 1,900 pounds per lateral foot while fluid intensity has reached 52 barrels per lateral foot) over the past three years.

EIA says proppant and fluid volumes will dial up again in 2018, estimating that each Midland Basin well completed will consume 200,000 more pounds of proppant than those completed in 2017, while Delaware Basin wells will pump 500,000 more gallons of fluid compared with wells completed this year.

Real-time completion analysis for quality assurance and quality control is key to maximizing productivity and recovery rates in tight oil and shale gas plays. Using pressure measurements as the primary input data, real-time analysis allows completion engineering to be optimized on site during treatment to improve stimulation effectiveness all along the lateral.

So how are operators managing to keep the logistics network connected and in sync? Depending on the company, Poulson says the preferred approach to “feeding the beast” ranges from outsourcing 100 percent of logistics to third-party specialists to assuming primary responsibility for virtually all well site logistics, including self-sourcing proppants and chemicals.

“Every operator has his own strategy for logistics, but it can be a short trip from hero to zero if something fails to show up when it is supposed to,” he comments. “There is a lot of pressure on the supply chain.”

Juggling Act

The first stop on the oil and gas logistics train is the first step in the value creation process: drilling. Ed Pilcher, drilling superintendent at Integrated Petroleum Technology, says the trick is in getting services and materials to site on time, but without overlapping. That is especially true in the Niobrara/Codell in the Denver-Julesburg Basin, where small-footprint pads are encircled by sound walls, light barriers and other measures to minimize disturbances.

“Along the Front Range in Colorado, a pad with 24 wells may be four acres total, whereas in the vertical drilling days, the surface area needed to drill 24 wells would have been 10-12 times that,” he relates. “It is a juggling act. Services must be lined up so that everything is orchestrated to show up when needed without having one operation interfere with another. Everyone has to get in and out on time so you don’t cause traffic problems or incur standby charges.”

Moving north to the Powder River Basin in Wyoming, logistical challenges during drilling are less about confined-space choreography and more about long-distance routing. “The population is sparse, unlike along the Front Range,” Pilcher observes. “But well sites usually are remote and distant, which means it takes longer to get equipment and supplies to the rig, especially during winter.”

Batch techniques have paid huge dividends in enhancing drilling efficiency in resource plays, but Pilcher points out that they also help streamline drilling logistics by repeating operations using common fluid systems, cements, pipe, downhole tools, etc. “In the D-J Basin, we estimate that batch drilling techniques save 20 percent of the cost of each well. If you batch drill five wells, the sixth one on a pad is basically free,” he notes.

It takes only a couple hours for a rig to skid between Niobrara/Codell wells on 15-foot centers, according to Pilcher. “We can drill a surface section to 1,600 feet, and run and cement casing every 16 hours, on average. If we have 10 wells on a pad, we drill all 10 surface sections using the same mud and bottom-hole assembly,” he outlines. “Once the last surface section is drilled, the mud and BHA systems are switched to start drilling the lateral sections and the rig begins working its way the other direction. Not having to change muds or BHAs each time the rig starts a new well has a huge impact on logistics.”

With batch drilling keeping crews hopping 24 hours a day, Pilcher says IPT maintains two company hands on site, each taking a turn in 12-hour shifts. “Everything happens so quickly and there is so much going on at any time that it is impossible for one guy to handle it,” he allows. “Drilling is an around-the-clock operation, which means everything associated with the rig also has to run 24/7.”

That includes logistics. To eliminate operational issues and supply chain choke points, Pilcher says IPT encourages operators to conduct detailed prespud meetings with all parties involved in a drilling operation on the first well on a pad, going through the well plan step by step.

“A ‘drill-the-well-on-paper’ exercise brings everyone together, from the driller to the cementer and well logger, and sometimes even the company housing the crews,” he details. “We make sure everyone who will be interacting on location during each step is on the same page and understands what is expected and when.”

The newest generation of transload facilities are designed to have the flexibility to accommodate large orders on short notice, with the proppant selection, storage volume and delivery mechanisms to allow just-in-time inventory management to quickly react to unplanned changes in treatment designs. Built-in quality control measures such as scannable rail car tags and SCADA system lockouts prevent cross-contamination of different proppant types and gain sizes.

Completion Quality

The mantra “more is better” has come to define the completion operation–more stages, more proppant, more fluid, more horsepower, etc. With pad frac operations occurring concurrently, the combination of larger job sizes and simultaneous workflows is putting even greater stress on what already was the most daunting aspect of managing oil and gas logistics, according to Poulson. “It is just getting more and more complicated,” he observes.

At the same time, the push to reduce break-even costs in tight oil and gas shale plays has put economic pressure on all aspects of well construction, including completion engineering. “With low commodity prices, the thought process of how to best engineer a completion has been driven more by what can save money than by what can make a better well,” he remarks. “The focus has been on completion quantity and how fast you can put sand down the hole. We are starting to see clients shift focus more to completion quality.”

Given the high degree of variability across shale basins, what works in one well may lead to subpar performance in an offset. “The way to maximize productivity and recoveries is to understand how the rock is fracturing along the lateral, and how completion engineering can be optimized in real time based on that information,” Poulson holds. “The key is real-time operational analysis for quality assurance and quality control.”

Real-time optimization means different things to different disciplines. In drilling, real-time analysis may be geosteering to keep the BHA in the target zone. But, Pilcher points out, the types of adjustments made to the drilling plan while the bit is turning–i.e., changing inclination or adding mud weight–usually have little immediate impact on the logistics network supporting a field campaign.

On the other hand, Poulson says, adjusting a completion design midstream may mean mobilizing the cavalry to swap out millions of pounds of proppant or thousands of barrels of frac fluid. “Logistics issues should never trump the engineering issues,” he contends. “We are not on location to empty the sand can. We are there to maximize well production and to ensure the treatment is performed and invoiced correctly.”

According to Poulson, small companies tend to be the most enthusiastic adopters of real-time completion analysis. “These companies cannot afford subpar wells. They are buying small leaseholds and using the best completion engineering they can get their hands on to get the most from each well they invest in. Utilizing consulting specialists gets the smaller companies the best engineering without having the overhead of large staffs,” he states.

Using pressure measurements as the primary input data, real-time analysis allows the engineer to quickly determine whether a pressure change is related to pipe friction or a formation response. “Maybe a treatment is about to screen out and we need to cut an interval treatment short, or maybe we should add proppant and fluid volumes or switch to a different mesh size. Real-time analysis is the only way to get the answer,” Poulson explains. “The goal is to let real-time data tell us how to treat each well as opposed to trying to force the same design on every well.”

While real-time workflows add some incremental cost to completion operations, Poulson says his company’s experience over the years underscores the technology’s potential to save money and bring in better wells. “On a multiwell pad with 70 or more total stages, real-time analysis can save hundreds of thousands of dollars while enhancing well productivities,” he contends. “That is the true value for the operator.”

Mega Storefront

The ability to diagnose and tailor stimulation treatments on the fly is pushing proppant supply to become more responsive with a delivery infrastructure capable of functioning on a just-in-time inventory management basis, observes Jeff Bartlam, president and co-founder of Shale Support in Picayune, Ms.

This real-time, on-demand requirement is reflected in the design of a new generation of transload facilities, such as Shale Support’s 300-acre center under construction in the Permian Basin. With a double-loop track and 40,000 tons of storage, Bartlam says, the facility is designed to have the flexibility to accommodate large orders on short notice.

By originating proppant in or near resource plays, regional sand mines enable faster and more responsive logistics, and ultimately, reduce proppant cost. With the U.S. Energy Information Administration estimating that proppant will account for 15 percent of an average Midland Basin well’s total cost in 2018, a lower-cost proppant supply chain can have a material impact on pad economics.

“The customization of frac treatments and bigger job sizes mean the supplier has to have more volume and product choice ready to deliver,” he says. “Transloads sites are becoming more of a regional mega storefront, with the proppant selection, storage and delivery mechanisms to allow just-in-time inventory management.”

These logistical challenges are forcing consolidation in proppant supply, making the supply chain more dependent on technology, and reinforcing the need for quality control measures, Bartlam continues. “With the increased amount of proppant being pumped in each well, you now need at least 50 rail car spots at a transload facility to service a well. Not long ago a client could easily be serviced with 20 car spots,” he recalls. “Given the lack of spare capacity, suppliers must have visibility to what is happening at the well so that when a change is made, the supply chain can adjust.”

The more tightly linked the communication along the supply chain, and the more storage that exists in proximity to the well, the better suppliers can react to unplanned changes to treatment designs, he emphasizes, adding that visibility works both ways.

“We are working with customers to integrate daily supply and demand forecasts. We generate daily reports for sand on location and sand in route, and integrate that core-level information so that it flows directly into customers’ systems,” Bartlam describes. “That gives us visibility all the way to the well site, and gives them visibility all the way to our production silos.”

Quality control concerns go along with increasing volumes of different grades and types of proppant moving through transload facilities, raising the risk of cross-contamination, Bartlam says. He says Shale Support attaches fabric tags with scannable barcodes to each rail car to identify the proppant type, mesh size, date of origination, etc.

“The scannable element reads into a cloud-based system,” he explains. “A transload operator can read the tag with a tablet or smart phone to get all the information on the proppant in the car, what purchase order it is attached to, where it is going and when it needs to be there.”

He adds that the supervisory control and data acquisition systems at the company’s transload facilities have lockouts so that when a rail car’s tag is scanned during unloading, proppant is automatically prevented from entering a silo containing a different type or size to eliminate contamination.

Higher proppant concentrations and real-time operations also place an even greater premium on efficient transport and local storage capacity, Bartlam adds. “Shipping by unit train lowers cost and reduces time to the delivery point, sometimes by several days compared with manifest shipment,” he says. “Also, a huge amount of storage is needed on location for proppant and every other product as the industry moves toward more customized frac treatments.”

However, moving storage closer to the well site adds another proppant handling point, creating more ambient dust and potentially reducing sand cleanliness. “We have integrated a new program with a supplier to provide turbidity testing in addition to sieve analysis for each rail car so the customer can know not only the sand’s quality and grain size, but also its cleanliness,” he concludes.

Last-Mile Logistics

Silica dust is subject to one of two new federal regulations that soon will weigh on the logistics supporting hydraulic fracturing, reports Taylor Robinson, president of Oak Park, Il.-headquartered PLG Consulting, which works with producers, pressure pumpers, sand companies and transload operators to improve proppant supply chain management.

In December, commercial truck drivers must begin complying with the U.S. Department of Transportation’s electronic logging device rule, which imposes electronic records tracking of service hours and duty status. In June, U.S. Occupational Safety & Health Administration rules take effect that set exposure limits for respirable silica dust and require employers to minimize worker access to high-exposure areas.

“Transload capacity has expanded significantly in most plays, but as the volume of sand per well grows, more and more trucking is required for the last mile. The implementation of electronic logging is going to make logistics even more challenging by reducing trucking capacity,” Taylor remarks. “Driver shortages will worsen, especially in the Permian, so everyone is focusing on trying to find processes and technologies to improve last-mile logistics.”

Although pressure pumping companies generally have assumed responsibility for well site proppant delivery, Taylor points out that a growing number of operators have decided to self-source proppants and chemicals. “Self-sourcing means they take ownership of the last-mile logistics, which is challenging,” he notes.

The traditional well-site delivery method uses pneumatic trailers and blowers to move proppant into a sand king, which then dumps onto a conveyor that feeds the blender. “It is noisy and generates a lot of dust, even when dust control systems are used,” Taylor says. “To control dust and speed delivery, projects are moving to either portable silo or mobile container solutions. Many companies also are investigating bottom-dump trucks that empty faster and generate less dust.”

The ability to unload faster and store more volume on site aligns with the demands being placed on transload facilities to accommodate short-notice design changes, Taylor notes. “Portable silos typically hold a day to a day-and-a-half worth of proppant, so it provides a buffer if changes need to be made on the fly,” he reasons.

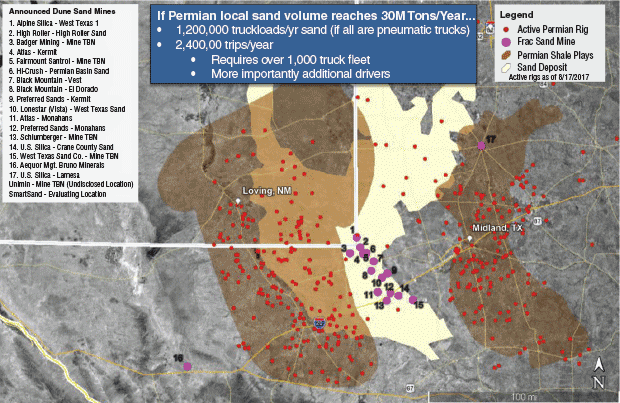

Localizing sand mines in shale basins also represents a big step toward faster, more responsive proppant logistics. “The trend in areas such as the Permian is opening local mines so that the sand originates near the wells. Not only is this increasing sand capacity, but it potentially is a game changer to the cost structure and cycle time. Instead of staging inventories all the way from Wisconsin or Illinois, local sand can be trucked straight from the mine to the well site, skipping all the logistics involved in rail shipping and transloading.”

The result is a leaner, lower-cost proppant supply chain that can have a material impact on completion costs, Taylor suggests. EIA estimates that proppant will, on average, account for 15 percent of a Midland Basin well’s total cost in 2018. For comparison, EIA projects that drilling operations and casing each will account for 10 percent of well cost.

“In wells with high proppant intensities, proppant actually can be up to 25 percent of the total well cost. If the total delivered cost of sand can be cut by 40 to 50 percent, there is an opportunity to save a significant portion of the well completion cost,” he summarizes.

For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter and bookmark www.aogr.com.